Car Insurance Excess Australia – We’re committed to helping you make smart financial decisions and we offer our award-winning comparison tools and services free of charge. As a marketing company we make money from advertising and this page contains links to the visiting site and/or products containing other paid links. You don’t pay anything extra to use our service.

We pride ourselves on the tools and information we provide and, unlike other comparison sites, we also have the ability to search all products in our database, whether or not we have a commercial relationship with the suppliers of the products. products.

Car Insurance Excess Australia

“Sponsored”; The “Special Offer” and “Featured Product” labels describe the products that the vendor has offered to promote more prominently.

Complete Car Rental Insurance Guide

“Sort order” refers to the initial sort order and is not intended to suggest that some products are better than others. You can easily change the assortment of products displayed on the page.

Rules, conditions, exclusions; Limitations and sub-limitations may apply to any insurance products displayed on the Website. Rules, conditions, exclusions; Sub-limitations may affect the benefits and level of cover available under insurance products displayed on the website. Please read the applicable product information statement and target market decision on the insurer’s website for more information before making an insurance product decision. The car insurance excess is a fundamental part of any car insurance policy. The balance is the amount you pay for a claim before your insurer pays out. How Excess Auto Insurance Works It can help you manage your policy effectively and make informed decisions about different types of coverage. This guide provides a comprehensive overview of auto insurance deductibles, answers common questions, and addresses different scenarios to help you navigate your auto insurance with confidence.

A car insurance deductible refers to a predetermined amount that you must pay out of pocket when making a car insurance claim. This amount is agreed when you take out your contract and meets two main objectives: reducing the insurer’s risk and discouraging small claims. Essentially, it is a franchise system that allows you to control the cost of the premium. The greater your surplus, the lower your premiums are generally. Conversely, plus the For example, If your deductible is $500 and your repair costs are $2,000, you pay $500 and the remaining $1,500 is insured.

The standard excess is the base amount you agree to pay for each claim. This amount is set by the insurance company and is covered in most claims. This ensures that you contribute to a portion of the cost of the claim, helping to keep insurance premiums affordable.

What Happens If A Friend Crashes Your Car In Australia

An automatic deductible is an additional amount you choose to pay on top of the standard deductible. Opting for a higher voluntary excess can lower your insurance premiums, but means you’ll pay more out of pocket if you make a claim. For example, your standard deductible is $500 and if you choose a voluntary deductible it is $200. Your total surplus will be $700.

Overtaking generally constitutes a surcharge for drivers under 25 years of age. This excess is due to a higher correlation with younger and less experienced drivers. For example, If a 22 year old driver is involved in an accident; They may have to pay more than their standard of living.

The inexperienced driver allowance applies to drivers with less driving experience; Generally those who have held a license for less than two years. This excess reflects the increase in association with new drivers regardless of age. For example, a thirty-year-old who has only been driving for a year can face this excess.

A driver’s record excess is an additional charge based on the driver’s record, including prior claims or traffic violations. Insurers use this deductible for the increased risk of injured drivers. For example, a driver with multiple speeding tickets may have to pay these additional fees.

Cheapest Car Insurance In Australia Revealed In New Data

Responsible accident: If you are responsible for an accident. The excess amount must be paid at the time of the claim.

Theft of your car: If your car is stolen. You must pay the excess amount to file a claim.

Windshield damage: Depending on your policy, you may have to pay a deductible for windshield repair or replacement.

Do you pay more if it’s not your fault? – If you can prove that the other driver was at fault and provide their contact details. No need to pay more.

Comprehensive Car Insurance Victoria Quotes

Policy Conditions: Some policies have specific conditions or add-ons that waive the excess for certain claims. For example, a windshield protection add-on can cover the full cost of a repair or replacement without having to pay a deductible. Other examples may include requests for emergency repairs or if the damage is minor and falls below a certain threshold.

Some insurers offer the possibility of paying your excess payments. The excess amount is significant and can be particularly useful if paid as a lump sum. Discuss this option with your insurer to understand the terms; Discuss whether this will incur additional costs.

Understanding these terms and payment options will help you manage your personal expenses and ensure you are prepared to make a claim.

An important thing to understand when managing your car insurance policy is the car insurance excess. This amount is the amount you agree to pay out of pocket before your insurance company steps in to pay the remainder of a claim. Here is a detailed overview of the factors that affect the car insurance deductible.

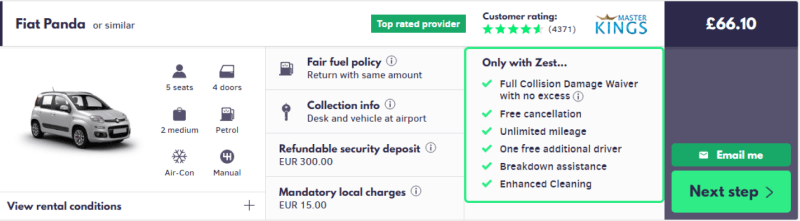

Rental Car Hire Excess Car Insurance Quote

A higher deductible generally lowers your premium. When you choose the highest deductible, agree to bear the initial cost of the claim. This reduces risk for the insurance industry, which often translates into lower monthly premiums for you.

A deductible affects how much you pay out of pocket when you make a claim. When an event occurs, the deductible is the part you pay before coverage begins. An excess means you have to pay more up front if you make a claim, but this may be offset by lower premium costs.

Choose a deductible that balances your premium and accident costs. Determining an excess amount is an assessment of your financial situation. If you must apply, you need to find a balance between manageable premiums and affordable expenses.

Make sure you understand your policy to know the exact amount of your deductible. Review your policy documents or speak to your insurer to clarify any uncertainties. Knowing the details ensures that a claim will not be overlooked when it arises.

What Is Car Insurance Excess And What Does It Mean?

Consider adjusting your deductible based on your financial situation and driving habits. If the claim is weak. Choosing a deductible can reduce your premiums. Conversely, If you want a lower out-of-pocket payment for a claim; A lower deductible may be more appropriate.

Understand your policy; By considering the benefits of adjusting your deductible and knowing the steps to take to file a claim, you can manage your car insurance more effectively and ensure you are prepared for any eventuality.

Understanding when you need to pay your car insurance helps you avoid surprises. Here are answers to common questions:

Yes If you are responsible for damage to another car, you will pay the excess. In fact, you are responsible for the incident and the excess constitutes your contribution to the repair costs. For example, if your other vehicle is totaled and the cost of repairs is $3,000. You must pay the deductible before your insurance company pays the rest.

Renting A Car In Australia: Your Complete Car Rental Guide!

Typically, if you can prove that the other driver was at fault and provide their contact information to your insurance, you generally do not need a deductible. It includes their name, includes contact details and insurance details. If you cannot provide these details; You may need to pay additional fees. For example, If you hit another car at a red light, if you have their information. Your insurance will likely waive your deductible.

Yes If your car is stolen and you make a claim, you must pay the excess. The excess is an integral part of your insurance policy, so it is covered whatever the circumstances of the theft. For example, if your car is stolen from your driveway. You are required to pay the deductible stated in your policy when making a claim.

Yes If your car is damaged by hail and you make a claim, you will usually have to pay the excess. Weather claims generally require you to provide an excess amount. For example, if a storm causes $2,000 worth of damage to your car. You may have to pay the deductible before your insurance will cover the remaining repair costs.

Yes If you claim destruction, you must pay the excess amount. As for theft and accidental damage, the excess constitutes a contribution to the repair costs. For example, if you repair it with your own car key, the cost is high.