Fintech Companies In Latin America – This month, money transfer giant Western Union bought Brazil’s e-wallet Te Enviei, which could launch new products in Latin America in the first half of 2023. The deal comes amid growing payment activity in LatAm as a major player. The market is expanding abroad, and other multinational players are increasing their influence in the region.

Latin America remains a thriving region for fintech due to its high unbanked population, increasing digitization and increasing adoption of mobile banking. By 2021, the World Bank reports that half of the population in Latin America and the Caribbean will be unbanked, with many using their mobile phones to make payments.

Fintech Companies In Latin America

Crypto continues to see high adoption in the region – El Salvador recently adopted Bitcoin as its national currency, while Argentina has seen an increase in companies paying employees in cryptocurrency due to the stability of the Argentine peso.

The Top 25 Early-stage Latam Vcs

This affinity for cryptocurrency is reflected in many important partnerships. For example, last year the crypto exchange Bitso, the first unicorn of LatAm, signed an agreement with the money transfer company Africhange to facilitate the transfer of crypto money between Canada and Mexico. At the same time, Visa is working with many countries and has partnered with major cryptocurrency crypto.com to launch a card that will reward users with bitcoins on every purchase (against players in the crypto card space). read this report).

Remittances to the region are on the rise as the migrant labor market in Latin America and the Caribbean and the United States recover. The acquisition of Te Enviei is part of Western Union taking advantage of this opportunity. The company offers digital and physical money transfers from Chile to more than 200 countries and territories, as well as adding 9,800 new delivery locations in Colombia by early 2022.

As Latam’s largest economy and fintech haven, Brazil has recently become an important market for cooperation. Ripple has partnered with Travelex to provide the liquidity needed to expand cross-border payments in Brazil and Mexico into LatAm. Brazilian fintech eBanks has made significant progress this year by launching mobile money services in Africa and partnering with global investment bank Citi to allow e-commerce customers in 11 LatAm countries to accept 100 online payment methods.

We’re always monitoring the payments industry in LatAm and other regions around the world, so stay tuned for new developments.

Fintech Startups In Philippines

Joe is a senior copywriter at FXC Intelligence, writing and editing reports, news and analysis to support the company’s weekly content and client programs. Prior to joining FXC Intelligence, he worked as a B2B copywriter, reporter and editor covering a range of topics including technology, logistics, retail and the food and beverage industry. He holds a BA in Philosophy from the University of Warwick.

We use cookies to provide the best user experience. If you continue to use our website, we indicate that you agree to our use of cookies. If you want to know more about cookies, see our cookies guide. Brazilian fintech company Nubank is currently the world’s largest neobank with 33 million customers and a value of $25 billion. That price is half the market value of Etaú, Brazil’s largest public bank, which has been around for more than 75 years. Even among fintech enthusiasts, NuBank’s rapid growth is nowhere to be seen – from over 1 million apps in 2016 to over 30 million apps in just a few years. Nubank has become one of the most influential companies in fintech in terms of size, growth and speed. One major advantage? Nubank recognized early on what was obvious to the rest of the world: Latin America had enormous untapped potential for all kinds of financial services.

As is often the case, growth appears gradually over a long period of time, then it occurs suddenly, seemingly all at once. Latin America is currently experiencing an explosion of fintech activity, and this is just the beginning. Here, we reveal the key market dynamics that make Latin America a great place to start fintech companies, the ebbs and flows in the region and the opportunities for the next multi-billion dollar company.

The rate of adoption of financial services in Latin America is very low; Most consumers are still banked or unbanked. This high demand creates a platform for new fintech players to serve existing customers and introduce consumers to the formal financial system for the first time. There are many systemic reasons for this historical underfunding, including:

Week 26, 2024

More than 650 million people live in the region in 33 countries. The two largest countries, Brazil and Mexico, have a population of 210 million and 130 million, respectively, GDP of $ 1.8 trillion and $ 1.3 trillion. Other countries in the region achieved higher rates, including Colombia (50+ million people, $300+ billion GDP), Argentina (45 million people, $445 billion GDP), and Chile (19 million people, $280 billion GDP). Establishing a company in Latin America provides an incredibly large address market to create better products and distribute them to many new customers.

By adopting strict underwriting requirements and limiting access to financial products, banks operating in Latin America exclude the majority of the population. For example, more than 50 percent of people in Mexico are unbanked, more than 30 percent do not have access to any financial products, and only 31 percent have access to credit products. Credit, a powerful tool for individuals to pay for college, start a business, or buy a home, is expensive and out of reach for many people. Therefore, there is a high demand among customers outside the financial system in existing financial institutions.

Until recently, most banks in Latin America did not have mobile apps and required personal banking for most of their users. For example in Colombia, consumers still have to visit a physical branch to open a bank account. Banks have long neglected a technology-based, mobile-first approach; The digital banking experience for consumers is often missing. For example, at Etau, one of Brazil’s largest banks, potential customers have to fill out 26 fields in their application, which takes more than 15 minutes, Idwal explained. If that’s not enough of a deterrent, it takes another 18 hours for the account to be approved! And that in itself is a big improvement: five years ago, applicants had to visit a branch to open an account, then wait several weeks to be approved.

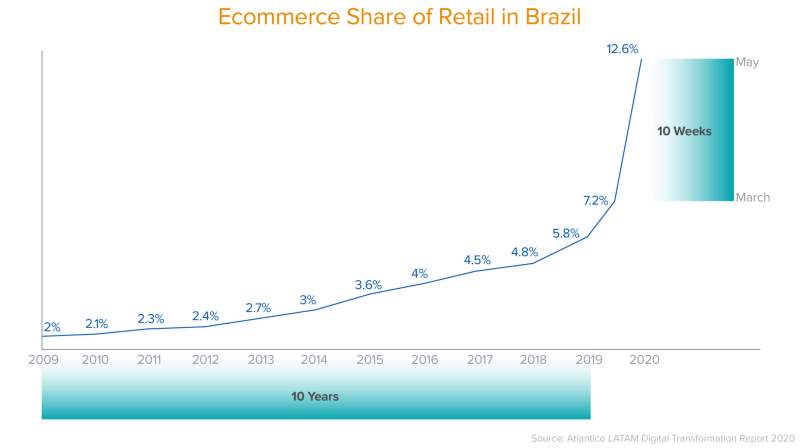

Latin America’s economy is still largely based on cash – in Mexico, more than 90 percent of payments are made with paper money; In Brazil it is about 70 percent. Although e-commerce has shown impressive growth in recent years (for example, Mexico has seen a growth of 32% in 2020), online shopping is still relatively hidden because only part of the population owns financial products. Participation in these online economies. In fact, the default for most customers in Latin America is to order online and then pay in cash at a local store. As the global economy transitions to digital payments and cards, Latin America is poised to follow suit.

Forecast: Which Fintech Sectors Will Vcs Favor In 2023?

5. “Your margin is my opportunity”: Latin American banks are among the most profitable banks in the world.

Large banks in Latin America have little incentive to innovate. There are 51 banks in Mexico. There are only 25 banks in Colombia. Compared to thousands of banks in the United States, consumers have a significant delta in the number of options. The low number of banks in the region has led to over-banking and monopolization by large institutions. For example, in Brazil, 80 percent of deposits are concentrated in the country’s top five banks. This creates a gap between financial institutions and their customers. As a result, Latin American banks have a healthier margin than other financial institutions around the world. In Mexico and Brazil, the rate of return on equity, or ROE – an important indicator for understanding the profitability of banks – is five times higher than that of French banks and twice that of American banks. These large sources of profit are indicative of fintech’s ability to offer better, more accessible and affordable products to consumers.

The situation described above has remained unchanged for decades. But there is reason to believe that changing consumer expectations, adoption and control of smartphones has created an opening for financial innovation.

In Mexico, 43 percent of the population is under 25 years old. This large, younger consumer base expects their banking services to mirror the applications that consumers use regularly. Moreover, the use of smartphones has become the norm rather than the exception. Just six years ago