Top Fintech Startups In Usa – The United States has 105 Fintech unicorns, making it the world leader in this field. The US has managed to get the highest position for Fintech unicorns and has not lost the leader of China, which is a great achievement in the fintech field. The continued growth of the number of fintech unicorns in North America is due to the sector’s large funding in the region. in 2021 The number of capital transactions jumped forward in 2021. in the second quarter compared to the number of transactions that fell in Asia and Europe.

Looking at the sector at a micro level, we can see that the first Fintech unicorns in the US ecosystem mostly come from small sectors such as Wealthtech, Payments and Challenger Banks, while Local demand for digital financial services has grown, with nearly 1 in 10 Americans now using some form of fintech app to manage their financial lives, according to Fortune.

Top Fintech Startups In Usa

The US Fintech ecosystem took a big hit in the first half of the year. In the first 6 months of 2021 In the last few months, the volume of investment transactions has already reached 117% compared to the first half of 2020. The $3.4 billion fund raised by Robinhood was promoted , $600 million raised by Stripe, and $500 million raised by Better, ServiceTitan and DailyPay.

6 Steps To Starting A Fintech Company In 2024 (+real Examples)

But that doesn’t mean 2020 isn’t a year for big investments. According to the KPMG report 2021 – 2020 78.9 billion has been invested. About 80 times over 11 years.

Investors in the U.S. are concerned that the Big Budget is ripe for a technological revolution, a view that continues to attract venture capital to key sectors such as finance, property technology and crypto currency.

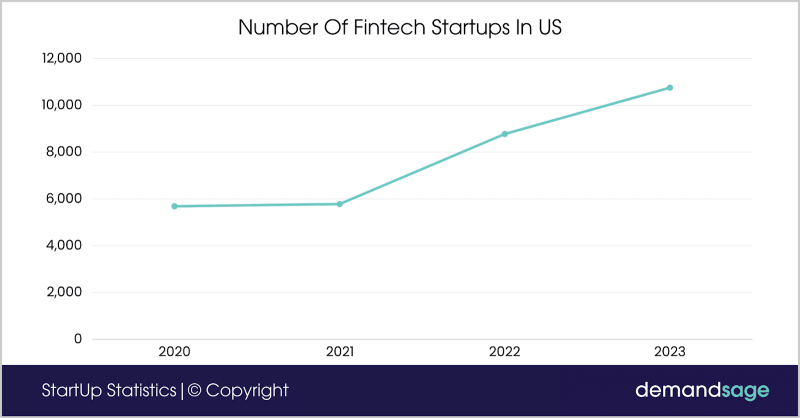

Fintech is a big industry in the US. The sector has grown faster than other countries. in 2021 in November There are 10,755 fintech startups in the United States, operating in 2021 according to Statista. according to research, this is the region with the most startups in the world.

Of these, only about 1% of the 10,755 fintechs are unicorns valued at $1 billion. USD or more. While this may seem like a drop in the ocean, the 105 US unicorns represent nearly 45% of the world’s fintech unicorns. China trails the US with 13 fintech unicorns, just a tenth of what the US has.

Top 200 Fintech Companies Revolutionizing The World Of Finance

So what drives innovation and startup growth? It’s an important step in the process! In the US, federal and state regulators are “innovating new technologies,” and regulatory sandboxes and pilot programs are key to the growth of financial services.

The US market is also seeing a wave of consumers jumping on the Fintech bandwagon and leading the country towards a trend of mass adoption. The percentage of US consumers using Fintech in 2021, according to Fortune increased to 88 percent, compared to only 58 percent. in 2020 In the Plaid election. Growing demand is a good business environment for US fintech companies to grow, and you can bet they are.

Wealthtech Technology and Payments, the Paytech industry is the most popular sector in the Fintech billion dollar group, with 38% of unicorns in this sector. Challenger Bank is behind the board of directors – a company owned and operated by the US.

The commodity technology industry has experienced unprecedented growth, driven by a surge in retail investment that continued after the pandemic. An increase in demand has a direct measurable effect on capital investment. According to CBInsights, the sector earned 4.7 billion.

The 50 Hottest Fintech Startups

The rise in enthusiasm for digital payments has been fueled by an epidemic. To put this in concrete terms, consider the 186% jump in PayPal’s cash flow over the past 12 months. In addition, square footage increased by more than 5 percent. The sector has been bolstered by a number of factors, including the rise of e-commerce and the shift away from finance as a way of doing business. first.

It is fair to say that although the growth of these two sectors has been slowed by the pandemic, changing consumer behavior and the demand for new financial services products will continue to increase in the coming years. However, only time will tell how the company will fare and watch closely.

Introduction As the asset management industry continues to embrace AI innovation, there is an increasing focus on effective data management.

Introduction The asset management industry is undergoing major changes due to changing perspectives and changing market conditions. How

Fintech 100: The Most Promising Fintech Startups Of 2023

Introduction The future of artificial intelligence (AI) is very promising as it continues to transform industries with increasing capabilities,

The Center for Finance, Technology and Economics (CFTE) is a global educational institution dedicated to providing financial professionals and organizations with the skills they need to remain competitive in a changing industry. fast. Led by global industry experts, the industry’s leading training programs help talent acquire the skills to join the digital currency revolution. CFTE courses are internationally recognized by ACT, IBF, CPD, SkillsFuture and ABS accreditation.

At CFTE, our program is tailored to each student’s goals to accelerate their careers, to succeed in their next project, or to overcome financial difficulties with their own business. . To help you do this, CFTE provides you with the tools you need to acquire the necessary digital banking skills. From global CEOs to disruptive entrepreneurs, we bring you unique insights from leaders driving financial change. With CFTE, you don’t just learn what’s written in books, you get hands-on experience with real-world applications.

If you’re looking for deeper insights into how the fintech world is changing from the inside, we can help you gain new insights to boost your business. CFTE offers online finance programs on a variety of topics such as finance, artificial intelligence, open banking, platforms, fintech, intrapreneurship and more to help you overcome the fintech landscape. With this experience, you can improve your performance.

Brazil’s Surprising Fintech Tailwind

You’ll learn from talking to industry leaders, experts and entrepreneurs from Fortune 500 companies and Tech Unicorns and more. Each person will present their knowledge and experience in the field of digital banking. Whether you’re starting a new journey or your career path is solid, these coaches and visiting experts will show you how from established companies like Starling Bank, Wells Fargo, and big names technology like Google, IBM, successful startups like Kabbage or “Plaid” in between. many more! Advances in data analytics, artificial intelligence, blockchain and mobile technology have given top fintech companies a powerful toolkit to innovate and disrupt traditional financial systems. These companies are not only adapting to change; they followed.

At a time when there is no end to technological progress, the financial sector is undergoing significant changes, and the Fintech 200 companies are leading this change and changing our relationship with money.

CNBC, in partnership with Statista, presents the top 200 fintech companies in the world for 2023. list. The 200 companies that have been carefully selected are examples of financial technologies that are changing the way people, companies and institutions approach financial services.

, the only Spanish company selected among the top 25 capital companies, ensures connections between technology startups, investors and companies through its digital platform and a global community of more than 130 countries.

Fintech Landscape In 2020 (with Infographic)

Join our global community and access our digital AI analytics platform to find the perfect partner, investor or B2B customer. You can get investment, request a connection call or connect with the best fintechs, investors and companies with just a click.

In addition to industry leaders such as Ant Group, Tencent, PayPal, Stripe, Klarna and Revolut, this final list also includes a number of up-and-coming startups dedicated to shaping the future of services bag.

Categories include neo finance, digital payment, digital wealth, digital financial planning, digital wealth management, alternative finance, alternative lending, digital financial solutions, digital business solutions- credit.

The Fintech sector is growing rapidly and has become a major focus, especially among investors, as B2B companies offer their services on a larger scale than ever before through platforms that manage relationships between Fintech, banks, insurers, lenders, companies and other startups. . throughout the world.

13 Fintech Startup App Ideas To Consider In 2024

Is proud to announce that it has been included in the official list of 200 fintechs in the world in partnership with Statista and CNBC.

This international award reflects the leadership position established in the fintech industry not only in Spain but worldwide. Statista, the leading statistics and market data base, has partnered with CNBC, the leading economic news network, to conduct an evaluation process to identify and identify the most influential fintech companies.