Car Insurance Mississippi – Home » Buy Car Insurance » Best Car Insurance in Your State » Mississippi Car Insurance (The Only Guide You’ll Need)

Jeffrey Johnson is a legal writer specializing in personal injury He has experience in personal injury and privacy litigation, family, property and criminal law He received his J.D. from the University of Baltimore and has worked at law firms and nonprofits in Maryland, Texas and North Carolina. She also earned an MFA in screenwriting from Chapman Univ…

Car Insurance Mississippi

Zac Faggiano has been in the insurance industry for over 10 years, specializing in property and casualty consulting and risk management. He started out specializing in small businesses and moved on to bigger ventures in commercial real estate During that time, he earned his property and casualty, life and health and residual line brokerage licenses He is currently vice president overseeing international…

Aarp Car Insurance Program

Advertiser Disclosure: We strive to help you make safe insurance decisions Comparison shopping should be easy We work with leading insurance providers This does not affect our content Our opinions are our own

Editorial Guidelines: We are a free online resource for anyone interested in learning more about auto insurance Our goal is to be an objective, third-party source for all things auto insurance We update our site regularly and all content is reviewed by car insurance experts

The Magnolia State, better known as Mississippi, is rich with that deep southern culture that continues to attract people. With so many people on the road, you want to make sure you have the right insurance coverage

That’s why we’ve created this comprehensive guide to help you find the best service for your needs and to make sure you have the basic requirements to legally drive in Mississippi.

Cheapest Car Insurance In Mississippi: Cost & Plans (2024)

Ready to get started now? Use our free online tool You need your zip code to get started

The biggest thing to talk about when getting insurance coverage is what kind of coverage you need and what price you will pay

We will discuss exactly that in this chapter We’ll cover everything you need to know about required coverage in Mississippi, and you’ll also find some fees for the state.

Like most states in the country, Mississippi requires you to have what’s called a minimum liability to legally drive. What exactly is minimum liability coverage?

Car Insurance Rate Increases

Minimum liability coverage is the lowest amount of insurance coverage (coverage that helps protect you in the event of an accident) that you are allowed.

So what can you expect for Mississippi? Mississippi comes with a 20/40/10 minimum liability insurance policy, which we explain in more detail below:

This is very important to obtain, as Mississippi is considered a “sin” state This means you end up in a “you broke it, you bought it” kind of situation

So while you should have minimum coverage, remember it’s only the minimum It is always wise to consider getting at least more than the minimum coverage

How To Get A Mississippi Bonded Title

A form of financial liability, known as proof of insurance, is a way for others to confirm that you have this minimum liability insurance.

So what type of proof of insurance is appropriate in Mississippi? Any of the following is considered an acceptable form of financial responsibility:

Per capita disposable income is the amount of money a group (such as the citizens of Mississippi) has after taxes

So let’s say you make $75,000 a year, but you have $60,000 after taxes. That $0,000 is your disposable income You have a disposable income with other Mississippi residents, and there you have it, a disposable income per capita!

Mississippi Auto Insurance [rates + Cheap Coverage Guide]

In Mississippi, the per capita disposable income is $31,365 after taxes, which you use to spend on things like rent, groceries and even car insurance premiums.

In the table below, we show three-year trends in per capita disposable income, the average cost of total insurance, and what share of this disposable income goes to insurance coverage.

As you can see, about 3 percent of Mississippi citizens’ income goes to their insurance coverage alone It is important to make sure that you budget yourself to pay for this coverage

According to the National Association of Insurance Commissioners, you can expect the following basic costs in Mississippi:

Cheapest Car Insurance In Mississippi (october ’24)

Your average monthly car insurance cost may not increase as much as you think by adding additional coverage like comprehensive. Check the prices for car insurance coverage below:

In addition to the minimum liability coverage available, there are additional types of liability coverage that are optional for Mississippi drivers, such as Medical Pay (MedPay) and Uninsured/Underinsured Motorist.

Medical expenses if you are injured in an accident Payments are made on bodily injury coverage

Underinsured/underinsured motorist coverage is if you are involved in an accident with a driver who has minimal coverage or no coverage at all.

Best Car Insurance For Doordash Drivers In 2024 (top 10 Companies)

According to the National Association of Insurance Commissioners (NAIC), Mississippi has 23.7 percent of uninsured motorists, making it the second most uninsured state in the nation!

Now that we’ve covered what additional types of liability insurance cover, we’ll discuss their loss rates in the state of Mississippi.

Claims ratio is the amount that insurance companies pay their customers compared to the amount they receive through insurance premiums that you pay.

The right place Not too high and not too low If the loss ratio of the insurance companies is very low, it means that they are not paying enough on the claims of their customers

Full Coverage Auto Insurance (2024)

If insurance companies have a high loss ratio (over 100 percent), it means they are paying too much in claims and are actually at risk of bankruptcy.

As you can see, both types of coverage are in a good place They are not too tall and not too short

Our biggest priority is to make sure you get the car insurance you need and the best price Did you know there are affordable supplemental insurance options you can add to your policy? Check the list below to see what you can add to your Mississippi policy:

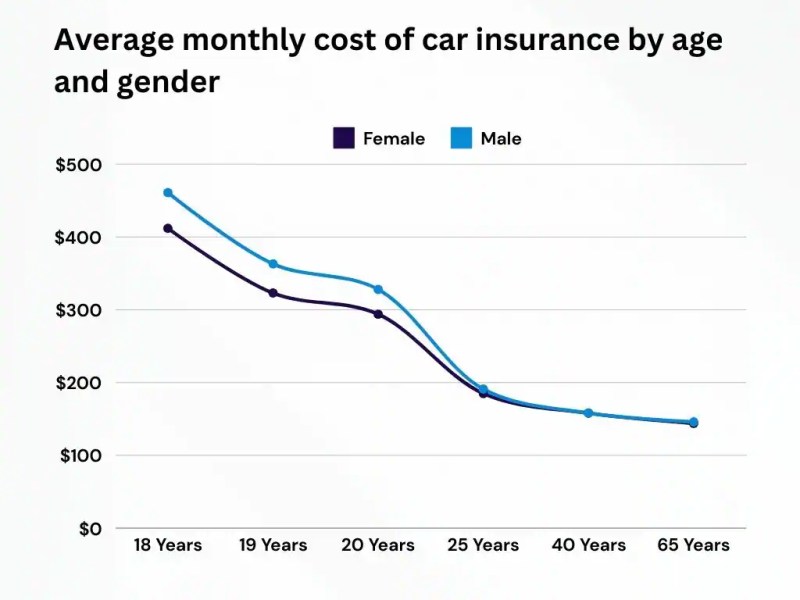

It’s often a myth that men are willing to pay more for their insurance than women, so we decided to find out if that’s true in Mississippi.

Mississippi Car Insurance

What we found instead is that more often than not, it’s not your gender that affects your insurance coverage, but your age and marital status.

In this next section, we will discuss auto insurance companies that you can use in Mississippi There are so many that it seems overwhelming, so we’ll cover the biggest companies in the state

How does a zip code affect car insurance? Factors such as traffic, crime and claim rates in your area are important Find out how your zip code compares to other zip codes in MS

Did you know that while insurance companies can check your credit history, what your financial health is, you can do the same for them. That’s right, you can easily check the financial health of a company through an agency called A.M Best grade

Best Car Insurance In Mississippi (2024)

This rating system rates a company based on several financial factors The higher the score, the better the financial health of the company.

Check out the chart below to see what the financial ratings are for Mississippi’s largest companies:

Studied J.D The power to discover which companies have the best customer ratings in every region of the United States Mississippi falls in the southeast region, so the following are J.D. Strengths of Study:

Just as you want to know how happy other customers are with a company, you also want to know how unhappy they are In the table below, we’ve compiled the complaint rates for various insurance carriers in Mississippi:

Affordable Car Insurance Online In Us

Yes, how far you travel regularly can affect what your insurance rates will be Generally the more you drive the more you pay But this is not always the case these days

Companies are starting to get smart and charge the same fee regardless of what your trip looks like You can watch it nationwide above Unfortunately, many companies still do So make sure you follow these factors, which will help you in the long run

Who wants to pay more for less? Nobody, right? Well, as it turns out, you may pay a higher rate for a lower level of coverage

As you can see from the table above, a short plan with Liberty Mutual will cost you $4,179.80 while a high coverage plan with Travelers will cost you $3,897.41. This means you will pay $282.39

Cheapest Car Insurance For A Bad Driving Record

That is