Car Insurance Delaware – You’ve come to the right place if you’re looking for a car insurance quote as a Delaware driver. Or, if you just need information about buying auto insurance in Delaware, we can help you with that, too. Diamond State drivers are fortunate to have scenic destinations like the Wilmington Riverfront and beautiful coastline just a short drive away.

Even if you don’t drive very far, it’s still important to have car insurance you can trust. Hartford AARP® Auto Insurance Plan

Car Insurance Delaware

Protecting AARP Delaware members and their families since 1984. We have earned a reputation for honesty, trust and excellent customer service. Hartford customers rate us highly for auto insurance claims service because they can trust that our auto insurance will be there when they need it most.

Car Insurance For High-risk Drivers In Delaware

Our customers in Delaware pay an average of $1,781 per year, or about $148 per month, for their auto insurance.

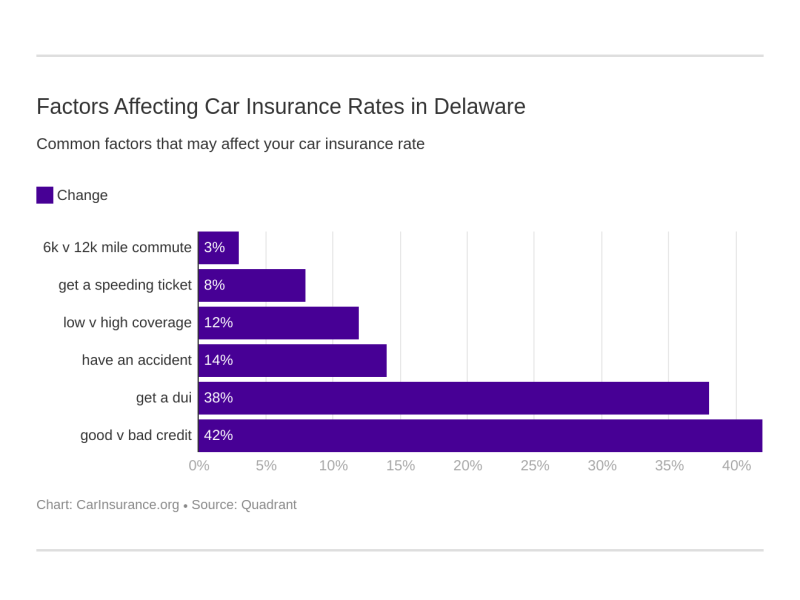

Keep in mind that the price of your car insurance depends on several factors. Therefore, the cost of your insurance may be different than the average.

By combining your auto and home policies, you can save on premiums in Delaware. You can save up to 12% on auto insurance and up to 20% on home insurance in Delaware.** Our customers have saved an average of $813 by combining their auto and home insurance.**

Minimum coverage requirements vary by state. Delaware state law requires Delaware auto insurance coverage to the following minimum limits:

Delaware Vehicle Color Change: Dmv Legal Guide & Insurance Regulations

Delaware state law requires you to show a copy of your auto insurance ID when asked by a police officer or other party if you are involved in an accident.

If you are a licensed driver in the state of Delaware, it is advisable to have a copy of your auto insurance certificate in your vehicle with your registration. Delaware is also among the few states that now accept electronic proof of auto insurance, and with the Hartford mobile app, you can store your auto insurance ID right on your phone. For more information, visit Google Play™ or the App Store.™

According to a 2021 Insurance Research Council report, 8.5 percent of Delaware drivers are uninsured, which is below the national average of 12.6 percent.

Getting into an accident with an uninsured or underinsured driver can be financially devastating. Delaware does not require drivers to have this coverage, but The Hartford offers this valuable coverage to give you peace of mind if you are involved in an accident with an uninsured driver.

Moving To Delaware

For added coverage, Delaware drivers may also be eligible for comprehensive coverage with additional coverage from the Hartford AARP Auto Insurance Program, including:

Delaware is a failed state. This means that you are responsible for paying for injuries or property damage caused by an accident that is your fault. Delaware requires drivers to purchase personal injury protection (PIP) insurance. This coverage helps with expenses such as medical bills and lost wages for the driver and his passengers. It can also help you pay for services such as babysitting or cleaning if you are unable to do so after a car accident.

When traveling in Delaware, there are a number of driving safety laws designed to protect you on the road. Here are just a few:

Delaware is one of 34 states that have seat belt laws, meaning authorities can ticket a driver or passenger for not wearing a seat belt without any other traffic violation.

Insurance Commissioner Karen Weldin Stewart Announces Delaware Now Allows Electronic Proof Of Auto Insurance

Getting a driver’s license is a rite of passage for teens, and Delaware wants to make sure teen drivers stay safe during it. Delaware has implemented graduated license laws to ensure that teenagers gain the experience and maturity necessary to be safe behind the wheel. Graduated license laws limit nighttime driving, limit teenage passengers, and ensure adequate amounts of supervised driving.

It only takes a few minutes to get a Delaware auto insurance quote from The Hartford. You can call a representative at 888-413-8970 or get a quote online. We help you decide which insurance products and services best suit your needs.

**Average savings based on information from customers who transferred to The Hartford from other airlines between 9/1/22 and 8/31/23. your savings may vary. The average savings on auto insurance is $577 and the average savings on home insurance is $236. Fees for AARP members and non-members vary by state and length of AARP membership. The auto/home discount is only available to policyholders who have auto and home insurance (or condo or renters) through AARP The Hartford Auto and Home Insurance Program. Hartford is not writing new business in all areas, including the states of CA and FL.

§ Availability of RecoverCare benefits and benefit levels vary by state. Hartford RecoverCare Advantage® is a registered trademark of The Hartford.

Aarp Delaware Car Insurance

‡‡‡ Based on car and driver; Individual price/premium/savings will vary depending on actual choice of coverage and vehicle/driver features.

Summaries of coverage and policy features are for informational purposes only. In the event of a claim, the current terms and conditions set out in your policy will determine your cover. AARP and its affiliates are not insurance companies. Notice paid. Hartford pays royalties to AARP for the use of its intellectual property. These fees are used for general AARP purposes. AARP membership is required for eligibility in most states. Hartford AARP Auto Insurance Program is underwritten by Hartford Fire Insurance Company and its affiliates, One Hartford Plaza, Hartford, CT 06155. It is insured in AZ, MI and MN by Hartford Insurance Company of Southeast; in California, by Hartford Underwriters Insurance Company; in WA, by Hartford Casualty Insurance Company; in MA, by the Trumbull Insurance Company; and in PA, by Nutmeg Insurance Company and Twin City Fire Insurance Company. Hartford’s AARP Home Insurance Program is underwritten by The Hartford Fire Insurance Company and its affiliates, One Hartford Plaza, Hartford, CT 06155. It is insured in AZ, MI and MN by The Hartford Insurance Company of the Southeast; in CA by Property & Casualty Insurance Company of Hartford; in WA, by Trumbull Insurance Company; in MA, by Trumbull Insurance Company, Sentinel Insurance Company, Hartford Insurance Company of the Midwest and Hartford Accident and Indemnity Company; and in PA, by Nutmeg Insurance Company. Domestic product is not available in all areas, including Florida. Savings, benefits and coverage may vary and some applicants may not qualify. The Application is not currently available in the territories or possessions of Canada and the United States. 1 In Texas, the auto plan is underwritten by Redpoint County Mutual Insurance Company through Hartford of Southeast General Agency, Inc. Hartford Fire Insurance Company and its affiliates are not financially responsible for insurance products underwritten and issued by Redpoint County Mutual Insurance Company. The home program is supported by Hartford Insurance Company of the Southeast. *Customer reviews are collected and compiled by The Hartford and are not representative of all customers. If you’re on a Galaxy Fold, consider unlocking the phone or viewing it in full screen to better optimize your experience.

Advertisers’ Ads Many of the offers that appear on this site are from companies that The Motley Fool receives compensation from. This compensation may affect how and where products appear on this site (including, for example, the order in which they appear) and may affect the products we write about, but our product ratings are not affected by compensation. We do not include all companies or offers available on the market.

Dana George holds a BA in Management and Organizational Development from Spring Arbor University. For more than 25 years, she has written and reported on business and finance and remains passionate about her work. Dana and her husband recently moved to Champaign, Illinois, home of the Fighting Illini. And while she doesn’t think the color orange is flattering on most people, she thinks they’ll really love Champaign.

Delaware Auto Insurance

Many or all of the products here come from our partners who pay us compensation. That’s how we make money. But our editorial integrity ensures that our product reviews are not influenced by compensation. Terms and conditions may apply to offers listed on this page.

Buying car insurance is not a fun idea for anyone. If you’re looking for the best car insurance in Delaware, there are types of coverage to consider, as well as driving record, deductibles, and possible discounts. Here, we help take the guesswork out of shopping for auto insurance in the First State by finding the best auto insurance companies with low rates and great customer service.

For a “normal” driver with a clean driving record, the cheapest car insurance in Delaware is available through Geico, with an annual average of $1,217.

4.50/5 Call with the letter I in. Our ratings are based on a 5-star scale. 5 stars are the best. 4 stars equals Excellent. 3 stars equals good. 2 stars equals Fair. 1 star equals bad. We want your money to work better for you. That’s why our rankings are focused on deals that offer versatility while keeping their own costs low. = Best = Excellent = Good = Average = Bad

Minimum Car Insurance Requirements By State: Complete Guide

Geico proves once again that its coverage is among the best auto insurance policies