Us Fintech Investment – Find anything about our product, search our documentation and more. Enter a question in the search box above, and the results will appear as you type.

As a financial partner to technology and healthcare companies and investors over the past four decades, he has provided support and guidance through various economic cycles. Dan Allred, senior marketing director leading the national fintech and payments strategy, shares trends from the recent State of Fintech report and insights into the future of the fintech sector.

Us Fintech Investment

Fintech companies are currently facing uncertainty as federal regulators grapple with the role of technology in financial services and examine potential risks to consumers.

10 African Startups Dominate 75% Of Fintech Equity Africa Funding In 2023

Many federal agencies already have broad mandates to protect consumers from data breaches, unfair lending and fraud, while ensuring that digital platforms comply with money laundering protections and international sanctions. Recently we have seen moves to strengthen fintech oversight, with the creation of the new Office of Financial Technology and the Office of Competition and Innovation at the US Securities and Exchange Commission (SEC) FinHub, the Consumer Financial Protection Bureau (CFPB). Controller of the Currency (CMO).

The CFPB indicated that providers of short-term consumer loans known as buy-now-pay-later (BNPL), which are not required to provide data to credit agencies, are under increased scrutiny. The popularity of BNPL products exploded during the pandemic, from 17 million loans in 2019 to 180 million in 2021 – a 10.6-fold increase, according to the CFPB.

Although regulators are cracking down on the fintech sector, they face the constant challenge of trying to keep up with technological innovation. The CFPB, for one, is drafting new rules under the 2010 Dodd-Frank Act — a set of financial rules passed to help prevent future financial crises — to address privacy concerns raised by BNPL to establish standards for sharing consumer financial data and other consumer payments. skills Meanwhile, the fall of cryptocurrency exchange FTX is likely to accelerate regulatory initiatives in the digital currency space. FTX arrests have led to other crypto bankruptcies, including BlockFi, which had to pay $100 million in SEC fines in February for violating securities laws. The FTX result highlights the complexity of regulating such an interconnected space.

Similarly, investors are closely monitoring the SEC’s lawsuit against payments platform Ripple Labs, which the regulator said sold digital assets as unregistered securities. Based on recent regulatory developments, it is clear that the issue of consumer disclosure will continue to be a recurring theme for regulators. In addition, the OCC indicated that partner banks, which typically provide the core banking products for fintech platforms, may face increased levels of regulatory scrutiny in the near future. Until we have a better idea of the direction of fintech regulation, startups are headed for a murky landscape.

Us Fintech Awards (@usa_fintech) / X

Consumer-oriented fintech offerings are also struggling with shrinking public markets and high interest rates, which are affecting investor interest in equity trading programs and consumer loan products. According to the FinTech Report, the number of deals for consumer loans and personal wealth management companies has halved year over year. The amount of investment in consumer payment companies decreased by 73% from 2021.

Despite the difficult times, consumer fintech companies remain on a strong footing for steady growth during the pandemic and product expansion opportunities. Interest accounts and a possible pivot to commercial products, including BNPL products for businesses, offer potential opportunities during a downturn.

Additionally, consumers are potential M&A targets for fintech banks, which is likely to increase due to the growing number of US fintech unicorns (a trend I will discuss in the next section).

From a business perspective, the outlook is even more promising. Based on our research, alternative lending was the only fintech sub-sector that showed quarterly growth. In addition, the insurtech and merchant payments sectors have been more resilient than their consumer counterparts.

Hong Kong Fintech Week 2024 Opens With Us$2.4 Bn Invested In 60 Startups

With public markets down and the IPO window closing, a backlog of late-stage fintechs is growing. This puts pressure on founders to maintain growth as they look for opportunities to return money to investors.

Dry powder is plentiful, but with valuations falling (earnings multiples for public fintech companies have fallen 55% since the market peaked on January 3), founders are avoiding deals. Many companies are flush with cash from major investments in 2021, but with the downturn, those companies are conserving cash. Based on our proprietary data, more fintech companies reduced net in Q3 2022 than at any time since the start of the Covid-19 pandemic. For example, 43% of fintechs cut payroll in Q3 2022, compared to a 25% decrease in Q3 2022. Overall, we are maintaining growth rates, with 66% of fintechs growing more slowly than in Q2 2022.

As for the growing stable of fintech unicorns – up 38% from Q4 2021 – they are facing the longest IPO drought since 2018-19. The average fintech unicorn is 6.1 years since the first round, up from 5.5 years last year.

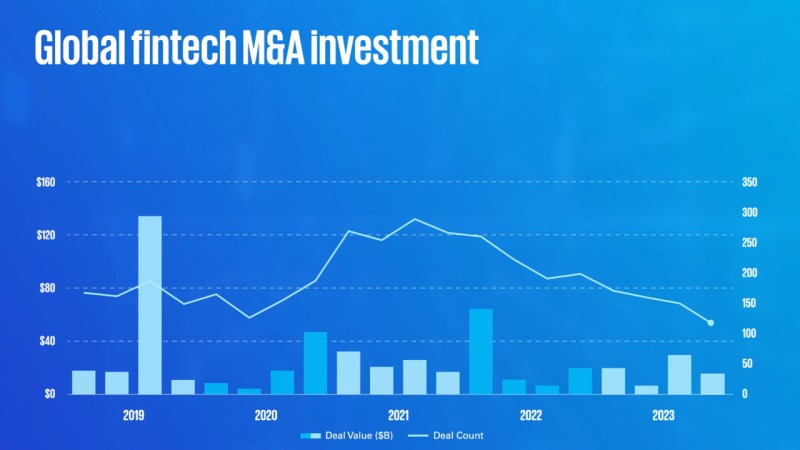

However, with valuations for Series C+ fintechs down 24% from their recent peak and a corresponding retreat from venture capital investors, we are likely to see an increase in M&A activity.

Portage And Taktile Unveil The Top 50 Us Fintechs Revolutionizing Business Finance And Lending In 2023

New research from Silicon Valley Bank looks at investment trends in US consumer Internet companies. Find out about the latest financing, investments and valuations in consumer technology.

Financial Group ( ) is the holding company for all business units and groups. , Financial Group, Silicon Valley Bank, and Chevron Devices are registered trademarks of Financial Group, used under license.

The opinions expressed in this column are solely those of the author and do not necessarily reflect the views of Financial Group, or Silicon Valley Bank, or any of its affiliates. This content, including without limitation the statistical information herein, is provided for informational purposes only. The content is based on information from third-party sources that we believe to be reliable, but which we have not independently verified; And therefore we are not sure that the information is accurate or complete. You should seek relevant and specific professional advice before making any investment or other decision. Silicon Valley Bank is not responsible for any costs, claims or damages related to the use of this material.

All unnamed companies listed in this document are independent third parties, as indicated by the various statistics, opinions, analyzes and insights shared in this document, and are not affiliated with the Financial Group.

Ghani Consulting Investment

Experts provide industry insight, proprietary research and insightful content to our clients. Check out these related articles that may interest you.

You will be directed to a separate website or mobile application that has its own terms of use, visitor agreement, security and privacy policies. EXCEPT FOR NAMED PRODUCTS AND SERVICES, WE ARE NOT RESPONSIBLE FOR (AND DO NOT PROVIDE) ANY PRODUCTS, SERVICES OR CONTENT ON ANY THIRD-PARTY WEBSITE OR APP. Agreement, Privacy Policy and Cookie Policy.

Fintech has had a tough time lately. Fintech funding has declined significantly over the past two years from its peak in 2021. And, amid a tight capital environment and a difficult macroeconomic outlook, we’ve seen significant layoffs even at some of the best-known firms. PayPal and Block laid off about 3,500 workers between them at the end of January, for example, while Brax laid off 282 workers, 20% of the total. Some fintechs are completely closed.

This has created general anxiety in the industry, and may affect bankers’ perception of fintech opportunities. However, it is important to remember that the issues the fintech industry is currently dealing with are largely cyclical and will likely create a more resilient sector in the process. In fact, there may already be some light at the end of the tunnel: According to CB Insights, global fintech funding rose 13% to $8.5 billion in Q4 2023, from a low of $7.5 billion in Q2.

Fintech Investment In The…

It is too early to say whether a real rebound is on the cards, and the total number of deals is still slightly down, but fintech activity seems to remain vertical and in different parts of the world, against a more alarming background of yes. at least some positive news against.

Metropolis, an American semi-embedded payment company that uses computer vision to initiate payments in cars, has raised $1.05 billion in Series C capital. It is a compelling use case for embedding artificial intelligence (AI) and finance in place in the future. the company’s core solution is to pay for parking. City combined its latest financing with $650 million raised in debt to buy the company that owns Parking.com. With that purchase, it acquired a footprint of more than 400 parking facilities. Tamara is a Saudi Arabian and Shariah-compliant Buy Now Pay Later (BNPL) shopping program operating in the Persian Gulf countries. (It makes money by charging fees to the merchants it partners with.) Tamara took in $340 million in Series C funding in Q4. It is said to be collaborating with Saudi brands such as SACO, Whites and Nice One, and UAE brands such as Namshi and Flowward. investors,