Car Insurance Malaysia – Effective 1 July 2017, Bank Negara Malaysia (BNM) proposed to liberalize motor insurance rates for its motor comprehensive and motor third party, fire and theft products. As a result of liberalization, product premium rates are set by individual insurance companies and taka operators. This move has provided consumers with more options due to different premiums offered by insurance companies.

In this article, we’ll share more about motor insurance rate liberalization and how it affects you as a consumer.

Car Insurance Malaysia

The liberalization of motor insurance rates means that motor insurance premiums in the market will no longer be based on the motor interest rates set by Bank Negara Malaysia. Liberalization allowed insurance and takaful operators to set premium rates for motor comprehensive and motor third party, fire and theft products.

Jom Cover & Get Rewarded

The move is beneficial to insurance companies and insurers as well as consumers. For policyholders and insurers, they can contribute premiums or contributions to policyholders. They can also customize insurance or coverage plans based on the risk profile of the proposer. At the same time, consumers can choose from a wider range of motor insurance products in the market at competitive prices.

Tariff is a set of fixed prices under the Insurance Act that simplifies and controls premiums and policy making. For example, depending on the interest rate, insurance and insurance operators do not have the right to change the premium rate.

As the regulator of all financial institutions, Bank Negara Malaysia sets and controls car insurance rates.

Before liberalisation, the calculation of car insurance premium was based on the number of insured persons and the number of cars. Insurers can also charge limited premiums based on the age of the driver and the number of road accidents.

Commercial Car Insurance Malaysia

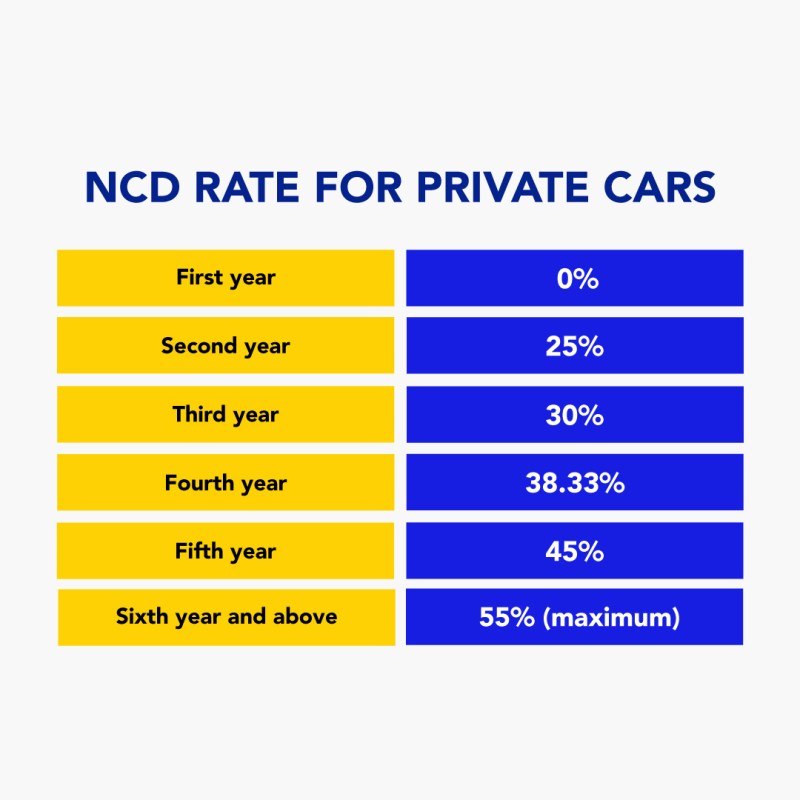

In addition, the calculated premium is adjusted based on the driver’s claim record (NCD). Generally, drivers with a good driving record can enjoy a higher percentage of NCDs, up to 55% for private cars.

From 1 July 2017, more risk factors will be taken into account when determining car insurance premiums. The risk depends primarily on the number of insured persons, the engine power of the vehicle and the age of the driver and vehicle.

The above factors determine the risk profile of insurance companies, which in turn determine premiums. Because insurance companies have different methods of determining their risk profile, insurance companies may differ in their premiums.

Liberalization was implemented on July 1, 2016. In this phase, insurance companies and takaful operators have the flexibility to offer new motor products and additional cover not covered by the current tariff.

Comprehensive Guide On How To Choose Car Insurance 2023

From 1 July 2017, insurance companies and takaal operators are given more flexibility. They can set premium rates for Motor Comprehensive and Motor Third Party, Fire and Theft products.

As mentioned above, premiums for Liberalization, Motor Comprehensive and Motor Third Party, Fire and Theft products are not based solely on vehicle model, age and engine power.

Premiums are based on the policyholder’s risk profile, such as driving record and claim history. This subjective assessment identifies the rates offered by insurance companies and taxi operators.

After liberalization, consumers can expect premium rates to vary between insurance providers and takaful operators, even if premiums are not the same.

Malaysian Motor Detariffication

Example: You may find that Company A offers insurance at a lower price that fits your budget and needs. On the other hand, Company B may offer the same insurance coverage but at a higher price.

Therefore, liberalization allowed comparison of insurance premiums between insurance companies. When considering different insurance premiums, it is always best to shop for the best insurance that fits your budget and needs.

Insurance can be easily compared online. For this, you can visit the insurance provider’s website and get your quote online.

Example: If you want to get a quote from Company A, you can visit their website and enter the necessary information to get your quote. To ensure the best insurance at the best price, it is best to compare at least three insurance policies in terms of premiums and offers.

Tokio Marine Is Now At All Pos Malaysia Outlets

An easier way to compare insurance companies that can save you is MyEG and. Instead of visiting multiple insurance websites, you can get quotes from different insurances in minutes.

No, you still get NCD. You can transfer from one insurance company or insurance carrier to another insurance company.

For your information, NCD rates for private cars vary from 25% to 55%. The table shows NCD rates every hour.

Yes, consumers who want to opt for a third-party insurance policy can purchase it based on their rates.

Commercial Auto Insurance Guide For Business Owners

As we have shared, after the liberalization of motor tariffs, motor comprehensive and motor third party charges, fire and theft products will not be subject to earlier fixed rates. Therefore, as a consumer, it is best to compare insurance companies to get the best car insurance or motor takaful at the cheapest price.

To easily compare insurance companies, use one of the largest insurance comparison sites in Malaysia to compare 15 insurance brands for free. Visit our free online car insurance to get started and choose the best plan that fits your needs and budget.

It is one of the largest insurance comparison sites in Malaysia, offering policies from more than 10 brands. Get your free insurance today! Third party coverage is motor insurance coverage that covers death or injury to a third party and damage to someone else’s vehicle or property.

Third Party, Fire and Theft Covers the loss to the insured’s vehicle due to fire or theft of the insured’s vehicle.

Allianz Car Insurance: Top 2 Plans To Consider For Your Vehicle

You know, even with comprehensive car insurance, car insurance only covers your car in the event of an accident. This means that you will have to pay for hospitalization or an ambulance as a result.

Consider getting an optional Driver Personal Accident (DPA) policy to protect yourself and your passengers. If you have been injured in an accident, DPA can cover total or partial permanent disability, medical expenses, hospital income, etc.

Did you know that wind damage can often be repaired? However, a claim against your motor policy will recover the ‘Non-Claim Deductible’ (NCD). So for windshield repair or replacement, it is better to get a windshield with additional cover.

Note: Between February 15th and August 14th, if you choose to repair the windshield instead of replacing it, the additional windshield will be refunded for an additional fee. The repair option saves time in the workshop and is environmentally friendly.

Toyota Car Tokio Marine Motor Insurance

If you’re in your car and floodwaters are rising, remember these simple steps and keep yourself and your passengers safe.

For more information on 24 hour motor assistance and special risk add-ons, contact an insurance advisor or click here to get in touch.

To learn more about mandatory excess and other important claims, contact your insurance advisor or click here to watch a video on mandatory excess motoring.

Refurbishment is an additional fee for older vehicles (typically 5 years or older) to cover the cost of replacing the old part with the new vehicle. It is common practice in the industry when this is requested.

Can You Cancel Your Car Insurance Policy?

If you’ve been involved in a car accident, you should know Knock or ODKFK’s own breakdown points – it’ll make your claim easier and save you NCDs too!

ODKFK allows you to file a claim with your own insurance company instead of the other party’s insurance company. This means faster processing of your business request.

Do you know what to do when you have a personal injury claim? It’s always good to know the basic steps before applying.

The auto insurance market used to be regulated by a fixed price structure called interest. In 2017, the industry began a phase of liberalization of motor insurance, gradually introducing more competition and flexibility.

Intelligent Money Malaysia

We are now moving to a more dynamic pricing system based on risk factors such as driver profile, vehicle type and historical claim data. This approach encourages competition, innovation and more accurate pricing.

As consumers shop for auto insurance, it’s important to know the options. Contact an insurance advisor today for more information!

Report to the police immediately and take the vehicle (if not drivable) to an approved toll repairer.

If you decide to apply. Notify your insurance advisor as soon as possible! You can find general application instructions here.

Phased Liberalisation Of Motor Insurance

Photographs of the incident and their contact details