Car Transport Insurance Australia – Our commercial vehicle insurance is designed to help cover the costs of your business in the event of accidental damage or theft of commercial vehicles. These include conventional cars, electric vehicles, vans, pickup trucks and vans.

You can get online public and product liability insurance for up to two vehicles as part of a business insurance package, or call us if you need cover for up to 20 vehicles.

Car Transport Insurance Australia

Helpful Hint: Do you use your personal car for business purposes? Your personal motor insurance does not cover damage to a third party’s property – or your own vehicle – while it is being used in connection with your business. Check your personal car policy to see if it applies to you.

Cheap Car Insurance In Australia

Call us to insure up to two vehicles online or as part of a business insurance package or up to 20 vehicles with independent company car insurance.

Choose from three commercial grade motor insurance policies to meet your business needs: comprehensive, fire and theft or third party property damage.

It covers damage to or loss of your commercial vehicle, excluding damage to other people’s cars or property.

It covers damage to other people’s cars or property, as well as fire and theft coverage up to the market value of your vehicle or $5,000.

Car Transport Sydney To Perth

It covers accidental loss or damage to someone else’s car or property due to an accident that is partly or entirely your fault.

This is a limited summary of some of our commercial vehicle insurance policies. Terms, conditions, limitations and exclusions apply. For details and prior to making a decision, please refer to the relevant Product Data Sheet (PDS)/instruction text, supplemental PDS (if applicable) and Target Market Definition (TMD) available on this website.

We’ve gathered information and resources including news, tips and insight to help you get started with EVs.

If you use vehicles as part of your daily business, commercial vehicle insurance can help cover the costs of an accident or theft of your car.

Dolphin Shipping: Your Global Car Import & Export Solution

Still not sure which commercial vehicle insurance is right for your business? Compare our three levels of coverage.

Incidents: Fire, lightning, explosion, theft or illegal alteration or damage caused by third party uninsured peril.

Up to $10,000 in coverage for stand-alone commercial vehicles and $5,000 for commercial vehicles with combined policies.

Accessories are automatically included in the market price selection. For the agreed value, include the value in the vehicle insurance amount.

Laid-up Car Insurance

These policy benefits are based on the purchase of commercial vehicle insurance as part of our commercial insurance package. Call our team of Australian business experts on 1300 131 000.

This is a limited summary of some of our commercial vehicle insurance policies. Terms, conditions, limitations and exclusions apply. For details and prior to making a decision, please refer to the relevant Product Data Sheet (PDS)/instruction text, supplementary PDS (if applicable) and Target Market Definition (TMD) available on this website.

There are many variables that affect the cost of commercial vehicle insurance including (but not limited to):

Business Insurance Package offers a variety of small business insurance policies to help you choose the coverage that best suits your business needs. If you wish to purchase commercial vehicle insurance as part of our commercial insurance package, you must purchase public and product liability insurance or commercial property insurance and add commercial vehicle insurance.

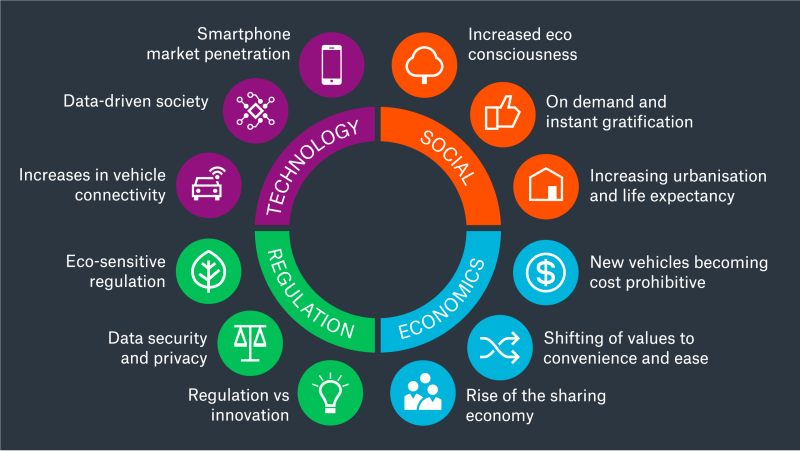

Modern Mobility And Transport Risks

Request quotes for up to two commercial vehicles online. For standalone commercial vehicle insurance for up to 20 vehicles, call our team of Australian commercial experts on 1300 131 000.

You can buy commercial vehicle insurance for a range of vehicles including: sedans, vans, cars, 4WD and vans up to 2, 5 and 10 tonnes, trailers, mobiles and earth moving equipment. Acceptance conditions apply.

Comprehensive car insurance is a car insurance policy that covers your car for personal, occasional and limited business use. Depending on the type of business use, comprehensive car insurance may provide coverage if you use the same car for both personal and business purposes. Note: We do not cover cars used for trade-ins or trade-ins.

Commercial vehicle insurance is specifically designed to cover vehicles used for commercial purposes. It provides a wide range of coverage for commercial vehicles such as cars, trucks, forklifts, excavators and trailers that are not normally covered by private motor insurance.

Average Cost To Ship A Car By Distance

For more information, see our personal vs commercial vehicle insurance for business article. For more information see the PDS or contact us on 1300 131 000.

Our comprehensive commercial vehicle insurance covers electric vehicle batteries, charging cables, wall chargers and mounts. To find out more about what is included in comprehensive motor insurance for commercial vehicles, see the PDS.

It recognizes that Aboriginal and Torres Strait Islander peoples are the traditional custodians of the lands we live and work on across Australia. We pay tribute to First Nation Elders past and present.

The advice given here does not take into account your individual goals, financial situation or needs. Terms, conditions, limitations and exclusions apply. Please consider the relevant Product Information Statement (PDS)/Policy Statement and Supplemental PDS (if applicable) before making any insurance decisions. Insurance PDS/Regulation Text, Supplemental PDS and Target Market Definition (TMD) are available on this website if applicable. If you call us to inquire about or purchase a product, we do not make any recommendations.

Driva Car Insurance

Australian Insurance Limited ABN 15 000 122 850 AFS License no. 234708 is the general underwriter of the insurance products offered and the AFS license number is ABN 27 076 033 782 of Australia Life Insurance Limited. 296559 is the insurer of the insurance products offered. Each party is responsible for the statements and representations made on this website regarding its products. Is adventure calling your name? Hit the road, see the sights and drive with confidence, knowing that with Touring Caravan Insurance your travelers and their contents will be protected against collisions such as bushfires, floods or storms, vandalism, theft or collisions. The way

Up to $1,000 for reasonable emergency transportation and lodging for you and your pet if it is at least 100 km from home.

The longer you are a member, the greater the discount on some products with annual membership benefits.

Take out two or more qualifying policies and save up to 10% on each – including home and car insurance.*

Ceva Vehicle Logistics

Many arrangements are covered by Touring Caravan Insurance. Here’s a summary of what’s included:

Up to $1,000 for emergency transport and accommodation cover if your caravan or motorhome cannot be used due to an event we have agreed to cover and you are within 100km of your home.

This is a summary of touring caravan insurance accessories. Please read the product description for more information such as terms, limitations and exclusions.

For more information on general exclusions and non-envelope items, see the product description.

Interstate Car Transport Quotes

You can choose to cover the construction for similar events with your passenger, up to an agreed price.

Your policy provides a total of $1,000 in contents coverage. You can increase this amount by entering any agreed value.

This is a summary of some of the provisions contained in the Caravan and Trailer Regulations. See the applicable Product Information Statement for specific terms, limitations and exclusions.

Log in to your online account to view instructions or update your personal information and payment methods. For other changes, call 13 72 28.

How To Renew, Change Or Cancel A Ptv Authorisation

The annex is an extension of the caravan – like a pop-up – providing extra living space.

Outbuildings are not automatically covered by insurance or travel insurance, but can be added as an option. Adding this adds premium value.

Your onsite or touring car insurance will cover the following contents owned by you or your family up to a certain amount (depending on the contents you require):

There is no statutory requirement for caravan insurance in Victoria. However, buying caravan insurance will protect you from major bills if your car accidentally damages another vehicle, or if your car is damaged by an uninsured event such as a fire or flood. , storm. , theft or attempted theft.

Car Insurance Quotes, Digital-first

There are insurance policies that provide coverage up to a certain amount and others that do not. It depends on the insurance company.

Both Complete Care® and comprehensive auto insurance policies offer up to $1,000 in coverage in the event of an accident with your trailer or camper—but only if the loss or damage occurs while the trailer or trailer is attached to or towed by your vehicle. The cover does not include damage to the contents of the caravan or mobile home and does not apply if your caravan or mobile home is parked here.