Car Insurance Punjab India – Shriram General Insurance Company is a joint venture between Shriram Capital Limited and Sanlam Limited (South Africa). Licensed by IRDAI (Insurance and Development Authority of India). Shriram General Insurance offers a wide range of general insurance solutions including auto, travel, home and more, designed to meet every need. So, the next time you are looking for affordable and comprehensive accident cover, insure with us and live a peaceful life.

Shriram General Insurance makes buying, renewing and claiming general insurance quick, easy and hassle-free. A completely redesigned customer journey for digital insurance, aimed at making insurance affordable and accessible to everyone. Irrespective of your age and ability, you can now get a Shriram General Insurance policy with minimum documents and the best.

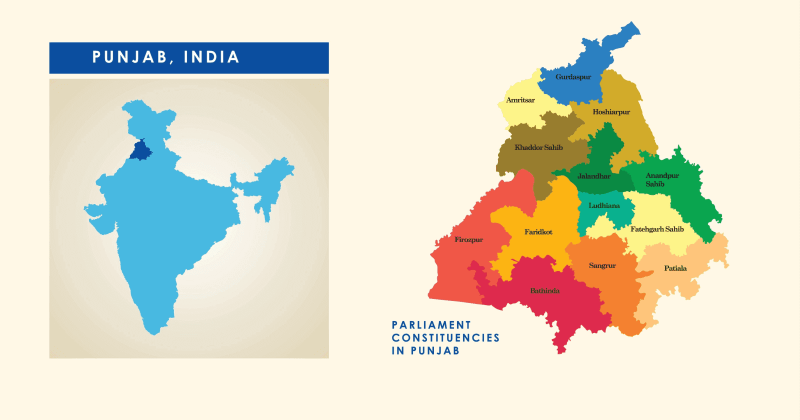

Car Insurance Punjab India

Shriram General Insurance has achieved a car claim payout ratio of 97% and more than 1 Lakh+ satisfied customers.

Is Your Car More Than 15 Year Old? Here’s What You Need To Know About Scrapping

Why choose 3-year car insurance? 2024-11-07 10:25:32 A responsible car owner prefers to choose the most suitable car insurance plan to protect his car. In this case, it is useful to know that the 3-year car insurance does not only provide security, but also long-term benefits. In this blog, we’ll discuss the many benefits of choosing 3-year auto insurance so you can make an informed decision about whether it’s the right choice for you. Read on

Does car color affect car insurance premiums? Posted 07-11-2024 09:46:16 Choosing the color of a new car is often a personal matter. But how does this affect your car insurance premium? While the color of your car can affect its value and appearance for sale, it is not a major factor in determining insurance premiums. This blog explores the specific factors that affect your insurance premiums, as well as facts about how car color affects insurance costs. Read on

Is long-term car insurance right for you? 2024-11-06 10:44:24 Managing car insurance renewals each year can be tedious, not to mention the risk that insurance premiums will change with each renewal. Long-term car insurance is a cost-effective alternative that offers coverage for several years with a one-time upfront payment. This type of policy is becoming increasingly popular in India, with insurers offering multi-year car insurance packages that combine external and comprehensive coverage. These plans guarantee convenience and financial security by limiting insurance rates and eliminating the need for annual renewals. But is a long-term policy the right option for everyone? In this article, we’ll look at how these plans work, what the benefits are, and whether long-term car insurance is right for you. Read on

Insurance at your fingertips, fast and reliable service, easy and seamless claims process. Shop, update and learn about all your insurance needs. A driver’s allowance is a type of insurance that allows the insurer to reduce premiums in the Accidental Damage category. The cost depends on how many kilometers the insured vehicle has traveled during the insurance period. This is a type of comprehensive car insurance; However, as a policyholder you can save on insurance premiums depending on the use of the vehicle during the insurance period. Simply put, you can say: pay less to get less car insurance.

Bmw 520d 5.series At. // Sunroof 2015 Model // Plate: Pb57 // Single Owner Insurance Available // Both Keys // Tyres New #dhindsacars #dhindsacarssector82mohali #dhindsacarsmohali #bmw #bmw520d #forsale #luxurycars #bmwforsale #india #punjab

If you use your car only occasionally, you will pay a lower price than usual for comprehensive car insurance. This does not depend on the usage or mileage of the vehicle.

You can modify the insurance policy based on the usage of the vehicle and the estimated distance traveled by the vehicle.

If you feel that you are about to exceed your mileage, you can top up the relevant km and ensure uninterrupted coverage.

Tax insurance is a little different than normal car insurance. The following points explain how car insurance works.

☎️81465-73759☎️ 98886-92786#car #usedcars #punjab #india #trending #viralvideo #instagram

You must state how many kilometers the insured vehicle will travel during the insurance period. The car insurance premium you pay depends on how many kilometers the insured car has driven. When you buy a plan, you have to select a ‘travel distance’ plate. Simply put, you make a conscious choice about how much you drive an insured car and pay the corresponding premium.

To avail the discount on your claim, you must pay the mileage of the car before the policy expires. For example, if you said that the car is driven 10,000 km per year, you must prove this to the insurer to cancel the policy by reporting the mileage. You will get the policy bonus depending on the distance travelled.

If you have a complaint against the system, the car must be within the specified distance. For example, if you chose 10,000 km, the car must not exceed this mileage limit when you order. If the vehicle is within the specified distance limit, your claim will be processed in the same way as the normal extended procedure.

If your vehicle exceeds the published usage limit, you won’t pay any extra and you’ll stay covered. However, during the claims settlement process, the insurer may ask you to pay an additional amount of personal contribution. Please note that this procedure may be different for each insurance. Therefore, please contact your insurer for more specific information.

How To Download Insurance Copy By Vehicle Number In Punjab?

Below are the steps to apply for car insurance online. This is a general process and the right purchase process can be different for each insurance.

Here you will find a table with the main differences between Premium car insurance and comprehensive car insurance.

What makes PAYD unique is that it is based on usage. You can choose from different mileage registrations (such as less than 3,000 km, 3,000 to 5,000, etc.) and pay the premium based on the use of your car.

Comprehensive insurance is unique because you can purchase annual or long-term coverage (such as three-year coverage) to insure your vehicle against long-term damage.

Tata Ace Insurance Price & Renewal Online

The cost of paying for this car insurance policy is usually based on the make and model of the car, its age, location, equipment and the Insurance Declared Value (IDV).

PAYD insurance is highly customizable as you can insure your car based on your usage. Unlike a comprehensive policy, you pay a lower premium if you use your car.

Comprehensive car insurances can be changed based on IDV and add-ons. You can usually customize your car insurance policy by selecting the IDV from different places and selecting the appropriate add-on. Your coverage varies.

Normally, Pay As You Drive is valid for one year. However, it can be different for each insurance.

Car Insurance Online, Buy Car Insurance Policy @ ₹2094

Whether you use your car or not does not affect the duration of the policy. For example, if you have chosen an annual policy, the policy will be valid for one year, regardless of the use of the vehicle.

Until you cross the selected distance limit, you can apply according to the policy conditions.

You can make a claim in accordance with the terms of the policy before your policy expires.

Your insurer may ask you to install a telematics device in your vehicle to track mileage.

Shriram General Insurance

This is a new type of car insurance in the Indian market. Not all existing insurances offer this at this level.

This type of insurance has been available in the Indian insurance market for decades. This is a popular cover that has been around for a while.

There are a few things to consider before you buy motor insurance.

If you have won more than one car, buy Pay As Driver cover for the least used car, usually less than 10,000-15,000 km per year.

How To Renew Driving Licence In Punjab Online/offline In 2024?

If you use a car that travels less than 10,000-15,000 km per year, or if you use public transport for your daily commute, or if you travel frequently to and from the station and rarely use the car, ‘Driver’s fee’ as’ valid insurance. it is seen as ‘the smell. the right plan.

Pay-as-a-Driver premium means car insurance based on the distance traveled by the insured vehicle.

Insurance is a good option if you don’t use your car very often, because the premium you sign up for depends on the distance the insured car is driven.

Payment insurance is a new concept in the insurance industry and most insurers offer this plan. You can search the internet for insurance companies that offer this plan.

Punjab National Bank

Pay a premium because the way you drive is a term used to pay