Fintech Programs In Usa – With over 100 million cards processed, Release is the exclusive provider of banking-as-a-service infrastructure to disruptive startups, software platforms, and growing businesses.

This document is intended to provide a preliminary compliance review for US fintech companies and should not be construed as legal advice. Additionally, compliance and regulations are constantly changing, so this guide does not provide a comprehensive overview. Consult with an attorney and compliance experts when reviewing and developing a compliance program for your fintech company.

Fintech Programs In Usa

Startups that offer financial services such as business charge cards, cash accounts, and loans must comply with a long and complex set of regulations necessary to protect businesses, consumers, and the US financial system.

Top 10 Core Banking Software Development Companies Usa

Compliance is relevant to every aspect of the financial product, from marketing to implementation to closing the account. For example, you should clearly state all the terms of the financial product (such as fees, interest, payment requirements and other factors) in advance. You must perform proper Know Your Customer (KYC) and sanctions checks when onboarding a user and comply with all File Lending regulations when granting a loan. If a user defaults on a credit account, they may be subject to certain collection requirements, which dictate how often and when collection reminders are sent. This only covers a small part of the compliance rules you may need to follow.

The diagram below is for illustrative purposes only and should not be considered an exhaustive list of fintech compliance requirements.

Compliance with various regulations is important for building fintech: if you don’t do it right, you can face huge fines that can damage your business. In the worst-case scenario, your business may fail.

However, compliance is about more than just avoiding legal fees and consequences. Investing in compliance means that your startup can create safe and robust products for users while ensuring the safe transfer of funds and financial products, which gives your company a long-term competitive advantage. Ultimately, you serve your users’ best interests by helping them find products that are safe, sustainable, and useful.

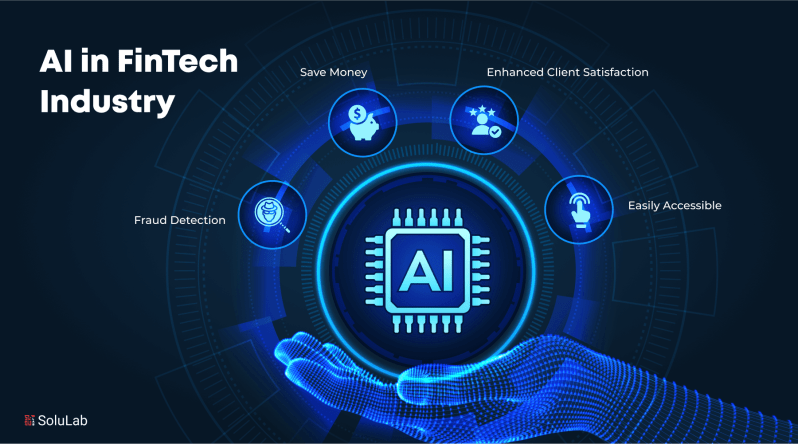

Ai In Fintech: Top 4 Use Cases And Case Study

This document discusses how financial services are regulated in the United States and what this means for your business. You will learn the basics of compliance, get an overview of the most popular compliance regulations, and explore your options for managing your company’s compliance.

The most common way to offer financial products in the United States is to partner with a bank to provide support for your product. Each subsidiary bank is regulated by the primary regulator (along with a number of other regulators), which regularly monitors the bank’s compliance. For example, banks can be audited for compliance with state and federal laws governing unfair and deceptive practices and practices (UDAP), which require (among other things) clear and direct communication with customers.

Any fintech company that works with a bank is indirectly accountable to the same regulator because of the bank’s association. Your startup will never have direct contact with the banking regulator; instead, the bank looks after your compliance with the bank’s rules and regulations. For example, using the same conditions as above, the bank also evaluates your UDAP compliance through regular testing and reporting requirements.

Additionally, regulatory agencies that oversee banks (and fintech) but do not operate as primary banks include, but are not limited to:

Blockchain Fintech Course

The rules and regulations you must follow are very specific to your business. For example, some laws only apply to consumer finance services or lending businesses. Generally speaking, however, there are some rules that apply to all businesses:

This section is for illustrative purposes only and should not be taken as a complete list of FinTech compliance requirements.

KYC or KYB is a mandatory service to verify the identity of the customer or company when registering an account and continuously monitor the transaction process to assess risk. Users must provide proof of identity and address during the boarding process to verify their identity.

What this means: Complying with KYC or KYB requirements helps ensure that money flowing through your system is safe and not involved in money laundering, terrorist financing, or other fraudulent schemes.

Growing Your Bank Through Fintech Sponsorship Revenue

Anti-money laundering laws are a set of laws and regulations designed to prevent criminals from committing financial crimes and illegal activities (ie, disguising illegal money as legitimate money). Anti-money laundering laws require banks and other financial service providers to record and report money flows to monitor money laundering and terrorist financing activities.

What it means: Help maintain the security of the financial system by preventing money laundering and terrorist financing.

OFAC imposes a number of economic and trade sanctions on countries, legal entities such as corporations, and groups such as terrorists and drug traffickers.

Purpose: To help achieve foreign policy and national security goals by preventing terrorist financing, money laundering, and other fraudulent activities.

M.s. In Financial Technology And Analytics (mfta)

The UDAP and UDAAP rules prohibit companies from engaging in unfair or deceptive (or abusive in the case of the UDAAP rules) actions or practices, such as failing to disclose fees or misrepresenting products or services. UDAAP provides protection to all individuals and organizations involved in transactions, while UDAAP provisions provide additional protection to consumers using financial products.

UDAP and UDAAP offer similar consumer protection, but with a few differences. The UDAAP imposes an intentional ban on “abusive” behavior, which is intended to cover a wide range of behaviors that can harm consumers.

What it means: Make sure you create a high-quality and secure user experience by making all communications transparent and easy to understand.

The red flag policy requires companies to adopt and implement a written fraud plan to identify warning signs or red flags of identity fraud. This program helps companies easily identify trends and trends in their operations and take appropriate steps to prevent and mitigate identity theft.

The Centre Of Fintech

There are many rules that apply to companies that extend, support or receive credit. For example, you may be required to comply with the Fair Credit Reporting Act, Servicemembers Civil Relief Act, Equal Credit Opportunity Act (ECOA), etc. This document is not a comprehensive list of all lending policies. Instead, we will discuss the two most common: fair lending laws and truth-in-lending laws.

Fair lending laws like ECOA prohibit lenders from considering race, color, national origin, religion, sex, familial status or disability when applying for a loan. These rules and regulations apply to all credit extensions, including credit to small businesses, corporations, and partnerships. Federal fair lending laws also impose technical communication requirements that require lenders to explain why they have taken an adverse action against a borrower or loan applicant.

What it means: To prevent discrimination and ensure equal and equal access to credit for people in protected classes;

TILA protects consumers from fraudulent credit and credit card transactions. It requires lenders to provide advance information about loan rates so that consumers can compare different types of loans. TILA mainly applies to consumer loans, but the basic fraud and dispute process also applies to business loans. For example, in some circumstances, an employee who owns a card may not be liable for more than $50 for the unauthorized use of a stolen credit card.

Pdf) Is Fintech Just An Innovation? Impact, Current Practices, And Policy Implications Of Fintech Disruptions

Implications: Protect borrowers from bad lending practices and improve customer experience by ensuring users have a clear understanding of credit costs Protect other borrowers from unauthorized use of credit cards.

You or your internal compliance team can work directly with your bank to maintain compliance, but this is often expensive and time-consuming. For example, this includes building a full-time compliance team from the ground up, hiring lawyers, compliance specialists, financial managers, and more.

To strengthen your internal compliance management program, banks expect you to implement the same level of rigor as their program. To meet the bank’s expectations, you will need to leverage a team of internal and external legal and compliance experts to continue implementing and maintaining a set of resource-intensive program components. These components include compliance principles, risk assessment methods and matrices, independent test plans and workflows, compliance training content and audits, various compliance procedures and controls, continuous “compliance status”, and compliance program management. They evaluate you and your team’s content knowledge, reporting capabilities, strategic planning, issue and risk management, content training programs, and more. We recommend that you speak with a compliance officer and attorney to fully understand what needs to be done to make the program successful.

In addition to managing compliance yourself, you can hire a third-party compliance consultant to create policies, audit solutions, and user behavior tests to ensure compliance with applicable regulations.

Women In Payments

However, external consultants are not only more expensive but also need to ensure compliance