Car Insurance Database – The Motor Insurance Database, or MID, is a computerized record of all insured cars in the UK. It maintains a database of all vehicles on UK roads, whether insured or not, and insurance details. MID data is used to differentiate between the insured and the insurer of the vehicles involved in the accident, which aids in claims processing. Motor insurers, the police, the Driver and Vehicle Licensing Agency (DVLA) and the government use MIDs. The data enables insurance providers to identify insured vehicles and their suppliers, which is useful in the event of accidents. The MID helps the police enforce insurance legislation for all vehicles. UK police and the DVLA use MIDs to confirm insurance details during routine traffic stops and investigations. It helps monitor uninsured drivers using the roads. Finally, it informs authorities about car insurance, including the number of cars covered, the types of cars covered and the average cost of insurance. The data reflects the regulatory policy of motor vehicle insurance. In addition, vehicle taxation in Northern Ireland is carried out at any post office, but the vehicle owner needs proof of insurance. Sweden Post will not check the MID, but the holder must provide proof of insurance in the form of a certificate or cover sheet. Additionally, the rate at which policies are added to the MID depends on the frequency with which the insurance provider makes changes. MID is updated more than 10,000 times per hour; however, the frequency of updates is determined by the insurance company.

The Motor Insurance Database (MID) is a database manager that contains details of all insured vehicles in the UK. It is administered by the Motor Insurance Bureau (MIB), a not-for-profit group formed to provide coverage to uninsured motorists and innocent victims of road accidents. The MID is updated in real time and sends information about the insurance status of the vehicle to insurance companies, law enforcement agencies and other authorized parties, including the name and address of the insured, the make and model of the vehicle, and its start and end. politics. the data. The details are used to help enforce legislation requiring all motor vehicles to be insured, to investigate road accidents and to deal with claims from uninsured motorists.

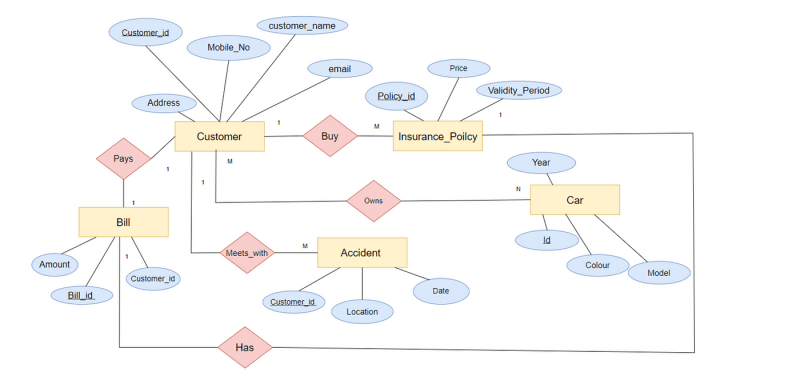

Car Insurance Database

The primary purpose of the Auto Insurance Database (MID) is to allow insurance companies, law enforcement agencies, and other authorized groups to quickly and accurately know whether or not a vehicle on the road is insured. The database ensures that all vehicles on the road have the insurance coverage they need and that the information is easy to find for those who need it. The MID information is used to detect and minimize uninsured driving in partnership with the insurance sector, the police, solicitors and the Driver and Vehicle Licensing Agency (DVLA). This makes the roads safer and reduces the number of uninsured drivers. MID helps reduce insurance costs by providing insurance companies with accurate information about each vehicle’s insurance history. This information can be used to determine the risk of each vehicle and set premiums. Overall, the MID aims to improve road safety, reduce the number of uninsured drivers and make it easier and faster for drivers and insurers to get and take out car insurance.

Gov’t Outlines Importance Of Insurance Contracts Database

The Motor Insurance Database (MID) is critical to motor insurance, particularly in the UK, for compliance, reduction of uninsured drivers, accuracy and efficient claims processing. The MID is important because it helps ensure that all drivers in the UK have the insurance cover they need, which is a legal requirement. Insurance companies and law enforcement agencies regularly check MIDs to make sure vehicles are covered. Another reason is that it reduces the number of uninsured drivers on the road. It increases traffic safety and reduces the chance of accidents caused by uninsured drivers. Additionally, the MID is important because it provides insurance companies with accurate information about the insurance history of individual vehicles, which is used to assess risk and determine insurance rates. It helps make sure drivers pay the right amount for insurance and prevents fraud. Ultimately, the database provides insurance companies with the data they need to process claims quickly and efficiently in the event of an accident. Complaint handling is more efficient for all parties involved and costs less time and money. The UK Motor Insurance Database is therefore an important element in ensuring that all UK drivers have the motor insurance cover they need, increasing road safety and simplifying the claims process.

UK-based insurers are responsible for collecting information for the MID. All motor insurers must follow Department for Transport (DFT) rules when adding vehicles to the Motor Insurance Database (MID) and will be fined if they don’t. Several insurers allow fleet and motor trade customers to transfer vehicle updates directly to the MID. It is governed by strict restrictions. The Motor Insurers Bureau (MIB), which represents the UK motor insurance industry, maintains the MID. The data contains information about vehicles, their owners and the insurance plans that protect them. Insurers are required by law to send this information to the MID to ensure that all vehicles on UK roads are legally insured.

The Motor Insurance Database (MID) exists to check that all vehicles on the road are properly insured. The purpose of the MID is to help the police and other authorities quickly and efficiently determine whether a vehicle is insured in the event of an accident or stoppage on the road. It helps reduce the number of uninsured cars on the road and ensures that people involved in accidents are adequately insured. A centralized database of vehicle insurance information allows insurance companies to quickly and easily verify that a vehicle is insured, speeding up the claims process after an accident.

The frequency of updating the MID is determined by the insurance company. Some insurance companies update the database every week, others use specialized teams that constantly make changes. The MID is usually updated every 48 hours. In addition, insurance details will be sent to the Motor Insurance Database (MID) immediately after a person has purchased temporary insurance. The insurer has 7 days to provide the database; therefore the insurance expires before the details appear in askMID due to the short term nature of the cover. In addition, all motor vehicle insurers are required to comply with Department for Transport (DFT) regulations on the timely submission of MIDs and are subject to penalties if they fail to do so. Several insurance companies allow their fleet and auto trade customers to transmit vehicle updates directly to the MID using a feature called MIDUpdate. It is governed by strict restrictions.

Updating The Motor Insurance Database (mid)

No, not all vehicles are in the Bilforsikringdatabasen (MID). Only vehicles covered by active auto insurance will be included in the MID. A vehicle is not included in the MID if it does not have current insurance, has been inactive for too long and the registration information is out of date, among other things. Most vehicles not found in the MID are those whose owners have failed to renew their insurance contracts and therefore do not appear as insured in the database. A lack of proof of cover from an authorized insurer in the relevant period when they make such a claim means that, even if they still own their car, potential claims against them are unlikely to proceed.

Yes, it is possible to search the history of other vehicles in the Motor Insurance Database (MID). However, only some people have access to auto insurance database information; only specific individuals or organizations can see this type of data. The most common users of auto insurance database records are law enforcement agencies such as police departments or highway patrol units. If you need details, including car accident claims, it’s best to contact your auto insurance company directly. It can take up to a month to process a request through MIB. If necessary, fill out their online form to access MIB store information. There is a fee associated with handling this process. Additionally, the vehicle owner has access to and can request information on claim history, MIB claim history, MIAFTR claim history and the No Claims Discount in MID database. The Auto Insurance Database is an invaluable resource for buying a used car. These databases contain information about the vehicle’s history, including previous owners, accidents and other incidents with the vehicle. The data is important for potential buyers who want to be sure they are getting a safe and reliable vehicle.

The Auto Insurance Database (MID) is often considered very accurate. The Motor Insurers Bureau (MIB) administers the MID in the UK. It is regularly updated with information from insurance companies. In addition, MIB has a dedicated team of professionals committed to verifying the quality and integrity of the database. However, it is significant