Fintech In Us – There are 105 fintech unicorns in the United States of America, making them a global leader on this front. It managed to top the US charts by matching its rival China in the number of fintech unicorns – a remarkable achievement in the financial technology sector. The continued growth of fintech unicorns in North America will be driven by the large amount of funding seen in the region’s sector. The number of venture capital deals in 2021 continues to rise rapidly in the second quarter of 2021, compared to the number of deals falling in Asia and Europe.

Looking at the sector on a micro scale, we see that the major fintech unicorns that make up the US ecosystem mostly belong to sub-sectors such as wealthtech, payments and challenger banks, which, as seen in this region, have fueled the appetite for digital financial services. According to Fortune, nine out of 10 Americans are now using some form of fintech app to manage their financial lives.

Fintech In Us

Some of the biggest checks were cashed in the US fintech ecosystem in the first half of 2011. In the first 6 months of 2021, the value of investment transactions has already increased by 117% compared to the first half of 2020. The funding includes $3.4 billion raised by Robinhood, $600 million from Stripe and $500 million raised by Better, ServiceTitan and DailyPay.

Generative Ai In Fintech Market Size To Exceed Us$ 6.2 Bn By 2032: Report By Market.us

However, that doesn’t mean 2020 won’t be quite an investment year in itself. According to KPMG’s 2021 report, $78.9 billion in investment was raised in 2020. Looking back, the industry has come a long way since fintech first started in 2009, when investments were only $1.1 billion. This is almost an 80-fold increase in 11 years.

This investor frenzy in the US is primarily driven by the realization that much of finance is ripe for the technology revolution – which continues to attract venture capital to emerging sectors such as payments, wealth technologies and cryptocurrencies.

Fintech is obviously a huge industry in the US. This sector is developing faster than other countries. As of November 2021, America is home to 10,755 fintech startups, making it the region with the most startups in the world, according to Statista’s 2021 study.

Of these, only 1% of the 10,755 fintech companies are unicorns, valued at $1 billion or more. While this may seem like a drop in the bucket, the 105 unicorns in the US make up about 45% of the world’s fintech unicorns. China trails the United States with 13 fintech unicorns, only a tenth of what the United States boasts.

Artificial Intelligence (ai) In Fintech Market Size, Share & Forecast

So what is driving so much innovation and startup growth? The biggest part is control! US federal and state regulators have become “fintech innovators,” with regulatory sandboxes and pilot programs serving as hubs for financial services growth.

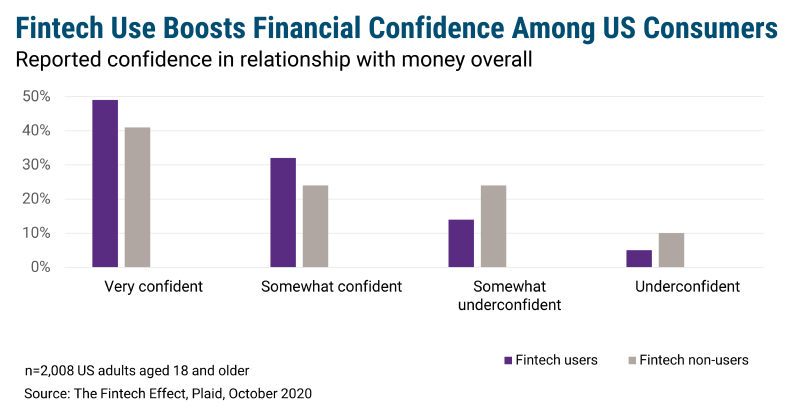

The US market has seen consumers jump on the fintech bandwagon, leading the country to a state of mass adoption. According to Fortune, the share of US consumers using Fintech increased from 58% in Plaid’s 2020 survey to 88% in 2021. This growing demand is an ideal business environment for American fintech companies to thrive, and you can be sure that it will continue to do so.

The wealthtech and payments industry, or paytech, is the most important sector in the billion-dollar fintech club, with 38% of unicorns based in this sector. Next on the leaderboard is the challenger bank sector, an up-and-coming US industry.

The wealthtech industry is experiencing unprecedented growth, primarily as the retail investment boom continues in the wake of the pandemic. Growing demand has a direct proportional impact on venture capital investment. The sector saw investment of $4.7 billion in the first quarter of 2021, up 562% from the fourth quarter of 2020, according to CBIinsights.

Out Of Many, One? — The Future Of U.s. Fintech Regulation — Fintrail

The pandemic has fueled a growing appetite for digital payments. To put these hard facts into perspective, consider the 186% jump in PayPal’s share price over the past 12 months. In addition, Square shares have increased by more than 5 times. The sector is facing a crisis for several reasons, including the rise of e-commerce and the general exodus of money as the primary means of doing business.

Even though the pandemic has acted as a catalyst for the development of the same sectors, it can be said that changes in consumer behavior and demand for new financial services products will continue in the coming years. But only time will tell how the industry behaves and we will be watching closely.

Introduction As the asset management industry continues to embrace productive artificial intelligence, the focus is increasingly shifting to effective data management.

Introduction The asset management industry has undergone significant transformation driven by generational change and changing market conditions. how

Top Fintech Companies In The Usa

Introduction The future of artificial intelligence (AI) is extremely promising as it continues to transform industries through improved operational efficiency,

The Center for Finance, Technology and Entrepreneurship (CFTE) is a global education platform dedicated to equipping finance professionals and organizations with the skills necessary to remain competitive in a rapidly changing industry. Our flagship training programs, curated by global industry experts, help talented professionals acquire the skills they need to participate in the digital revolution in finance. CFTE courses are globally recognized and accredited by ACT, IBF, CPD, SkillsFuture and ABS.

At CFTE, our mission aligns with every student’s goals: advance quickly in your career, succeed in your next project, or even overcome a financial crisis in your own business. To help you do this, CFTE gives you the tools you need to master the right digital financial skills. We offer exclusive insight from leaders driving the financial sector, from global CEOs to disruptive entrepreneurs. With CFTE, you don’t learn what’s in books, you live the experience through real-world applications.

If you’re looking for a deeper understanding of how the fintech industry is changing from the inside, we can help you gain the latest knowledge to propel your career. CFTE offers leading online programs in digital finance, covering a wide range of topics such as payments, artificial intelligence, open banking, platforms, fintech, intrapreneurship and others. Having this skill at your disposal can help accelerate your career.

Why You Should Enter The Us Fintech Awards

You’ll learn from a carefully selected group of industry leaders, experts and entrepreneurs, including Fortune 500 companies and tech unicorns. Each will present their knowledge and experience in the field of digital finance. Whether you’re embarking on a new journey or strengthening your role, these mentors and guest experts guide you through the perspectives of established organizations like Starling Bank, Wells Fargo, tech giants Google, IBM, successful startups like Kabbage. Or plaid, among many others! Learn about our product, find our documentation and more. Enter your query in the search box above and the results will appear as you type.

As a financial partner to technology and healthcare companies and investors over the past four decades, he has provided support and guidance through various economic cycles. Dan Allred, Senior Market Manager, who leads the National FinTech and Payments Strategy, shares trends from the latest State of FinTech report and views on the future of the FinTech sector.

Fintech companies now face uncertainty as federal regulators try to understand the technology’s role in financial services and examine potential risks to consumers.

Dozens of federal agencies have a broad mandate to protect consumers from data breaches, abusive credit and fraud, and ensure digital platforms comply with international and anti-money laundering protections. U.S. We’ve recently seen moves to strengthen financial technology regulation with the creation of the Securities and Exchange Commission’s (SEC) FinHub, the Consumer Financial Protection Bureau’s (CFPB) Office of Competition and Innovation, and the new Office of the Financial Technology Regulator. . Currency (OCC).

Fintech As A Service Market– Industry Trends And Forecast 2024 To 2034

The CFPB has indicated that it will pay more attention to providers of short-term consumer loans known as buy-to-pay (BNPL) short-term consumer loans that are not required to report data to credit reporting agencies. The popularity of BNPL products has grown during the pandemic, with loan originations growing 10.6 times from 17 million loans in 2019 to 180 million in 2021, according to the CFPB.

Even as regulators look to the fintech sector, they face a constant challenge in keeping up with the pace of technological change. The CFPB, for example, created new rules mandated by the Dodd-Frank Act of 2010—a series of financial regulations enacted to prevent future financial crises—to establish standards for sharing consumer financial data to address privacy concerns recently raised by BNPL and others. Customer Payment Options. Meanwhile, the collapse of cryptocurrency exchange FTX is likely to accelerate regulatory initiatives in the digital currency space. The FTX infection has led to the bankruptcy of other cryptocurrencies, including BlockFi, which in February had to pay $100 million in SEC fines for violating securities laws. FTX effects highlight regulatory complexity