Malaysia Car Insurance Compare – Even before you get sick, planning a trip can be stressful, no matter how well you prepare. Moreover, there are many aspects of travel that you may have forgotten due to the closure of borders in the last two years.

When driving or traveling in Malaysia, it is important to ensure that your current insurance will cover you in Malaysia as car or motorcycle insurance is valid for all cross-border vehicles, except for those registered overseas.

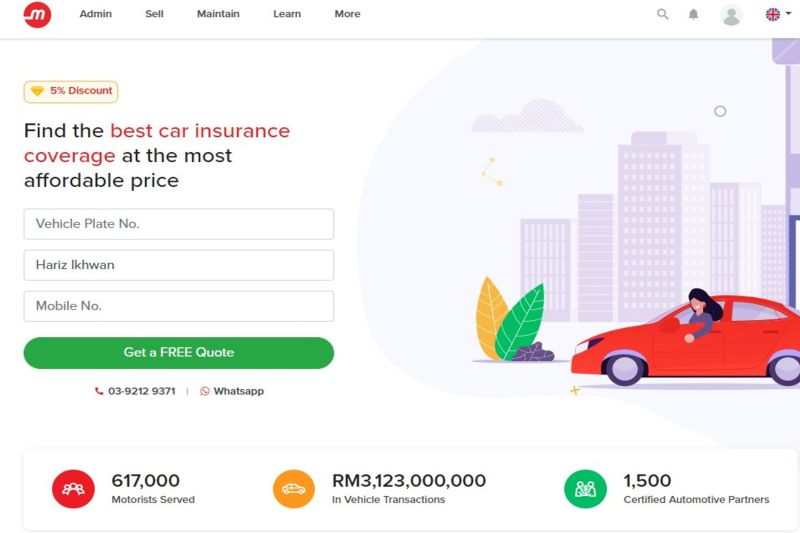

Malaysia Car Insurance Compare

As a rule, it is good to prepare for any kind of disaster with as much information as possible, so that you have complete peace of mind while traveling.

Malaysian Car Company Logo

WAYS can now help you reduce your stress by giving you clear information on the most important things you need on your list: car or car insurance, including Malaysian insurance. Remember to make sure your car insurance will cover you in Malaysia as not all laws are protective outside of Singapore. If you want to add insurance on the other side of the border, make sure to add it at least 7 days before the trip.

Pure Budget Insurance takes care of everything for you, so you can have peace of mind when an emergency arises. Budget Friendly Insurance allows you to customize your insurance plan, allowing you to make add-ons to suit your needs. In this case, this will include communication and travel to Malaysia.

Depending on the type of insurance you have, you may want to check other things you need to have before traveling to Malaysia to ensure you are fully covered.

Here’s how you can take advantage of their car insurance options, in addition to what you need to have Third Party, Fire and Theft, or Comprehensive insurance.

Cheap Car Insurance In Malaysia 2024

If your car is immobile or lost for more than 6 hours after an accident, breakdown or theft in Malaysia, Budget Direct Insurance will cover:

If your car breaks down in Malaysia and you or your insured driver is unable to drive, Budget Direct Insurance covers:

Please note that the above is an overview of the car insurance options offered by Budget Direct Insurance and is not an exhaustive list.

Many of these special features are available with your motorcycle insurance policy. Visit Direct Insurance Quotes for more information on direct car and motorcycle insurance quotes.

Buy Online Malaysia Car Insurance At Insuranceonlinepurchase.com

With Budget Direct Insurance’s customer service team to address your concerns and advise on next steps, you can be sure you’re in good hands, even if things go wrong.

In the unlikely event that your car or motorcycle is stolen while in Malaysia, you should first file a police report in Malaysia and report it to your insurance company via the insurance company’s phone number within 24 hours. It’s a good idea to check your car insurance before you leave so you know exactly what to expect in the event of an emergency.

Going somewhere or know someone who travels fast? Share this guide with them so they can update on the latest immigration information. On 1 July 2017, Bank Negara Malaysia (BNM) released) car insurance rates for third party vehicles, fire and theft. As a result of the liberalization, premium prices for the products began to be set by individual insurance and takaful companies. This move has given consumers more options as premium rates vary between insurers.

In this article, we will take a closer look at car insurance rates and how they will affect you as a consumer.

Top 8 Best Cheap Car Insurances In Malaysia 2024

The liberalization of car insurance rates means that car insurance rates in the market are no longer based on the car insurance rates previously set by Bank Negara Malaysia. Liberalization has allowed insurance and takaful operators to set reasonable premium charges for cars, third party vehicles, fire vehicles and theft vehicles.

This initiative will be beneficial for insurers and takaful users and consumers. From insurance providers and takaful providers, they can charge premiums or premiums according to the policy holders. They may arrange insurance or takaful plans depending on the risk level of the policyholders. Currently, customers can find a wide range of car insurance products at competitive prices in the market.

Rates are a set of fixed rates under insurance laws that regulate and regulate the cost of premiums and policy details. For example, in terms of prices, insurance and takaful operators do not have the right to change the cost parameters.

As the regulatory authority for all financial institutions, Bank Negara Malaysia sets and regulates car insurance rates.

How To Choose Personal Accident Insurance In Malaysia

Before the release, car insurance rates depended on the number of policies and the model of the car. Insurers were also allowed to set limits on insurance payments depending on the age of the driver and the number of road accidents.

In addition, the estimated costs are adjusted to take into account the No Claim Discount (NCD) based on the driver’s contribution. In general, drivers with a good driving record may have a higher percentage of NCDs – up to 55% in private vehicles.

Starting July 1, 2017, more risk factors are taken into account when calculating fire insurance rates. The risks depend on the amount of insurance, the size of the car’s engine and the age of the driver and the car.

The above, among other things, will determine the risk to policyholders that will justify the cost. Premiums may vary among policyholders because insurers may use different methods to determine the risk level of their policyholders.

Car Insurance In Malaysia: All You Need To Know

Released on 1 July 2016. At this stage, insurance and takaful customers have the opportunity to offer new and improved car products. Additional services are not included in the current price.

From 1 July 2017, insurance and takaful operators have been given greater flexibility. They have the right to charge car and third party insurance premiums, fire and theft.

As already mentioned, after the release, the cost of “Extensive Vehicle Maintenance” and “Third Vehicle”, “Fire and Theft” no longer depends on the vehicle model, age and severity of the fire.

Premium payments are based on the policyholder’s risk profile, including their driving record and history. These features differentiate the premiums offered by insurance companies and takaful operators.

Get Insurance & Takaful Online Or More

After the release, customers can expect different premium prices between insurance companies and takaful companies even if the coverage is the same.

Example: You may find that Company A offers insurance at a lower price that fits your budget and needs. On the other hand, you may find that Company B offers the same insurance but at a higher price.

Thus, freedom gives you the opportunity to compare insurance premiums. Given the difference in insurance premiums, it’s best to shop around for the right insurance that fits your budget and needs.

You can easily compare insurance online. To do this, you can visit the insurance company’s website and get a quote online.

Malaysian Motor Detariffication

For example. If you want to get a quote from Company A, you can visit their website and enter the required information to get a quote. To find the best insurance at the best price, it is recommended to compare at least three insurance companies in terms of prices and coverage offered.

An easy way to compare insurance that will save you time is to use insurance comparison sites like MyEG and. Instead of visiting multiple insurance websites, you can easily get quotes from all different insurance companies on one platform in a few minutes.

No way. You will keep your NIH. You can also switch from one insurance company or takaful operator to another.

FYI, NCD rates for private vehicles range from 25% to 55%. See our table below for NCD indicators.

What Is Carinsure By Touch ‘n Go? Here’s What You Need To Know.

I agree. Consumers who want to opt for credit insurance can buy it through rates.

As we have already said, after the liberalization of car prices, the prices of comprehensive and third car services, fire and theft are no longer regulated by the prices set before. Therefore, as a consumer, it is better to compare insurances to get the best car insurance or the cheapest car insurance.

To easily compare insurance, you can use one of the best insurance comparison sites in Malaysia where you can compare 15 insurance policies for free. To get started, visit Find Free Car Insurance Online and choose the plan that best suits your needs and budget.

Is one of the best insurance comparison sites in Malaysia, offering policies from over 10 brands. Get a free insurance quote today! What does Myvi have in common with Mercedes? Answer: Both vehicles require valid insurance to be driven on the road.

Friends Of Myeg

New or used, local