Fintech In Usa – Director of FinTech. Former vice-president of Goldman Sachs. Blockchain and Web3 expert. Experienced engineering manager and technical director.

The world of finance is evolving rapidly and fintech companies are leading the way in innovation and disruption. Offering a wide range of services to individuals and businesses, fintech companies make it easier to manage finances, invest in stocks and conduct transactions online.

Fintech In Usa

If you’re looking for the best fintech companies to watch, this article is for you. In this article, we’ll look at America’s best fintech companies, their unique features, and what sets them apart. From payment processors to digital banks, we cover everything you need to know to stay ahead in the world of finance. So, here we go!

Fintech And Ecosystems

One of the main reasons for the growth of fintech in the United States is the increasing adoption of mobile devices and online platforms. By 2021, 80% of American adults will own a smartphone and 67% will use mobile banking apps.

Another factor driving the growth of fintech in the United States is the rise of digital banking. These digital banks offer a variety of fintech services, including checking and savings accounts, debit cards, and investment options.

Overall, the luxury goods market in the United States is expected to continue growing in the coming years. With the increasing adoption of mobile devices and online platforms, the rise of digital banking and significant investments, the sector is driving innovation and creating new opportunities for consumers and businesses.

Find out who is at the top of the industry in the United States by downloading the list of the 100 largest fintech companies. Here are brief overviews of each company, the funds raised, and its founding story.

Fintech Companies In The Usa

Later in this article, we’ll take a closer look at the top 10 companies on the list. But first, let’s look at the market context. (Use the navigation bar on the right to jump directly to any part of the article.)

In the United States, the FinTech sector is home to many companies specializing in various areas of finance. Leading FinTech experts in the United States include:

Payment processing companies like Stripe, PayPal, and Square have revolutionized the way businesses process online transactions. These companies offer secure, easy-to-use payment processing tools that allow businesses to accept payments from customers around the world.

Digital banking has become a major issue for financial technology companies in the United States. Companies like Chime and Varo Money offer fully digital banking services, including checking and savings accounts, debit cards, and investment options.

Fintech Laws And Regulations Report 2024 Usa

Wealth management is another important area of specialization in the US fintech industry. Betterment and Wealthfront offer investment management services that use algorithms to create and manage portfolios.

Insurtech is an emerging area of FinTech focused on using technology to disrupt the insurance industry. Companies like Lemonade and Root are using artificial intelligence and machine learning to offer more personalized insurance products and services.

Whether you’re looking for payment processing tools, digital banking, investment management, digital asset management development, or innovative insurance products, the US fintech industry has something for everyone.

The first online banking and stock trading platforms appeared in the 1990s, paving the way for the FinTech revolution.

All About Fintech Startups

The combination of a mature financial services sector, a strong entrepreneurial culture, access to capital and a diverse consumer market makes the United States fertile ground for fintech companies.

The fintech industry is constantly evolving and the largest fintech companies in the United States are always looking for new ways to improve their services and gain a competitive advantage. Here are the hottest fintech trends for 2024 related to new features in the US fintech industry:

These are just a few potential ideas for new features in the US fintech industry. As technology continues to advance, there are sure to be many more exciting innovations in the future.

The most innovative and largest fintech companies in the world are in America. Let’s take a look at the top 10 of them and what they do.

Top 10 Women: Fintech Leaders Driving Innovation In Us

Robinhood has quickly become one of the most popular online trading platforms. The platform offers commission-free trading on stocks, ETFs, options and cryptocurrencies. It has over 18 million users.

Acrisure is an insurance brokerage company that offers a variety of insurance products and services. The company has grown rapidly in recent years, acquiring several other insurance brokers and agencies.

SoFi is a personal finance company that offers a variety of financial products and services, including student loan restructuring, mortgages, personal loans and investment services.

Cabbage is an online lending platform that provides access to financing for small businesses. The platform uses advanced algorithms to analyze data from various sources, including social media and accounting software, to assess the trustworthiness of potential borrowers.

Fintech Explained With Al Periu, Ceo Of Zilch Usa

Stripe is a payment processing company that provides a simple way for businesses to accept payments online. The company’s platform is used by businesses of all sizes, from small startups to large enterprises.

Navan is a corporate travel and expense management platform that provides businesses with a variety of tools and services to help them manage their travel expenses. The platform uses machine learning to optimize travel plans and save businesses money on travel costs.

Cham is a new bank that offers its customers free checking and savings accounts. The platform offers other financial services, including debit cards, loans, and credit monitoring.

Avant is an online lending platform that allows users with low credit scores to access personal loans. The platform uses machine learning algorithms to assess the trustworthiness of potential borrowers and provide them with consumer loan options.

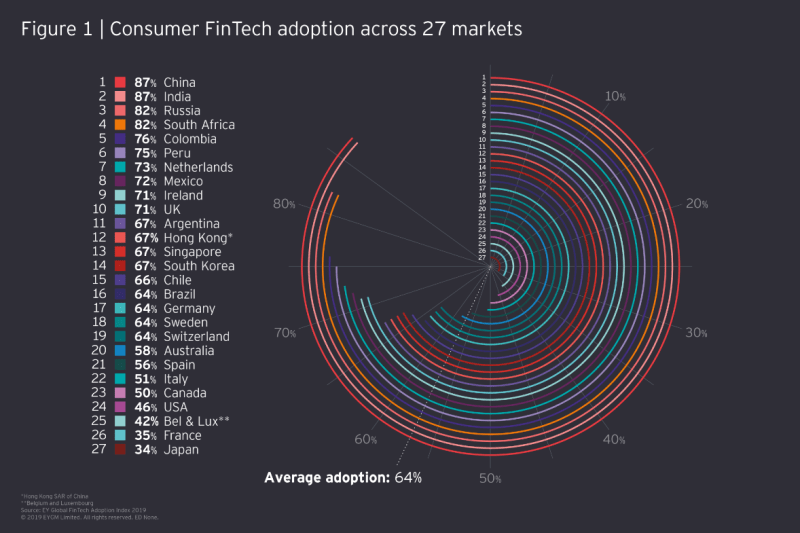

Japan Fintech Adoption: Dead Last, But There Is Hope

Fare is a car rental platform that allows users to rent cars on a flexible monthly basis. The platform uses various factors to determine the monthly cost of leasing a specific vehicle based on various factors, including the make and model of the car, the user’s credit score, as well as access to the vehicle and financing via the application.

Opendoor is an online real estate marketplace that aims to make buying and selling homes easier and provides a simple and transparent process for both buyers and sellers. The platform uses a proprietary algorithm to determine the value of a home and provide users with a cash offer for their home.

The U.S. fintech industry is a rapidly evolving environment with a variety of companies and experts driving innovation and growth. From digital payments and online lending to trading platforms and cryptocurrency exchanges, the US fintech market is home to some of the fastest growing and most disruptive companies in the world.

Of course, these are just a few of the many exciting and innovative companies shaping the future of finance in America. As the fintech industry continues to evolve and grow, we can expect many breakthroughs and innovations that will change the way we think about and interact with money.

Top 10 Fintech Companies In Usa [updated List]

Follow these top 100 fintech companies and the market as a whole and witness the birth of the next big thing in finance: FinTech software development services. From cryptocurrency exchanges and blockchain platforms to payment processing applications and asset management product development, we provide end-to-end software development for businesses of all sizes.

Get insider information on industry news, product updates and emerging trends so you can make more informed decisions and stay ahead of the curve.

Selecting a FinTech Cloud Provider: 5 Expert Tips for CTOs August 19, 2024 • 11 min read.

Digital Transformation in Business Banking: Shaping the Future of Financial Services August 16, 2024 • 7 min read.

2021 Global Fintech Rankings

Payments Innovation: Top 10 Payments Trends That Could Make or Break Your Service August 2, 2024 • 16 min read The percentage of U.S. consumers using technology to manage their finances is up from 58% this year . This figure rose to 88%, according to a Plaid survey. . The online survey was conducted July 6-20, 2021 among 2,000 U.S. adults.

In a Plaid survey last year, 69% of respondents said fintech had become a lifeline during lockdown. Even though businesses and bank branches have reopened, 58% still say they cannot live without technology to manage their finances. In fact, 80-90% of fintech users plan to use these solutions the same way, or even more often, in the future.

Fintech solutions have traditionally resonated with younger, affluent consumers. But new customer segments are growing rapidly: Baby boomers are the fastest growing segment, with adoption rates now ranging from 39% to 79%. And a whopping 96% of Latinos now use fintech, up from 62% last year.

According to eMarketer, as U.S. consumers become more comfortable with fintech, they will make more purchases. And it’s even harder to stand out now that all financial service providers, whether incumbents or startups, are leveraging technology in their offerings. Therefore, fintech companies looking to strengthen their competitive advantage will need to take a more complex approach than simply offering standard services in a digital format, leading to audience hyper-segmentation. Fintech or financial technology has been one of the most developed sectors in the world over the last decade. FinTech has changed the way we manage our finances through mobile banking, investing and blockchain applications. According to the modern world of knowledge, the center of this technological trend is in the United States, where there are 1,491 startups and $58.5 billion invested.