Car Insurance Perth – This guide will help you view your insurance policy online. This feature is currently not available for the following products:

If you buy a new car, you don’t need to cancel your current car insurance policy. You can only change your old policy. Updating your car details online may result in a higher premium or a refund if the new premium is lower.

Car Insurance Perth

If you have changed your address or stored your car elsewhere or in the suburbs, you must notify us. This may affect your premium, so you may have to pay a little more or get a refund.

Corporate Car Hire Perth

There are many reasons why you might want to change your information. You can close your account and start paying from a new account. You want to consolidate your payments so they all come from one bank account. You can also choose a separate bank account for each insurance policy. If you need to change your bank details, you will need to change them for each policy you wish to use the new bank details for. For example, you can’t just exchange it for your car insurance policy and then expect it to automatically update to your home policy.

The certificate of validity is a document that confirms that the current policy is valid from the date of issue and indicates the details of the insurance policy. Third parties are often required to provide evidence that you have adequate coverage for the property or business. Relax – your policy covers you with up to $30 million in liability coverage, regardless of who is at fault.*

If the authorized repairs prove to be defective, CGU will inspect them and be able to repair them free of charge.*

Change your mind? Get a refund if you cancel your policy within the first 21 days without making a claim.*

Wa Car Insurance

This is just a summary. See what is and isn’t included in the Product Disclosure Statement (PDS).

The whole family can enjoy additional peace of mind! With this option, the vehicle can be driven by any licensed person.

This is a great premium saving option if you don’t drive your car often or for another car.

With comprehensive car insurance, you have the option of adding additional extras such as windscreen protection, rental car accident coverage and more. Policy terms, conditions, limitations and exclusions apply.

Non-owner Car Insurance: Facts You Need To Know

In addition to the cost of damage to another vehicle, third-party property damage insurance helps provide up to $5,000 in uninsured motorist protection and up to $30 million in liability coverage.

Third-party fire and theft auto insurance helps provide up to $5,000 in uninsured motorist protection and up to $30 million in liability coverage.

It also covers your legal liability for loss or damage to your vehicle as a result of fire or theft, and for loss or damage to another person’s vehicle or property.

If you have a standard policy, your car is covered regardless of who is driving it (with some exceptions).

Cash For Totaled Cars

If you have a designated driver policy, drivers under 25 are not covered (except for learners with a fully licensed driver over 25). Also, if someone is driving and isn’t listed as the designated driver on your policy, you’ll pay more if you make a claim.

Excess insurance is simply the amount you pay to cover the cost of an insurance claim.

There are different types of excesses that apply to different policies. For example, on top of the basic excess that applies when you apply for car insurance, you may also have to pay an excess, inexperienced driver premium or additional excess. Please see the Product Disclosure Statement for more information.

*Underwriting criteria, policy conditions, limitations and exclusions apply. Please see the Product Disclosure Statement for complete information.

Car Insurance Quotes Online

Police & Nurses Limited (P&N Bank) ABN 69 087 651 876 AFSL 240701 operating under its AFSL and trading as CGU Insurance ABN 11 000 016 722 by arrangement with Issuing Insurance Australia Limited, AF812 provides general advice only. and does not take into account your personal goals, financial situation or needs (“Your Personal Circumstances”). You should consider your individual circumstances and the relevant Product Disclosure Statement and Target Market Definition (TMD) before using this advice to decide whether to purchase a product. Insuring a new purchase is something most people do by default. You don’t really think much about it. In fact, if your new purchase is underwritten by a lender, it is imperative that you have full comprehensive insurance.

Comprehensive insurance is a great way to provide peace of mind against the unexpected. This will likely cover you in the event of an accident, regardless of who is at fault.

Our specialist motor insurance company team can help you with your insurance policy.

Yes Approved Finance is a trading entity of Yes Approved Pty Limited A.C.N 655 225 264. National Loans Pty Ltd Authorized Credit Representative (ACR # 536225).

Cheapest Cars To Insure In Australia

*Comparison rates shown are based on a secured loan amount of $30,000 over a 5-year term. This benchmark is accurate only for the examples provided and may not include all fees and charges. Any changes in terms, fees or other loan amounts may result in a different comparison rate. Any rates or payments shown are not a credit offer or an official credit offer. This is just an estimate and estimate of what you can achieve based on input or general information. It does not take into account different product features or types of loan products and does not take into account all aspects of your individual situation. Rates and payouts are based on user input or general information. All loan applications must be verified prior to the official evaluation process. All loan applications are subject to credit approval from the lender and approval is not guaranteed. We do not compare all brands on the market or all products offered by all brands. Sometimes certain brands or products are not available or offered to you. Learn more about how our comparison service works.

All WA drivers have four main types of insurance, one of which is compulsory and three which are optional and should be considered before driving on any Australian road.

If you drive in WA, there are some car insurance options that can pay for your policy to top up your cover.

If necessary, there are ways to reduce the cost of premiums, such as restricting younger drivers from using your car or withdrawing unused benefits such as roadside assistance or increasing your excess.

Car Insurance Claims

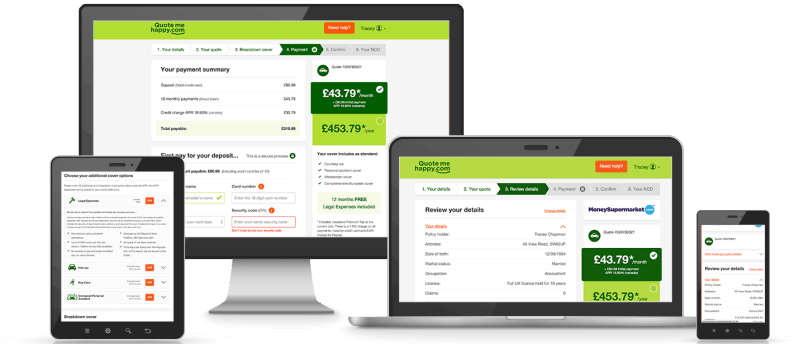

Take a few simple steps online to switch to a new deal that’s right for you and your budget.

When you buy through us, our partners pay a commission that provides our service to you free of charge. We do not mark any prices on our website.

We take privacy and data security seriously and will only use your information with your permission. You can read our full privacy policy here.

Kochi discusses car insurance in WA. Types of Car Insurance What car insurance features should WA drivers look for? Car Insurance WA How Car Insurance Premiums Work in WA What Will Car Insurance Cover? Check out our expert affiliates

Terms & Conditions

Looking for the best value car cover in WA? Our Chief Economist David Koch shares our expert advice to help you save.

Protecting your car in Western Australia is very important. Covering more than 2.5 million square kilometers, it’s a great place to roam and has a variety of road conditions to get used to. Fortunately, there’s a car insurance policy for every car and every driver—you just need to know what’s right for you.

If you want to insure yourself against the cost of a potential loss, you have three options. Third party property damage will cover you for damage to other people’s vehicles and property and, in limited circumstances, to your own vehicle. A third-party fire and theft feature adds fire and theft protection on top of that. And comprehensive car insurance covers damage to your car and more for complete peace of mind.

But finding the right coverage doesn’t mean you’ll get carried away. Here are some tips to help you save on comparison shopping. transfer excess. If you are a safe driver, you can pay less on your premium if you choose to pay more in the event of a claim.

Car Rental Insurance

Update your information. Small changes like parking your car in a garage overnight or limiting your policy to drivers 25 and older can lower your premiums. If you now drive less because you work from home, see if a low mileage policy might be right for you. Pay your own way.

Pay bi-weekly, monthly or annually to suit your budget and cash flow, but remember that payments can be made in installments.