Fintech Regulations In Usa – The financial system has been evolving recently, with many technology companies working to bring the financial sector to life by 2022. It’s an exciting time not only for the financial industry, but also for the fintech companies, developers and investors who are driving the sector forward.

Working in FinTech has never been more powerful and exciting, but it comes with a significant obstacle. Namely, financial control and financial and legal matters related to the region.

Fintech Regulations In Usa

Of course, financial performance comes with regulatory standards. It is a difficult process for the technical community to follow these rules. Our CTO Nazariy Khazdun thinks about this in a new article in Forbes magazine.

Fintech Laws And Regulations 2021

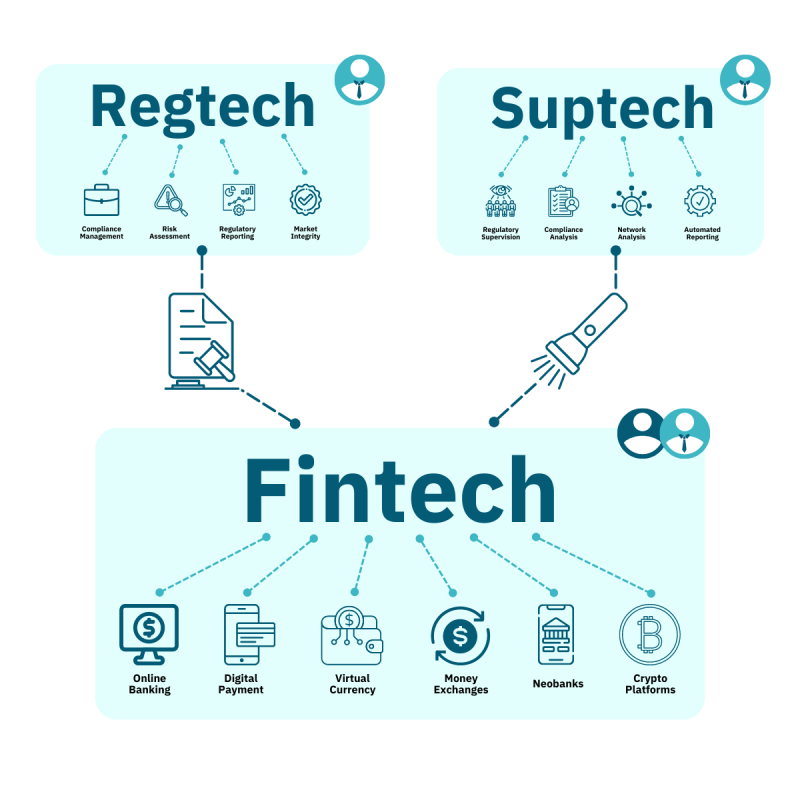

As a FinTech company, investor or developer, financial regulations are not the most exciting problem you will face. FinTech software development is a very fast growing area. Understanding the key legal issues of FinTech is essential to reaping the rewards that FinTech offers. Three main directions:

You may have already seen some of the problems with FinTech laws and financial regulations. That is, it is not necessary to have a general system of rules and regulations. Each major state has specific laws that differentiate the standards parties must meet based on where they are located. There is a lot of conflict between different agencies and regulations, but at first glance it can seem like a tangled web of good governance!

To help you understand the landscape, we have presented important ecosystems in key areas.

The CSBS launched the Vision 2020 plan to bring more uniformity to licensing and has been very successful in lowering the barrier to entry for financial institutions offering new technologies in the United States.

U.s. Open Banking Poised For Major Acceleration, But Political Uncertainty Could Hamper Momentum

All these regulatory bodies play an important role in overseeing and regulating the FinTech business model. These federal financial regulators ensure that FinTech companies comply with applicable federal laws and regulations, promote corporate transparency and integrity, and protect consumers from fraudulent or deceptive practices in the rapidly growing FinTech industry.

There’s a lot to take in already. Fortunately, in most cases you need to be aware of these various governing bodies, laws and standards. It is not uncommon for a FinTech to start operating in all these areas and break all the rules.

Before we look at some examples of licensing, let’s take a moment to explain some important areas of FinTech work.

We face the same problem as companies in general when it comes to managing FinTech. I mean, rules change everywhere!

A Case For Ict Regulatory Sandbox

For example, in the US, government bank managers are part. However, there are some universal truths.

Even savings banks are making digital transformations, but smaller, new banks are emerging or already operating, attracting customers with the benefits of being digitally native.

As we can see, there is a lot of movement in technology-based payment methods. There are specialist organizations in the UK and Europe that can guide you in payment system licensing. In the US, it will eventually be covered by the CSBS.

Therefore, customers can shop, pay bills, and more from the comfort of their homes. If you want to expand your skills, there are several license structures that you should know. But the rewards can be great because this is a popular place to grow; You must comply with consumer protection laws.

Top 10 Fintech Risks: Strategy, Cybersecurity, Operations & More

Choose the best payment method once and for all. Here’s a tip from a leading FinTech software developer in Eastern Europe

Because stablecoins are often linked to assets or money, they are a regulatory requirement for new FinTech. Blockchain, as a whole, remains a fertile field for growth. The Stablecoin Trust Act was established by the government to regulate FinTech, specifically which products can be linked to crypto.

Fintech software development services are designed to provide technical capabilities to any potential FinTech company to realize its potential. It’s not just about the code; It’s about bringing together a set of diverse and highly related skills and knowledge to achieve a unique and cohesive end result. These services include:

Next Next A permanent online payment system benefits not only you, but also your customers.

Fintech: A Content Analysis Of The Finance And Information Systems Literature

Many companies are looking to FinTech as an ideal area for technology development. This is entirely appropriate as consumer expectations, blockchain technology and globalization are driving the digital transformation of traditional financial institutions and the need for new FinTech companies to transform the regulatory environment.

However, for startups or companies that have previously been successful in app development, FinTech presents a unique challenge. Combined, FinTech and regulations are complex and enforcement bodies are toothless. These are not guidelines; These are the rules!

We looked at how FinTech laws and regulatory approaches differ by country and type of activity. In practice, many FinTech companies must be experts in the specific regulatory practices of their chosen industry – otherwise risk management failure.

It is easy to get caught up in the big idea, ignoring (of course) the complex nuances of financial management requirements. However, beyond the need for compliance, these laws and regulations are ultimately a force for good, allowing companies to compete fairly, reducing tax compliance requirements and reducing the risk of money laundering. All help to ensure financial stability, which is essential to the success of FinTech.

Financial Regulation In Emerging Markets And The Rise Of Fintech Companies

If you need help or want to learn more about building a Neobankor payment processing system, get in touch today.

Featured articles: Neobanks: Disrupting the Cashless Banking Landscape: Top 10 Digital Wallets in 2025 Top 15 Real Estate Tech Trends in 2025 IT Industry Structure: Everything You Need to Know [ 2025 Guide]

Austin 1108 Lavaga Street, STE 110-750, Austin, TX 78701, USA Stockholm Conventum, Katarinavegan 15, 116 45 Stockholm, Sweden Warsaw Ul. Adama Branickiego 21/U3, Warsaw 02-972, Poland Kyiv BC Y4, Yaroslavs’kyi Lane 4, Kyiv 04071, Ukraine. Issuing and issuing over 100 million cards is the banking service of choice for those who break the infrastructure. Software platforms and emerging companies.

This guide is intended to provide a basic overview of compliance for fintechs in the United States and should not be construed as legal advice. Additionally, compliance and regulations are constantly evolving, so this guide does not provide a complete overview. Consult legal and compliance experts when evaluating and developing a fintech compliance program.

What Is Financial Technology (fintech)? A Beginner’s Guide For 2023

Startups that offer financial services such as business charge cards, cash accounts, and access to credit are subject to lengthy and complex regulatory requirements necessary to protect the startup’s business, customers, and the U.S. financial system.

Compliance covers all aspects of a financial product, from marketing to onboarding to closing an account. For example, your marketing materials should clearly state all the terms of the financial product in advance (such as fees, interest, payment terms and other details). When onboarding users, you must thoroughly conduct Know Your Customer (KYC) and sanctions checks, and comply with all applicable credit laws when extending credit. Users may also be required to comply with certain debt collection requirements that limit the frequency and timing of communication of collection notices if they are in violation. It covers only part of the compliance rules you must follow.

The chart below is for illustrative purposes only and should not be taken as a comprehensive list of fintech compliance requirements.

It is very important to follow the various fintech setup rules: not doing it right can expose you to huge fines that can damage your business. In the worst case scenario, your business may be shut down.

Fintech Laws And Regulations Report 2024

However, ensuring compliance is not just about avoiding fees or legal consequences. Investing in compliance means your business can create safer, longer-lasting products for users, ensuring cash flow and product financing that gives your business a long-term competitive advantage. Ultimately, you act in the user’s best interest, helping them find a safe, stable and effective product.

This guide provides an overview of how financial services are regulated in the United States and what this means for your business. You will learn the basics of compliance, review the most common compliance laws, and understand compliance management options for your business.

A common way to offer financial products in the US is to work with a bank to power your product. Each banking partner is regulated by a central regulator (and other regulatory bodies) who periodically review the bank’s compliance. For example, a bank may (among other things) assess compliance with state and federal laws governing unfair and deceptive practices and practices (UDAP), which require open, transparent communication with customers.

Any fintech company working with a bank will be indirectly accountable to these same regulators