Fintech Bank Account Usa – Advances in data analytics, artificial intelligence, blockchain and mobile technology have given fintech companies a powerful tool to innovate and disrupt traditional financial systems. These companies are not just adapting to change; They manage well.

In a time of seemingly endless technological progress, the financial sector is undergoing a major change, with 200 fintech companies leading this change and shaping our relationship with money.

Fintech Bank Account Usa

CNBC, in partnership with Statista, presents the official list of the Globe’s 200 Leading FinTech Companies in 2023. These 200 companies, carefully selected, pioneer financial technology and organize financial services for individuals , businesses and organizations.

Top 5 Use Cases Of Biometrics In Banking

, the only Spanish company selected among the top 25 business solutions companies, facilitates relationships between technology start-ups, investors and organizations through its digital and global presence more than 130 countries.

Join our global community and use AI software to find the perfect partner, investor or B2B customer. You can find investments, request for partnership networks or connect with the best fintechs, investors and organizations in one click.

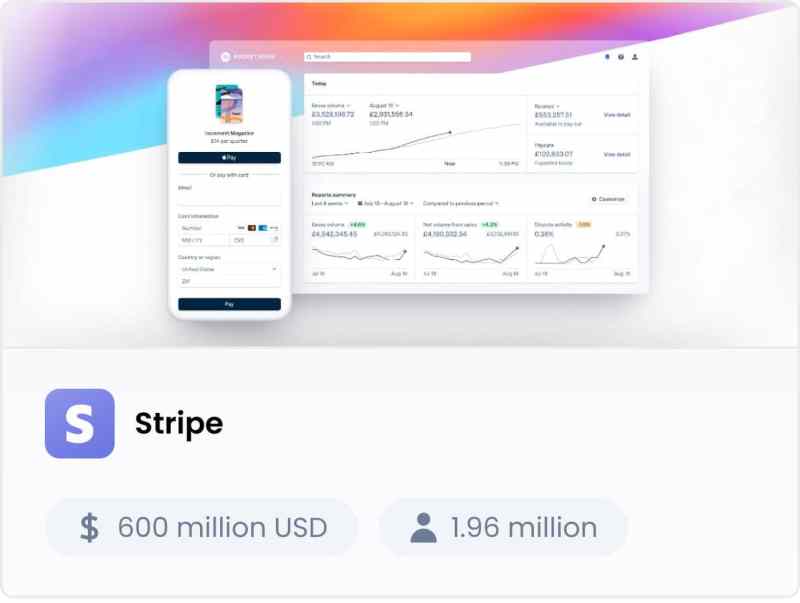

This final list includes not only industry leaders such as Ant Group, Tencent, PayPal, Stripe, Klarna and Revolut, but also many new and upcoming startups that join forces to shape the future of services. money.

Topics include NeoBanking, Digital Payments, Digital Assets, Digital Investment Planning, Digital Wealth Management, Money Transfer, Credit Transfer, Accounts Payable technology, Digital Business Solutions.

Oro Bank — Asia’s First Full Reserve Digital Bank

The fintech sector is experiencing explosive growth and is a focus of interest, especially among investors, as B2B companies offer their services more than ever through the fintech, banking networks, insurance, investors, institutions and other startups. All over the world.

Proud to announce its inclusion in the prestigious list of the top 200 fintechs in the world in association with Statista and CNBC.

This international award emphasizes the leadership position established in the fintech industry not only in Spain but worldwide. Statista, the leading data and market data provider, in collaboration with CNBC, the financial news network, conducted a thorough study to identify and validate the most famous and promising companies in the fintech world. In the midst of fierce competition, it has played a major role in the transformation of the world economy.

Inclusion on this list reflects his continued commitment to financial performance and his contribution to the development of disruptive solutions that are transforming financial industry. The company has played an important role in promoting the economy in Spain and abroad, and this result shows its positive impact on the sector.

Fintech Trends: Headwinds & Tailwinds Amid The Covid-19 Pandemic

We thank everyone who has been a part of its success and look forward to continuing to innovate and contribute to the growth and development of the global fintech ecosystem.

About: X-Tech is the first AI-based service in the X-Tech sector (FinTech, InsurTech, WealthTech, PropTech, LegalTech, RegTech, Healthcare and Cybersecurity) that allows all natural players to access, communicate, offer their solutions and work together. Fast, digital and comparable to organizations and investors around the world.

He specializes in promoting financial products and connecting fintech companies with traditional financial institutions. Through his work, he encourages cooperation and the use of improved financial decisions in the global market. Digital banking designed for global businesses. Transform your business with our new financing tools and join our community today.

® is a user-friendly fintech tool protected by trademarks. We’ve built a banking platform to help simplify your business’s complex banking needs. It’s available on desktop, web and mobile apps for both iOS and Android.

African Fintech Afriex Launches New Global Accounts Feature To Boost Cross-border Payments

Borderless Banking is what we mean. That’s why we built a licensed and regulated digital bank from scratch. It’s not easy, but international customers deserve better banking services. Here we come.

Schedule payments, download information, check and clear history. Check USD, multiple currencies and make international payments in one app.

We know how it feels to run a business, it always starts with chaos and a vision. We want to help you build your global footprint.

:max_bytes(150000):strip_icc()/FinancialTechnology_Final_4196400-3a7fb7e98adf4370b6e493034ade80bd.jpg?strip=all)

The bank is a US bank licensed and regulated by the Commissioner of Financial Institutions (OCIF) in Puerto Rico.

Pdf) The Role Of Fintech On Bank Risk-taking: Mediating Role Of Bank’s Operating Efficiency

Ready to support you around the clock. Get support during or after business hours with a dedicated account manager (financial information only).

Technology startups should have access to convenient, online and reliable banking services. As an innovator, we offer the latest advances in technology: high levels of security, friendly tools and support at all times.

The special information is aimed at companies with special banking and capital needs. Expect better features and more attractive prices to help you run your business more efficiently.

It has global SOC-2 certification, runs standard tests and uses firewalls. Plan to protect your assets in any way.

Banking On Fintech: Where Incumbents Are Making Investments In Wealth Tech

Enough chatter and ready to explore the bank yourself? Apply to your account online and in minutes. If you have any questions, don’t hesitate to get in touch. Mobile banking software gives users 24*7 access to view their account balance and past transactions. Due to the flexibility of access and ease of use, mobile banking applications attract customers all over the world. Unlike traditional bank accounts and long lines, digital banking apps help people send or receive money quickly through mobile devices.

Financial institutions around the world are using digital technology to take advantage of market opportunities and provide exceptional banking services to their clients. In this article, we want to talk about the use of mobile software in the US. We’ve also compiled a list of the top accounting software in the US by percentage of downloads and usage.

Mobile software is the fastest growing application segment in the United States. About 90% of banks in the US are using digital to provide instant and contactless banking services to customers during this pandemic. This is the driving force behind the increasing adoption and use of mobile computing software in the US.

Due to COVID-19, the installation and use of banking and financial products has increased since 2019. According to market research reports, installation and registration of online banking software in the United States has increased. by nearly 60% last year. These are the main reasons behind the increasing adoption of financing programs in the country.

Synapse Bankruptcy: Yotta Ceo Says 85,000 Bank Accounts Locked

As shown in the chart, the most common reason for installing and using a mobile phone in the United States in 2020 is checking account balances. About 90% of mobile phone users have downloaded apps to check their account balance.

Following the use of financial software to view the history of transactions, money transfer and payment of credit bills are other main reasons for the growth of app installation in the US.

It is important to note that in the US, the demand for Android or iPhone banking apps is among 25 to 44 year olds. The chart below shows the growth of mobile apps in the US by younger generations and millennials.

Therefore, these applications provide a useful and important way to develop funding programs in the US during this coronavirus pandemic. In the context of the COVID-19 pandemic, the development of special or digital apps for Android and iOS in the US, as in countries affected by COVID, allows people to manage their money through on their mobile phones without visiting a physical bank branch. . for their needs.

Fintech App Development: How Are The Fintech Companies Overcoming The Covid-19 Pandemic?

If you are waiting for mobile phone development services in USA, get the best price from us. Get in touch now!

This is the top list of cell phone carriers in the US and you can target any of the cell phone carriers listed below to explore the available digital market. in the country.

#1 Popular Mobile Banking in the United States. Chime is the most downloaded app in the US in 2020

Chime is the best accountant in the US. There are still more than 10 million users download from app stores. With user-friendly features such as TouchID, faceID, two-factor authentication, free deposit up to $200, instant cashback, free of charge unmanaged and fast advertising, this app is listed among the most trusted shopping apps in the US. The app is compatible with Android and iPhone.

7 Best Mobile Banking Apps In The Usa

Bank of America mobile banking app is another top bank account in the US with a 4.6+ app rating and 10,000,000+ installs. This banking software allows users to deposit checks, view credit scores, set up regular advertising, set up e-bills, set up travel information and manage account balances and digital loans. It is popular for its guaranteed cash back offers and BankAmeriDeals®.

Acorns is America’s leading software and financial services provider. The main benefits of a mobile app like Acorns include the ease of checking personal information and investments, the flexibility of direct deposit and mobile checking, the ability to check and see transaction history, and special authentication processes to detect and prevent fraud. .

The current demand is mobile phones

Phd in fintech usa, fintech bank usa, fintech savings account, best fintech bank, fintech bank account, fintech banks in usa, bank fintech partnerships, fintech usa, fintech business bank account, fintech account, ms in fintech usa, fintech bank