Car Insurance Age Uk – The cost of car insurance is on the rise – drivers now pay an average of £251 more for an annual policy than last year.

Motorists are being warned to expect costs that could be hundreds of pounds higher when they need to renew their cover as the car market feels the effects of high inflation.

Car Insurance Age Uk

The latest figures from Market Compare, which tracks price increases, show that the average motorist will have to pay an extra £251 to pay the average cost of the new policy.

Car Insurance Group Rating

Younger drivers appear to be worst affected by the sudden increase, with cover for drivers aged under 24 rising from £1,200 a year ago to £1,800 last month.

In July, price comparison website Confused.com looked at inflation, warning motorists they could be “surprised” by higher mechanical costs and rising insurance claims.

The latest data from Market Compare, which compares premium prices in August 2022 with the previous month, shows that young drivers now pay £600 more, while drivers of all ages pay less.

Julie Daniels, director of Compare Markets, said: “Rising car insurance prices are causing concern for motorists.

New Driver Insurance Uk

“Compared to the latest market data, the average cost of car insurance increased by 251 pounds compared to last year to 794 pounds in August 2023. The increase in insurance prices is partly due to higher claims costs. For insurers.

For drivers hoping to save money on car insurance, one of the best ways to find out if you’re getting the best deal is to compare quotes online. “

Consumer champion Martin Lewis is among those raising concerns about rising car and home insurance rates. It encourages drivers to check their policies even if the renewal date doesn’t happen right away.

Money Savings Expert wrote in a letter on its website: “My email inbox is growing with angry customers about insurance renewal changes.

Why Are Low Mileage Drivers Charged More?

“The cost of repairing cars is increasing, and insurers say this is due to factors such as reduced housing demand and general inflation. Fair or unfair, car insurance is a ridiculous purchase and you have no choice, so my clear call is to check if you are paying too much. “Take a minute, you can lock in the price to prevent it from increasing for years.”

Vote for the Kent & Medway Food & Drink Awards and win a champagne dinner at The Ivy.

The educational guide is the right preschool in Kent or Medway. Looking for a school, college, university or training provider? Our training manual has everything you need.

Disable this website’s use of cookies. By continuing to browse the website, you agree to our use of cookies. Learn more This magazine is contributed by our readers. We may receive a commission when you purchase through links on our site. Why should you trust us?

Car Insurance Price Clarification Guide

Whether you’re buying your first car or looking to lease someone else’s car. After passing the actual driving test, you need car insurance.

Unfortunately, new driver insurance can be very expensive due to your lack of driving experience. However, the cover in your name will help you build a bonus (NCB) that will help you get cheaper car insurance in the future.

New driver insurance is affordable car insurance for those who have passed their driving test. New drivers can apply for special products designed for new or young drivers, such as telematics policies or premium coverage.

What type of car insurance do you choose; It is important to understand the different levels of coverage and what each one includes:

The Ultimate List Of Uk Driving Statistics For 2024

Finding cheap insurance for new drivers can be difficult. This is because young or novice drivers often have accidents due to lack of driving experience.

But that drops to 57 percent when drivers turn 18 and have a year of driving under their belt.

The more experience you have, the better. Lower your car insurance premiums – It will be cheaper if you collect your unclaimed bonus at the same time.

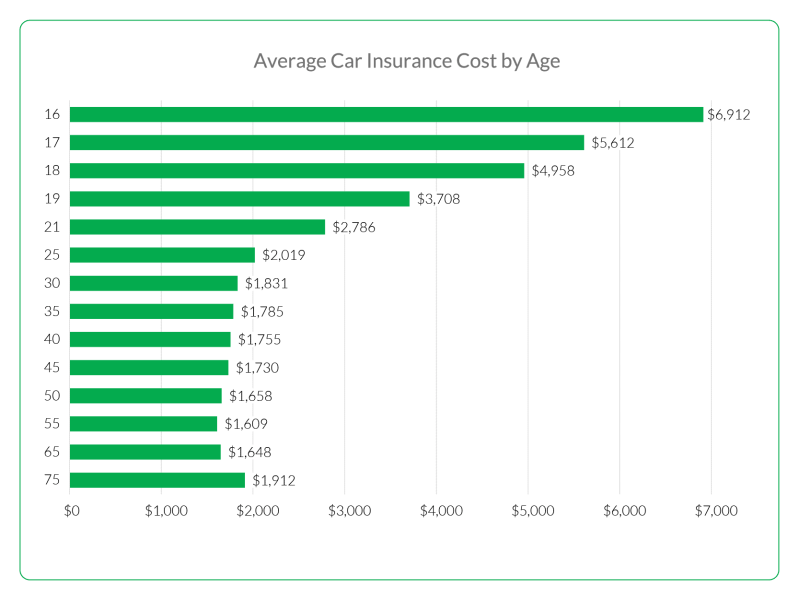

How much a new driver pays for car insurance depends on many factors, with age at the top of the list. For example, a New Drivers cover costs £7; £1 falls from £813.51 for a 17-year-old to £615.73 for a 27-year-old.

Temporary Car Insurance For Over 50s

Some cars are more expensive to insure than others, so research the terms on different cars before buying a used or new car. (Adobe)

We’ve put together our top tips on how to reduce the cost of your cover and try out the cheapest car insurance for new drivers.

If you have your own car insurance policy year. Your insurer will send you a renewal quote – but you don’t have to accept it. In fact, if you can help it, we recommend not automatically renewing your car insurance. Instead, compare rates elsewhere and see if NCB is available.

It’s best to buy car insurance three to four weeks before it expires – studies show that drivers who cancel their insurance before it expires pay more to renew.

The Key Feature Of Extended Warranty

Use our price comparison page to compare new driver’s car insurance rates from different insurers. Some insurers are eager to get these customers, so premiums for new drivers can vary greatly, while others deliberately price out of the market.

When you buy your first car; Check which insurance groups are included in your intended purchase. All cars are divided into 50 from one insurance group – your more powerful and expensive car; The higher the insurance group, the more you pay. Cars such as Fiat Panda, Ford Ka Plus or Nissan Micra are in Group 1 and are the cheapest to insure. If you buy a used or used car, the insurance premium may be lower because of the lower price of the car. However, this may not apply to everyone.

The excess on your policy is the amount you pay per claim. All policies have mandatory advantages. Adding bonuses can reduce your wealth, but make sure it’s an amount you can afford to pay on demand.

If you can, it’s best to pay your car insurance once a year. Most insurers offer a monthly payment option, but this is more expensive.

Annual Car Insurance: How Much Does Car Insurance Cost?

As a new driver, you can add someone with more driving experience as a designated driver to reduce the cost of your cover. Because it shows the carrier that you won’t be behind the wheel forever as a vulnerable driver.

On average, we’ve found that you can save up to 10.24 percent on your policy by adding older drivers.

The biggest savings were for new drivers aged 19, who saved 17.61 percent by including their parents as drivers.

When you buy car insurance, you should indicate your approximate annual mileage. This number can be difficult to predict as a new driver, but remember, lower mileage means less chance of an accident and lower insurance premiums.

Cheap Car Insurance And Average Costs For 16-year-olds

Insurers don’t like modifications like spoilers and tinted windows – these changes to your car can lead to higher insurance premiums.

Having an immobilizer or tracker on your car reduces the likelihood of it being stolen and increases the chance of recovery, which can lower your insurance premiums. Dash cameras are useful for recording what happens in an accident.

Building a no-claims bonus for new drivers is important – you can do this by driving carefully and making no claims on your policy. NCB guarantees a discount on your premium on renewal; But remember that it affects most of the costs. Having a clean driver’s license also helps, as speeding and motorcycling cost more to insure.

Advanced driving courses that teach drivers to improve their skills and drive more safely. When you complete Pass Plus and receive your Pass Plus certificate, you may receive a discount from some insurers.

Car Insurance Renewal Hi-res Stock Photography And Images

New driver insurance often costs more than regular driver insurance. Student drivers on temporary licenses always drive under supervision; This means they are less risky for insurers.

New drivers who pass the test can drive alone – but lack of experience puts this population at high risk. For example, according to the Association of British Insurers (ABI), drivers aged 17 to 24 only have 7 percent of UK licenses and drive fewer kilometers on average, but this age group;