Car Insurance Uk Quotes – At Just Quote Me we can provide you with both business and personal vehicle insurance. Whether you need personal car insurance or company car insurance or even later fleet insurance, we offer a range of options and opportunities to get you a unique car insurance quote.

Car insurance usually includes a range of main covers and may include cover for accidental damage, fire and theft and windscreen repair or replacement. Some car insurance policies include cover for personal items left in the vehicle, and some also offer cover for legal expenses in the event of a claim, as well as a courtesy vehicle if your car is damaged or stolen.

Car Insurance Uk Quotes

Finding the right level of car insurance to suit your needs isn’t always as easy as it seems, which is why Just Quote Me is here to discuss your options and provide expert advice on the best car insurance quotes and rates for your vehicle and situation . .

Minehead Car Insurance

At Just Quote Me, we specialize in quality insurance quotes and offer quotes to suit almost any situation.

It is common knowledge for many that their car insurance is sold quickly and without due consideration and thought as to whether it is the right level of cover and whether it is fully adequate for the driver’s needs. Too many policies are sold as a flat rate rather than policies tailored to the policyholder and for real peace of mind it pays to find the cover that is ideal for your situation.

Just Quote Me brings together the talents of insurance professionals with over 30 years of experience and industry knowledge, many of whom specialize in auto insurance. We are proud to have covered national businesses including charities, wine bars, nightclubs and places of worship.

As one of the most common types of insurance, car insurance can be found in many places, at different prices and levels of coverage.

Car Insurance Cover & Quotes Uk

Our unique position as an independent broker means we can compete with both other car insurance brokers and direct insurers in the market on price and service.

See how much you can save with Just Quote Me. For further advice and guidance, please call us on 0800 084 2325 or complete our form below.

This website uses cookies to improve your experience. We’ll assume you’re fine with this, but you can opt out if you’d like. Get Read more

This website uses cookies to improve your browsing experience. In addition, cookies are stored in your browser that are classified as necessary because they are necessary for the basic functions of the website to work. We also use third-party cookies to help us analyze and understand how you use this website. These cookies will only be stored in your browser with your consent. You also have the option to opt out of these cookies. However, disabling some of these cookies may affect your browsing experience.

Vehicle Insurance Quotes Hi-res Stock Photography And Images

Necessary cookies are absolutely necessary for the website to function properly. This section only contains cookies that provide the basic functionality and security features of the website. These cookies do not store any personal data.

All cookies that are not specifically necessary for the operation of the website and are mainly used to collect personal data of users through analysis, advertisements and other embedded content are called non-essential cookies. It is mandatory to obtain user consent before these cookies are activated on your website. A good insurance policy will protect your business from financial loss in the event of an accident. Specifically, insurance transfers the risk from the policyholder to the insurance company.

Policies usually have to be renewed annually, often with the option of a one-time premium or monthly installments. Insurance companies evaluate the details of each new customer and provide a unique quote. The price of the policy will reflect the model and age of your vehicle, your age and driving history along with many other criteria that will be included. Car insurance is a legal requirement if you use a car on public roads in the UK and it is an offense to drive without the correct insurance. There are many insurance policies available in the UK and car insurance can provide cover for your vehicle in the event of theft, fire or accident damage. Third party insurance is the legal minimum level of insurance cover you must have. If you are caught driving a vehicle on the road or in a public place without the minimum insurance cover, you may receive penalty points on your license and your vehicle may be impounded or even destroyed. You may be banned from driving.

There are three levels of car insurance – comprehensive, third party fire and theft and third party only. A comprehensive policy will cover you if your vehicle suffers accidental damage, needs repair after an accident or sustains damage. Third party insurance only covers damage and injury caused by third parties, not you or any damage to your own vehicle. Third party fire and theft insurance policies offer additional protection against a third party only, covering a new or repaired car if it is stolen or damaged by fire.

Innovative, Comprehensive Gap Insurance Quote

As previously mentioned, all vehicles on the road must have adequate insurance and taxis are certainly no different. The number of collisions on Britain’s roads is increasing, which is increasing

The risk of a person being involved in an accident. Taxi insurance is more expensive than standard car insurance because of the time taxi drivers spend on the road and the risks associated with carrying paying passengers. Standard taxi insurance covers you in case of loss of property, vehicle or persons from a third party. In case of an accident, it covers both the driver and the car. The price of the insurance may vary depending on the number of kilometers driven per year. There are two types of fees in the UK; Public hire taxis can be hailed from taxi stands or directly from the street, but private hire taxis are pre-booked via app, phone or website. Taxi insurance is relatively more expensive than standard car insurance, but that doesn’t mean you can’t get good deals. If you use Try Compare to compare taxi insurance quotes online, they will give you the best policies at the best prices. When comparing taxi insurance, make sure the policy provides enough cover for your vehicle and occupation. Try Compare has a team of professional customer service agents to answer all your questions and help you find the cover you need, car insurance in 2024 is more expensive than ever before, which means it’s more useful than ever to know which insurance companies have arranged your car best in the UK. We’ve analyzed all the major UK insurance companies and below you’ll find a detailed summary of their strengths and weaknesses. So you can still find the best insurance company and the best deal for you in this time of car insurance costs. Whatever type of car insurance you’re looking for, we’ve put together a list of the top 10 UK car insurance companies for you.

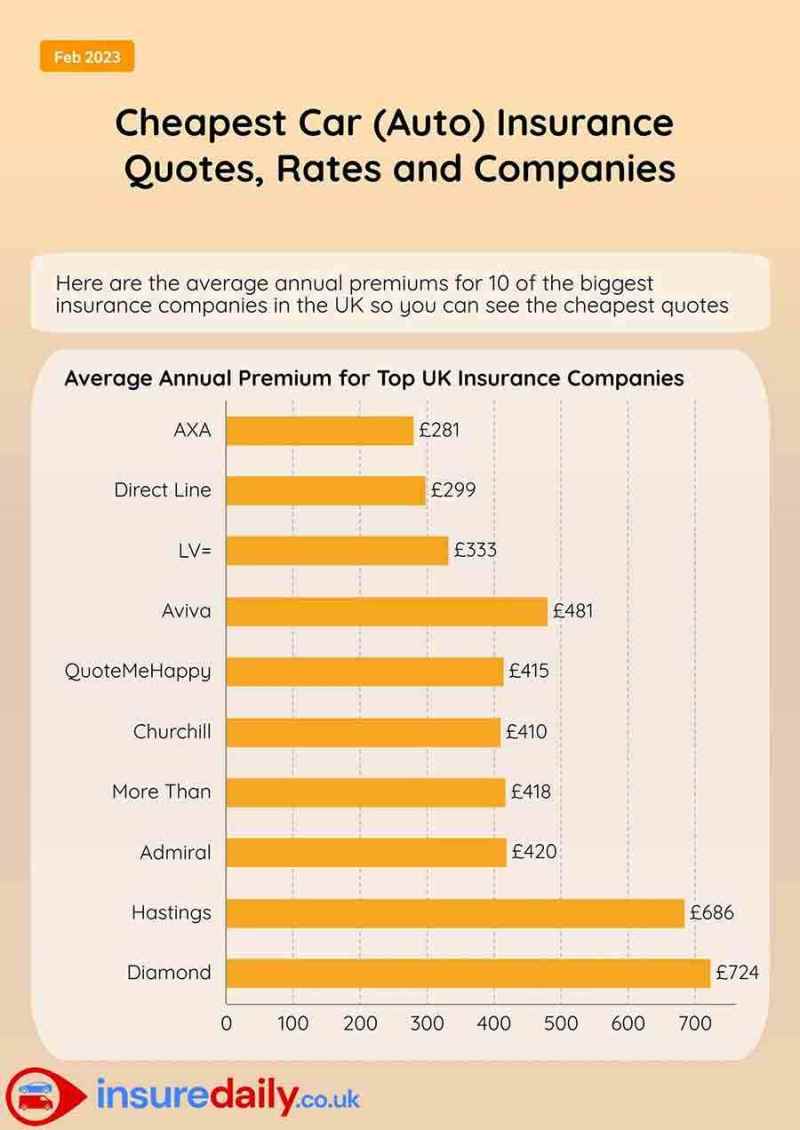

The type of car insurance you choose will depend on your individual needs and circumstances. There are different types of car insurance such as liability, comprehensive and third party insurance. The best insurance company for you is the one that provides the best coverage at the most competitive price. Leading UK insurers include Aviva, Direct Line, Admiral and LV=. When looking for car insurance, it’s important to compare different companies and policies to find the best coverage at the most competitive price. Consider factors such as cost, coverage, customer service and discounts. In addition, make sure that the company is reliable and has a good reputation.

Choosing the best car insurance company can be a daunting task. Research different companies, compare their policies and coverage, and find the best deal. Consider the total cost of the policy, the type of coverage you need, and the customer service the company offers. Check the company’s financial stability and BBB rating to ensure that the company is reliable and trustworthy. Consider shopping around for the best deals, increasing deductibles, reducing coverage for older vehicles and using discounts to lower the cost of your policy. There are also different types of insurance to consider, such as liability, uninsured motorist, collision and comprehensive, personal injury and gap insurance. It is important to compare policies and providers to find the best coverage and price for your needs.

Insurance For Convicted Drivers

The best insurance companies in the UK vary depending on the type of insurance required. For example, if you’re looking for the best value for money, Admiral, Direct Line and Aviva are highly rated. For those looking for comprehensive coverage, Aviva a