Fintech Banks List Usa – The United States of America has 105 fintech unicorns, making it the world leader in this regard. The United States has managed to climb the ranks of the number of fintech unicorns without losing to its rival China. The continued growth in the number of North America’s fintech unicorns is fueled by the huge amount of money the sector has seen in the region. The number of VC deals in 2021 continued to increase in Q2 2021, compared to declining prices in Asia and Europe.

Looking at the sector at a smaller level, we see that the large fintech unicorns dominating the US landscape are mainly from sectors such as Wealthtech, Payments and Challenger Banks, which account for nearly nine out of 10 of the growing demand for a digital financial environment. services. Americans now use some form of fintech app to manage their financial lives, according to Fortune.

Fintech Banks List Usa

The US fintech ecosystem saw big fat checks come out in H1’21. In the first 6 months of 2021, the prices of investment funds increased by 117% compared to H1’20. The funding was led by $3.4 billion raised by Robinhood, $600 million raised by Stripe, and $500 million raised by Better, ServiceTitan and DailyPay.

As Banks Cut Off Risky Fintechs, A Tiny Lender Leans In — The Information

However, that does not mean that 2020 was not a great investment year in itself. According to KPMG’s 2021 report – 2020 saw investments worth $78.9 billion. That is an increase of 80x in 11 years.

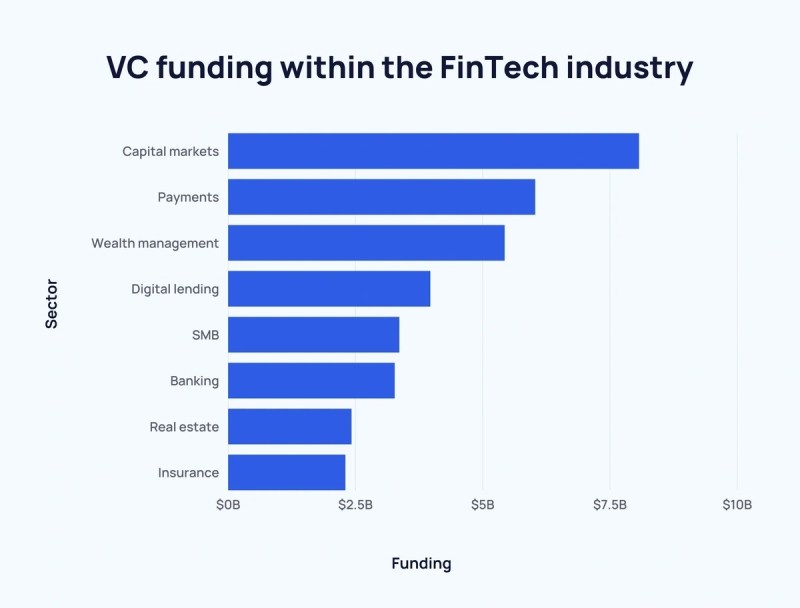

This investor frenzy in the US is largely driven by the realization that Big Funds are ready for a technological revolution – a realization that continues to attract venture capital in sectors such as payments, hitech and crypto.

Fintech is a huge American industry. This sector has grown faster than other countries. In the year From November 2021, there were 10,755 fintechs in the US, which made it the region with the most startups in the world, according to the Statista 2021 study.

Of these, only 1% of the 10,755 fintechs are unicorns valued at $1 billion or more. While this may seem like a drop in the ocean, the 105 US unicorns make up 45% of the world’s fintech unicorns. China trails the US with 13 fintech unicorns, just a tenth of what the US has.

How To Create A Fintech App That Is Not Dull: 4 Ui/ux Design Tips

So what drives so much innovation and growth in startups? The biggest part is control! US federal and state officials are ‘pro-fintech innovation’ with regulatory sandboxes and pilot programs that serve as hubs for financial services growth.

The US market is also seeing more consumers jumping on the fintech bandwagon – leading the country towards greater adoption. In 2021, the percentage of American consumers using fintech grew to 88%, compared to 58% in the 2020 edition of the Plaid survey, Fortune reported. This growing demand is the perfect business environment for US fintechs to thrive, and you bet they are.

The Wealthtech and Payments or Paytech industry is the most popular of the multi-billion dollar fintech group, with 38% of unicorns based in these sectors. Next in the ranking is the banking industry, which is a promising industry in the US.

The Wealthtech sector has seen unprecedented growth, largely due to the continued growth of retail investments due to the pandemic. The increased interest has had a direct effect on VC investment. The sector received investments worth $4.7 billion in Q1’21, a jump of 562% from Q4’20, according to CBinsights.

World’s Best Banks 2023: Global Winners

The growing demand for digital payments has also been dampened by the pandemic. To put this in stark contrast to the hard facts, consider the 186% jump in PayPal’s share price over the past 12 months. In addition, Square’s shares rose 5 percent during the period. The sector is on fire for a number of reasons, including the e-commerce boom and the general shift away from cash as the primary sales method.

Although the growth of both sectors has been supported by this epidemic, changing consumer behavior and the demand for these new financial services products are likely to grow in the coming years. But only time will tell how the industry works and we will be watching closely.

Introduction As the wealth management industry continues to embrace AI innovation, the focus is shifting to more accurate data management.

Introduction The wealth management industry is undergoing significant change driven by changing productivity and market conditions. as of

Top 10 Core Banking Software Vendors In 2024

Introduction Artificial Intelligence (AI) holds great promise as it continues to transform industries by improving work efficiency.

The Center for Finance, Technology and Entrepreneurship (CFTE) is a global educational platform dedicated to equipping financial professionals and organizations with the skills needed to remain competitive in a rapidly changing industry. Our leading training programs designed by global industry experts help you develop the skills to join the digital transformation of finance. CFTE courses are internationally recognized by ACT, IBF, CPD, SkillsFuture and ABS.

At CFTE, our mission is related to each student’s goal to accelerate their career, succeed in their next project, or solve financial problems in their career. To help you do this, CFTE provides you with the tools you need to master digital finance. From global CEOs to disruptive entrepreneurs, we bring you unique insights from leaders driving progress in the financial industry. With CFTE, you don’t just learn what is in the books, but you live through experience by understanding real applications.

If youare looking for more information about how the financial technology field is changing from the inside out, we can help you gain the latest knowledge that will empower your career. CFTE offers leading programs in Digital Finance such as – Payments, AI, Open Banking, Platforms, Fintech, Intrapreneurship and more to help conquer the financial technology landscape. With this knowledge, you will be well on your way to improving your career.

Customers In The Spotlight: How Fintech Is Reshaping Banking

You will learn from a diverse group of industry leaders, experts and entrepreneurs from Fortune 500 companies and technology unicorns, among others. Each of them presents their knowledge and experience in the field of digital currency. Whether you are embarking on a new journey or consolidating your role, these instructors and guest experts come from companies like Starling Bank, Wells Fargo, tech giants like – Google, IBM, successful startups – Cabbage or Plaid among many others! Challenger banks have increased in number in recent years due to the advent of fintech. Indeed, today there are around 100 banks worldwide, offering a variety of financial services to customers to transform their banking choices into simple, transparent and digital ways to manage money.

Nubank, backed by Tencent and Warren Buffett, has a large presence in Latin America, developing interest-free credit cards into a full-service financial services company.

Revolut is a private digital bank that offers not only card payments, but also savings plans and services such as investments or international transfers.

Chime is a multi-bank financial services company that offers a user-friendly application for credit cards, savings accounts and seamless payments.

Top Core Banking Software Companies List In 2024

Developed by a consortium of technology companies, WeBank is another private bank that operates transparently and works with underprivileged groups.

The star of last year’s stock market craze, Robinhood is a commission-free investment tool with a wide range of income streams, as well as a variety of unique financial instruments.

Tinkoff, created as an experiment for the Russian market, is the champion of the region’s digital banking, with an emphasis on open and big data solutions.

A model Silicon Valley unicorn, Brax meets the growing banking needs of technology companies, helping with cash management and lending needs.

Fintech Vs Bank: A+ Comparative Breakdown For 2024

Sophie is known for taking a different approach to the credit side of personal finance and investing.

A US-focused lending platform. within the bank network, Improve offers a balanced range of loan products to meet local needs.

Monzo has proven itself to be the easiest money saving tool and digital wallet for everyday expenses. The USPs are not only interesting analytics and transaction speed, but also predictability.

To see the full list, see the ranking of Buy Now (BNPL) Unicorns by Market Capitalization of the largest fintech companies.

Neobanking Market Size, Share, Growth

Of the 20 challenger banks in our database, 7 are from the US, 6 from the UK, 2 from China and one each from Argentina, Brazil, Georgia, Germany and Russia.

The most successful of the rival banks was Nubank, a company from São Paulo. No one expected NewBank to take down the big five banks, but they did.