Car Insurance Estimate Calculator – Last week, it was time to renew my car insurance, and I got quotes from many insurance companies, but I’m not sure which one to choose. So, to educate myself, I tried several auto repair tools. The same details are provided here for quick understanding.

First, car insurance is mandatory. Cars are usually insured for the first year when they are purchased and must be renewed thereafter. Insurance contracts cover damages to third parties. This means that the beneficiary of the insurance policy is someone other than the two parties involved in the contract: the car owner and the insurance company. A third party is someone who may have been harmed by you and is suing you for damages. In addition to the mandatory third party insurance, it is wise to cover the loss or damage to the vehicle itself in the form of comprehensive insurance / package. This includes both “liability” for the vehicle (ie mandatory third party liability) and “own damage”. Vehicle engine.

Car Insurance Estimate Calculator

Premiums for the same policy can vary between insurance companies, so it’s best to choose the policy that offers the most value. Some of the insurance companies that offer car insurance include New India Insurance, United India Insurance, Oriental Insurance Company, ICICI Lombard, Bajaj Allianz, Tata AIG, HDFC Ergo, and Royal Sundaram. Many companies also provide premium online quotes. If you are not satisfied with your current car insurance, you can also switch to another company’s car insurance.

How To Estimate Your Home Insurance Cost

As explained above, there are two parts to a package insurance policy: personal injury insurance and liability insurance. The loss ratio of your insurance premium is calculated based on the following factors:

IDV – The declared value of your car insurance is the maximum amount that can cover losses caused by theft or accidents. This is a significant change that will have a significant impact on insurance costs. IDV is calculated based on the vehicle’s original value. When you renew your policy, your IDV will be adjusted for the reduction that has occurred over time. The reduction rate from IRDA to IDV is shown below.

IDV for vehicles older than 5 years is calculated according to the agreement between the insurance company and the insured. Instead of depreciation, an older car’s IDV is calculated by an evaluation of the vehicle’s condition done by an inspector, car dealer, etc.

Personal injury insurance premiums depend only on the IDV and it is about 2-3% of the IDV depending on the age and volume of the vehicle. Therefore, the lower the IDV value, the lower the premium, and vice versa. We highly recommend getting an IDV that is close to the market value of your car. Some insurance companies will lower your IDV value to lower your premiums, but your coverage will be lower. On the other hand, insurance companies pay based on the discount schedule rather than the IDV at the time of payment, so a higher IDV does not guarantee a higher insurance (even if you pay a higher price).

Average Cost Of Car Insurance 2024

NCB – No Claim Bonus is the next important variable that affects the premium amount. If you did not make a claim last year, you are entitled to NCB compensation. The biggest advantage is that NCB accumulates over many years, so if you are a good driver you can get discounts of up to 50%. However, this benefit will be lost once you start. Therefore, if the amount charged is less than your monthly payment amount, please do not submit the claim. IRDA’s NCB discount table for determining NCB discount rate is given below.

NCBs are collected from the driver rather than from the vehicle, making it possible to transfer from an old vehicle to a new one. If you want to change your insurance again, you can transfer your NCB to a new insurance company by submitting your NCB certificate.

Discounts – In addition to NCB, there are additional discounts on Damage Premium. Types of discounts include installation of anti-theft equipment, membership in the Automobile Association of India, and optional/extreme towing. Voluntary Deductible/Maximum Amount means the amount responsible for paying the insurance claim. For example, if the amount exceeds 1000 rupees, you will pay 1000 rupees of the invoice amount and the rest will be paid by the company. There are two types of excess. The first is an obligation based on C.C. It cannot be excluded from the insurance contract as it depends on the volume (volume) of the vehicle. The second is a voluntary excess, which when accepted will reduce your premium. However, this means that if you incur a loss, you will have to pay most of the money out of your own pocket. Taking a voluntary deduction is generally not recommended, but if you are confident in your driving ability, you may choose to stay within your tax bracket.

Electronic loading and electronic components installed in the vehicle, but not included in the retail price of the vehicle manufacturer, will be insured at an additional cost and will increase the tax. The same applies to CNG/LPG systems.

Appearance Allowance On Insurance Estimate? How To Dispute

In any of the above cases, only the “personal damage insurance fee” will apply. The ‘liability’ portion of the insurance premium is fixed (by the insurance regulator IRDA based on the size of the vehicle) and the rate is subject to change every year. When buying a car, it’s wise to ask, “How much does car insurance cost?” Because it is often the biggest recurring expense for car owners. The average annual premium in the UK is currently £444. This can be difficult to understand. Several factors are taken into account when calculating your price, including your age, driving history, and the type of car you drive. To help you, here are some things that insurance companies take into account when calculating the amount of car insurance.

Insurance premiums vary greatly depending on the make and model of your vehicle. The chart below shows the difference in annual insurance costs for electric cars to give you an idea of how the size and model of an electric car affects insurance premiums.

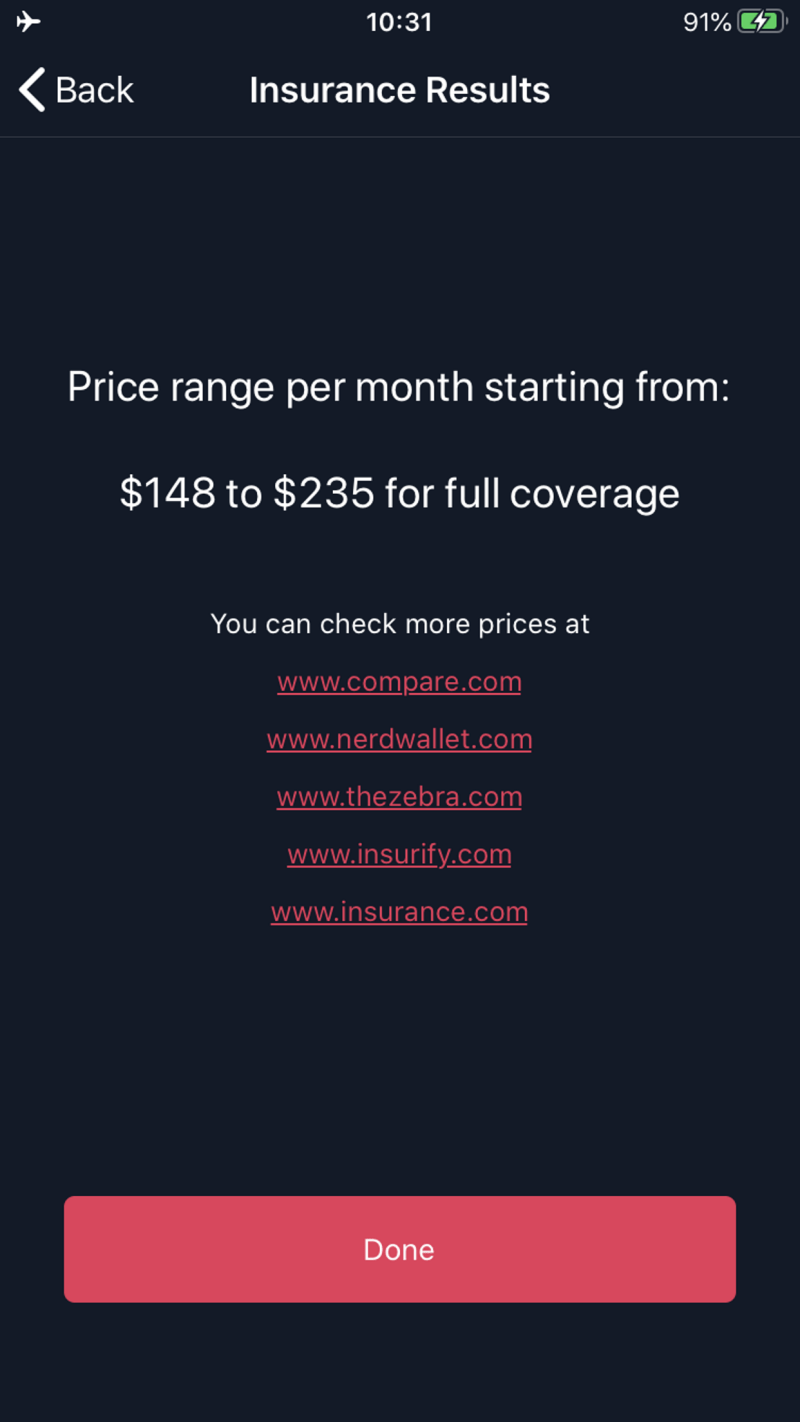

The best way to calculate insurance costs is to narrow down your choices to a few cars that fit your budget and driving needs. From there, you can get quotes from different insurance companies and compare prices.

Remember that the cheapest car is not always the best to ensure. Safety features and maintenance costs should also be considered before making a final decision. Doing your research will ensure you get the best value for your money.

Car Comparison Calculator For Excel

Estimating the cost of car insurance is an important part of owning a car, and there are many things you should consider before getting a quote. First, determine how much area you need. If you rent or lease a car, your lender will want you to pay it back in full. However, if you completely own your car, you may be able to get liability insurance. Don’t automatically decide to choose the best third party insurance. In some cases, the additional travel cost may amount to additional insurance. Think carefully about what you would do if you could lock your car. I would like to change it now, but do you have the time?

Next, consider your driving history. If you have been in an accident or had a previous traffic violation, you can expect a higher rate than someone who was not injured. Finally, research different insurance policies to find one that provides the highest level of coverage you need. By considering these factors, you can estimate how much your car insurance will cost.

As anyone who has purchased car insurance knows, the cost of coverage varies greatly from vehicle to vehicle. That’s why it’s important to get a quote for the same coverage for the car you’re thinking of buying. That way, you can compare insurance rates and decide which car is right for you.

Insurance premiums are a consideration when you buy a car. However, this is important and getting quotes for the same area will make it easier to compare. So, when buying a new car, be sure to get multiple estimates. It will save you money in the long run.

How To Calculate Your Car Insurance Cost

There are other factors to consider when evaluating the cost of auto insurance. Insurance companies often consider individual characteristics when setting rates. For example, young drivers are often considered dangerous. As a result, you can pay higher profits. Likewise, men are often seen as more reckless while driving than women, which can affect your insurance premiums. Finally, insurance companies are in the business of risk assessment and use personal characteristics such as age and marital status as important indicators of risk.

Your driving record is one