- Car Insurance Certificate Malaysia

- How Can A Singapore Vehicle Claim Against A Malaysian Vehicle

- Takaful Vs Conventional Car Insurance

- The Start Of Motor Insurance Liberalisation In July 2017

- Car Insurance Rates & Quotes

- What Is Voluntary Deductible In Car Insurance?

- Honda Dealership Quoting High Price For Insurance Policy!

Car Insurance Certificate Malaysia – Vehicle owners in Peninsular Malaysia, Sabah and Labuan can rejoice! From 1 July 2024, the fee for printing a physical copy of the Vehicle Operation Certificate (VOC) has been reduced to RM20. This is a welcome change from the previous payment of RM50 in Peninsular Malaysia and RM25 in Sabah and Labuan.

In the year Introduced by the Ministry of Transport (MOT) in 2016, it replaced the VOC Registration Card (RC) as the vehicle ownership record. It contains the same important details about your vehicle as the RC. However, unlike the RC, the VOC component model is not required for most businesses. You can update your road tax, change ownership or update vehicle details digitally.

Car Insurance Certificate Malaysia

The Malaysian government made this change to achieve a more balanced wage structure across sectors. Transport Minister Anthony Locke highlighted the project as “a toll bridge between Peninsular Malaysia, Sabah and Sarawak”. While the new rate applies to Peninsular Malaysia, Sabah and Labuan, Sarawak will incur a slightly higher fee of RM25 (RM5 for regular printing + RM20 fee).

Things To Take Note About Car Insurance In Malaysia

Although not necessary for most businesses, some people may still prefer a physical copy of VOK for their records. The reduced fee makes hard copy more affordable.

You can check official sources about VOC and toll reduction from the Ministry of Transport (MOT) or the Malaysian Government website.

By implementing this change, the Malaysian government is making it easier and more convenient for cardholders to manage their vehicle registration.

Download the app now. Designed by drivers for drivers, this all-in-one app helps you get the latest traffic reports, access live traffic cameras and manage vehicle-related tasks Home » Lost your car gift? What do you need to lose your car loan? Here’s what you have to do

Online Quote Car Insurance Malaysia

The Road Transport Department (RTD) has announced the replacement of the old car license with the Vehicle Possession Certificate (VOC) in June 2016. This is an effort to further simplify and improve the service of the department and make it easier and faster in the future. of the country. .

Although it is not necessary to give it to renew the car or change the ownership of the vehicle, remember that you need the document if you want to sell your car.

Good luck with the store. In this post, share the steps to follow to find a replacement for your car.

You need to go to your nearest JPJ office to get the original card or a new copy.

Car & Motorcycle Insurance Renewal Malaysia

You will receive a copy of the original gift after the required verification process. Fees are RM50 for car concessions and RM20 for motorbike concessions.

Alternatively, you can get a copy of your card at any of the 36 JPJ kiosks across the country. Here are the steps.

For the third option, you need to go to your bank to get a car loan. According to the Credit Reform Act of 2010, you must apply for a primary car loan with your bank.

Even though VOC is available online, that doesn’t mean you shouldn’t try to protect it. If you want to sell your car, you still need to look ahead.

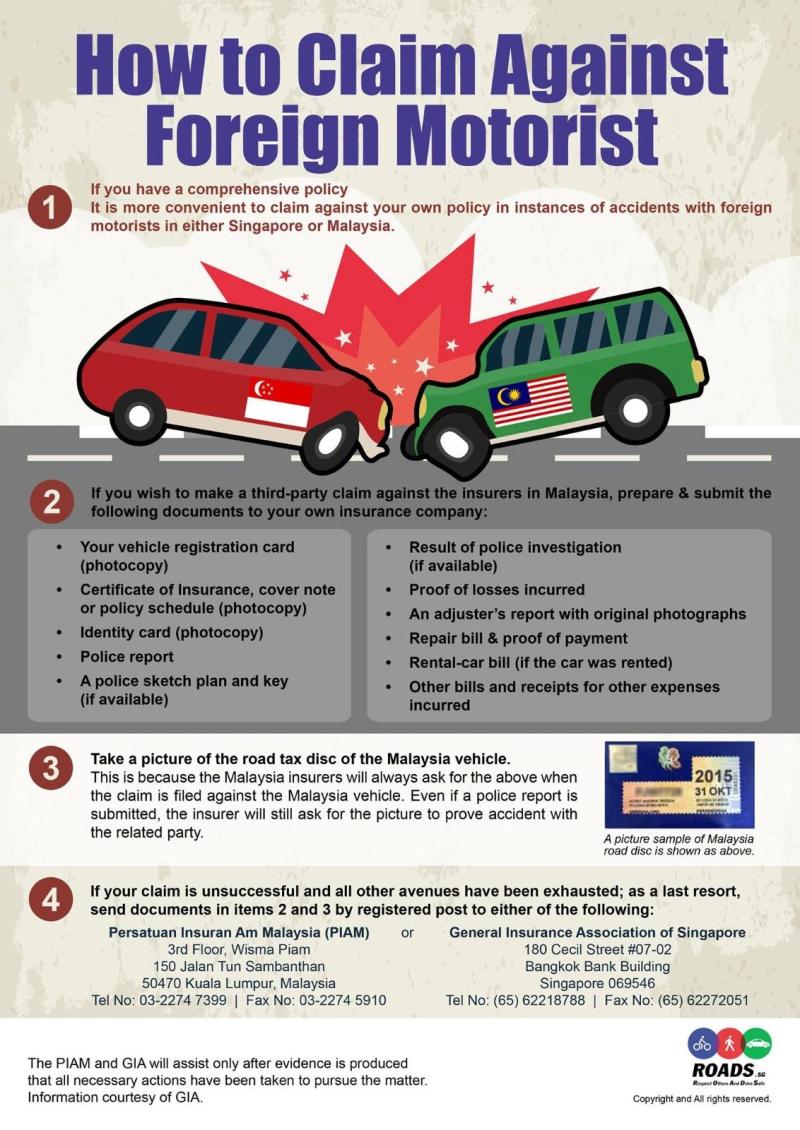

How Can A Singapore Vehicle Claim Against A Malaysian Vehicle

Be responsible for the car and make sure your car is safe so you don’t have to go through trouble in the future.

Isone is the largest car insurance comparison platform for consumers to compare 15 insurance brands. Free car insurance quote and renew your car insurance online in 5 minutes. Having travel and personal car insurance in Thailand is very important, and some people don’t even choose one, but really, emergencies seem to happen, even when you least expect it. And it’s not important at all.

Medical bills and vehicle damage repairs abroad can be expensive, and you can rest easy if you have personal and vehicle insurance in Thailand.

As part of preparing to cross the border into Thailand by car or motorbike, it is important to obtain vehicle insurance. People who have traveled to Thailand know how complicated it is if you have an accident, especially if you don’t have insurance.

Takaful Vs Conventional Car Insurance

Compulsory Insurance (CI) provides limited medical compensation (usually up to 80,000 THB) to anyone involved in a vehicle accident on Thailand’s roads.

Please note that in Thailand there are regulations for vehicles that must have compulsory insurance (CI) (Motor Vehicle Accident Victims Act 1992).

Thai Voluntary Insurance provides cover for property/vehicle damage in an accident in Thailand and is divided into three sections.

Note: Class 1 is only available for vehicles registered in Thailand. Sections 2 and 3 are provided for foreign registered motorcycles, and Section 3 for foreign registered cars/MPVs/SUVs only.

The Start Of Motor Insurance Liberalisation In July 2017

It includes personal and third party vehicle damage and personal injury and damage caused by fire and theft and natural disasters such as floods. It also covers certain collisions, accidents, broken windows and towing.

Similar coverage to Type 1, but with coverage for damage to the vehicle and a limitation relating to the removal of accidental damage to the vehicle (eg falling into a parking lot wall).

Third-party property damage and third-party excess bodily injury, as well as collision-only vehicle property damage coverage.

Commonly used in other areas such as third-party liability, fire and theft, Type 2 covers third-party property damage, third-party excess damage, and fire and theft damage.

How To Choose The Best Car Insurance

Subscriptions 101 provides comprehensive Malaysian insurance for use in Thailand. More information about this extension can be found in the FAQ section.

Medical fees in Thailand can be very expensive for foreigners, so please get travel insurance for yourself and/or your passengers).

Below are the lowest prices for compulsory and voluntary insurance coverage for your vehicle. Here you can convert prices to local currency.

Contact them on WhatsApp on GoThai to buy or inquire about latest insurance etc. Alternatively, you can scan the QR code below:

Singapore / Malaysia Vehicle Accident Claims 2016-2017

I recommend them because they provide reliable and good services. They can also provide you with TM2, TM3 and TM6 immigration forms. If all the documents are arranged in advance, it will save a lot of time in the end.

You can ask them to deliver the documents directly to you or collect them from their office before you leave for Thailand.

If you are coming to Thailand from Laos, Cambodia, Myanmar or other Malaysian borders, they can send you an electronic copy and you can just print it.

They are located 20 kilometers from the Bukit Kayu Hitam/Sadao border. The Go Tai office is located next to a Petron gas station. Use the details below to browse.

Etiqa Malaysia First Insurer To Sign Un Principles For Sustainable Insurance

They have a DD-Trow line to collect documents. This will definitely save you the hassle of getting out of your vehicle and waiting in line at their office.

The biggest problem you will face is the language barrier. If you speak English, contact the Thai tourism authorities by calling 1155 using your local Thai SIM card. Alternatively, contact the Thailand Tourism Center for assistance.

If you are injured, get treatment at a hospital. If you have travel insurance, contact your insurance company to join the hospital panel.

You should also inform your embassy/consulate general in Thailand and they can provide further assistance if necessary.

Car Insurance Rates & Quotes

Then call your car insurance agent in Thailand to be pointed in the right direction and/or purchase compulsory and voluntary insurance if you need medical attention.

Finally (if necessary) notify your Malaysian insurance company (if you get a CIA extension) and tow your vehicle to the Malaysian border at your own expense.

The cost of towing from the Malaysian border is covered by the Malaysian insurance company. Please note that your vehicle must be repaired in Malaysia.

If you don’t have insurance; Be prepared to bear the high cost of vehicle maintenance etc.

What Is Voluntary Deductible In Car Insurance?

Yes you can. Compulsory insurance is the only legal requirement to drive your vehicle in Thailand. However, if you take the chance, be prepared to pay a heavy price.

Yes, he needs it. Thai Voluntary Insurance only covers damage to a third party’s car/property, not yours. Extension 101 covers damage to the vehicle.

Yes you can. Please note that the minimum coverage days are 9 days for 4 wheelers and 3 months for 2 wheelers.

As far as I know there are Allianz, AXA, AIG, Etiqa, Tokio Marine and others. You just need to verify your article for this.

Honda Dealership Quoting High Price For Insurance Policy!

You need to have an active Malaysia comprehensive vehicle insurance with your insurance company and go to the insurance company’s office to get this cover for your vehicle.

No, Signature 101 does not cover physical damage. You should get personal travel insurance to get disability cover.

That is, total premium (x) 15% (x) 12.5% | The formula of 12.5% varies depending on the number of days