Study Fintech In Usa – Director of FinTech at former Goldman Sachs VP. Blockchain is a Web3 expert. Experienced Engineering Manager and CTO.

Traditional financial institutions will never change. Looking to the future, we will see more and more changes in lifestyles and interactions between people.

Study Fintech In Usa

In Q2 2022, fintech investment fell sharply, the lowest level in the last five quarters and down 39% from the peak in Q4 2021.

North America Fintech Market

However, fintech is the most lucrative sector in the world. It has collected $21.5 billion worldwide in Q2 2022.

90% of the US population now uses fintech. Global isolation and global closures have made digital currencies increasingly customer-centric. This encourages fintech companies to keep up with the times and use the latest technologies, providing the expected service and maintaining high levels of satisfaction.

The fintech market is expected to be $698.48 billion in 2030 and $110.57 billion in 2020. Startups and established organizations adapt to the speed of new technologies and change and adapt their work and gather enough skills and resources.

If you don’t have a scale – you will fail. But you also need to ensure the need for a risk-based solution – that’s why fintech companies can decide to have an edge over their competitors in following the trends in the fintech industry in 2024.

Dreamfitfintech (@dreamfitfintech) • Instagram Photos And Videos

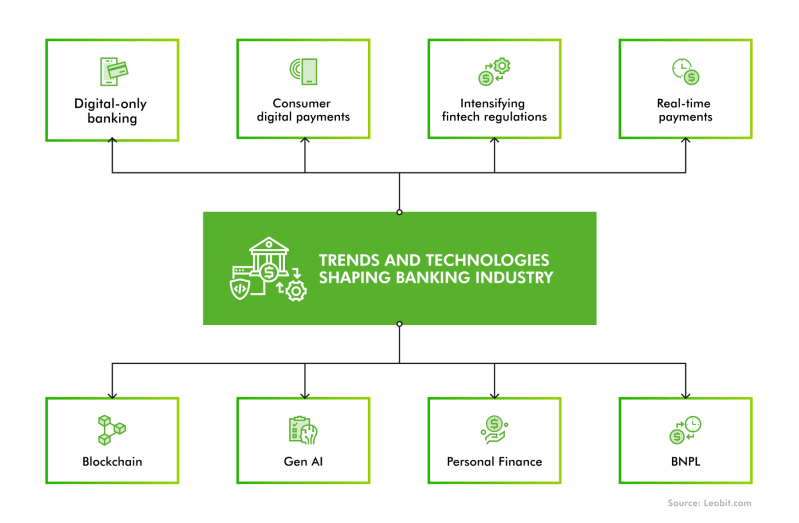

We took a financial survey to find out how fintech companies can increase their efficiency. From BNPL to cryptocurrencies, how the world of payments will be changed and changed, and the place created by fintech in recent years – all this and much more about fintech 2024 that we have explained in this post. Without further ado, let’s get to the top trends in fintech!

According to Dealroom’s analysis, the combined financial solutions market is expected to reach $7.2 trillion by 2030, surpassing the combined value of fintech businesses and the world’s top 30 banks and insurance companies.

Integrated Finance refers to the seamless integration of financial products and services into non-financial platforms or services, which makes financial services an integral part of everyday life. This is breaking down the silos between finance and other industries, giving consumers access to financial services without the need to go to a bank or spend money. For various fintech companies they facilitate access to customers, including online savings accounts that allow them to use digital wallets or other fintech-based payment methods for online purchases.

Examples of fintech systems include interest-free loans for online payments, one-click payment programs, and the introduction of brand accounts and king cards for many consumers.

Top Fintech Trends To Watch In 2024 — Techmagic

Statista predicts that in 2024, 63.8 million people will use open banking. This is more than five times more than in 2020.

Open banking focuses on the sustainable exchange of money. Customers can agree on ways to securely share their financial data with non-traditional financial institutions. Accessible APIs allow third-party providers to access customer funds. Many fintech startups and businesses that offer budgeting, money tracking, financial planning, lending and other services use Open Banking.

According to McKinsey, only 10% of open banking promises have been fulfilled. This is an area of financial technology that still shows promise. Users are slowly beginning to understand the benefits of working with open data as the exchange of information encourages academic research, software development, and economic development.

Open banking and the use of APIs to securely share information enable, accelerate and “pull” greater transparency in the purchase or financing of products, funds and other transactions. As a result, consumers are expected to see lower credit scores and hear “yes” more often when applying as lenders compete to apply rich data to their credit models. – Greg Mitchell, First Tech Federal Credit Union

Ms In Big Data In Usa

For example, a loyal customer may choose not to switch financial institutions because he is satisfied with the reliability and stability of his bank. However, the bank is very conservative and has not yet adopted many of the digital services offered by its competitors.

Thanks to open banking software, the account holder benefits from regular reports on income, expenses and expenses.

The bank can access customer funds through open APIs to insurance companies, retailers and other businesses. Before providing insurance, granting credit or allowing installment payments, they must ensure that the customer is in good standing with the banks. With the help of open banking, consumers can now pay for goods and services online quickly and easily, receive loans quickly and pay for services at the same time.

The pandemic has taught us that we can do anything at home and financial banks have taken this seriously. Fintech has fueled the growth of neo-banking. Just like fintech banks are similar to traditional banks but have no physical location.

Preparing For Your F1 Visa Interview: Do’s And Don’ts

As of 2021, Neobanks has over 145 million customers worldwide. Forecasts show great growth, and the number is expected to reach 360 million customers by 2026. In an era where remote work is essential for many businesses, instant transfers, quick registration and IBAN and ACH accounts that allow access to online banking are a huge advantage.

Statista says 48% of respondents like Chime. More than 13 million people do their banking with Chime, one of the largest banks in the United States. With their mobile banking app, Chime Cash receives any funds deposited into your bank account up to two days in advance.

Chim offers essential banking services, alternatives to credit and debit cards and an easy-to-use interface. Fintech companies can build your credit and save money for the future when you use Chime to access your banking needs without paying any fees.

The activities of financial institutions are governed by laws, regulations and rules that they must know and follow. Businesses must keep accounting records, tax reports, financial reports and customer reports.

Vol. 2 No. 1 (2024): American Journal Of Financial Technology And Innovation

According to the plan, they provide the necessary documents to the governing bodies. They ensure the accuracy of the data and the legitimacy of the work. Control technology can help in this regard.

RegTech is a type of technology used to manage regulatory compliance. Control technology identifies non-compliance issues and enables them to work with the system. Special programs use unaltered methods, monitor data security, and notify customers and bank employees of fraud.

Millions of dollars are being paid for non-compliance. For example, Bank of America Corporation previously had to pay $42 million to the State of New York for providing customers with brief explanations of how their stock orders were handled.

RegTech makes it easier for organizations to communicate with their regulators so that data can be sent without interference, compliance is monitored (for example, by complying with PCI regulations) and financial crimes are tracked.

Financial Technology (fintech): Its Uses And Impact On Our Lives

More than half of the world’s consumers are now more concerned about the preservation of the environment than a year ago. Sustainability has become an important factor in the fintech movement as companies are evaluated by investors, consumers and peers.

Some fintech companies and banks are already moving forward with sustainability, while many neobanks and payment providers are making ESG (environmental, social and governance) disclosures. Players in this industry are rapidly developing products and financial services that are environmentally friendly.

Digital payments show a greener profile than traditional cash and cards. These fintech companies are taking steps to mitigate environmental impacts. For example, some banks are pledging to achieve carbon neutrality and reduce waste emissions.

Recognizing the importance of sustainability among consumers, fintech practices tend to favor financial institutions that demonstrate an unwavering commitment to social and environmental responsibility.

Applications Of Data Science In Fintech

The global market for AI in fintech is an industry expected to reach $26.67 billion by 2026, maintaining a CAGR of 23.17% from 2021 to 2026. More than 90% of global fintech businesses already rely on AI and machine learning.

By collecting and processing information about customer accounts, credit accounts and transactions, AI helps financial institutions monitor their customers’ financial situation and provide them with relevant services and preferences. ML models look at various factors to identify potential fraudsters, resulting in a 20% reduction in the number of jobs needed to be searched.

Artificial intelligence interacts directly with customers through chatbots and automated learning programs. Chatbots and AI-powered digital assistants are able to create intuitive content, helping users with tasks such as selecting investment opportunities and managing complex financial decisions. In addition, the latest fintech trends are where even modern chatbots can store past interactions with users, allowing meaningful and useful responses based on past input.

UBS Group, one of the world’s most important financial institutions, has partnered with a Singaporean fintech company that uses AI for banking assistants. The UBS Group has developed the first financial services that help VIP clients to know and forecast their income and expenses more intelligently.

Fintech: Foundations & Applications Of Financial Technology Specialization (penn)

To that end, UBS held a technical challenge where more than 80 teams competed for a $40,000 prize and a contract from the company. The latter software analyzes the data of UBS clients and delivers information on their laptops, mobile phones and iPads.

AI provides information