Car Insurance Uk Check – Sells the UK’s cheapest car data checks so anyone can instantly confirm if a vehicle has a recorded accident history.

We love free stuff, hence the name! So we want to share here with you a little-known (and free) method of quickly checking any British vehicle that has been involved in an accident. There’s no catch, it’s free.

Car Insurance Uk Check

All you need is your VRM (ie vehicle registration number) and approx. Check the mileage of the car or bike you want – it must be a UK registered vehicle, but private plates will also work.

How To Get Cheap Car Insurance

Unfortunately, it is impossible to be 100% sure if a vehicle has been involved in an accident in the past. Many drivers do not report to their car insurance companies.

In other words, if there is no insurance record, there is very little way to find out – it depends on how good the repairs were.

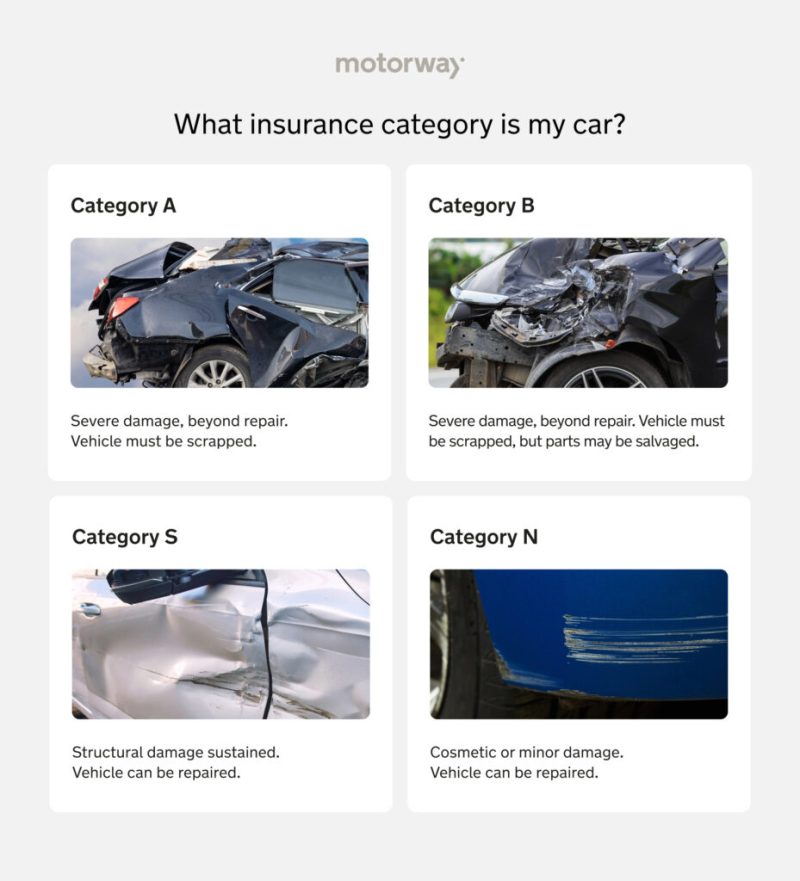

Most insurance companies will attempt to repair a vehicle if the damage is minor. You can read about the type of rating insurance companies do here.

Declared, it will be logged – and our deep data checks look for more of these flags (the free method below works to some extent). If you are unsure of these grades, eg the new ‘CAT D’ or ‘CAT S’, we have a handy guide available at the link above.

Motor Insurance Database (mid): Definition, Purpose And Importance?

In other words, it cannot be exact. If you want a car data check backed by a £30,000 data guarantee, you can get it for less than a tenth – the cheapest price online – start here.

In the UK the law is pretty clear – if the seller is a dealer, yes – but only if they are aware that there is a sign of damage to the vehicle. Dealers are not always aware that a vehicle has been in an accident. Like everyone else, they just go by what the records show.

If you’d like to manually check your vehicle for damage, we’ve got a handy guide here too.

Private sellers, on the other hand, are NOT required by law to report damage, so it is recommended that you inspect your car. For the one-off price of £9.95, we check the full depreciation and insurance history of any vehicle in the UK – car, bike or van (plus much more such as outstanding finance, honored checks and more).

Online Car Insurance Quotes

Unfortunately, it is impossible to be 100% sure if a vehicle has been involved in an accident in the past. Many drivers do not report to their car insurance companies.

In other words, it cannot be exact. If you want a full car data check backed by a £30,000 data guarantee, you can get it for less than a tenth – the cheapest price online – start here.

In the UK the law is pretty clear – yes if the seller is a dealer – but only if they are aware that there is a sign of damage to the vehicle. Dealers are not always aware that a vehicle has been in an accident. Like everyone else, they go by what the records show. You need to check if your car Is it taxed and insured, but don’t know how? Read on to find out.

Keeping your car taxed and insured is an expensive business, but it’s a legal requirement if you drive on public roads.

Buying Car Insurance Online: How To Do It (2024 Tips)

There are serious penalties if you are caught driving without these things, up to six points on your licence, heavy fines and your car can even be broken into.

It’s very easy to check your car’s tax and insurance status, and in this handy guide we’ll show you how to do both.

Checking your car’s tax status it’s free and easy. You can do this for free through the government website or .

Do not go to websites that try to charge for this service. It’s not faster or easier and you don’t have to pay.

How To Check For Free If A Car Has Been In An Accident

Once you’ve done these three things, you’ll be presented with the car’s tax status, including whether it’s taxed and how long the tax will last. You can also view the car’s MOT history here.

The DVLA has a service that allows you to report a car tax-free if this is an action you wish to take.

The best way to check if a car is insured is to use the Motor Insurance Database (MID). It’s a publicly available database that insurance companies also have access to and you can use it to confirm the condition of a car.

This does not reveal any personal insurance information or anything. A simple confirmation of the car model and whether or not it is insured.

Bmw Flex Car Insurance

Again, this is a free service to use; so avoid third party companies that try to charge the same.

You should only use it to check the status of your car insurance. MID has a separate tool to check another car in case of an accident.

Once you do this, you will be shown a page confirming your car model and insurance status.

It is a legal requirement that your car be taxed (unless exemptions apply) and insured if you use it on public roads.

Call: 07922202057 #car #insurance #cars #carsoftiktok #automotive #uk #firsttime #firsttimedriving #theorytest #learnerdriver

Driving without tax on public roads can result in a fine of up to £1,000. A few exceptions apply, remember you have to file taxes every year even if you don’t pay. The exceptions are:

You can claim a disabled person’s exemption when you claim vehicle tax. Until this is confirmed, you should continue to charge your car as normal.

Electric cars do not have to pay tax at this time. Note, however, that from April 1, 2025, electric cars will pay road tax. New electric cars will cost £10 in the first year and the current annual price is £190 after that. However, it is likely to rise in line with inflation next year.

These include tractors and light agricultural vehicles that are typically used in the field. “Limited Use” vehicles that are not used more than 1.5 kilometers (0.93 miles) between lots occupied by the same person.

Can I Insure My Car Without An Mot?

If these exemptions do not apply, you will have to pay car tax. It’s easy: go to the government page and follow the steps. You will need the V5C logbook and the V11 notice if you have one.

There is only one exception for car insurance and that applies to SORN vehicles. Declaring a car SORN means you must park it on private property; it cannot be on the public road.

Driving on public roads without insurance carries a fixed penalty of £300 and the risk of 6 license points. If the case goes to court, there is the possibility of an unlimited fine and disqualification from driving.

If you need car insurance, your best bet is to use price comparison websites. They can compare quotes from different insurance companies to help you find the best deal for you.

Free Car History Check

It is a legal requirement that all cars are taxed, unless you have filed a SORN and your car is taxed. it is not kept off the road (it cannot be parked on the street) and you must pay a penalty of £1,000 or five times that amount. of unpaid tax, whichever is greater. your car it can also be seized by DVLA agents, with confiscation costs added to the bill.

It is also illegal to drive your car on public roads without at least third party insurance. Penalties for driving without insurance include six penalty points and a £300 fine, or an indefinite driving ban and fine if your case is sent to court.

The road tax can be paid monthly, semi-annually or annually. When the deadline comes will of course depend on these factors as well as when you started paying tax. If you choose the annual option and pay on, say, March 21, it will be due again on March 21 of the following year. Note that paying for the whole year will save you some money: a car with a standard annual price of £190 will cost you a total of £199.50 if you pay monthly or half-yearly.

You can use the Government’s online tool to check whether a vehicle is taxable or not, as well as when the tax expires and therefore needs to be renewed.

Free Car Check

As with road tax, car insurance companies usually offer annual and monthly payment options, and paying for the whole year will save you money. Even if you pay monthly, your renewal date will usually be annual, meaning your monthly payments will be fixed for one year. Talk to your company of insurance about when you should renew your policy if you are not sure.

It is illegal to have a paid off car without insurance. If so, you may receive a warning letter from the auto insurance database