Car Insurance In England – Help Links Terms of Use Privacy Policy Information Security Marketing Information Cookies Terms of Use Click Work With Us Download Application

Our analysis of 2.5 million car insurance policies by MoneySuperMarket shows that 19 million low-income drivers in the UK (those who drive less than the UK average of 7,134 miles) are at risk of paying out too much for car insurance.

Car Insurance In England

On average, drivers who drive 5,000 to 6,000 miles a year are paying an average of 3,233 more than those who drive 11,000 miles a year.

How To Check Your Vehicle Insurance

Car insurance is a very simple concept. You pay your insurance every year and you will be covered if the worst happens. The price you pay for your insurance depends on how much your insurer thinks you should claim. The less risk you are exposed to (for example, because of your better driving history), the lower your insurance premiums. That is justice.

Your insurance company will make all the decisions to determine how many accidents you have, one of which is how much time you spend on the road. Because if you don’t stop and drive, you’re less likely to be in danger. So should the insurance premiums for drivers be lower? Unfortunately, the evidence shows that the money paid by the long distance drivers is used to help pay for the medical expenses of the long distance drivers. This is not fair.

We have analyzed nearly 2.5 million car insurance quotes made on the MoneySuperMarket comparison site. We found that low-income drivers (drivers who say they drive less than the national average) can pay up to 9 389.

According to the latest MoT data published by the Department for Transport, the average car in the UK is driven 7,134 miles a year, which means (according to our calculations) about 19 Millions of drivers are at risk. Their car insurance.

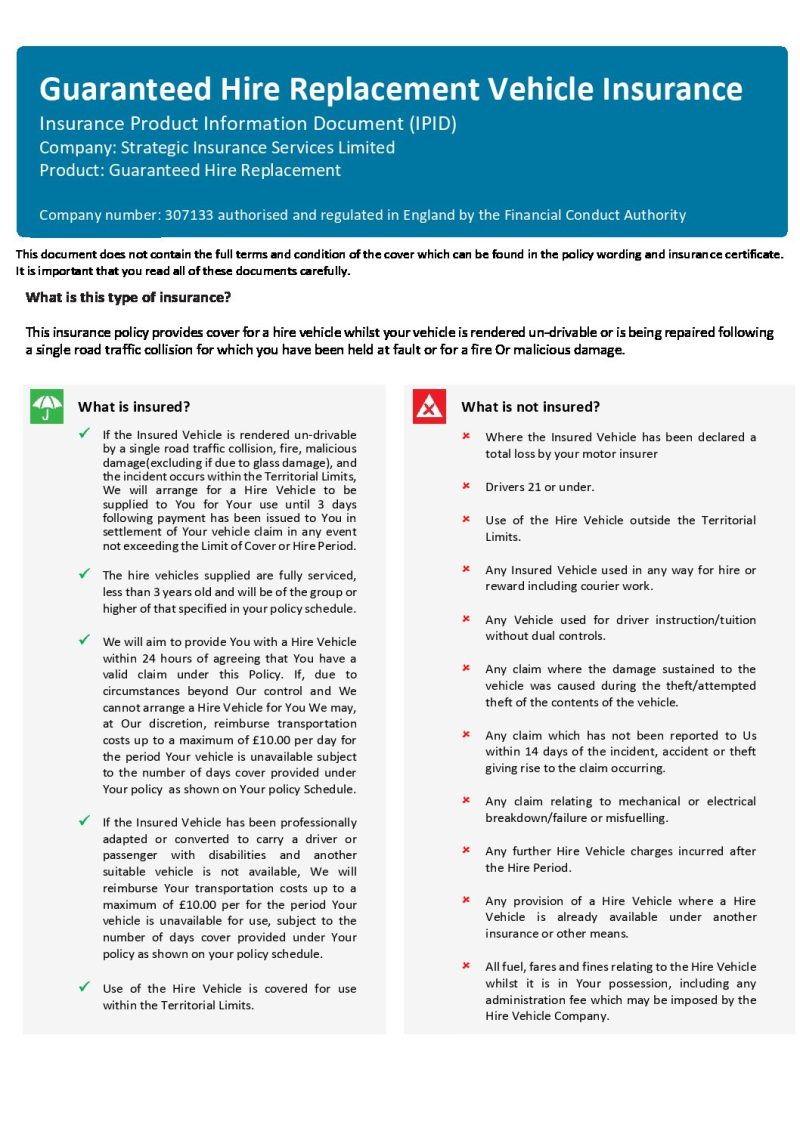

Introducing…our Guaranteed Hire Vehicle Insurance

That’s why in 2018 we set up the Mileage Payment Policy. We think it’s time to present the best and brightest car insurance to the long distance drivers. Unlike traditional doctors, it is now possible because we can measure the miles driven by our members. We believe that if you drive less, you should pay less. It’s very easy.

“Helping drivers get the best out of their car insurance is in our DNA, so offering mileage insurance is a no-brainer. We want to put more brakes on people drive. With less, less ride, less money.

“It’s important to take a tour to make sure you’re getting the best value for your car insurance. It now includes looking at the latest technology that gives people drivers change the way to secure their cars.

For too long, drivers have been led to believe that the cost of their car insurance is tied to the miles they drive, and if they drive less, they pay less.

How To Get Cheap Car Insurance In Uk (england) , 10 Tips And My Experience

This analysis shows the opposite, offering the cheapest car insurance rates for drivers who drive 11,000-12,000 miles a year.

Even the most experienced drivers prefer it, with people aged 50 to 64 driving 5,000 miles a year, using 100 100 more than those driving 11,000 to 12,000 miles.

From 6 to 8 years there is no discount and drivers who drive 5,000-6,000 miles a year are charged 100 100 more than those who drive 10,000-11,000 miles a year.

“It would be right to charge an inexperienced driver more, but if someone has been driving for 20 years, the fact that they now drive 3,000 miles or 10,000 miles a year will have little impact. “they are able to drive.” Discounts are not required to show experience, but are still good for drivers who do not drive long distances.

Kia Car Insurance

Drivers do not receive the discount for consecutive years without the requirement of the policy, so it is a good indicator of the driver’s driving experience and record. traffic safety.

The graph of the cheapest annual car insurance by age (indexed to 1, for example 11,000-12,000 miles).

For most age groups (drivers between the ages of 20-64), drivers estimated to drive 11,000 to 12,000 miles per year receive the cheapest rates, and the most It is estimated that at the age of 25 years. , 000+ miles or less than 1,000 miles. It is surprising to see this phenomenon even among older drivers who often have many years of driving experience.

Surprisingly, only the youngest drivers or experienced drivers (ages 17-19 and over 65 years old) saw cheaper prices for long journeys.

Best Car Insurance Quotes And Providers In 2024

The highest mileage covered in our analysis is between 5,000 and 6,000 miles per year, while the cheapest is between 11,000 and 12,000 miles, with low driver fees £232.59 more. Their car insurance.

The cheapest quotes are for those with an annual mileage of 12,000 miles, which is 50% higher than the UK average.

The most advertised annual distance is 5,000-6,000 years (19%), while drivers aged 30-39 see the advertisement (23% of all quotes).

3) Prices shown are the average price of cheap car insurance for each age group and distance group each year.

How To Check If A Car Is Insured In The Uk?

Note: In all cases, the so-called ‘average price’, ‘average quote’ or otherwise, the prices contained in this report are the average of the cheapest auto insurance quotes for age and annual distance group.

1) Data based on quotes from 2,466,055 customers from car insurance companies on MoneySuperMarket, which started from July 1, 2018 to September 30, 2018. The prices shown are the average of the lowest car insurance rates for each age group and annual distance group. Location

2) According to the Department for Transport, there were 31.6 million registered vehicles in the UK as of September 2018. Source

3) 8,755,173 out of 14,503,248 cars drive less than 7,134 miles a year (60.4% of all UK cars). According to the latest MoT data from the UK Department of Transport, the average was 7,134 miles in 2017. Cars that are less than 3 years old are not included in the MOT data. Location

New Driver Insurance Uk

4) 60.4% of 31,600,000 cars are 19,086,400 units. According to the survey data above, 19 million drivers are at risk of paying too much for car insurance. Location

By Miles is the UK’s first startup offering car insurance for people who drive less than 7,000 miles a year. Drivers pay a small fee for the policy each year and then pay at the end of each month for the miles they drive. This gives many drivers the opportunity to reduce their costs if they use their car more often for short trips or holidays.

As of January 31, 2019, we have a 9.7 rating on TrustPilot and a good 5 star rating from Defaqto. BuyMiles is licensed and regulated by the Financial Execution Authority.

MoneySuperMarket is the UK’s leading comparison website. They provide free online tools to help people manage their savings and grow their money, allowing people to compare and shop for insurance products and home services from more than 980 service providers across 44 different sectors.

Young Drivers Face £3,000 Cost For Car Insurance

MoneySuperMarket is part of MoneySuperMarket Group PLC, a founding member of the FTSE 250 Index. In 2017, they helped nearly eight million families save $2.2 billion on their household bills, including 5 million people who saved money on insurance, 2 million people who were better off financially. and more than half a million households have switched to electricity. Distributor.

Moneysupermarket.com Limited is a representative of Moneysupermarket.com Financial Group Limited and is authorized and regulated by the Financial Conduct Authority (FCA FRN 303190) for credit insurance and the credit products it offers. On the Ofgem Trust Code. According to the data, young drivers have suffered the most with the highest car insurance premiums, with insurance costs around £3,000, according to information.

Confused.com, a price comparison company, says that the average life expectancy of 17-20 year olds is up by more than £1,000 compared to the same period last year.

Steve Dukes, CEO of Confused.com, told Radio 4’s Today: “The frequency of requests has increased in the last few years since the outbreak, but so have their costs.

Car Insurance Uk Hi-res Stock Photography And Images

“Used car prices are higher than before, the cost of spare parts, the labor cost to repair everything must be passed on to the customer.”

The price for used cars, the first regular car for young drivers with new capabilities – has changed since the month of the Covid outbreak. Demand for used cars is increasing because new cars are in decline due to the global shortage of computers and other necessary equipment.

In March 2022, prices in the used car market reached an all-time high.