Top 100 Fintech Companies In Usa – What it does: Sunbit specializes in retail financing solutions for consumers and merchants. Installation plans facilitate organization at the point of purchase, facilitate customers’ ability to purchase products and services, and support sales growth. By removing barriers to traditional financing, Sunbit improves the shopping experience and promotes financial inclusion for consumers across industries.

What they do: Akur8 is an AI-powered booking and booking platform. The company uses proprietary machine learning algorithms to automate and improve the insurance pricing process. It offers models for various aspects of pricing, including risk modeling, cost optimization, and pricing strategies.

Top 100 Fintech Companies In Usa

In September 2024, the startup raised $120 million in Series C funding, and the platform is used by over 250 leading insurance companies and supports 2,400+ users in 40+ countries.

Best Places To Work In Fintech 2024

What they do: Sendwave is a leading payment service focused on enabling fast and secure payments across borders. Sendwave operates primarily in North America and Europe and allows people to send money to many countries in Africa and Asia, providing an efficient and effective alternative to traditional money channels. The startup has more than 1 million global users in 130 countries.

What they do: Rapid is a payment gateway that focuses on international payments. Some of the startup offerings include Rapyd Wallet (multi-currency digital wallet), Rapyd Disburse (global distribution to 190+ countries), Rapyd Virtual Accounts (local bank accounts in 40+ countries, and Rapyd Card Issuing). After PayU’s acquisition in July 2023, the company was valued at $8.75 billion. .

What it does: Tonic Bank is a pioneering digital bank headquartered in Singapore. Tonic Bank operates exclusively through digital channels and uses technology to provide seamless and accessible banking services to customers. The bank offers an easy-to-use mobile and online platform that allows people to open savings accounts, apply for loans and manage their money efficiently, providing a seamless banking experience.

What it does: Cash App is a mobile payment solution that allows users to send and receive money. Customers can buy and sell Bitcoin and invest in stocks. The Cash app has become a popular tool for peer-to-peer payments, managing personal finances, and doing business with small organizations. As of May 2024, CashApp reported supporting 57 million active users making monthly transactions.

The Future Leaders In Fintech 2025 Revealed By Juniper Research

What they do: Razorpay is an Indian fintech startup offering corporate banking, payroll, payments and solutions. The company’s integrated platform allows businesses to manage operations and accept 100+ payment methods. By 2023, Razorpay will reach 450,000 customers and $226.6 million in revenue.

What it does: Chime is a neobank that provides mobile banking solutions without fees. The company is FDIC insured and has a customer base of over 22 million. As the startup eyes an IPO in 2025, it reported 7 million monthly active users and profits in the first quarter of 2024.

What they do: Altruist is a savings, self-explanatory brokerage firm. The platform utilizes independent and independent investment advisors for its all-inclusive custody services, trading capabilities and portfolio management tools. More than 3,000 advisors currently use the Altruist platform, including firms such as Venrock and Vanguard.

What it does: Tradovate is an online brokerage firm that trades futures and options. The company equips new and experienced traders with powerful tools, real-time market data and competitive pricing.

Pulse Of Fintech

What it does: Trueaccord is a machine learning solution to help with debt collection. Basically, their “HeartBeat” algorithm was developed to automatically improve the success rate of debt collection. To date, TrueAccord has worked directly with over 20 million customers.

What it does: Stripe has become one of the most private companies in any industry. Our online payment processor is used by 1.9 million different websites, from small startups to large corporate brands. By 2023, Stripe will process $1 trillion in total payment transactions. Today, it remains the largest private fintech company with a valuation of $65 billion.

What they do: Klarna is a payment solution for e-commerce sellers and buyers. Like many “BNPL” solutions, Klarna offers the option to pay through installment plans (usually with no interest or fees). The company now works with 550,000 merchants to support 150 million active customers worldwide.

What they do: Tickertape is an investment research platform that provides real-time financial data and analysis to Indian investors. The platform offers stock screening, market news and analysis tools, enabling investors to make informed investment decisions. TickerTape’s mission is to empower Indian investors with reliable and actionable financial data.

The Fintech Year Of 2021

What they do: Wise (formerly TransferWise) started as a money transfer service that allows users to send money abroad without hidden fees or high exchange rates. After launching neo-banking services like credit cards and property management services, they expanded their services.

What they do: InfinitePay (parent company of CloudWalk) offers seamless border payments with relatively low transaction fees and currency conversion rates. Its platform offers a variety of payment options, including card payments, bank transfers and virtual accounts, making it easy for the company to accept payments worldwide. InfinitePay recently launched InfiniteCash, which allows users to create loans using smart contracts in the crypto space.

What they do: Check if it’s a buy-to-let payday lender (BNPL). The company has been in business for over ten years, raised $1.5 billion in 12 funding rounds, employs over 2,000 people, and has over 18 million users.

What it does: Creditas is a Brazilian digital platform for consumer loans. Their credit scoring systems use houses and cars as collateral for loans. The company was originally called Banque Facil before being renamed Creditas.

The Cloud 100 Benchmarks Report 2024

What it does: GoHenry is a money management platform that teaches young people how to manage their money. Kids can transact using prepaid, parent-managed payment cards. The company reports that GoHenry is used by more than 2,000,000 paying customers.

What it does: Nubank is a neobank. They offer customers credit cards, cashback rewards, digital bank accounts and personal loans. As of May 2024, Nubank reported $8 billion in revenue, $1 billion in profit, and 100 million customers (92 million in Brazil).

What it does: Vivid Money is a financial and mobile app solution. Their platform includes advanced savings accounts, access to multiple currencies, and reporting capabilities. Recently, they expanded the platform to include brokerage capabilities that allow users to buy or sell stocks and ETFs. They also offer a useful cashback option to spend and save on their platform.

What it does: Monzo is a UK-based digital bank. In addition to offering a variety of bank accounts and loan products, the Monzo app includes a number of features to help with budgeting and cost control. In March 2024, the company raised an additional $430 million in Series I funding at a valuation of $4.6 billion.

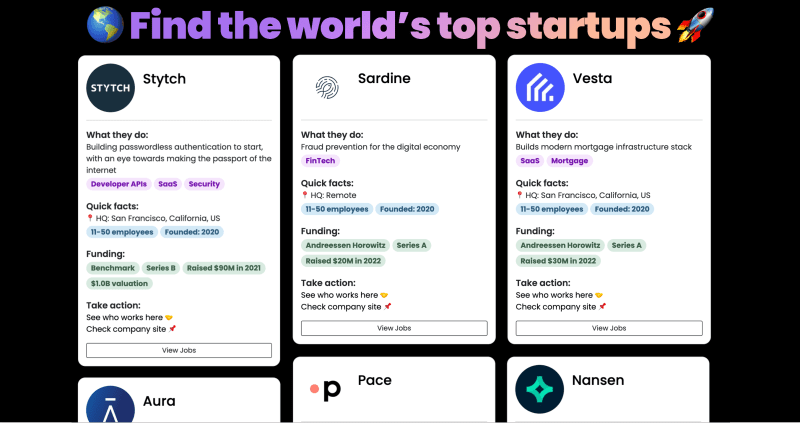

Top Series B Startups 2024 — Sequoia, Yc, A16z, Benchmark

What they do: London-based Revolut has become one of the world’s most valuable fintech startups. The company reports that they have 15 million independent customers in 35 different countries. They recently expanded into the US with the aim of obtaining a UK license in early 2022.

What they do: Bookipi is an easy-to-use invoicing and accounting app for small business owners, freelancers, and the self-employed. The application allows users to create and send professional invoices, track expenses and manage company finances in one place. BookIP simplifies the invoicing process with an intuitive interface, automated features, and customizable options that help users save time and optimize their finances.

What it does: Gumroad is an e-commerce platform that allows independent creators to sell digital content directly to their customers. Many famous singers, including Eminem and Bon Jovi, have used the platform to sell products.

What it does: OnCredit is a digital lending platform that provides short-term loans to consumers and small businesses in emerging markets. It uses advanced data analysis and machine learning algorithms to assess creditworthiness and offer personalized loan products, enabling borrowers to access loans quickly and efficiently.

October 2024 Fintech Newsletter: Fintech Isn’t Dead. Ai Is Driving A New Beginning

What it does: The Brex online banking platform is almost 100% focused on the B2B market. Especially, fast growing startups. Its products include business credit cards, cash management accounts and built-in analytics tools.

What they do: PayMongo is a payment processing company serving the Philippines. The company’s revenue increased by 60% in 2020.

What they do: Lumanu is a supply management platform with invoicing, onboarding, compliance and payment capabilities. Instead of managing multiple invoices and payments for each contractor, the Lumanu platform consolidates the company’s expenses into one place. More than 50,000 consumers have more than 50,000 income of over 50,000 perins.

What is this done: The pitchbook is a platform that is collected and compiling data for vcs. In fact, they have data of 3 million companies, including funding rounds.

Top Countries In Information Technology

They are doing: The utechle corresponding institute Dana is a digital valt of the Indonesian market. Send money, close the bills, close the number of three important activities online, customers provide e-wallets to perform three important activities online. The total transactions increased by 100% increase last year.

What does this do: iValua is an online purchase management platform. Software is based on cloud