Car Insurance Value – , look no further as we explain the different car insurance premiums in Malaysia with the aim of teaching you what the two mean.

If you own a car in Malaysia, you need car insurance. The best way to get comprehensive coverage is to get one

Car Insurance Value

Insurance coverage shows when your car is declared lost or stolen.

How Much Is Car Insurance In South Africa? (rates In 2024)

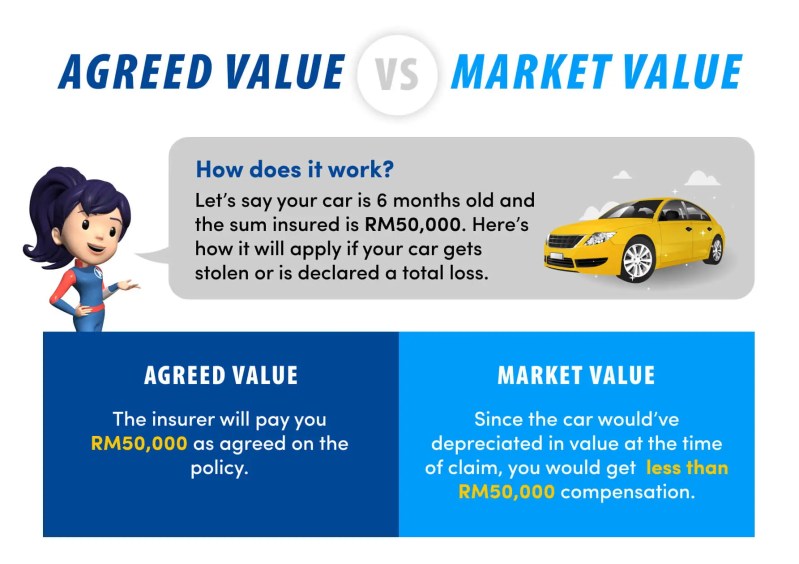

As the name suggests, it is based on the value of the car calculated at that time. Assuming you bid on a 2015 Perodua Myvi for RM 50,000 in January of that year, the Myvi’s value dropped eight months later. If you want to file a claim based on the loss or theft of your vehicle, i

However, this is an amount recommended by the insurer depending on the make and age of your vehicle. From your car insurance

, If you have to file a claim in a total loss event, the amount that will be paid will depend on your policy as the agreed value. for being

, there will be no risk of under or over the value of your car insurance. But this way, insuring your car for more than its value will cost you more than your premiums.

What Is An Agreed Value Vs Market Value In Car Insurance?

The policy may cost you because it will depend on the value of your car. Finally, your car insurance depends on the best insurance will be from a reputable company like Allianz.

It is better to get comprehensive and comprehensive car insurance from Allianz that protects your car from third party liability for personal injury, accidental fire and theft of your car. On top of your car insurance, it’s even better to have reliable 24-hour roadside assistance and unlimited towing distance with Allianz’ Enhanced Road Warrior.

Also if you are looking to pick up a second hand car, click here for five tips for buying a car 2. In this guide, we will examine the aspects of understanding the value of marketing and negotiating for car insurance. Auto insurers reward policyholders based on the market value or contract value of auto insurance, each with unique characteristics. When an unfortunate event, such as theft or unexpected damage, happens to your car, insurance is important. Get vehicle tracking data.

In most cases, auto insurance policies are subject to market value coverage. This value is determined by the insurer taking into account the written value of the car, referring to similar models in the market. Different types of car insurance.

Best Car Insurance Value In Powerpoint And Google Slides Cpb Ppt Sample

In contrast, the agreed price is a predetermined amount established at the beginning of the policy, which provides stability during the forecast period despite market fluctuations.

For policyholders with defined benefit, periodic reviews during renewal are important. Car prices can increase, requiring adjustments to ensure adequate coverage.

Even if the goal is to replace the car according to the market price, it can decrease depending on the market conditions. A fixed rate policy, however, protects the owners by guaranteeing an agreed amount, providing greater security.

To determine the vehicle’s value, applicants must submit a photo, and for repaired or restored vehicles, an invoice can help verify the vehicle’s value. Sometimes, an independent value may be required.

Shy Automotive: High-value Car Insurance And Zero Risk Car Storage

Contract price insurance policies are usually more expensive due to the larger amount agreed upon in the market price. Insurance rates reflect this difference, making additional adjustments to cover the increased value.

For those looking to save on insurance, pricing below the market rate may be an option. However, this practice is rare.

For vehicles that qualify for agreed price policies, specialty insurers, especially class-guards, can provide such coverage. Although some insurers offer negotiated price policies, finding a competitive rate requires serious research.

Negotiation or testing of other insurance is acceptable if the insurance agent does not agree with the assessment of the vehicle. An independent assessment can be a useful tool to reach a better agreement between the applicant and the defendant.

The Cheapest Cars To Insure In 2024

Ultimately, understanding the nuances between market value and contract pricing policies helps car owners make the right decision for their car and situation.

Here’s an overview of six hidden costs to help you make an informed decision when your car is in an accident, whether your insurance company is paying you for the car’s value — or, rightly so. , what he pays. What you say is valuable.

Almost anyone who has gone through this process can testify that the most frustrating part is accepting the auto insurance company’s review of your car’s value. Almost always, the plan comes in lower than you expected, and the money you earn is not enough to buy goods apples-to-apples. Sometimes, this is not enough to cover the rest of the car.

Many consumers do not know the process by which insurance companies determine the value of a car, which makes the issue difficult. Car insurance pricing methods are esoteric, they rely on invisible data, the most intelligent is invisible. This makes it difficult for consumers to challenge low-ball car insurance companies.

Replacement Cost Vs. Actual Cash Value In 2024 (differences Explained)| Autoinsurance.org

Knowing the basics of how insurance companies value cars and the terminology they use can put you in a difficult negotiating position.

When you report a car accident to your insurance company, the company sends an adjuster to investigate the damage. The organizer’s first order of business determines whether or not the vehicle has been properly configured.

Even if it can be repaired, the insurance company can consider the whole car. According to Insure.com, usually, the company covers the cost of the car if the repair costs exceed a certain percentage of its value, ranging from 51% to 80%. Some states provide rules or guidelines for this percentage: Alabama, for example, sets it at 75%.

Assuming that the vehicle is complete, the adjuster checks and can offer a value on the vehicle. Long-term damage is not considered in the assessment. The adjuster wants to quote the right amount of money for the car immediately after the accident.

What Is Idv In Insurance

Then, the insurance company asks other people to provide car quotes. This is to minimize the appearance of any inaccuracies or compromises and to put the vehicle through a different inspection process. The company considers its own ranking and that of others when making an offer.

It is possible to hire your own appraiser if you do not agree with your insurance company’s value, although you will need your insurer’s permission.

There is a big difference between the price of your car insurance as determined by the insurance company and how much it will cost to buy a suitable replacement. Insurance companies base their premiums on asset value (ACV). This is the amount that the company will charge for the correct payment on the car, assuming that the accident has not occurred.

The true value of a coin often takes into account factors such as depreciation, wear and tear, mechanical issues, cosmetic flaws, supply and demand in your area. For example, State Farm clearly explains the value of a car insurance calculator: “We value your car based on its age, make, model, finish, overall condition, and options. basically – minus your taxes and city fees.”

Factors To Consider When Choosing Rental Car Insurance

Before buying auto insurance, take the time to compare rates and fees from the best auto insurance companies to make sure you’re getting the right deal.

If you buy a new car and only drive it for a year before an accident, its ACV will be less than what you paid for it. Driving a new car on the lot is reduced by 9% to 11%, the price increases to 20% at the end of the first year.

In fact, the insurance company wants you for everything from mileage and odometer to soda stains and clothes collected this year.

The amount of the ACV contribution will be less than the replacement cost – the amount it would cost you to buy a new car like the one you broke down. Unless you’re willing to pay for insurance with your own money, your next car will be a downgrade from your old car.

8 Types Of Car Insurance Coverages And All Options For Auto Insurance

This type of policy uses the same process as totaling a car but, then, pays the current market price for a new car in the same class as your damaged car.

If you finish your car too soon after buying it, you may end up with bad equity in the car depending on your finances. Meaning, the insurance premium may be lower than what you would pay on the car.

If the car is new, the situation can be worse. The amount paid by the insurance company for a stolen car may not be enough to cover the damage to the car.

This can happen if you spend too much when buying a new car. A