- Car Insurance Vic

- Cheaper Multi Car Insurance? Save 12.5% On Each Car

- Corporate Watchdog Asic Is Suing Qbe, Australia’s Largest Insurer, For Allegedly Misleading Hundreds Of Thousands Of Customers On Price Discounts. #qbe #qbeinsurance #insurance #asic #7news

- City Taxi Club Insurance

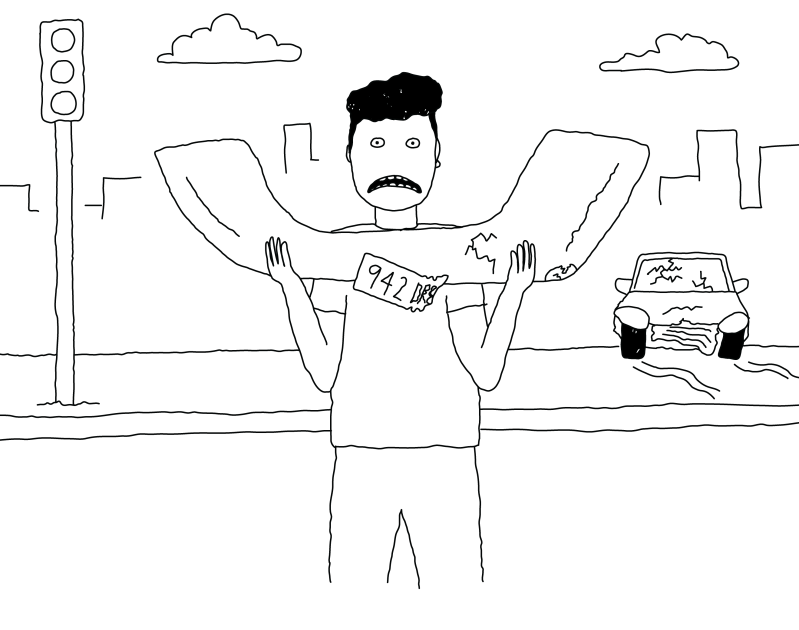

- Put The Brakes On Expensive Car Insurance

Car Insurance Vic – Help protect your vehicle from loss or damage – whether you need insurance for your own vehicle, or just damage to someone else’s property.

Whether you’re ready to buy insurance or need to manage an existing policy, you can get started by logging into your online account.

Car Insurance Vic

The highest protection. Everything comes with comprehensive insurance, including car pickup and return, taxi fare, optional repairs and more.

Cheaper Multi Car Insurance? Save 12.5% On Each Car

Cover damage to the corners of your car, as well as accidental damage to property and other vehicles – regardless of who is at fault. There are still options that suit you.

Cover if your car is damaged by fire or stolen. In addition, for accidental damage to property and other vehicles.

Whether it’s your first car or not, find out what’s in car insurance to better understand your policy

This is the extra amount you pay on top of your excess if it is found to be due to an incident. For more information, read the Premium Guide, Passes and Discounts.

Australia’s Biggest Car Insurance Companies In 2023

In Victoria, CTP insurance is included when you register your vehicle with VicRoads. It gives you coverage for personal injuries caused by accidents with your vehicle.

Log in to your online account to view policy documents or update your personal details and payment methods. For other changes, call 13 72 28.

When you are behind the wheel as a learner, under the supervision of a fully licensed driver, we treat the supervisor as the driver.

If a learner driver is involved in an incident, the learner driver will be held responsible for the driver.

Why Insurance Premiums Are Squeezing Australians And Fuelling Inflation

The longer you’re a member, the more savings you earn on select products plus our annual membership benefits.*

Choose two or more qualifying policies and save up to 10% on each – including home and motor insurance.

This depends on the level of cover included in your car insurance policy and the nature of the incident (for example, collision, fire, theft or flood).

Comprehensive Care® car insurance offers the highest level of motor insurance coverage when you need to pay, while third party property damage will protect you for the essentials.

Corporate Watchdog Asic Is Suing Qbe, Australia’s Largest Insurer, For Allegedly Misleading Hundreds Of Thousands Of Customers On Price Discounts. #qbe #qbeinsurance #insurance #asic #7news

Choosing a higher pass can reduce your savings. But remember that if you sue, you will pay more out of pocket.

Get two or more qualifying insurance policies and save up to 10% on each. Find out what policies are available

The longer you’re a member, the more savings you’ll get on selected products * plus our annual membership benefit #.

You will need to provide us with information about the incident, such as the time it was recorded, contact details of witnesses and details of other drivers involved (if applicable). Photos of the incident can give us a clear picture of what happened and help with your claim.

The Cost Of Car Insurance In Australia

If your car is stolen in Victoria, your first step is to contact the police helpline on 131 444 before getting insurance. We may ask you for the reference number of the police document and the date it was issued, so it’s a good idea to make a note of these details.

This is the amount that the insurance agrees to use to insure your car. You can choose from a range of prices, but it remains fixed for the duration of the policy.

On renewal, the insurance takes into account changes in the value of your vehicle and agrees with local market values. Check your new status for changes.

This is an analysis of the value of your car during the event you are talking about. This takes into account local market prices and the age and condition of your vehicle.

Ford Crown Victoria Insurance Cost, Rates & Quotes By Lemonade

You can only choose between guaranteed value and market value if you buy a comprehensive car insurance policy.

All auto insurance policies have access to quality partner manufacturers. We trust these companies to quote, inspect and provide repairs for your car – we offer a lifetime guarantee on every service we authorize, for as long as you own the car.

If you need your own manufacturer, Complete Care® car insurance includes this option, or you can add this option to your comprehensive car insurance policy. However, this does not apply to third party car insurance.

If you choose to hire your own repairman, make sure you choose a licensed manufacturer that meets industry standards. If something goes wrong (like a job goes wrong), your policy won’t cover it.

City Taxi Club Insurance

Car insurance coverage gives you the peace of mind to manage the costs in the event of an accident. For example, you may have to pay excess insurance more than the full amount to repair the damage to the car.

Unlike other states, in Victoria, a compulsory third party (CTP) is included when you register your vehicle with VicRoads. CTP covers you for any damage caused by an incident with your vehicle.

Having additional car insurance, such as Comprehensive Care® car insurance, comprehensive car insurance, third-party fire and theft or third-party property damage, gives you additional protection in the event of an accident – especially when it involves someone else’s car .

You do not need to have a driving license to qualify for a car. However, to be covered in an incident, the driver must have a license.

Third Party Car Insurance Quotes Victoria

To understand your eligibility for motor insurance, call us on 13 72 28 or visit a retail store.

All motor insurance policies are suitable for drivers under the age of 25. Compare options to find a policy that suits your life stage, budget and needs as an older driver.

This is the highest level of motor insurance. You will be covered for damages caused by the insured event, and you will receive benefits such as:

~ Please note that drivers under the age of 21 cannot rent a car, and there may be additional restrictions and charges for drivers between 22 and 24.

Toyota Car Insurance

You will be covered for damage to your car and property or someone else’s car if you are in a collision.

Not only will you be protected if you accidentally damage someone else’s property, but you will also be covered if your car is stolen or damaged.

You will not be covered for the cost of repairing your damaged car after an at-fault incident.

You will be covered for accidental damage you cause to someone else’s car or property – such as driving a car or someone’s fence.

How Australians Can Save Money On Car Rentals: Figure Out What’s Popular And Drive The Opposite Way

Excess is the amount you contribute to the cost of the claim. There are three types of passes: basic, annual and special. For drivers under the age of 25, the extra years can be beneficial if you are involved in an accident. This will be paid in addition to the basic pass.

When you start reporting online, you will know if the excess will be paid. If you have an overpayment, you can log in to pay it online.

Turn off the engine and turn on your hazard lights. If a road accident or injury requires ambulance assistance, call 000 for emergency services.

Remember that other drivers are still using the road, so if possible, move to a safe place.

Market Watch Insurance Search — Travel, Beauty, Food & Lifestyle By Uk Blogger Sian Victoria — Sian Victoria

It is always a good idea to take lots of photos and/or videos of the scene and damage. Also record the date and time of the incident.

In Victoria, for minor cases where there are no injuries but police assistance may be required, call the Police Helpline on 131 444.

If you can’t drive home, call 13 19 03 and a tow can be arranged.

As soon as possible, enter a claim by logging into your online account or call 13 19 03. The insurer will evaluate your claim and get back to you.

Put The Brakes On Expensive Car Insurance

Regardless of the driver, motor insurance covers all licensed drivers as long as they meet the criteria. An additional age surcharge may apply for drivers under the age of 25.

You don’t need to list all the drivers who use your car, but it’s worth considering based on how often others drive and any excesses that may apply to unlisted drivers.

It is important to note that your car insurance premium may change if there is another driver listed on your policy. If an unregistered driver is responsible for an incident while driving your vehicle, you may have to pay more than your original premium.

For more information about excess charges based on your policy, read the Guide to Premiums, Excesses and Deductions (PED).

Cheapest Car Insurance In Australia Revealed In New Data

Remember, as a learner, you do not need to be listed on your supervised driving policy. The insurance covers all learner drivers without a second pass when supervised by a licensed driver.

Emergency roadside assistance from flat tires and empty fuel tanks to flat locks and batteries, we’re here to help. Get 24/7 roadside assistance. Find out more

A quality repair partner to help you get back on the road. Find a trusted and certified partner near you. Find out more

Car Search Thinking of buying a car? can help you make your decision by providing a qualified car inspection. Find out more

Why Is Car Insurance So Expensive In Australia

1 In a defined benefit policy, coverage is limited to the defined benefit. Vehicles must be roadworthy and registered

# Year one: in 5 years copper card holders receive a discount of 5%, in 10 years, silver card holders receive a 10% discount, in 25 years, gold card holders receive a discount of 15% and in 51 years gold.