- Car Insurance By The Mile

- On-demand Insurance Abstract Concept Vector Illustration. Online Insurance Policy, Affordable Personalized Service, Flexible Price And Term Coverage, By-the-mile Car Insurance Abstract Metaphor Stock Vector Image & Art

- This Tech Start-up Wants To Insure Your Car

- Trident Insurance Barbados

- How Pay-per-mile Auto Insurance Works: Faq, Pricing, Liability, Cars

Car Insurance By The Mile – If you’re using a Galaxy Fold, consider opening the phone or viewing it in full-screen mode to optimize your experience.

Advertiser Disclosure Many of the offers on this site are from companies compensated by Motley’s. This compensation may affect how and where products appear on this site (such as the order in which they appear), but our reviews and ratings do not affect compensation. We do not include every company or every offer on the market.

Car Insurance By The Mile

David S. Chang, ChFC®, CLU® is an entrepreneur, keynote speaker, author, and consultant. He has more than two decades of experience in the asset management industry and has been featured on dozens of news, radio and podcasts nationwide. He is currently the head of IoT for the Western region of a Fortune 200 company at the United States Military Academy at West Point and is currently a lieutenant colonel in the California Army National Guard. He is an East-West Graduate Fellow and holds an MBA from the UCLA Anderson School of Management.

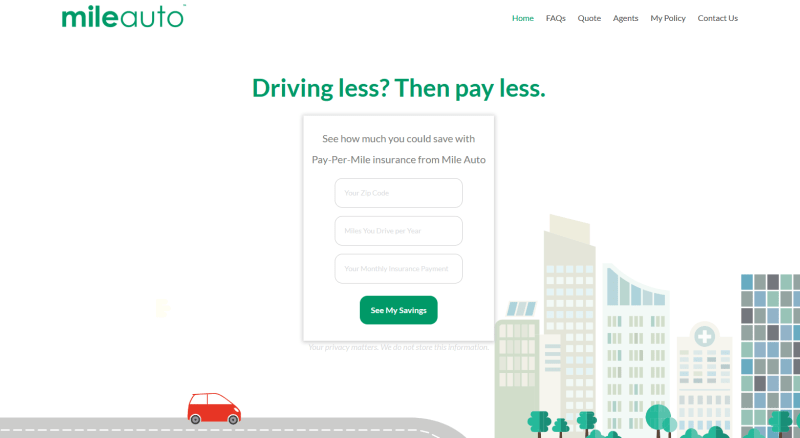

Don’t Drive Much? Don’t Pay Much — Andy Lam

Ashley Marready is a former history museum professional who transitioned to writing and editing digital content in 2021. He holds a BA in History and Philosophy from Hood College and a MA in Applied History from Shippensburg University. Ashley enjoys creating content for the public and learning new things that she can teach others, whether it’s information about salt mining, channel mules, or personal finance.

Most or all of the products here are offset by our partners. This is how we make money. But our editorial integrity ensures that our expert opinion is not influenced by compensation. Terms and conditions may apply to the offers listed on this page.

More people are driving now that pandemic restrictions have eased. However, many drivers have changed their driving habits below pre-pandemic levels. As a result, per-mile car insurance has become more popular among drivers who want to pay only for what they need.

Pay-per-mile car insurance is where your monthly car insurance premium is calculated based on the number of miles you drive. Monthly rates are flexible and vary based on how many miles you actually drive. The insurance company offers the same coverage options as a traditional policy, except you pay a lower base rate and more pennies per mile you drive. This type of car insurance is best for people who don’t drive a lot.

On-demand Insurance Abstract Concept Vector Illustration. Online Insurance Policy, Affordable Personalized Service, Flexible Price And Term Coverage, By-the-mile Car Insurance Abstract Metaphor Stock Vector Image & Art

As more and more auto and insurance companies embrace “telematics” technology, the real-time monitoring of vehicles via GPS, insurers can offer personalized coverage tailored specifically to a driver’s needs. Large insurance companies are using telematics a lot. Telematics can track each driver’s habits behind the wheel.

Cars like Tesla can include telematics, or you have to connect the device to the car’s diagnostic panel. Some insurance companies require drivers to connect their mobile apps to the device.

The rate for a premium policy usually has two parts: a base rate and a variable rate (cost per mile). Base rates are based on factors such as gender, age, location and driving history. The variable portion of the rate is based on actual miles driven. Unlike a one-size-fits-all policy, where the monthly premium is the same, the monthly premium for a pay-by-the-mile policy varies from month to month because the variable portion of the rate is based on mileage.

The cost of car insurance per kilometer can vary depending on the insurance company and the driver. Paying per kilometer can be 30% to 50% cheaper if you’re a low-mileage driver. Here is an example of a 35-year-old single man with a good driving record driving 500 miles per month.

How Low-mileage Drivers Could Save Nearly £170 On Car Insurance

To calculate the monthly payments for a premium policy, add the base premium and cost per mile times the number of miles driven in the previous billing cycle (usually the previous month). The basic price of auto insurance for the same driver can range from $45 to $60 per month. Variable rates can range from $0.06 to $0.07 per mile driven.

In this example, the pay-per-mile policy is about 30% cheaper than the regular policy for this particular month. The break point is just over 1,000 miles. Drivers who regularly drive more than this under this policy would be better off using a regular policy. Auto insurance companies today can offer cheaper and more targeted auto insurance policies to meet the needs of drivers.

Low-mileage insurance is best for low-mileage drivers: people who use public transportation, retirees who don’t drive often, college students who don’t commute, those who work close to home, and those who have a spare vehicle. It’s also best for low-mileage cars, as the variable price you pay depends on the number of miles you drive.

Unlimited auto policies are best for high-mileage cars because you only pay the base rate, regardless of how many miles you drive. Others who may benefit from mileage insurance include weekend drivers, city commuters and rental cars. Rental cars often have a maximum number of driving miles.

10 Best Companies For Low-mileage Car Insurance Discounts In 2024 |

Pay per kilometer is also for those who want more transparency and control over insurance costs. According to Kelly Hernandez, vice president of personal line telecommunications at Nationwide, many consumers are “taking advantage of usage-based capabilities and saving money as they gain more control over insurance prices.”

Many drivers have permanently changed their driving behavior due to the pandemic, especially those who work from home and use their vehicles less. Per mile car insurance is worth it if you only drive a few miles a month.

After getting a quote from the insurance company, compare the basic and variable interest rates to how much you drive with the cost of a traditional insurance policy. If your monthly premiums are lower than a regular policy, per-mile car insurance may be worth it. This is important to keep in mind if you plan to take long road trips during certain times of the year. Some insurance companies will limit the number of kilometers you drive, from 150 to 250 kilometers per day you have to pay for an insured vehicle if you are making a long trip.

As insurers and drivers rapidly adopt telematics, drivers can customize their car insurance coverage based on the number of miles they drive. People who don’t drive much pay too much for car insurance. Usage-based policies may soon become the norm.

This Tech Start-up Wants To Insure Your Car

Although Root does not set a specific price per kilometer, the premium it charges is largely based on driving habits. Traditional auto insurance companies often rely on demographics such as age, zip code, occupation and credit score to determine insurance rates.

Root is different in that it prioritizes driving behavior when rates are determined. Unlike other insurers, Root doesn’t take occupation or education into account, and Root says it’s committed to completely eliminating credit scores from its rates by 2025.

Using the Root app while driving allows the insurance company to collect and analyze data from the phone’s sensors. After a few weeks, Root can provide drivers with auto insurance quotes based largely on driving behavior and actual driving.

Root says drivers can save up to $900 a year and get coverage in 34 states.

Trident Insurance Barbados

SmartMiles offers the same coverage options and flexibility as regular car insurance. But with SmartMiles, drivers can pay less because monthly payments are based on miles driven.

Most vehicles manufactured after 1996 are eligible for SmartMiles. Some hybrid and diesel vehicles may not be compatible with the device. Unlike the other insurance companies on this list, SmartMiles is available in most states except:

Milewise offers coverage and claims similar to a regular Allstate policy, but is based on miles driven. The Allstate app allows drivers to quickly access Milewise policy details, account balance, miles driven and safe driving status.

With Allstate, drivers can choose a pay-per-mile vehicle option, an unlimited vehicle option, or a combination of the two. With pay-per-mile, drivers get paid a lower daily and per-mile rate as they drive. Unlimited vehicles are charged at the daily rate only regardless of mileage.

How Pay-per-mile Auto Insurance Works: Faq, Pricing, Liability, Cars

Two payment per kilometer options follow a convenient payment process: when the account balance reaches the minimum, the payment is automatically added from the source on file. Mileage payment uses an easy-to-use mobile app and/or website, along with a small device that plugs into the vehicle’s diagnostic port, usually located under the steering column.

This device tracks accurate mileage for accurate billing and ensures an unlimited number of vehicles get all the benefits of per-mile payments, such as trip information, account statements and Allstate reward points. Drivers can review weekly trips and expenses to set goals. They can also browse detailed maps for personalized driving feedback.

Drivers can also earn Allstate rewards through the Milewise tool. The program allows drivers to earn points for driving safely. These points can be redeemed for merchandise, gift cards, daily deals and discounts at local stores.