Fintech Id – The fintech industry combines financial services with the latest technology to provide seamless on-demand access to banking, payments and more. This digital transformation allows people to easily manage their finances anytime, anywhere. But with this rapid growth, fintech companies are at increased risk as online marketplaces become prime targets for fraud.

Identity verification processes are important in fintech, especially for mobile banking, digital payments and cryptocurrencies. Without due diligence, fintech companies are vulnerable to fraudulent activity, causing significant financial losses and compromising trust. This blog examines the unique challenges of identity verification (IDV) in fintech and highlights important features and strategies to help strengthen the industry’s security.

Fintech Id

Read: A Guide to Testing FinTech Apps for Enhanced Functionality and Security Key Role of Personal Data Protection in Fintech ● Fighting Fraud and Financial Crime

The Future Of Digital Identity In Fintech

Also Read: How Financial Institutions Can Take Advantage of Cloud-Based FinTech Identity Verification Solutions

Compliance with anti-money laundering (AML) and know-your-customer (KYC) laws is critical for financial firms. Each region has unique structures that create a complex landscape that is not universal. Fintechs must adapt KYC requirements to industry specifics, such as cryptocurrencies or payment services, which can make compliance difficult. Verification procedures vary from platform to platform, further complicating compliance.

Since users often use their smartphones, tablets or computers, authentication on personal devices poses additional risks. This creates an opportunity for fraudsters to manipulate authentication results via compromised devices, putting fintech companies at potential risk. To address this issue, companies are encouraged to adopt an untrusted mobile framework that focuses on device authentication and rigorous security checks to mitigate the risks associated with untrusted devices.

Today’s customers want digital financial services that are fast, intuitive and convenient. Long or complex IDV processes can frustrate users, resulting in high bounce rates at boot. Issues such as limited document type acceptance, difficulty navigating, and inability to localize contribute to this dissatisfaction.

Japan’s Mufg To Invest $200m In Indonesia Fintech Akulaku

For fintech companies, a strong identity verification (IDV) solution is critical to managing risk, ensuring compliance and creating a seamless business experience. Choosing the ideal IDV solution can seem difficult, but following a clear process can make the decision easier.

With a structured approach and the right partner, your IDV solution can support regulatory compliance, simplify onboarding, reduce fraud risk, and put your fintech business on a sustainable growth path.

Read: Banking App Functionality Testing Tips Specific Fintech Identity Verification Training Solutions ● Increase Customer Conversions

Choosing the right identity verification (IDV) solution is a critical decision for businesses, whether they are implementing it for the first time or replacing an existing platform. Proper planning and thorough preparation can greatly reduce the uncertainty in the entire selection process and ensure an easy way to find the best one.

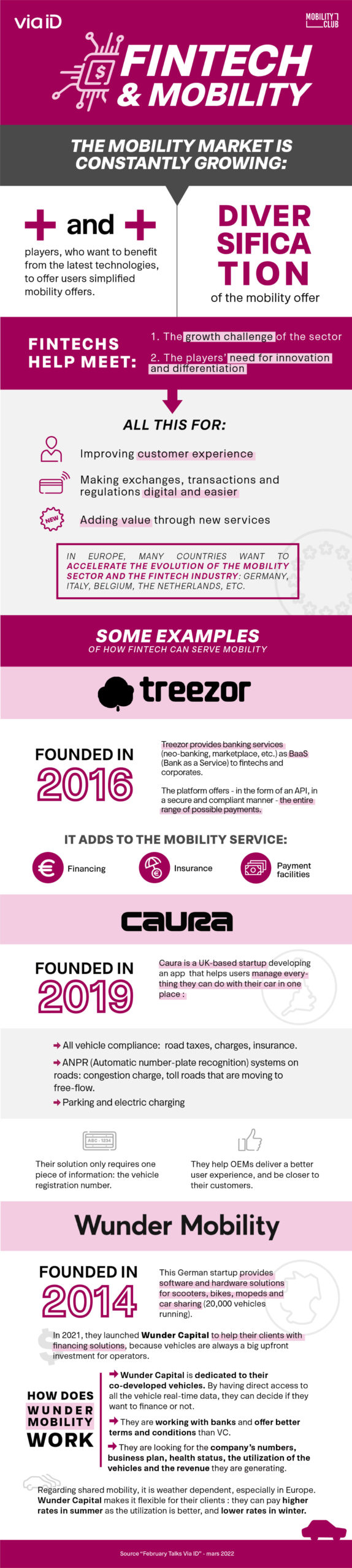

Fintech & Mobility: The Infographics!

Choosing a vendor that meets your goals is critical to achieving significant results. A strong partnership with the right vendor will help you achieve OKRs and create long-term value for your business.

, we emphasize a deep understanding of your unique use cases and how they fit into your overall business goals. Our approach focuses on collaborative thinking and tailored recommendations to help you solve your banking domain application testing challenges with advanced solutions for your success.

Answer: Fintech authentication includes the processes and technologies that fintech companies use to validate user information and secure their platforms. Methods include password protection, two-factor authentication (2FA), and biometric authentication (such as facial recognition). This approach uses advanced technologies such as artificial intelligence and machine learning to prevent fraud while ensuring a seamless user experience and protecting personal and financial information.

A: To verify your identity, please provide accurate and current information that matches your official identity. This usually requires government-issued ID (such as a passport or driver’s license) and a selfie or live video for biometric verification. Make sure the document is clear and legible, follow the instructions on the photo platform and make sure the information entered matches your identity.

Innovation And Digital Electronic Service Supports Digital Economy Ecosystem

Jun 7, 2022 A Practical Guide to Regression Analysis for Advanced Users (Part 1) Read More 13 Jul 2022 A Practical Guide to Regression Analysis for Advanced Users (Part 2) Read More Financial fraud is on the rise. Here are our top 10 anti-fraud and identity verification platforms to combat the rising tide of fraud.

As the financial services industry moves into the digital age, fraud is also keeping pace with digital innovation. In 2022, Cifas found that the fraud rate was 17% higher than the previous year, 11% higher than during the Covid-19 pandemic.

It is now more important than ever for businesses and financial institutions to protect themselves from fraud. Below, we present you the top 10 companies working to reduce fraudulent activity using identity verification and fraud platforms. So let’s see…

HealthVerity is a US-based IT services and consulting company that aligns technology services with the national healthcare ecosystem and consumers. These capabilities enable HealthVerity to achieve previously impossible results and advance the science of identity, privacy, governance and exchange (IPGE). A complete suite for the healthcare industry, HealthVerity integrates ID management with privacy compliance and management capabilities, enabling customers to quickly discover and share virtually unlimited data.

Fintech Identity Verification: Best Ideas For The Industry

Bureau ID is a codeless identity acceptance platform that provides businesses with a comprehensive risk, compliance and fraud control solution powered by artificial intelligence. Using a next-generation architecture, the Bureau provides business clients with contextual insights that guide them to make fully informed decisions about digital identity trust. The company says this not only facilitates user transactions, but also prevents hacking by bad actors. It helps businesses to operate efficiently and limit fraud attacks.

IDVerse, formerly OCR Labs, operates a fully automated solution that verifies new users in seconds using biometric authentication via smartphone. IDVerse technology is used in more than 220 countries and territories today and can authenticate users with specific documents without human intervention. Today, the company is a pioneer in Generative AI, which uses artificial intelligence with Zero Bias AI technology to learn deep neural network systems. As such, the IDVerse system claims to protect against age, race and gender discrimination. Today, IDVerse claims that its solutions are 99.99% accurate when tested in an independent lab. CEO John Myers recently spoke with Fintech Magazine about the company’s future direction.

IDnow is an identity verification platform provider that offers a range of identity verification and document signing solutions in addition to comprehensive services. From automation solutions to web resources and point-of-sale solutions, IDnow optimizes and customizes its services for its customers. With various offerings, IDnow claims that verification methods are optimized to meet the highest security standards along with maximum customer conversion. FinTech Magazine recently spoke to IDnow Head of Crypto & Fintech Jason Tucker-Feltham at Money20/20 Europe to discuss their UK expansion plans.

A leader in digital trust and security, Sift provides fraud and abuse prevention solutions with leading-edge technology, expertise and a global network that handles billions of events annually. Because of its commitment to long-term customer relationships, Sift has partnered with many well-known brands, including DoorDash and X (formerly Twitter), that rely on Sift to gain a competitive edge in the marketplace. The Digital Trust & Safety platform is built around a single, intuitive console that eliminates the need for multiple tools, single-purpose software, and incomplete or insufficient insights that drain resources. The Sift platform connects data, is flexible, and leverages intelligent automation across all aspects of risk operations.

Digital Identity Verification: Ensuring Trust In Fintech Services

Jumio offers companies the tools to better understand and trust their customers online through the Jumio KYX platform. From user account opening to continuous monitoring, risk alerts, identity verification, and compliance solutions, Jumio’s platform helps businesses build, maintain, and trust their customers. Using automation, biometrics, artificial intelligence, machine learning, codeless organization and live identification technologies, the Jumio platform helps businesses fight fraud and other financial crimes, acquire good customers faster and meet regulatory KYC and AML meet.

ID.me offers solutions to help individuals define and share their identity online. The ID.me network has 113 million members and will add an average of 90,000 new customers per day in 2022. The company also works with 30 US states, 14 federal agencies and more than 600 vendors. ID.me provides identity, identification and group membership verification for organizations across a variety of industries. ID.me also offers a video chat service to support its customer base with the mantra “Anonymous Identity Behind It” so they can be confident that they have a secure digital identity.

Onfido offers enterprises a true identity platform that can customize the platform to meet user and market needs in a code-free layer. This makes it easier for companies to detect any bad actors and gives people easier access to services with faster authentication solutions. The Onfido platform uses document and biometric authentication, trusted data sources and passive fraud alerts.

.webp?strip=all)