Car Insurance Bc – You can renew an insurance policy up to 44 days before it expires, either by phone, in person or online – we’ll send you a renewal reminder by post to let you know. Learn more about what you need and find the configuration method that works for you

Renew online for the first time? If you have never used the BC Service Card app or the Interac® Checkout service to sign in to another online service, we recommend that you set up your preferred sign-in option at least a few days before your renewal starts.

Car Insurance Bc

Both options verify your identity during initial setup, and it may take several days for this verification to complete. ?

Premiums V Professions

Most insurance renewal reminders provide an estimate of the cost of your insurance for the same period and coverage of your previous policy period (usually one year).

The estimated premium is the total cost (annual, monthly) of the primary insurance with the auto plan, including any optional coverage purchased through it.

If you’re thinking of making changes to your policy, such as adding a driver or changing coverage, you can estimate your insurance costs using our online tool before you renew. You will need to sign in with the BC Services Card app or Interac® verification service to prepare your estimate.

Learn how to submit your odometer reading to get a mileage-based discount on your optional insurance

Insurebc (marpole) Insurance Services

Where you live (your region) and how you use your car (rate class) have a big impact on your premiums. of insurance.

Driver protections listed in the free policy are automatically applied As long as the drivers listed do not cause an accident in any of your vehicles, this protection will be free

This section of your renewal memorandum provides a breakdown of your coverage. current, basic Autoplan insurance and optional coverage.

And B.C. The Government has announced no overall change to basic insurance rates until April 2025. This means no overall increase since the last increase in April 2019.

How To Register And Insure Your Diy Van Conversion In British Columbia

Rising repair and replacement costs are putting pressure on the market for all auto insurers, including Technology is making our cars safer but more complex with advanced crash technology, cameras and sophisticated operating system. These new developments are very exciting – but they also mean that our cars are becoming more expensive to repair, with many manufacturers using custom and proprietary parts. It reviews our optional coverage rates quarterly and adjusts them based on market conditions and current claim costs.

Before renewing your license, you must pay all outstanding balances owed to the provincial government, including provincial violation tickets, fines with penalty points and any autoplan debt. An unpaid debt may affect your ability to renew or renew your license If you have an outstanding debt with us, please call Account Services (604-661-2723 or 1-800-665-6442) before – book an appointment. For more information about when we will refuse to issue a licence, please see the relevant section of the Motor Vehicles Act

If you are repeatedly or seriously convicted of driving, your collision premium costs and third party liability coverage will be affected as a result of the offence. As many of you know, we do things a little differently with auto insurance here in the West We often get calls from residents moving to BC from other parts of the country When they feel confused, they get caught up quickly.

Let’s avoid the confusion and talk about BC Auto! Heck, even the residents of our province could learn a thing or two. Here are 5 things to know about auto coverage in BC:

Icbc — Insurance Corporation Of British Columbia

Auto Insurance BC was established in the spring of 1973 by the provincial government (PND at the time) as a way to regulate premiums and products offered to local drivers. Today, the Insurance Corporation of British Columbia, or more commonly referred to as ICBC, requires every driver in British Columbia to register and purchase a portion of their insurance.

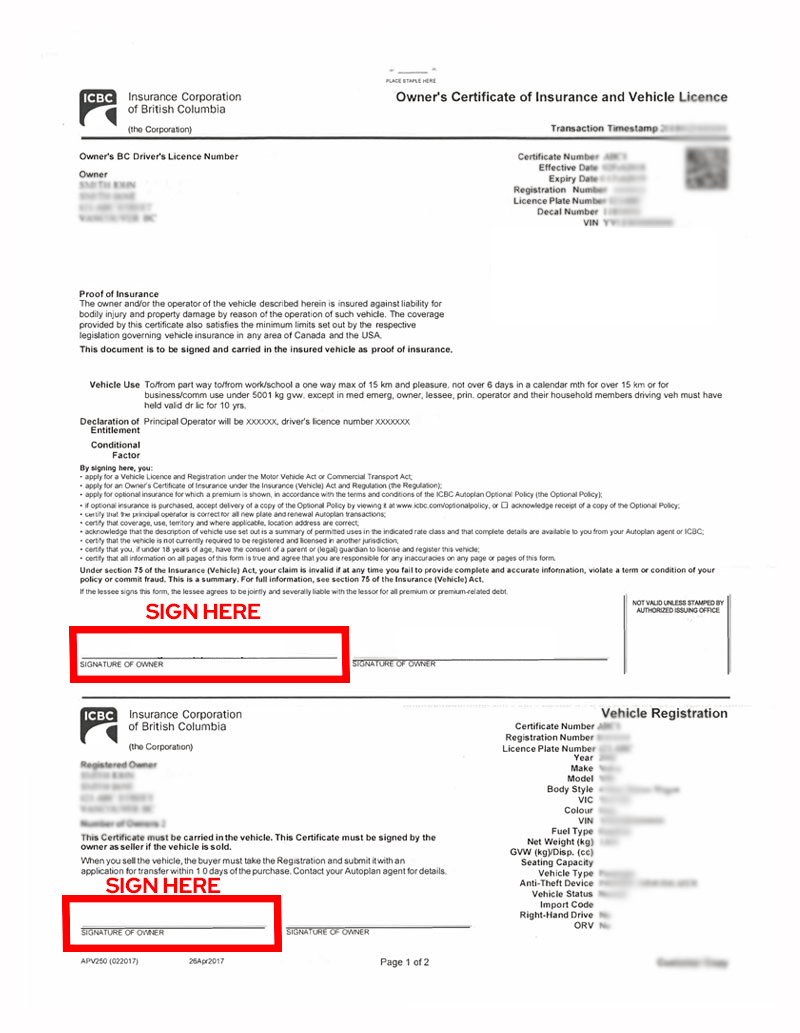

BC car policies are divided into two parts – basic and optional The ‘basic’ part allows you to register your car with Crown Corp (which gives you a plate and decal) and gives you nominal (basic) cover. With the base purchase, you get $200,000 in third party liability, underinsured motorist protection and some accident benefits.

While many people find it frustrating to buy some of their coverage from one (government-owned) insurer, the good news is that you don’t have to buy it all from them! The ‘optional’ cover consists of additional third party liability, collision, comprehensive and over insured motorist protection. Today there are several insurers that offer optional vehicles in BC

ICBC introduced a new “no-fault” insurance model on May 1, 2021. Under the new model, which ICBC calls “enhanced care,” people involved in car accidents in British Columbia cannot sue crown corporations for compensation, even if they are injured. The severity of the injury has no effect on your ability to sue. The system has been working successfully in other provinces for many years and ICBC’s implementation of this change was largely due to the volume of small claim payments that ultimately influenced the need to increase premiums.

Bc Government Changes To Calculating Pst On Private Vehicle Sales

Since its inception, Crown Corporation has used independent brokers to promote and sell its liability coverage. In the 70’s they gave licenses to brokers called “Autoplan” certificates which allowed these agencies to sell prime parts. In the 1980s, a moratorium was placed on these licenses; So the same 800 across the province today is the same as 40 years ago ICBC has informed us it will allow customers to purchase their “basic” coverage online in 2022; However, you need to visit your local ‘Autoplan’ dealer for plates and decals.

That’s the bottom line Autoplan is not an authorized entity; However, we do sell custom cars! Fill out this form now or email us for information and we’ll help you purchase this coverage! If you own a vehicle in BC, you are required by law to purchase auto insurance But did you know there is better coverage and ways to save? Our local BC experts understand the unique needs of BC drivers and will help you find the auto insurance that’s right for you at the best price. Here are six things you may not know (yet) about BC auto insurance!

You don’t have to pay the same insurance rate as the neighbor down the road. You can save more by driving less If you drive less than 10,000km a year, you may be eligible for additional savings on your policy. ICBC Autoplan. Make sure you show proof of your odometer reading when you renew next year and again when you renew.

Another way to save, if you can afford the higher deductible, is to consider increasing your insurance deductible. By increasing your car insurance from $200 to $500 or $1,000 in car insurance, you will lower your monthly premium costs.

Personal Auto Insurance

We also recommend that you shop around for optional car insurance to get the best rates.

Membership is also worth it! Members save up to 20% on optional car insurance. * Other optional car insurance discounts include:

You might think that collision and comprehensive coverage are the same thing.

Collision: If you are in an accident with another vehicle, collision coverage will cover the cost of repairing or replacing your vehicle. It also covers you for hit and run damage

Oc] Annual Auto Insurance Premium By Province

Comprehensive: This covers the cost of repairing your vehicle if it is damaged in a non-motor accident such as wind, fire, flood, vandalism or break-in. And like collision coverage, comprehensive coverage will pay you if you hit an animal on the road, like a deer.

If you’re worried about lending your car to a close friend or family member, these helpful tips are for you. Sometimes you can borrow your car if you have registered driver protection. To qualify, drivers sometimes have to drive less than 12 days in the 12 months after the accident.

People who regularly drive your car, such as family, roommates or employees, should still be on your policy. This helps to accurately assess the risk and ensure that the right person is responsible in the event of an accident You can learn more about driver lists