- Car Insurance South Africa

- Jaecoo J7 Sales In South Africa

-

Why Is Car Insurance So Expensive

- Top-rated & Top-reviewed Car Insurance Companies In South Africa

- Car Insurance Statistics

- Cartrack South Africa

- Affordable Car Insurance South Africa

- 6 Cheapest Car Insurance Companies Of November 2024

- Chery South Africa Achieves Record Sales In October, Strengthening Its Position In The Local Market

- Car Make And Model: How It Matters For Insurance

- Understanding Car Insurance For High-risk Drivers In South Africa

Car Insurance South Africa – How much does car insurance cost in South Africa? To do this, you need to know a few things. Here are the basics and costs.

Thanks for viewing this article. We help South Africans manage their debt, protect their assets and get their money back. Make sure you qualify to learn more.

Car Insurance South Africa

Car insurance rates in South Africa range from R310 to R1,450 per month. Low prices start from R130 and high prices can go up to R2, 500+ per month. Other risk factors, such as the type of insurance, the price of the car and the driver’s claim history, affect the price.

Jaecoo J7 Sales In South Africa

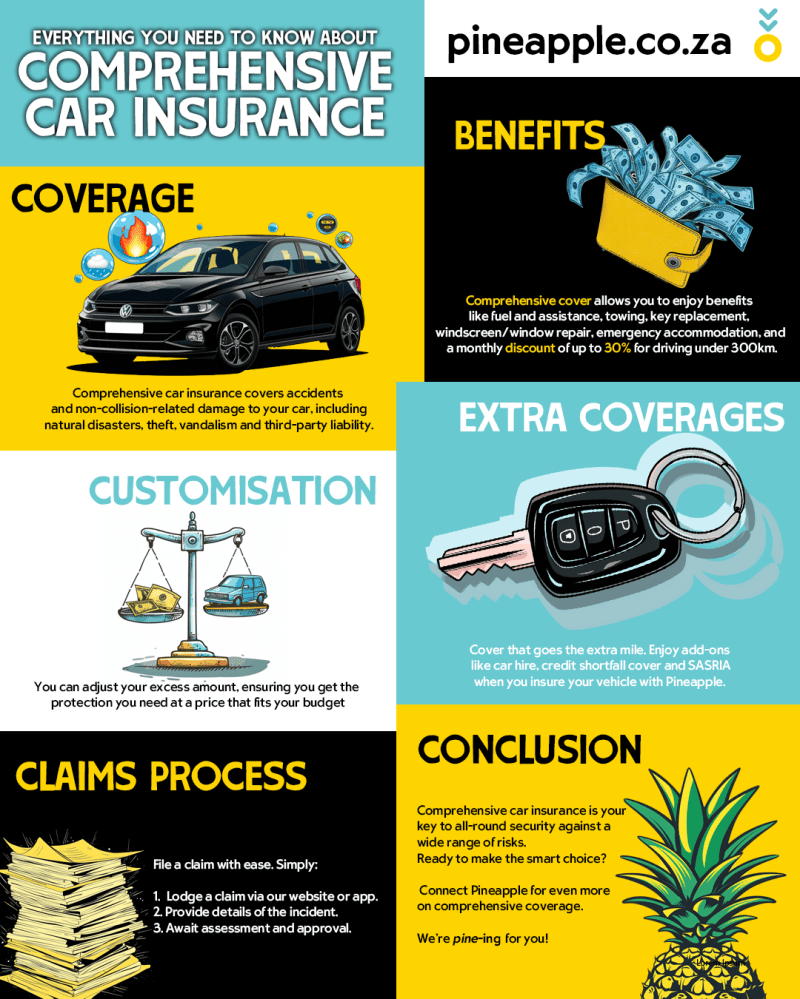

There are two main categories. Third party insurance usually costs less, comprehensive car insurance is more expensive. But it gives better coverage.

Third party insurance per month Rs. 120 to Rs. 500 can be spent in between. It depends on the price of the car and the risk of the driver. Third party insurance is cheaper and offers less protection. It covers damage to other vehicles and property as a result of an accident.

In SA we also get “third party, fire and theft insurance” which is a bit more expensive. But it also adds additional coverage for theft and… yes, you guessed it… fire damage.

Comprehensive coverage ranges from R400 to R2,500+ per month. Costs vary depending on the make and model of the car, driver risk and insurance premiums. Comprehensive car insurance covers most. This includes third party damage, theft, fire or accidental damage to the insured vehicle.

Compare Vehicle Insurance Quotes South Africa

Struggling to pay off your debts? Make sure you qualify to reduce your debt payments and set aside money for other expenses. Reduce my bill

There are three main types of car insurance and there are many variations. The three main types are comprehensive insurance, third party insurance, third party insurance, fire and theft insurance. Options include GAP insurance, collision coverage, roadside assistance and towing.

Third party insurance: This is the minimum amount of insurance cover. It covers damage to other vehicles or property caused by an accident, but not to your car.

Third-party, fire and theft insurance: This type of insurance is somewhere between third-party insurance and comprehensive insurance. It covers damage to other vehicles and property, as well as fire and theft of your personal vehicle, but not accidental damage to your vehicle.

Why Is Car Insurance So Expensive

Comprehensive insurance: Covers maximum coverage. It protects your car against third-party liability, theft, fire damage and accidents, regardless of who is at fault.

The average cost of car insurance in South Africa ranges from R310 to R1,450. Costs vary depending on the type of insurance, vehicle price, driver risk profile and excess. But most policyholders drive mid- to high-priced cars and have comprehensive car insurance, so this range provides an accurate estimate.

Remember, these are estimates. Mathematics is based on research and speculation. This is the best we can do, but it will give you a good idea of where your premiums will fall.

Follow these steps to calculate your annual or monthly car insurance premium based on the value and risk of your vehicle.

Top-rated & Top-reviewed Car Insurance Companies In South Africa

Start calculating the original premium by multiplying the value of the vehicle by a percentage. Most insurance companies don’t publish their rates publicly, so you’ll have to guess or make one up.

Then we multiply the base premium by the risk factor. Again, you are not a risk factor for using the right insurance companies. Imagine what risk the insured see you as. Then assign a value between 0.1 (low risk) and 0.4 (high risk).

In our example we have Rs. 10,000 basic transfer fee and assume a risk factor of 0.1 (10%):

Finally, we will calculate the monthly costs. It’s simple. There are 12 months in a year. So, divide the annual adjusted premium by 12.

Car Insurance Statistics

Insurance companies take all these factors into account. Each insurer has its own risk criteria. They establish a risk profile or risk level based on these factors that affect the overall cost of the insurance premium.

If you feel like you’re paying too much, why not shop? Get several quotes to compare prices. Switching can save you a lot of money every month and year. It’s worth looking around. Contents 1. Understanding UBI: How does it work? 2. Conventional car insurance: Breakdown3. Who should consider UBI? 4. Common misconceptions about UBI5. Finding the right fit: UBI and traditional insurance6. A resource for South African drivers7. conclusion

The beauty of life can be found in its evolutionary nature, like car insurance (which no one ever said would last). In this article, we look at the evolution of vehicle insurance by comparing traditional insurance with a new block policy offering, usage-based insurance (UBI).

Imagine paying for car insurance based on how much you drive, not who you are. This is basically how UBI works.

Cartrack South Africa

Usage-based insurance is a new form of vehicle insurance. It operates on a pay-as-you-drive model, using telematics technology to collect data on driving behavior rather than human risk.

Telematics technology typically involves installing a small device in your car or using a smartphone app to collect data about your driving.

After analyzing this information, auto insurance providers can adjust the monthly premium to accurately reflect the policyholder’s driving habits.

Note that not all UBI apps track metrics. Some focus on core portfolios, while others provide more detailed analysis.

Affordable Car Insurance South Africa

The days of calculating car insurance premiums based on your age, demographics, marital status and number of dependents are soon numbered.

Usage-based insurance encourages responsible and safe driving and can provide savings for conscientious policyholders. This is good news for drivers who rarely ask their insurance companies: the safer you are, the less you drive, the lower your premiums!

If your telematics data shows frequent speeding, sudden braking or a lot of night driving, the insurance company will consider you a higher risk and increase your monthly insurance premium.

At the claim stage, the data can help confirm details such as the time and location of the accident and help resolve your claim.

6 Cheapest Car Insurance Companies Of November 2024

For example, if you claim you were involved in a rear-end collision, but your telematics data shows you braked hard before the collision, this could raise questions about your role in the accident.

But before you worry, while the data can be used to investigate, the point is to investigate the claims themselves, not necessarily assign blame.

In addition, insurance providers must comply with data privacy regulations. They mean that telematics data cannot be used in a way that is not expressly stated in the policy contract.

Traditional auto insurance often uses a fixed factor to determine the amount of the insured’s monthly premium. These factors include, but are not limited to, the driver’s age, location, vehicle type, driving and insurance history.

Do I… Lie Or Tell The Truth To My Insurance Company? 🧐🔌 . . . . . . #insurancetiktok #insurancetips #carorhome #insurnaceclaims #discoveryinsure

Unlike UBI, it does not involve the personalization of already existing insurance. Instead, it offers standard policy options such as liability, third party protection and comprehensive coverage, which are still useful for vehicle insurance policies.

However, unlike a UBI policy, traditional coverage does not require the installation of additional hardware or software. It depends on certain and available factors.

In addition, traditional insurance does not continuously monitor your driving habits, which can be a privacy concern for some.

Finally, if you are someone who drives a lot (for work or other reasons), a traditional insurance policy may be cheaper.

Chery South Africa Achieves Record Sales In October, Strengthening Its Position In The Local Market

Usage-based insurance premiums depend on a driver’s unique driving behavior. So drivers who don’t normally travel long distances and know how to brake easily have reason to celebrate.

If you know how to control your driving behavior, the potential for insurance savings is huge. The better you drive, the higher your insurance premium will be.

As mentioned earlier, insurance providers often calculate premiums for conventional policies based on fixed factors. Generally, the best way to get good insurance premiums (besides negotiating like a boss) is to have a good risk profile and a good car insurance history.

Long-term auto insurance coverage and no claims show a responsible attitude and low risk profile.

Car Make And Model: How It Matters For Insurance

There is almost no difference in UBI coverage from conventional insurance policies. UBI provides you with the same level of basic coverage as conventional insurance to protect you against accidents, theft and other unforeseen events.

Of course, ‘conventional insurance’ is a broad term that can be broken down into the types of car insurance policies offered by most insurance companies in South Africa.

Standard policies often encourage policyholders to offer discounts based on their claims history. Depending on the insurance provider, incentives may include lower premiums, cash-back options or other benefits such as discounts on ambulance or other insurance products.

UBI can offer similar benefits, but goes further by including additional benefits to reward excellent driving behavior.

Understanding Car Insurance For High-risk Drivers In South Africa

Usage-based insurance is often ideal for drivers who use their car on weekends, occasional trips or short distances. This type of insurance is best for low mileage, safe drivers and those who want to save on premiums and prefer private insurance.

If you