- Car Insurance Increase Australia

- Insurance Renewal Email Template: What To Write To Current Customers To Renew Insurance — Stripo.email

- Car Insurance In South Australia

- The Rise Of Electric Vehicles In Australia

- Why Insurance Premiums Are Squeezing Australians And Fuelling Inflation

- Oc] Car Insurance Prices Top Latest Cpi Report

Car Insurance Increase Australia – Data shows young drivers are hit hardest by record car insurance premiums, with some facing premiums of almost £3,000.

On average, premiums for 17-20-year-olds have risen by more than £1,000 compared to the same time last year, according to price comparison company Confused.com.

Car Insurance Increase Australia

Steve Dukes, chief executive of Confused.com, told Radio 4’s Today programme: “The frequency of claims has increased in recent years since the pandemic, but so have the costs.

The Big Read: Growing Calls To Regulate Car-sharing, Amid Rising Complaints Of Hefty Repair Costs And Poor Service

“Used car prices are higher than before, including parts and repair labor costs, all of which are passed on to consumers.”

Prices of used cars, the first cars for qualified young drivers, have been volatile in the months since the corona pandemic began. Demand for used cars has soared as production of new cars has fallen due to global shortages of computer chips and other materials needed for manufacturing.

According to the Office for National Statistics, the rate of price increase in the used car market reached 31% in March 2022. After that, it fell sharply.

However, the young driver faced the strongest hope. For 17-year-old drivers, insurance premiums rose by an average of £1,423 to £2,877. For 18-year-old drivers, the average insurance price came to £3,162.

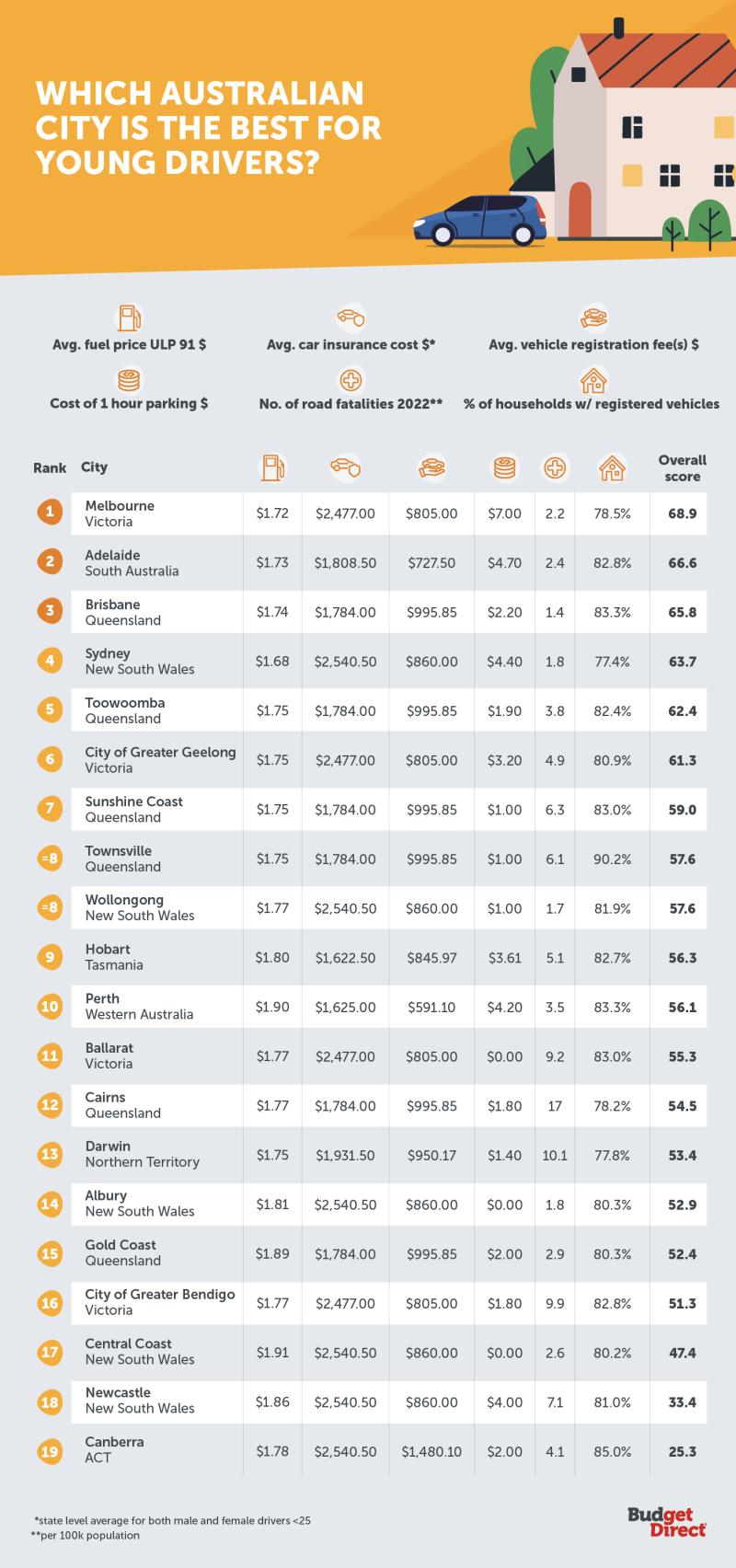

The Best And Worst Cities For Young Drivers In Australia

This data is calculated based on the average of the top 5 quotes from Confused.com, not the actual price paid for the policy.

Dukes said there are ways to lower premiums. “If you can legally share the drive with a more experienced and older driver and adding that person as a designated driver can make a huge difference and reduce your charges by hundreds of pounds, it’s worth considering,” he said.

Dukes also suggested young drivers consider telematics and “pay as you drive” insurance. With this insurance, your driving behavior on the road is shared with your underlying insurance company and with the driver’s temporary insurance.

But with the rising price of cars for 17- to 20-year-olds, many young drivers will question whether they can afford to drive, he said.

Insurance Renewal Email Template: What To Write To Current Customers To Renew Insurance — Stripo.email

He said: “The industry needs to be careful not to force young drivers to use other modes of transport, and with prices this high, that’s a huge risk.”

The Association of British Insurers (ABI) said car insurance can be expensive, but there are ways to reduce costs.

He also said it was important motorists never drive without cover and urged anyone struggling with the costs to contact their insurance company.

However, the ABI says insurance is always based on risk and its data shows average costs and claims rates are higher for younger drivers, which can affect premiums.

Surging Auto Insurance Rates Squeeze Drivers, Fuel Inflation

The ABI’s exclusive analysis of 28 million policies found that insurance costs for drivers rose by an average of £561 between July and September, a 29% increase compared to the same period in 2022.

The association said the figure was based on the price customers paid for their insurance, not the amount they were offered.

If you would like to speak to a reporter, please provide your contact number. You can also contact us via:

If you are reading this page and cannot see the form, please visit the mobile version of the website to submit your questions or comments, or email [email protected]. When applying, please state your name, age and location.

Car Insurance In South Australia

3 days ago ‘Dartford Crossing tour ends with bailiff showing up at door’ Dart Charge bailiffs have raised almost £112m since 2019, it has been revealed. England 3 days ago

4 days ago Do ultra bright headlights really blind drivers? Special vehicles are equipped with instruments to measure the light level of the headlights of oncoming vehicles. 4 days ago United Kingdom

7 days ago Pall Mall closes to show older and newer cars. The vehicles on display in central London include models dating back to 1896 and modern supercars. London 7 days ago

30 October 2024 Vehicles seized in crackdown on illegal bids Seven people were arrested overnight and the drivers of five vehicles were found to have no insurance.

The Rise Of Electric Vehicles In Australia

30 October 2024 Gloucestershire Police have shared images from an operation involving officers in an unmarked lorry. Oct 30, 2024 Gloucestershire car insurance is a must-have product for many Australians across the country, but you don’t have to spend a lot to get some peace of mind.

So if you’re getting close to renewal time or you’ve just found out your car insurance premiums are going up, it might be time to call on your inner “Karen” and negotiate.

Pay no “loyalty tax” Car insurance companies often offer favorable terms to new customers, but premiums for existing customers can increase year after year. See how to negotiate car insurance

If you feel you need more industry knowledge before venturing into the haggling territory, check out our guide to switching car insurance.

Why Insurance Premiums Are Squeezing Australians And Fuelling Inflation

Jack is RG146 Generic Knowledge certified and holds a BA in Communication in Creative Writing from UTS, using his creative talents to understand financial jargon and make mortgages, insurance and banking interesting. His reader-centric approach to content creation and passion for financial literacy means he’s always looking for innovative ways to explain personal finance. Jack’s research and explanations have appeared in government publications, and his work regularly appears alongside top publications in Google’s top insurance stories.

Insurance products displayed on the Website may be subject to conditions, exclusions, limitations and sub-limitations. These conditions, exclusions, limitations and sub-limitations may affect the levels of benefits and reimbursements available with the insurance products displayed on the Website. Before making a decision on an insurance product, please see the relevant product information and target market definition on the provider’s website for more information.

Join over 35,000 subscribers and receive Moneyzone’s weekly newsletter, featuring the latest in interest rates, exclusive offers, money-saving tricks and expert insights.

Our goal is to help you make smart financial decisions, and our award-winning comparison tools and services are provided free of charge. As a marketplace company, we make money from advertising and this site contains products that include “Go to Site” links and other paid links that allow users to access the site from our site. When you do something or buy a product, the supplier pays us a fee. de You pay no extra fees to use our services.

Oc] Car Insurance Prices Top Latest Cpi Report

We pride ourselves on the tools and information we provide, and unlike other comparison sites, we also have the ability to search all products in our database, regardless of whether we have a business relationship with the supplier

The labels “Sponsored”, “Popular Offers” and “Featured Products” indicate products that the supplier has paid to promote more prominently.

“Sort order” refers to the original sort order and does not imply that any particular product is better than another. You can easily change the order of the products displayed on the page. Watch the video below to learn how to install our website as a web app on your home screen.

It’s no secret that the cost of living is rising, and older Australians are hit particularly hard when it comes to car insurance. “The average increase nationally is 18% compared to last year,” said Canstar’s Steve Mickenbecker. This is an average increase of $274 per policy.

Car Insurance Marketing: 3 Trends + 9 Strategies

But don’t despair. This cloud looks great and comes in the form of Compare Markets*. This smart comparison business helps thousands of seniors save big on car insurance* by comparing up to 10 car insurance companies. One customer saved $418 on their insurance.

So how can you take advantage of these potential savings Adrian Taylor, managing director of Property & Casualty Insurance at Compare the Market*, shares inside information.

“Your renewal policy should show both last year’s premium and the new one, so you can see straight away how much more you have to pay,” advises Adrian. “Before you compare car insurance, look at the differences to see how big the new changes are.”

But it’s more than just comparing apples to apples. Adrian suggests that you think about who will drive your car. “In general, drivers under 25 can expect to pay higher premiums. If you can limit the age of the drivers on your policy, you can ultimately save money.”

How Much Does Car Insurance Cost In Australia?

Also, don’t forget potential savings with our pay-as-you-go policy, rebates and no-claims rebates and buying cover online*. You can also lower your premium by raising your deductible, but this means that your deductible will be more expensive if you make a claim.

You don’t have to wait for updates to save money. You can cancel your existing insurance and change insurance companies at any time. Please note that cancellation fees may apply.

As car insurance premiums rise,