What Is A Fintech Bank – Grow your career with 20% off certified certifications and learning programs with coupon BCHAIN101

There have been many promising developments in the field of financial services recently. Digital banking, cryptocurrencies and most importantly digital lending have changed the traditional concept of fintech. Although specific examples and types of fintech show the potential of financial technology, it is important to know its uses and examples. The combination of finance and technology has become a popular general term with many meanings.

What Is A Fintech Bank

However, it highlights the growth of a new industry that relies on technology to improve traditional financial services experiences. However, the general perception of fintech refers to blockchain and algorithmic trading. On the other hand, everyday use can also be found in the field of fintech. For example, mobile banking or online loan applications are popular examples of fintech that we use in our daily lives.

The Bank-v.-fintech Battle For Payments Moves Into B2b

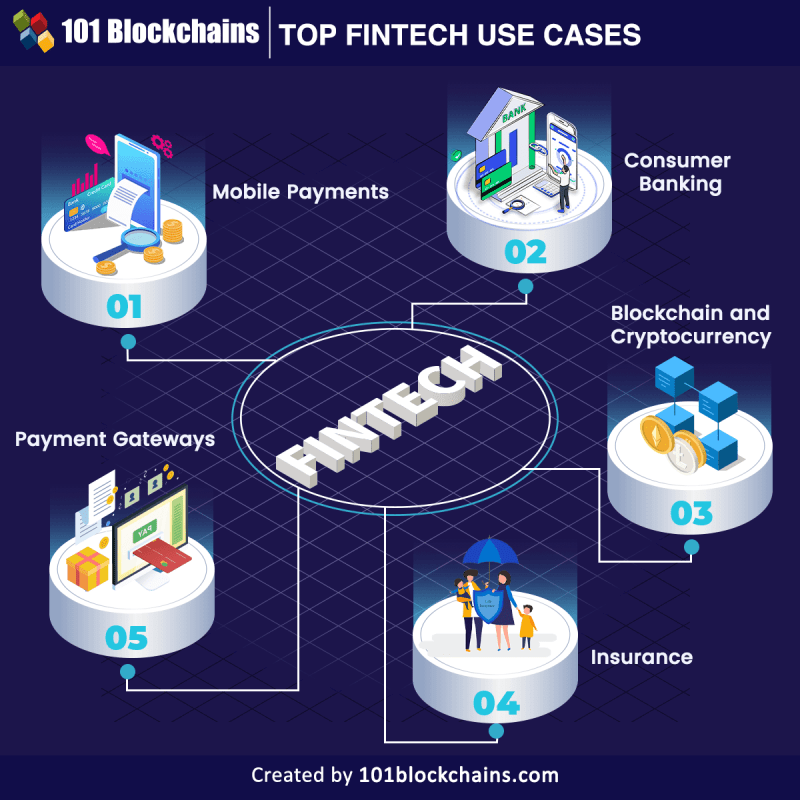

What other fintech models should you know about? A deep understanding of fintech use cases can help you understand the potential of fintech and how it can help you. The following post shows some popular applications and practical examples of fintech.

Do you enjoy exploring the impact of technology on financial services? Register for the Certified Fintech Professional (CFTE)™ course now! A brief overview of Fintech

Before considering popular fintech examples, it is important to develop a basic understanding of fintech. The simplest definition of fintech describes it as any technology that helps businesses and consumers have better experiences with financial services. It refers to any organization or service that facilitates banking and financial services using software programs or other technology. Fintech begins with the advent of early credit cards and ATMs. Since then, fintech has gradually had a disruptive impact on various aspects of the financial services world.

Once upon a time, fintech referred only to the back-office operations of financial institutions such as public limited companies and banks. The advent of the Internet and the growth of mobile computing have encouraged the adoption of new fintech models in banking. Consumers and businesses can now rely on an ever-increasing array of advanced technology tools to support personal and business finances. How does fintech fit into the future of financial services? The answer is clear in the need to create a cashless society based on the astonishing growth of technology’s impact on the financial world.

Witness The Impact Of Fintech On Banking & Financial Sector

Fintech-based goals can provide a reliable picture of the gradual integration of financial services and digital technologies. Fintech enables the efficient and automated delivery of financial services to businesses and consumers. Most importantly, fintech examples show how it forces companies to offer financial services and innovative solutions.

What does fintech aim to achieve? The main purpose of fintech is to help various companies and consumers manage financial transactions efficiently. Financial transactions are now not limited to laptops and desktops as fintech enables consumers to access the financial services they want from their smartphones.

The huge growth in fintech funding every year has proven that fintech is becoming more powerful and better able to achieve your goals. Fintech-enabled tools have enabled many potential improvements in monitoring, managing and accessing financial services. In fact, nearly 64% of US millennials have at least one comprehensive banking app on their phone along with multiple financial services. Is fintech relevant to different consumers of financial services?

Communicating the benefits of fintech to different types of consumers will undoubtedly promote fintech adoption. The impact of fintech can be seen in how it has disrupted traditional banking and financial services. Many fintech use cases have emerged as significant threats to traditional brick-and-mortar financial services institutions. To date, millions of consumers have relied on fintech in one form or another, usually via smartphones and mobile devices.

How Technology Solves Threats To Banking

Most importantly, fintech has also developed as a viable solution to the problems of access to banking and financial services. For all we know, fintech can open the door to financial services for the world’s nearly 2 billion unbanked people. Fintech examples will help you understand how it can improve access to financial services without relying on traditional banks and other financial institutions. Here are some notable fintech applications with relevant examples for each use case.

The most viewed answers to the question “What are fintech models?” The possibility of mobile payment transactions is being considered. More than 5.11 billion mobile phone users worldwide can enter the mobile payment market using fintech innovations. Experts predict that the mobile payments market could grow to more than $4.3 trillion by 2023.

At the same time, the integration of financial services and mobile computing has been a remarkable phenomenon. Fintech companies are constantly working on new ways to provide access to their services regardless of location. Some of the notable fintech developments fueling the growth of mobile payments include digital authentication, NFC and mobile wallet technology. Mobile payments can help pave the way for a cashless society.

Fintech examples in the mobile payment category can further illuminate practical applications. Among fintech mobile payment apps, you can define Apple Pay and Venmo. Venmo is one of the most popular mobile payment apps, with over 65 million users using it every day. Interestingly, Venmo recorded nearly $12 billion worth of transactions in 2018.

What Is A Virtual Bank?

Apple Pay is also an innovative example of mobile payment software in fintech. It is a digital wallet that supports both electronic payments and non-Apple Pay terminals for making payments. Another popular example of fintech mobile payments is Revel Systems, which installs retail POS systems for restaurants, grocery stores and other businesses.

Consumer banking or private banking use cases demonstrate the use of fintech models in profitable banking. Banking services are out of reach for billions of people around the world. Approximately 2 billion people worldwide do not have access to a mobile payment service or a bank account for various reasons.

Traditional banks operate in a way that excludes certain social groups from banking and financial services. For example, bank transaction fees and identity verification requirements can make it difficult for everyone to access banking services.

With fintech, customers can find alternative consumer banking products and solutions aimed at solving access problems. Fintech systems or consumer banking solutions can help improve access to and affordability of financial services.

Fintech Reshaping Traditional Banking Landscape: Embracing Innovation Amidst Community Focus

Mobile banking, digital banking and overall fintech models are bringing new steps to consumer banking. Some popular examples of fintech in consumer banking are Moven, Green Dot and Netspend. Green Dot is one of the most popular banking programs, trusted by millions as a retail deposit network.

Moven is a fintech platform that offers flexible and smart banking services that can reduce customer acquisition costs, generate new revenue streams and improve customer retention. NetSpend is another example of fintech in banking, promoting security, convenience and financial freedom.

You may also be interested in Central Bank Digital Currencies. Register for the Central Bank Digital Currency (CBDC) Masterclass today.

Fintech examples cannot be complete without mentioning blockchain and cryptocurrency. Blockchain meets the definition of fintech in its ability to transform traditional ways of providing financial services. Blockchain and cryptocurrencies “What are fintech models?” There are answers. Because they have the ability to initiate major reforms in various industries.

Fintech Banking Vs Traditional Banking: Key Differences

To begin with, blockchain technology uses cryptography to develop cryptocurrencies as a secure and efficient source of cash. As a result, blockchain technology can prove its potential to bring about disruptive changes in a variety of traditional businesses.

Many organizations have used blockchain and cryptocurrencies to achieve significant benefits such as better traceability, security and transparency, as well as faster and cheaper transactions. In addition, blockchain-based smart contracts can also introduce new models of access to financial services.

Fintech examples of blockchain and cryptocurrencies can refer to many platforms and applications such as Bitcoin, Ethereum, Binance, Coinbase and many others. One of the main interesting aspects of blockchain and cryptocurrencies as fintech models is the diversity of solutions. As the best fintech experience, you will find crypto exchanges and different types of crypto assets and defi solutions.

Want to gain a deeper understanding of crypto basics, trading and investment strategies? Become a member and get free access to the cryptobase, trading and investing course.

What Is Fintech? And How Does It Affect The Traditional Banking Industry?

Another popular example of fintech use cases can refer to payment gateways. Electronic payment systems have been operating since before the development of e-commerce. The introduction of online payment gateways helped revolutionize payments on e-commerce platforms.