New Car Insurance Price India – Dealer Name – DRITI MOTORS Used Maruti Swift Dzire VdiModel -2012 Price -2,95,000 km – 59,000 Dealer Address – Hatigaon Puberun…

Dealer Name -DRITI MOTORSUV Used Hyundai Creta SX Model -2023 Price -1,45,0000 km – 41,000 Dealer Address – Hatigaon Puberun PathGuwahati

New Car Insurance Price India

Dealer Name – DRITI MOTORS Used – Wagonr LXI for Sale in Guwahati Dealer Number – 8811098816 Model – 2009 Price – 1,95,000…

Vehicle Insurance: Digital First, Digital Only Or Dealer Exclusive?

Dealer Name – DRITI MOTORSed – Wagonr LXI in Guwahati Dealer Number – 8811098816 Model – 2008 Price – 1,75,000 km – 73,000 Dealer…

Dealer Name – DRITI MOTORSed – Chevrolet Beat LS in Guwahati Dealer Number – 8811098816 Model – 2014 Price – 1,65,000 km – 68,000…

Dealer Name – DRITI MOTORSed – Alto K10 LXI in Guwahati Dealer Number – 8811098816 Model – 2011 Price – 1,85,000 km – 35,000…

Dealer Name – DRITI MOTORSed – Wagonr VXI Dealer Phone Number – 88110988816 Model – 2020 Price – 5,50,000 km – 37,000 Dealer Address –…

Society Of Indian Automobile Manufactures

Dealer Name – DRITI MOTORS Dealer Phone – 8811098816 Used – Maruti Wagon R VxiModel -2016 Price -3.85,000 km – 36,000 Dealer Address –…

Dealer Name – DRITI MOTORSD Dealer Phone – 8811098816 Used Marui S-presso Vxi Model – 2021 Price – 4,65,000 Km-1, 800 Dealer…

Dealer Name – DRITI MOTORSed – Alto 800 LXIModel – 2015 Price – 2,65,000 KM – 38,000 Dealer Phone Number – 8811098816 Dealer Address – Hatigaon… This is the first time MoRTH has communicated with the insurance company and insurance company Development Consultation Authority of India (IRDAI).

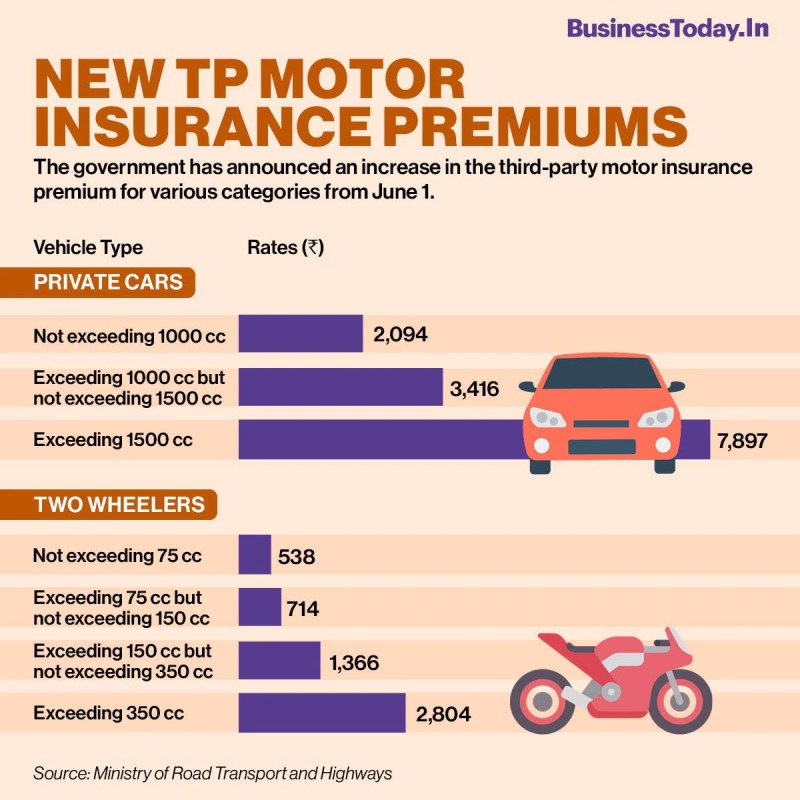

The government announced that it will increase road insurance premiums from June 1. The revised tariff is expected to increase insurance premiums on cars and two-wheelers. This is the first time MoRTH has published third-party rates in consultation with the Insurance Regulatory and Development Authority of India (IRDAI).

Loss Of Personal Belongings Add-on Cover In Car Insurance Policy

According to the Ministry of Road Transport and Highways (MoRTH), private cars with an engine displacement of 1,000 cc will be charged Rs 2,094 as compared to Rs 2,072 in 2019-20 when the rates were last revised. Prices remain unchanged due to the covid-19 pandemic.

Prices of private cars with engines between 1,000 and 1,500 cc will increase from Rs 3,221 to Rs 3,416. But for cars above 1,500 cc, the premium comes down to Rs 7,890 from Rs 7,897.

Two-wheeler owners will also have to pay a premium of Rs 1,366 for bikes of 150 cc but not more than 350 cc and Rs 2,804 for bikes above 350 cc.

The ministry said there will be a 7.5 per cent discount on premiums for hybrid electric vehicles. Private electric vehicles with a maximum power of 30 kW will pay a premium of Rs 1,780, while those with a power of more than 30 kW but not more than 65 kW will pay a premium of Rs 2,904.

Best Crossover Cars In India And Their Insurance Cost

This coverage applies to all incidental damages caused to third parties (usually individuals) as a result of a traffic accident. Liability insurance is mandatory, as is your own damage insurance.

15% discount on buses for educational institutions. The ministry also provides a 50% premium discount for private cars registered as vintage cars. Like your sturdy umbrella, car insurance is foolproof insurance that protects you from a sudden downpour. Since you don’t take an umbrella with you when it rains, car insurance is a must when traveling on India’s unsafe roads. It protects you from the financial shock of accidents, theft, and other unforeseen events that can leave you with high bills.

It’s important to purchase car insurance, and it’s also important to pay your annual premiums on time to maintain your coverage.

Another important element in the “Protect Your Car” journey is understanding the annual cost of car insurance for better financial management. This can help you evaluate whether the coverage fits your budget needs. However, there are several factors that determine the cost of car insurance, and this article will help you analyze all the factors related to them.

Insurance For Electric Vehicles (evs): What All To Consider Before Buying Specific Covers; Check Details Here

Long-term care insurance protects your car from any type of loss or damage caused by traffic accidents, theft, natural disasters, and other negative events. This is not only a prudent decision but also a mandatory requirement for every vehicle plying on Indian roads.

One of the reasons for the introduction of car insurance is to provide financial security to car owners so that they can easily meet their legal obligations.

Whether it’s a minor collision or a serious accident, with car insurance, you’re fully covered when you need it, allowing you to better manage your financial consequences.

The average car insurance premium in India ranges from Rs 10,000 to Rs 20,000 per annum or even more. However, to get an accurate idea of the cost, it is necessary to obtain individual quotes from insurance companies, taking into account variables such as vehicle type, age, location, and more.

Analysis: China’s Ev Market Reshaped By A Brutal Elimination Round

How to find the financial security that best suits your needs. You can do this by comparing quotes from different insurance companies.

Note: Premium is applicable for comprehensive coverage on TATA TIAGO XT Rhythm (new car) models subject to the following conditions:

There are many factors that determine how much it will cost to insure your vehicle in India. Knowing these will help you make an informed decision when purchasing a policy. Here are some factors that determine the cost of car insurance in India:

Disclaimer – Please note that if you select the optional excess, you must pay the optional excess out of pocket each time you make a claim.

How To Calculate Motor Insurance Premium Online

The average car insurance premium ranges between INR 10,000 to INR 20,000 per year. Again, the cost depends on many factors: including insurance coverage, the car’s value, make and model. You can only get the best quote when you get individual quotes from your insurance company. This way you can protect your vehicle without spending a lot of money. By comparing your options and considering the points above, you can make sure you’re adequately covered for whatever the road throws at you.