Average Car Insurance Per Year Uk – Young drivers are hardest hit by higher car insurance costs, with some paying premiums as high as £3,000.

Confused.com, a price comparison company, found that the average 17-20-year-old has seen insurance costs rise by more than £1,000 since the same time last year.

Average Car Insurance Per Year Uk

Steve Dukes, chief executive of Confused.com, told Radio 4’s Today programme: “The French have seen an increase in claims over the last two years due to the pandemic.

Car Insurance Groups Explained (uk)

“The cost of used cars is higher than ever, the cost of parts, the cost of labor for repairs – and all of that is passed on to the consumer.”

Prices of second-hand cars – the usual first car for a newly qualified young driver – have fluctuated for months amid the Covid pandemic. New car production has fueled demand for used cars, driven by global shortages of computer chips and other materials needed for manufacturing.

According to the Office for National Statistics, prices on the used car market rose by 31% in March 2022. Since then they have made a strong comeback.

But young drivers suffered the sharpest decline. Premiums for 17-year-olds rose by an average of £1,423 to £2,877. The average price of a policy for 18-year-old drivers rose to $3,162.

Car Insurance Online Uk

The data is calculated based on the average of the five best quotes obtained on Confused.com, excluding premiums paid for the policy.

Mr. Dukes said there are ways to reduce premiums. “Where they can share the ride with an older, more experienced driver and add that person as a named driver, that could have a really big impact and reduce costs by hundreds of pounds, that remains to be seen,” he said.

Mr Dukes also suggested young drivers should consider using telematics, or take out road behavior insurance shared with their primary insurer or occasional driver insurance.

But he said the increase in fares for 17- to 20-year-olds would see more young drivers able to drive.

The Snp On X: “🚨 Scotland Is Bearing The Brunt Of A Broken Brexit Britain, With Uk Car Insurance Skyrocketing By Up To 43.1%. Car Insurance Inflation Remains Low Within The Eu:

“The industry needs to be careful not to push young drivers into other modes of transport, and that’s dangerous when prices are high,” he said.

According to the Association of British Insurers (ABI), although car insurance can be expensive, there are ways to cut costs.

He also emphasized the importance of motorists not driving without cover and he asked those struggling with the cost to talk to their insurers.

However, ABI Insurance is always about risk, and its data shows that costs and average claims are higher for younger drivers, which can affect premiums.

The Effects Of Covid 19 On Hgv Insurance Prices

According to the ABI’s analysis of 28 million policies, motorist insurance costs rose by an average of £561 between July and September, a 29% increase compared to the same period in 2022.

The association says the figures are based on the prices consumers pay for their coverage, not what is delivered to consumers.

If you would like to speak to a journalist, please enter a contact number. You can also contact the following ways:

If you are reading this page and cannot see the form, you must visit the mobile version of the website to submit your question or comment, or you can email us at [email protected]. Please include your name, age and location with each submission.

How Much Does Your Job Title Impact Your Car Insurance Costs?

16 hours ago had a driver’s license with 229 points. Because the data shows that hundreds of people could be driving with penalty points. 16 hours ago Wales

2 days ago Motorists who bought a car on finance could share in billions The car finance industry has set aside billions to pay for potential claims after a test drive. 2 days ago Wales

8 days ago ‘Dartford Cross trips ended with carers on my doorstep’ Dart charges have raised £112 million since 2019. 8 days ago England

November 6, 2024 Do headlights really blind drivers? The vehicle will be equipped with special equipment to measure the light level of the headlights

Best Car Insurance Quotes And Providers In 2024

2 November 2024 Pall Mall closes for the world’s oldest and newest car show, with cars from 1896 to modern supercars on display in central London. 2 November 2024 LondonMotor insurance premiums fell for the first time in two years this spring – with an average policy costing £622.

Figures released today by the Association of British Insurers showed that the average cost of car insurance premiums fell by £13 in April-June, compared to £635 in January-March this year.

But the average motorist will have to fork out £111 more on their policy, compared to the same period a year ago, when the average premium is £511.

Mervyn Skeat, director of general insurance policy at ABI, said: “After a very difficult time for policyholders and consumers, we are encouraged to see motor insurance premiums ease as costs stabilise.

The Dynamic Rise Of Insurance Premiums In 2020 Versus The Previous Year

“While this is good news, we must continue to work to reduce claims costs for the benefit of consumers.

The latest ABI figures, which look at rates rather than what drivers pay, come after premiums have risen in recent years.

According to the ABI, the average premium price in the last three months of 2022 was 0.470.

But in the first quarter of this year, the figure increased by 35% to 5,635 – £165.

Common Factors That Affect Car Insurance Rates (2024)

Rocio Concha, which one? Director of Policy and Advocacy said: “It is encouraging to see premiums starting to come down, and motorists certainly expect that trend to continue.

“However, with premiums increasing significantly last year, many drivers who open up to renewals will still be in for a nasty shock.”

My insurance dropped me because of the make and model of my car – they won’t renew the policy due to “high theft rates”.

:max_bytes(150000):strip_icc()/how-car-insurance-companies-value-cars.asp-final-e3fe7d12f1fc4cb9bef0d86ca31d28c4.jpg?strip=all)

Insurers face higher repair costs, more thefts and increased car manufacturing costs, leading to higher inflation in premium costs.

The Rising Cost Of Uk Car Insurance

They also say that due to the rapid development of vehicle technology, vehicles are now more expensive and difficult to repair.

In total, insurers paid out £2.9 billion in car insurance claims in the last twelve months, and above the cost of premiums.

Although the average premium may increase, there are some things you can do to save a little extra money.

In the month before you renew, it’s best to shop around to see what deals are available to you – especially if your circumstances have improved since your last insurance.

Gap Insurance 101

These sites allow you to enter your details and then search the market for which products you are eligible for.

Not all insurance comparison sites have the same coverage, so it’s a good idea to check two or three from GoCompare, Market Compare, MoneySuperMarket and Confused.com.

Also worth checking out is Line Direct. Like insurance, do not use comparison sites, but sometimes there are good deals.

You may like your current provider – but that doesn’t mean you can’t save a little extra money if you do your research.

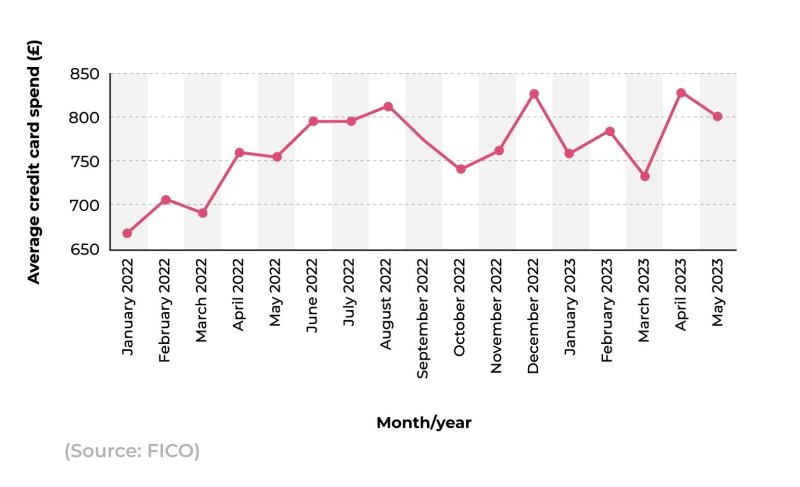

Credit Card Statistics 2023

Insurance companies often offer incentives for customers to stay, so it’s worth looking elsewhere for better deals – and then checking with your current insurer to see if the offer matches.

Some jobs are considered more dangerous by insurers than others, so small but precise changes to your job title can save you money.

It’s worth noting that lying about your employment can void your policy, so make sure any changes are legal and accurate.

New shoes cost more the closer you get to renewal. If you really want to save money – start by saving the date.

Car Insurance Quotes Online

You can buy insurance up to 29 days before the policy starts and ‘lock in’ the price quoted on that day.

When setting up, you can usually choose an excess, which can range from £100 to £500 or more.

The higher the premium, the lower the premium and vice versa. This means that you can lower the price of your insurance by agreeing to pay more.

The device uses the vehicle’s speed, distance traveled, how it accelerates and brakes, and what time of day or night it is.

Ni Second Cheapest For Car Insurance

If you are a careful driver, your behavior will count when it comes to your premiums. But be careful – if you make risky decisions, your premiums will increase

If you are new to communication, here are some simple tips to help you simplify the process.

Analysis of 2.5 million car insurance claims by MoneySuperMarket shows that 19 million low mileage drivers in the UK (the UK average drives less than 7,134 miles a year) are at risk of paying too much for their car insurance.

On average, drivers who drive 5,000 to 6,000 miles per year are charged.