Value Fintech In Usa – Global Fintech Market Size, Share, Trends and Growth Forecast, Technology, Service (Payments, Exchange, Personal Finance, Credit, Insurance and Wealth Management), Application (Banking, Insurance and Security ), delivery channel (cloud and beyond). ) and Regional Analysis, (2024 to 2032)

The global fintech market is expected to reach USD 1,264.6 billion by 2032, from USD 167.55 billion in 2023, growing at a CAGR of 25.18% during the forecast period. This growth is driven by the rise of business and consumer fintech solutions and consumer preference for mobile banking and the widespread use of digital technologies in the financial sector. The emergence of the COVID-19 pandemic has also increased the use of digital financial services, as more consumers can use payment methods and remote banking methods to reduce the impact of the virus. In 2023, North America is expected to hold 34.3% of the total market share.

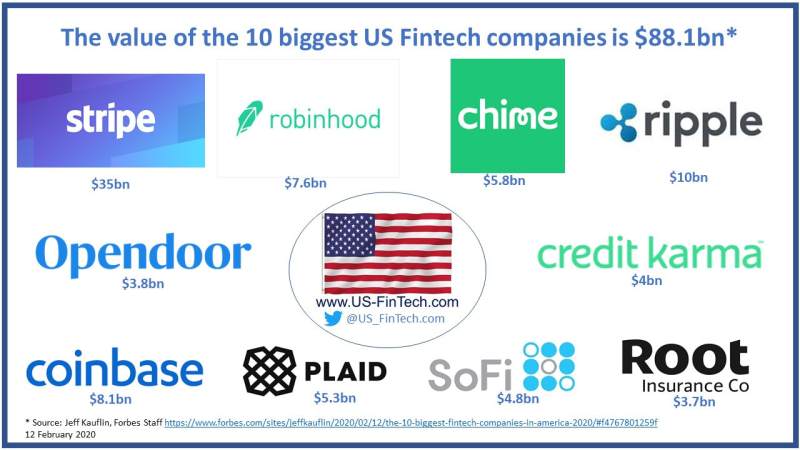

Value Fintech In Usa

:max_bytes(150000):strip_icc()/GettyImages-2003405527-216928ad0442488e8725ee4d0c326c79.jpg?strip=all)

Fintech encompasses a variety of services, including mobile banking, insurance, cryptocurrency, and financial services that combine finance and technology. From start-ups to established enterprises, they follow innovations in the finance and banking sector to enable the development of flexible services. The implementation of digital financial solutions enables financial service providers and technologies to work together, creating disruptive technologies that meet consumer demands. The penetration of e-commerce platforms is driving the growth of the fintech market. Global e-commerce is estimated at $5.8 trillion in 2023 and is expected to reach $8 trillion by 2027. The increasing number of people using mobile phones, which enable online payments using the Internet, ensures a seamless and efficient experience. It is expected to set new standards in the fintech industry in the coming years.

10+ Top Fintech Software Development Companies [2024]

The continuous growth of the banking sector under the influence of the latest technologies and the increasing popularity of these services among consumers are expected to bring opportunities to the fintech market. The development of fintech is related to the combination of AI, blockchain, cloud computing and IoT, which enables faster, safer and more efficient financial transactions. Redefining financial services is one of the main ways that businesses and consumers can use digital money solutions in various industries such as payments, banking and financial management.

Financial services are changing dramatically with artificial intelligence in line with consumer demand for personalization. New innovations such as artificial intelligence-based chatbots, fraud detection systems, and robo-advisors are becoming increasingly popular. For example, Erica, A.I. Chat at Bank of America engages millions of customers every day by reducing the human tasks of customer service and empowering them to focus on important tasks. Leading companies like Zest Finance have also contributed to the use of A.I. tools to improve access to credit, improve financial services for the underprivileged, and more.

Blockchain technology plays an important role in increasing security and transparency in financial transactions, with applications ranging from smart contracts to cross-border payments. Ripple, one of the blockchain payment networks, has completely reduced the cost and time of cross-border transactions, making it more compatible with traditional methods. Implementation of blockchain technology aims to reduce risk and increase operational efficiency in real time.

Many fintech companies are focusing on computerization for efficient data processing and storage. Due to the large number of customers using the Internet, managing large amounts of data is possible with cloud computing solutions that allow companies to launch digital services without investing large amounts of money. Royal Bank of Canada has already adopted cloud-based infrastructure to improve service delivery and operational efficiency.

Pulse Of Fintech

The Internet of Things (IoT) enables real-time data collection and analysis using physical devices. A physical device connected to the Internet can collect data stored in the cloud from anywhere. A strong internet connection enables convenient payment terminals such as smart ATMs and increases convenience and speed. This technology also has the ability to launch personalized services based on the history of past transactions that support the customer perfectly.

The adoption trend of digital financial services is one of the most important factors for the growth of the fintech market during the forecast period. With the shift to online banking, digital payments and investment platforms, the need for fintech services has declined and new banking services are expected to drive market growth. According to recent data, the number of digital banking users in the United States is expected to grow from 196.8 million in 2021 to 216.8 million by 2025. Mobile wallets and digital payment methods have become important financial tools in areas where traditional banking is lacking. Less.

Advances in technology, including AI, blockchain and cloud computing, are transforming the financial industry. These advances enable fintech companies to provide efficient, secure and innovative solutions against traditional banking methods. AI is used to improve customer experience, detect fraud and manage risk. For example, Bank of America’s AI-powered chatbots like Erica have interacted with more than 100 million people, proving useful in managing customer inquiries. Known for its security and transparency, blockchain technology is expected to grow significantly, from $7.18 billion in 2022 to $163.83 billion by 2029. This technology not only improves financial performance, but also opens up new opportunities for creating financial products.

Fintech bridges this gap by providing access to financial services to the unbanked and underbanked. Around 1.4 billion adults worldwide are unbanked, mostly in developing countries. More than 40 million users already use M-pesa in Kenya. Similarly, Tala and Kiva provide microloans to companies that do not have access to modern banks. Economic growth in developed and developing countries is associated with rapid implementation of monetary policy.

10 Biggest Us Fintech Companies Worth $88.1bn

Many fintech companies pose serious barriers to market growth. Laws and regulations such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the US help companies manage data protection requirements. The rise of digital loans and cryptocurrencies with regulatory loopholes has led to the closure of several fintech platforms in China and India. These countries have already imposed strict regulations on digital lending, creating significant challenges for fintech companies to stimulate market growth. In 2021, China banned the sale of cryptocurrency and prevented innovation in the economy, which could also harm the growth of the market.

Fintech companies use large amounts of financial data, which makes them attractive to cybercriminals. Cybersecurity issues, including data breaches and identity theft, can seriously impact consumer confidence and limit fintech adoption. To maintain consumer trust, fintech companies must invest heavily in cybersecurity, which is expensive and difficult to achieve.

Cybercriminals focus on financial data, which is the target of fintech companies. It is very important for these companies to take data security from cybercriminals seriously. Data breaches and identity theft at companies can undermine customer loyalty to fintech adoption. An Accenture report found that between 2014 and 2019, the average cost of cybercrime in the financial industry increased by 40 percent. The 2017 Equifax data breach represents a high-profile incident that exposed the data of 147 million people. financial insecurity. Because of this, investing in cybersecurity costs a lot of money, making it difficult for companies to invest so much that they can trust consumers to slow the growth of the fintech market.

There are many companies that use old systems and it is very difficult to integrate new technologies with old or outdated methods. Reluctance of small or medium enterprises to adopt new technologies due to complexity and integration processes is limiting the market growth. According to a 2020 study by Cornerstone Advisors, 70% of community banks and credit unions in the United States still rely on traditional banks. Hence, the risk of rising traditional systems disrupting the existing systems may also hamper the growth of the market.

Revolut’s Instant Card Transfers: A ‘visa’-ble Game-changer For Businesses

Emerging markets offer huge growth opportunities for fintech companies due to the increasing number of unbanked and unbanked people. For example, in sub-Saharan Africa, approximately 66 percent of adults do not have access to a bank. Fintech solutions such as mobile money and microloans fill this gap. Platforms such as M-Pesa in Kenya and Paga in Nigeria are revolutionizing financial access by providing easy and affordable digital money. The fintech market in Africa is expected to reach $30 billion by 2025, driven by growth in digital connectivity and support services. Growth in these industries can drive financial inclusion and create ample opportunities for fintech companies.

Further expansion of cooperation between fintech companies and financial institutions is an important opportunity for the growth of the fintech market in the coming years. The relationship between these companies is growing stronger