Car Insurance Rates By Age Chart – We found car insurance rates for 18-year-olds using rates provided by Quadrant Information Services. The 2017 Toyota Camry LE has 10,000 miles per year in all 50 states and Washington. Our data experts have analyzed the rates for each postcode, where the rates are for full protection and the following coverage limits:

Some carriers may be represented by subsidiaries or affiliates. The prices given are examples of fees. Your actual rating may vary.

Car Insurance Rates By Age Chart

Car insurance costs $411 per month for an 18-year-old. That’s $4,931 a year, which is $3,279 more than the average premium for adults (drivers ages 30, 35, and 45).

Compare Car Insurance Quotes (2024 Updated)

Although rates are higher for 18-year-olds, young drivers can find cheaper car insurance by comparing rates from different companies. At COUNTRY Financial, for example, rates for an 18-year-old are 49% cheaper than the average for drivers this year, at $209 a month.

Many companies with low car insurance for under 18s are not national carriers, including COUNTRY. But we found the cheapest insurance at USAA, State Farm, and GEICO, which sell auto insurance in nearly every state.

Grades How we grade: ‘ Grades are determined by teachers. Our process takes into account many factors including price, financial aspects, quality of customer service and other product features.

COUNTRY is the cheapest car insurance company for 18 year old drivers. The average 18-year-old COUNTRY spends $2,419 less per year than the average in their age group – almost half the national average.

Security National Insurance Company Review [2024]

COUNTRY is the best insurance company for 18 year old drivers because of their discounts. In addition to a range of policies and legacy exclusions, COUNTRY also offers cost-saving options designed for young drivers.

According to the National Association of Insurance Commissioners, the country receives the fewest complaints. J.D. Ike’s 2021 Auto Insurance Survey Recognized COUNTRY as one of the Midwest’s Best Service Providers.

The best car insurance for 18-year-olds is GEICO, which has the highest rating among the cheapest companies.

GEICO has the cheapest auto insurance rates for 18-year-olds in 13 states. After GEICO, USAA is the cheapest car in 12 states. IN COUNTRY is a low-cost agency for under 18s in Illinois and Oregon.

Compare St. Paul, Mn Car Insurance Rates [2024]

Affordable rates for 18-year-olds range from $74 to $321 per month, depending on where you live.

Hawaii has the cheapest car insurance for 18-year-olds of any state because it doesn’t allow insurance companies to set rates based on age.

Louisiana is the most expensive state for 18-year-old drivers, with car insurance in the Pelican State costing $748 per month for an 18-year-old.

In many states, your rate is determined in part by the gender of your license. Car insurance for 18-year-old drivers is on average more expensive than female drivers with the same profile.

Average Cost Of Car Insurance (2024)

On average, male drivers spend $439 a month, which is $56 more than their female counterparts.

The difference between car insurance rates for 18-year-old male and female drivers and the cheapest company is less between insurance groups connected to the Farm Bureau. Farm Bureau drivers pay an extra $4 a month for insurance.

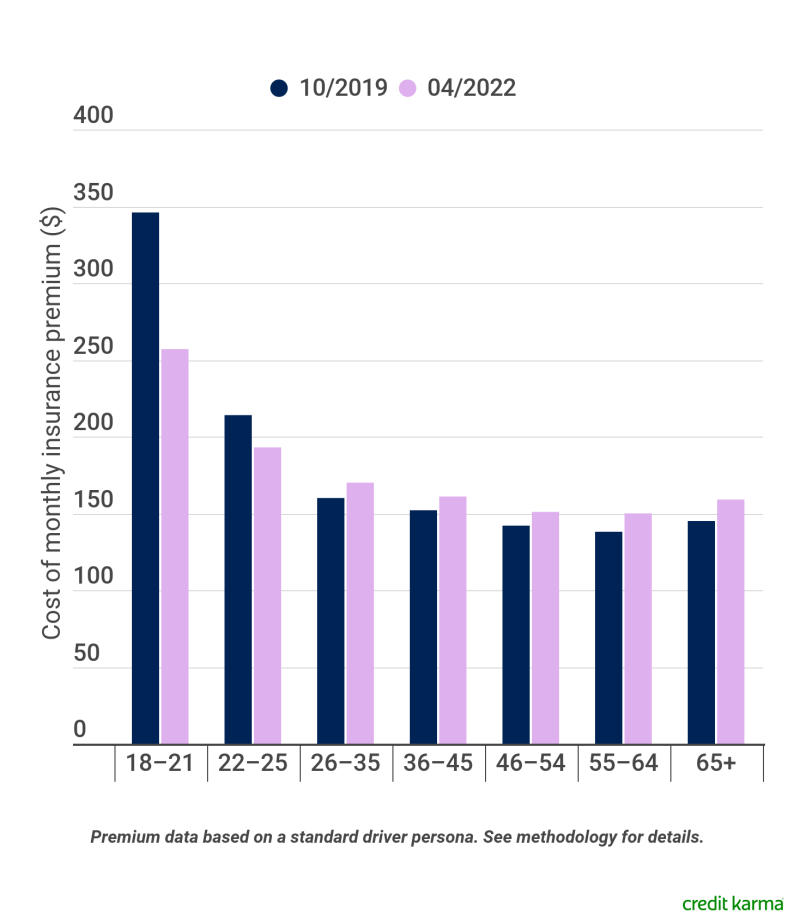

Car insurance for 18-year-olds is cheaper than for 16-year-olds, but 18-year-olds pay on average 198% more than 30-, 35- and 45-year-olds.

Car insurance rates for 18-year-old drivers are higher than for older drivers because they are more likely to drive recklessly, get tickets, cause accidents, and make payments than more experienced drivers.

State Farm Auto Insurance Review: Should You Buy In 2024?

Between 2011 and 2020, 9,500 fatal crashes involved 18-year-old drivers behind the wheel, according to the Department of Transportation. Here’s why young drivers pay more for insurance than older drivers. [1]

But if 18-year-olds keep their driver’s licenses clean, the number will drop until they reach the critical age of 25.

The cost of insurance for 18-year-olds is higher than average, but cheaper than insurance for young drivers. Compared to 16-year-olds, 18-year-olds get $1,848 less insurance per year. Between the ages of 16 and 18, car insurance premiums drop by 37 percent.

But compared to drivers with less experience behind the wheel, 18-year-old insurance is still more expensive. Our analysis shows that the average price for a 21-year-old is $2,223 less per year than an 18-year-old – a 45% difference.

State Farm Car Insurance Review: Cost And Coverage (2024)

It is legal for an 18-year-old to get their own auto insurance policy. Unlike young drivers who are legally minors, those who have reached the age of 18 can purchase insurance without the consent of a parent or guardian.

If you have an 18-year-old driver in your family, it’s better to add them to your existing policy than to have them on their own. Most companies require you to list licensed drivers on your policy. Adding a young driver to your policy will increase your premiums, but it will be cheaper than if they had their own policy.

But 18-year-olds who no longer live at home and own their own car will need their own policy. One exception is if they’re not in school—many companies offer car-free schooling for families with college students.

Adding an 18-year-old to your car insurance can be expensive. But adding a teen driver to your insurance is cheaper than getting them their own policy.

6 Cheapest Car Insurance Companies Of November 2024

Car insurance for under 18s is expensive, but it’s still possible to find cheap insurance. You can avoid paying more for teen insurance by:

If you’re still having trouble finding cheap car insurance for an 18-year-old, a surefire way to make sure you’re getting the lowest rate is to compare quotes from several insurance companies in your area.

According to our research, insurance for an 18-year-old would cost $411 a month, or $4,931 a year. Eighteen-year-old male drivers pay $439 per month, while the average cost of car insurance for one-year-old female drivers is $383 per month.

COUNTRY Financial is the best car insurance for under 18s. COUNTRY insurance costs less than $209 a month for under 18s – the cheapest of the companies we reviewed. COUNTRY has discounts to help young drivers keep prices down.

Why Insurance Premiums Are Squeezing Australians And Fuelling Inflation

Although car insurance for under-18s is usually cheaper than for under-16s, it can be more expensive for first-time drivers, regardless of age. This is because insurance companies set rates based on your driving history. Without a good driving record, rates can be expensive until you have more experience.

Yes, you can get car insurance at 18. It’s cheaper to sign up for an existing policy if you can, but 18-year-olds are now minors and can buy their own car insurance without parental consent.

Uses external sources, including government data, industry research and authoritative media, to complement proprietary market data and internal expertise. Learn more about how we use and review resources as part of our editorial policy.

Andrew Hurst is a veteran author who has spent his career writing about life, disability, home, auto and health insurance. His work has appeared in The New York Times, The Wall Street Journal, The Washington Post, Forbes, USA Today, NPR, Mic, Business Insurance Magazine and Real Estate 360.

Maryland Car Insurance Rates, Quotes & Agents Reviews & Research

Maria Flintras is a financial advisor, licensed life insurance agent in California, and a member of the Financial Review Board. At what age does car insurance decrease? Find out how your age affects your car insurance rates and when your salary drops.

If you are a young driver in your teens or early twenties, you will often pay more for car insurance. This is because, according to insurers, young drivers have a higher standing than older drivers.

According to the Insurance Institute, drivers between the ages of 16 and 24 are involved in more fatal accidents than any other age group.

Read our guide to finding out when your car insurance premiums will drop and what you can do to get the best deal while you wait.

Best Car Insurance In Wisconsin (2024)

Car insurance rates are determined by the insurance company and are based on several factors such as the policy term, the amount of coverage and the risk profile of the driver.

Insurance companies use ratings to determine the risk of insuring a particular driver, and rates are often higher for drivers considered higher risk.

Underwriting is the process of analyzing the risk profile of a potential customer and determining his insurance rate and policy.

Once the underwriter determines the level of risk, they set rates that reflect that risk. For example, someone with a clean driving record and no medical problems will usually pay a lower premium than someone with a history of accidents or chronic illnesses.

Average Cost Of Car Insurance For 18-year-olds

Age plays a big role in determining your risk and car insurance rates. Younger drivers pay more for insurance because, statistically speaking, they