Top Fintech Apps In Usa – By clicking Continue to sign in or log in, you agree to the User Agreement, Privacy Policy and Cookie Policy.

When choosing a FinTech software development company in the US, there are many things to consider to make sure you are working with the right team for your project. Experience in the FinTech industry, stable portfolio, innovative approach, sound evaluation and cost-effectiveness are the main criteria for consideration.

Top Fintech Apps In Usa

In this digital age, FinTech (financial technology) plays a major role in changing the way we manage our money. From mobile banking to online investments, FinTech software has revolutionized the financial industry by providing convenience, comfort and innovative solutions.

7 Best Mobile Banking Apps In The Usa

Behind these cutting-edge applications are FinTech software development companies that are developing technology that plays a major role in the financial world.

Mobulous is a leading US-based FinTech development company with a strong focus on FinTech solutions. With years of experience in the industry, Mobulous specializes in creating innovative mobile applications for the financial sector.

Mobulous is dedicated to helping financial institutions and startups use technology to streamline processes, improve user experience and stay ahead in a competitive market.

FinTech Software Improves Experience User Friendly Interface Good Design Payment Gateway Integration Real Time Analytics & Reporting Features Tailored to Customer Needs

10 Best Digital Wallets In 2025 You Need To Know

Mobile Banking Development Payment Gateway Integration Personal Finance Investment Management and Trading Cryptocurrency Wallet Development

Appian is one of the leading FinTech software development companies in the US and a global leader in low-code software that helps businesses quickly build and deploy powerful applications.

With a wide range of tools and comprehensive services, Appian helps organizations in the FinTech sector accelerate their digital transformation and drive innovation.

Their low-code integration enables seamless integration with existing systems, making them ideal for developing powerful FinTech applications that meet the needs of customers and businesses.

Top Banking App Development Companies And Services

Small-scale platform for fast operation Fast development Software and existing systems Scalable and scalable First-class security solutions for compliance

Coding FinTech Software Development Automation Solutions Regulatory Compliance Software Incident Management Platforms Customer Relationship Management (CRM) Systems

Raizlabs, America’s leading FinTech development company, is a leading innovator and marketer of FinTech software development products.

With a focus on user-friendly design and cutting-edge technology, Raizlabs helps FinTech startups and industries build mobile apps that better reflect how people manage their money.

Top 10 Regtech Companies: Fintech Magazine’s Insights

From secure banking to online investments, Raizlabs combines design, development and FinTech expertise to deliver solutions that drive growth and increase user engagement.

FinTech Design and Development of Peer-to-Peer Lenders Wealth Management Software Budgeting and Leveraging Credit Tracking Tools Sources and Operating Software

Fueled is a highly respected FinTech research and development company based in the US and known for its expertise in developing FinTech applications.

With a diverse portfolio of successful projects, Fueled combines creativity, technical expertise and industry knowledge to deliver unique mobile experiences.

Top 10 Sustainable Finance Companies

From digital wallets to e-commerce, Fueled works closely with clients to understand their unique requirements and deliver customized solutions that exceed expectations.

FinTech Software Development Designed for Multi-Device Blockchain and Cryptocurrency Integration AI-Based Human Features Comprehensive Testing and QA Process

Custom FinTech Software Development Digital Accounting & Payment Solutions Business & Investment Software Marketplace Crowdfunding Platforms Blockchain & Cryptocurrency Apps

Thoughtbot is a trusted partner for FinTech software development companies looking for innovative FinTech solutions in the US. With a focus on rapid development and continuous delivery, Thoughtbot helps startups and industries bring their ideas to life quickly and efficiently.

Top 13 Fintech Trends For Business Leaders To Trace In 2024

Their team of experienced engineers and developers specializes in building scalable and secure FinTech applications that improve business and value users.

Methodology used in development User experience in research and design Security of flow and storage Large scale architecture for future growth Continuous delivery and return.

Agile FinTech Product Development Phone First Banking Software Financial Planning & Advisory Tools AI Powered Financial Assistants Compliance & Security

Appster is the leading technology partner for FinTech industry-leading software development companies and competitive mobile applications in the US.

Discover 20 Fintech Startups To Watch (2025)

With a proven track record of delivering successful projects, Appster combines technical expertise, strategic thinking and a customer-centric approach to develop successful FinTech operations.

Whether it’s payment solutions, peer-to-peer lending platforms or financial management tools, Appster has the expertise and ability to transform ideas into reality and drive digital transformation in the financial sector.

Disruptive FinTech Software Development Rapid Prototyping and MVP Development Independent Regulatory Compliance Strong Results Behind the scenes Dedicated Project Management and Support Team

FinTech Startup Incubation & Acceleration Mobile Payments Solutions Robo-Advisory Forums Supply Chain & Software Real-Time Data Analytics

Fintech Software & Mobile App Development Company In Usa

The development of FinTech applications in the US is dynamic and dynamic, with many leading companies offering innovative solutions to solve various financial problems.

Considering factors like experience, portfolio, reviews and prices, you can choose the best FinTech software development company to bring your ideas to life and stay ahead in the competitive market.

FinTech app development refers to the process of creating mobile apps that provide financial services such as banking, investment and payment solutions. This is very important because it adds convenience, comfort and security to financial management.

Key features include secure authentication, real-time authentication, seamless internet access, multi-channel connectivity, seamless data integration and integration with financial institutions’ APIs.

Top 7 Fintech Trends For 2025 And Beyond

Schedules vary depending on factors such as complexity, site compatibility, regulatory compliance, and team performance. It can usually last a few months to a year.

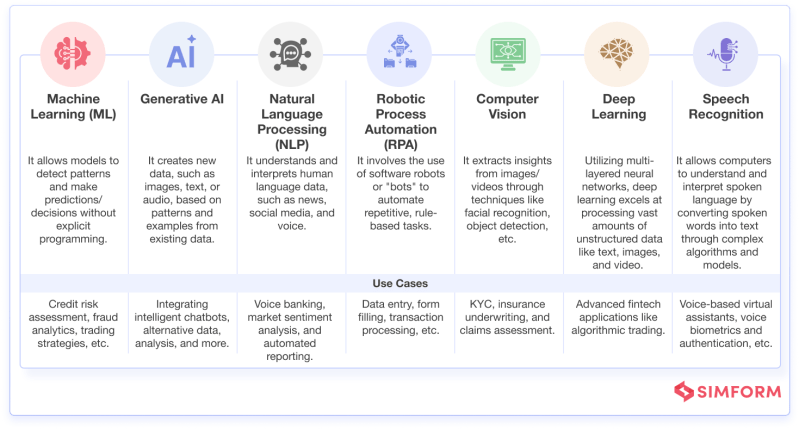

Common technologies include security and transparency, artificial intelligence and machine learning for personalized financial insights, APIs to connect with financial institutions, and cloud computing for scalability and flexibility.

FinTech software can protect security through robust algorithms, security authentication methods such as biometrics, regular security checks and compliance with regulations such as GDPR, PCI DSS and PSD2.

Challenges include cyber security threats, compliance challenges, integration with legacy systems, user authentication and acceptance, and keeping pace with the rapidly evolving technology and market.

Top 5 Current Fintech Trends [2022

The price depends on factors such as the complexity of the application, the features, the site(s), the size of the development team, and additional services such as maintenance and support. Typically, FinTech software development costs can range from tens of thousands of dollars to millions of dollars.

Examples include PayPal for online payments, Robinhood for stock trading, Venmo for peer-to-peer payments, Baby for micro-investing, and Mint for personal finance management.

Focus on delivering unique content, providing a strong user experience, prioritizing security and privacy, leveraging data analytics for personalized services, and building strong partnerships with financial institutions.

Future trends include the adoption of decentralized finance (DeFi), the expansion of artificial intelligence and machine learning, a renewed focus on cyber security, the convergence of voice and evidence-based solutions, and the rise of embedded finance. Non-financial goods and services are on the rise. The rise of fintech solutions has revolutionized personal financial management in recent years. Bolstered by the ubiquity of mobile phones and increasing customer demand for convenience through technology, a new line of easy-to-use apps has disrupted traditional banking.

How To Build A Fintech App In 2024: Step-by-step Guide

According to Accenture’s 2024 survey, nearly 60 percent of U.S. consumers use fintech services, up from just over 45 percent in 2022. These apps facilitate critical tasks such as payments, loans, investments, and more. ‘ budget for all equipment.

According to KPMG, global investment continues to accelerate fintech innovation, with funding increasing by 30 percent annually to reach more than 170 billion in 2023. This financial movement will promote continuous growth in response to the changing user experience, especially through the mobile experience.

As consumers and entrepreneurs continue to embrace digital transformation, fintech applications will provide more opportunities to transform in the era of 6G/WiFi7 broadband, AI connectivity, and real-time insights. Identifying the best solutions that empower people in the financial sector can help you stay ahead of this disruptive trend.

This article analyzes the top 15 fintech apps to look out for in 2025 based on popularity, ratings, and breadth of services offered. They argue that the future of personal finance has never been more unified, individualized or developed for convenience.

83 Fintech Statistics You Need To Know For 2024

Fintech software is changing the way we manage our money. These apps offer a variety of features that help you budget, save, invest and borrow. With so many fintech programs available, choosing the right one can be overwhelming.

In this article, we look at the 15 best fintech apps you should check out in 2024.

Fintech software is financial technology software designed to make money more efficient. They can offer a variety of products including budgeting tools, savings accounts, investment accounts, payment methods and credit facilities.

Fintech apps can be used on smartphones or tablets and are available for iOS and Android devices.

Best 6 Challenges That Fintech Startups Will Face & Efficient Solutions To Overcome

When choosing a fintech program, it is important to consider your financial goals and what is most important to you. For example, if you want to save money, you can choose a high-interest savings account or a program that offers automatic savings.

If you are interested in investing, you need an app that offers great investment opportunities with minimal investment. It is also important to consider the security features of the program and whether it is FDIC insured.

Are you looking for the best fintech software to help you control your finances? Look no further! This list includes the best fintech apps