Car Insurance Driving To Malaysia – Our premium estimate only provides approximate costs; The final amount at the time of purchase may vary depending on the information provided.

We offer additional benefits to keep you safe. As an added bonus, we offer the following:

Car Insurance Driving To Malaysia

Do you know? In addition to protecting you and your car, you get a lot more when you choose us!

As Malaysia’s Vep Policy Kicks In, What Can Singapore Drivers Expect?

Get 10% off when you renew your insurance online. Tired of going to the counter? Now you can buy insurance through our website or mobile app!

Our trusted online payment partner iPay88 is regulated by Bank Negara Malaysia and complies with the highest international security standards (PCI DSS 1) as well as the Financial Services Act 2013.

ProOmilej offers all the benefits of our comprehensive plan at a lower price. Depending on how far you plan to travel, Promilej offers cash to keep you and your wallet safe.

Depending on the Promilej plan you choose, you’ll save between 10% and 40% off your base price (including the above bonus benefits, if any).

Income Insurance Launches Edrivo Emergency Mobile Ev Rescue Service

You can purchase ProOmilej through our mobile app (), visit our website or call our call center.

Yes, but based on the short term cancellation rates of current insurance policies, you should consider whether they are good for you.

No. Before purchasing ProOmilej, you must upload a photo of your odometer reading via our mobile app or online. Otherwise, we reserve the right to cancel your policy.

Yes, you can. You must notify us of your request in writing. Once it’s cancelled, you can get your premiums refunded.

Malaysia Vep: How To Get A Vehicle Entry Permit For Drivers Entering From Singapore

Don’t worry if you exceed your allotted space. You will be given an additional 500km before your policy expires.

Beyond the specified distance of 500 km, your vehicle will not be covered for loss, damage or other benefits. However, third party protection remains unchanged.

You must complete your plan before you exceed your limit. It fully protects you and your car on the road.

You can add online using our app or by calling us, just as you would when buying a policy. This is the cost difference between your current policy and your new policy.

Ultimate Guide To Car Insurance In Singapore (2023)

For example, if your current plan costs RM500 and the next plan costs RM800, you will only be charged RM300.

If you exceed the specified distance before the policy expires, you will be given an additional distance of 500 km.

If you exceed your allotted miles and grace miles and do not top up, you are only covered for bodily injury, death and third party property damage, but not for accident, fire or vehicle damage. theft. (For ProOmilej policies issued after 19 March 2021, the other benefits in point 1 do not apply if you exceed the Grace mileage limit).

Once the process has started, you can upgrade to the next level of “mileage” coverage or “full mileage coverage” at an additional premium. A maximum of 2 charges are allowed. If you add a second time, you can only top up full mileage coverage.

How To Easily Convert Your Foreign Driving License In Malaysia

No, you cannot downgrade your plan. You cannot get a refund or transfer unused miles to a new plan.

Will I get 10% off my payment if I use the website or app to buy my policy?

Your browser does not have a tool to monitor the site. After buying the insurance, you just need to enter the current location of the car. In the event of a claim, we will recheck your mileage. We’ll also send you reminders to check your mileage.

You can contact our staff at 1-800-88-2121 to send a photo of the odometer one day before publication. We will then make the necessary changes.

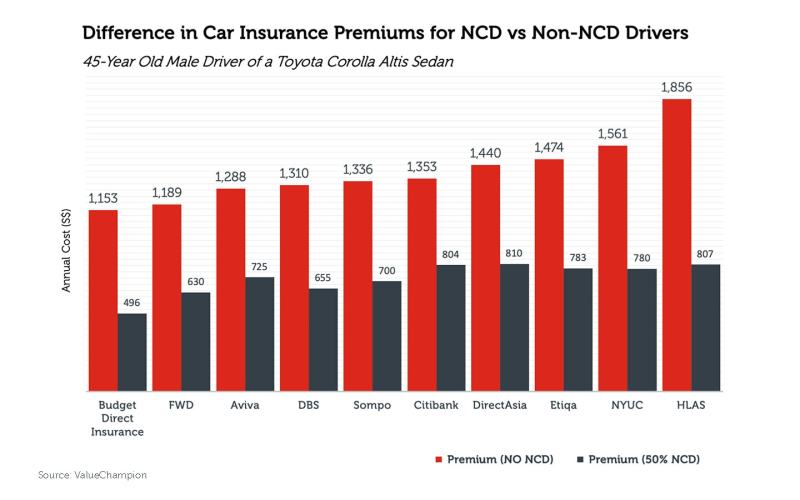

No-claim Discount (ncd): The Complete Guide

Yes. You can buy flood covers and windows for the same amount as your allotment.

PLEASE SEE THE POLICY AGREEMENT AND PRODUCT DESCRIPTION PAGE FOR THE TERMS AND CONDITIONS OF THIS POLICY. Malaysian drivers! Congratulations on getting your new Malaysian driving license! Now that you’re ready to hit the road, it’s time to talk about the most important part of the driving game: car insurance. In this blog, we delve into the world of car insurance for new drivers in Malaysia. So contact us and let’s browse through the information to find the right content for your trip to Malaysia. Understanding Car Insurance Terms:

First, let’s clarify some insurance terms. “NCD” means new coffee shop in town; This is your No Claims discount. In fact, it’s a reward for safe driving – the longer you go without logging in, the more money you’ll save. “OD” and “TP” may sound like secret society acronyms, but they are actually types of content: personal and third party damage. Now let’s take a closer look at what Malaysian drivers should look out for when entering the car insurance game.

Money is important, right? Before you start looking for insurance options, determine your budget. Malaysian drivers, especially novice drivers, should be ringgit wise. Balancing security and cost is important. Don’t look for the cheapest; make sure it covers what you need. Compare prices, read more and choose promotions that won’t make your wallet cry.

Self-drive Trips To Malaysia: Key Things To Know

Let’s talk about the no-claims discount again. It’s like finding a treasure hidden in the insurance forest. Your NCB rate increases every year you don’t make a claim. So, if you are a safe driver, protect NCD like it is the last piece of durian in the market. This can result in big discounts on your premiums, and who doesn’t love a good discount?

Your Damages (OD) and Third Party (TP) – It’s like choosing between satay and nasi lemak. OD covers damage to your car, while TP covers damage to other people’s cars. For the new driver, consider a comprehensive package that includes both. You never know if you might accidentally get into a relative’s car during Raya. Better safe than sorry, right?

Just as kikap (soy sauce) enhances the taste of your nasi goreng, nutritional supplements enhance your insurance coverage. Consider options like windshields, flood protection, or special discounts like towing services. It’s like tailoring your insurance to your driving style and needs.

In the digital age, information is at your fingertips. Don’t ignore the first insurance ad that pops up on your screen. Dig in, read reviews and ask your campers (friends) about their insurance experiences. Malaysians like to share their opinions, especially on things like insurance and mamak stalls.

Simplifying Vehicle Ownership For Drivers

Imagine being stuck on the side of the road with a flat tire – it’s a nightmare, isn’t it? Get a roadside assistance insurance policy. It’s like having your own mining team ready to help you when your car decides. Malaysia’s roads can be unpredictable, so it’s always a good idea to have a backup plan.

The excess is the amount paid when the claim is made. It’s like a very spicy sambal – it can be a little too hot. Assess your risk tolerance and choose an extreme that won’t break your budget. By finding the right balance, you’ll be able to enjoy your meals without worrying about unexpected expenses.

New drivers in Malaysia, now you are armed with the knowledge to beat the car insurance game. Remember, it’s not just about following the law; It’s about your safety and driving. So go ahead and explore Malaysia’s roads and drive safely! May your NCD grow, may your income be reasonable and may your journey be smooth like a well-fed navel. Ride safe, sis!

Now that we’ve got your car insurance coverage out of the way, it’s time to put that knowledge to work. At , we put your needs and comfort first, making us the natural choice for your driving journey. Choosing means choosing a partner who appreciates openness, individual solutions and peace of mind on the road.

How To Register Grab Driver In Malaysia

Are you ready to turn your new information into comprehensive information? For more information, insurance quotes, custom plans or to purchase, visit us at https:/// Improve your driving experience as your safety and satisfaction take the driver’s seat. Third party insurance is basic car insurance that covers death or injury to another person or damage to another person’s car or property.

Third Party, Fire and Theft covers damage to the insured vehicle due to fire or theft of the insured vehicle.

Do you know? Even if you have comprehensive car insurance, your car insurance will only cover your car in the event of an accident. As a result, you will have to pay for hospitalization and ambulance expenses.

Consider hiring a driver