Fintech Banks In Usa – As Bill Gates said, “Banks are needed, banks are not.” This is true. Digital financial technology is all about improving users’ lives, and Fintech’s disruption of the banking industry is already happening. Let’s find out how it all started and what the bank can do.

At first glance, the largest banks manage about $17 trillion in assets, and the $132 billion Fintech industry looks like nuts.

Fintech Banks In Usa

We have to consider that retail banks spend $30 billion annually on digital transformation, compared to Fintech’s $132 billion.

Why Does The Bank Of America Want Lower Interest Rates?

It’s clear that Fintech’s disruption of the banking industry is ongoing, a trend that is increasingly reviving and making inroads into all financial sectors. Bank managers are reluctant to embrace changes and new technologies in the banking industry. Some may disagree and say that the bank has evolved over the years, but in fact, all the improvements have been made for the benefit of the bank and not for the customers.

Online banking reduces the need for frequent bank branch visits. It has changed the way we look at banking services, but not the banking system itself.

Internet banking would not have happened if accountants had not realized that the cost of maintaining an online banking system was lower than that of a branch office.

The evolution of online access is a strategy to support the bank. Unfortunately, just because you’re online doesn’t mean you exist. On the other hand, Fintechs protect customers better than other banks with proper and effective online strategies.

How Is Fintech Changing Banking Industry [key Trends}

First, Fintech’s disruption of the banking industry began during the last financial crisis in 2008, when ex-finance workers who lost their jobs were not ready to leave finance. They work with IT professionals to start Fintech startups that solve people’s problems instead of banking problems.

Due to the financial crisis, trust in traditional banks has waned and everyone wants to save and manage their money. This is a huge opportunity for the digital industry, and new user-centric financial services are beginning to proliferate.

Second, we live in a digital age, which opens up many opportunities for the financial industry. If you look at the most important products of 2022, you will see five big technologies. The digital age requires new approaches and thinking.

Mobile banking removes barriers to entry, creating demand for financial services regardless of location. According to a Business Insider Intelligence survey, 89% of customers are using mobile banking today, and Fintech is providing banking customers with solutions that allow them to compete with the “big” banks.

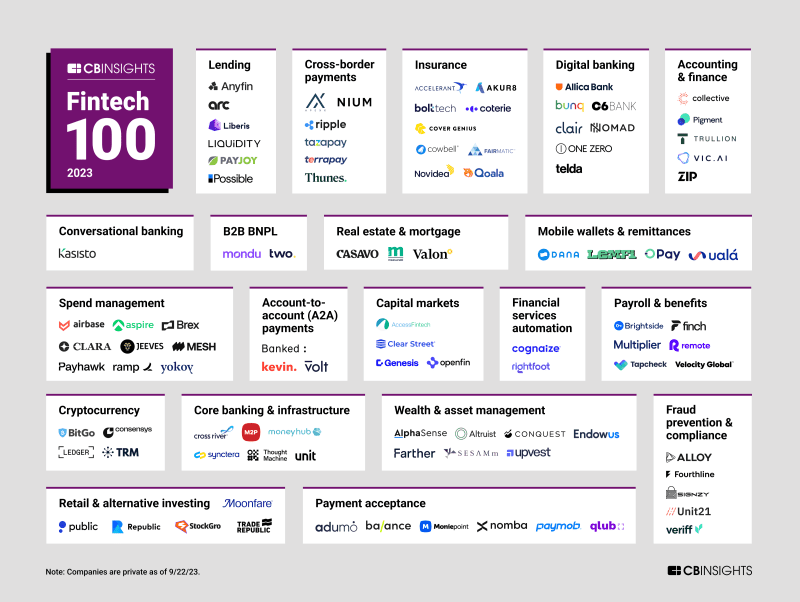

Fintech 100: The Most Promising Fintech Startups Of 2023

Fintech disruption in the banking industry will bring us better financial management tools, mobile payments, crowdfunding, quick loans, peer-to-peer lending and even Insurtech solutions. All of this comes together with an understanding of the importance of design thinking and the wisdom of creating services in an environment where banks are struggling. Fintech innovators understand the real problem customers face when they need banking services.

Fintech startups understand that sharing banking services and knowing at least one of them will give them more exposure and customer satisfaction. This is where banks fail with online services. Fintech and Insurtech are a lot more complicated and messy compared to UI friendly designs. Some Fintechs and Insurtechs have a design perspective that traditional financial institutions do not have, and this perspective is about user experience.

Value index data for approximately 6,500 financial apps on Google Play and the Apple App Store as rated by US consumers.

Fintech and Insurtech owners see digital services through the eyes of consumers. They choose to be relevant to the customer and create products they want to use. Banks, on the other hand, focus on good credit, payments and branches, but users value convenience, usability and convenience. Money and debt quickly became popular. Starting a Kickstarter campaign and getting the necessary funding for a product is easier than going to a bank branch and asking for a loan. The same thing happened with the new digital bank that has protected millions of customers in the last few years.

Top Neobanks Of 2024: Revolutionizing The Banking Industry

More consumers are opting for Fintech products and banks are losing customers. Because such banks believe that they already have a well-made product, so why should they change anything?

The same has happened with payday loans, personal financial management tools and Insurtech services. Almost all online banking services have financial management tools, but have you tried or used them? Maybe not because you don’t know they exist, but even if you try to use them, you might be put off by their complexity. Also, how much does Mint’s success story help Fintech design build money management tools? Mint does what it needs to do in a simple, elegant and fun way.

All we have to do is open the App Store and see how digital banking compares to traditional and digital banking.

In recent years, we have seen a change in the activities of bank users. According to Citi Mobile Banking research, 91% of users prefer mobile banking to going to a branch. Capgemini research shows that 68% of consumers say they currently use a major bank checking or savings account or are likely to in the next three years. The top three reasons for switching to fintech services are lower cost (70% of respondents), ease of use (68%) and faster service (54%).

Top 10 Challenger Banks In 2023

All the aforementioned statistics show that Fintech and UX (User Experience) design are disrupting traditional banks. If we compare the monthly user activity (MUA) levels of banking applications and top Fintech, we see a big change between 2016 and 2019. According to App Annie, it only took three years for fintech to become the same as many other sectors. . Billions of dollars. Bank.

For some customers, banking can be difficult, but life would be cruel without them. Banks will not go bankrupt or disappear, but almost everyone believes that change must be embraced. Most established banks already have a platform to offer new services – a challenge in implementing customer banking experience planning.

According to the McKinsey Global Bank Annual Survey 2022, there is a 70% value gap between banking and other sectors. Almost half of the price gap is an indication of low profitability for the banking industry, and the other half indicates a lack of expectations for future growth, which indicates a low P/E ratio for the bank. Banks’ P/Es are around 13, compared to an average of 20 for the rest of the sector, and the discount is growing. The banking industry as a whole does not have good growth trends, which leads investors to discount this sector, which does not have the high growth seen in other industries.

Only banks that create long-term value (North Star) perform well in terms of high current profitability and future growth. High P/E ratios indicate strong expectations for long-term growth, while high price-to-book ratios (P/Bs) indicate short-term risk adjustment. These banks are extremely rare: only 15% of banks worldwide qualify as North Stars. Their value is two to five times higher than others.

Fintech Disruption In The Banking Industry • Uxda

A shift from product-centric thinking to a more customer-centric approach to service design was cited by 79% of respondents to Finextra & Virtusa’s survey of more than 100 bank executives in North America, Europe and Asia Pacific.

Improving the digital customer experience challenges traditional banking practices and cultures. It requires a customer-centric approach, offering financial services that customers use banking technology to accept.

Today’s digital consumer has higher expectations than ever before. To be successful, financial companies must have effective ways to attract and retain customers with relevant and personalized experiences. One of the best ways to do this is to embed design thinking into the culture of the organization rather than the process.

Fintech knowledge can provide customer depth and add value to customers and the company. McKinsey’s analysis here shows that major specialist and fintech players work in profitable banking products such as savings, payments and consumer finance. This will not change the scope or size of the practice after the market correction in 2022.

How Fintech Changes Banks And The Future Of Finances

New financial technologies are giving consumers the freedom to change their financial services faster than ever before, and this is increasing with open banking initiatives. It’s up to the bank to open up more services and ultimately put the customer at the center of what they do. Having a good user-friendly web service is a good step towards achieving this goal.

We see traditional financial companies such as banks working with Fintech and Insurtech companies to integrate them into their environment. This is a great way to encourage innovation and implement Fintech and Insurtech UX