Car Insurance Uk Price Increase – The cost of car insurance is rising rapidly – drivers now pay on average £251 more for an annual policy than a year ago.

Motorists are being warned to expect sums of up to hundreds of pounds when they need to renew their insurance as the car market takes a hit from high inflation.

Car Insurance Uk Price Increase

The latest figures from Compare the Market, which has been tracking price increases, suggest drivers will need an extra £251 on average to cover the average cost of a new policy.

Car Insurance Renewals, Lapsing, And Dual Pricing

The sudden rise appears to have hit young drivers hard – motor insurance for under-24s has risen from £1,200 a year ago to around £1,800 last month.

In July, price comparison site Confused.com warned that drivers could be in for a “shock” as inflation, rising mechanical repair bills and insurance premiums in the wake of Covid-19 show signs of rising prices.

The latest market benchmarking data, which compares insurance prices in August 2022 with the previous month, shows that drivers of all ages are being squeezed, although young drivers are currently paying around £600 more.

Julie Daniels, director of Compare the Market, said: “The rising cost of car insurance is worrying many drivers.

The Effects Of Covid 19 On Hgv Insurance Prices

“A comparison of the latest market data shows that the average car insurance premium increased by £251 per year, reaching £794 in August 2023. The increase in insurance premiums was partly due to an increase in the cost of insurance premiums. for insurance companies.

“For drivers looking to save on car insurance, one of the best ways to secure great rates is to compare prices online.”

Consumer champion Martin Lewis is among those concerned about the rapid rise in car and home insurance prices. It encourages drivers to check their policies, even if the renewal date is not imminent.

In a report published on the Money Saving Expert website, he explained: “My email inbox was quickly flooded with angry customers reporting a huge increase in insurance renewals.

New Driver Insurance Uk

“Insurers say this is due to factors including rising car repair costs, rising demand for housing and general inflation. Whether it’s worth it or not is debatable, car insurance is an impulse purchase, you have no choice. That’s why I challenge Clarion: take a few minutes to check whether you’re overpaying. If so, you can lock in the price to avoid future increases for a year, even if you’re not close to renewing your contract.”

Vote for the Kent & Medway Food & Drink Awards and win a champagne lunch at The Ivy

Education Directory Having trouble finding the right nursery, school, college, university or training provider in Kent or Medway? You will find everything you need in our educational catalog!

Close This website uses cookies. By continuing to browse the site, you agree to our use of cookies. Learn more According to the latest data from Consumer Intelligence, the average cost of car insurance has increased by 67% in the last 12 months. This is due to inflation – many car insurers are increasing the prices of replacement cars and repairs – as well as rising claims. These additional costs are passed on to consumers in the form of higher prices.

Car Insurance Renewal Hi-res Stock Photography And Images

Climate change also has an impact. The increasing occurrence of extreme weather events, such as flooding and hurricane damage to homes, can increase accident and insurance payouts, as well as vehicle damage. As providers pay more for claims related to these events, auto insurance premiums have increased in response.

Insurance fraud is another major cause of rising car insurance premiums. Figures published by the Association of British Insurers (ABI) in August 2023 showed that around 42,500 cases of car fraud were detected last year, accounting for two-thirds (59%) of all fraud claims. To combat false claims, insurers have invested in fraud prevention measures and passed on these additional costs to policyholders.

Key anti-fraud measures include abolishing the right to general compensation for soft tissue injuries to combat fraudulent claims, and encouraging the exchange of insurance data and cooperation between regulators and the insurance industry. The upper limit for personal injury claims that can be met by the small claims court has also been increased from £1,000 to £5,000.

We commissioned a survey to ask you what you think about car insurance in the UK and the affordability of annual policies after costs have skyrocketed over the last few years. We also wanted to find out how these increases have affected your costs, as well as what changes you might consider making to keep your car insurance premiums low.

Car Insurance Excess In Singapore. Your Smart Guide

We asked respondents what they thought about the recent price increase and how affordable their car insurance was compared to previous years. We also wanted to find out how concerned drivers are about the future affordability of car insurance if costs continue to rise.

When asked what their last car insurance premium was, half (46%) said current car insurance costs were between £251 and £500, while a quarter (25%) said recent car insurance costs ranged from from £501. and 800 pounds.

Almost half of drivers (45%) said the cost of their previous car insurance was between £251 and £500, while 21% said the cost of their car insurance last year was between £501 and £800.

In the past, 14% of drivers paid less than £250 for car insurance. – How much are you paying now? only 7% said it cost less than £250. A further 7% saw their costs increase, with half of those surveyed saying their premiums had increased by up to £100. A staggering 49% confirmed they were currently able to pay their bills but that further increases would cause financial difficulties.

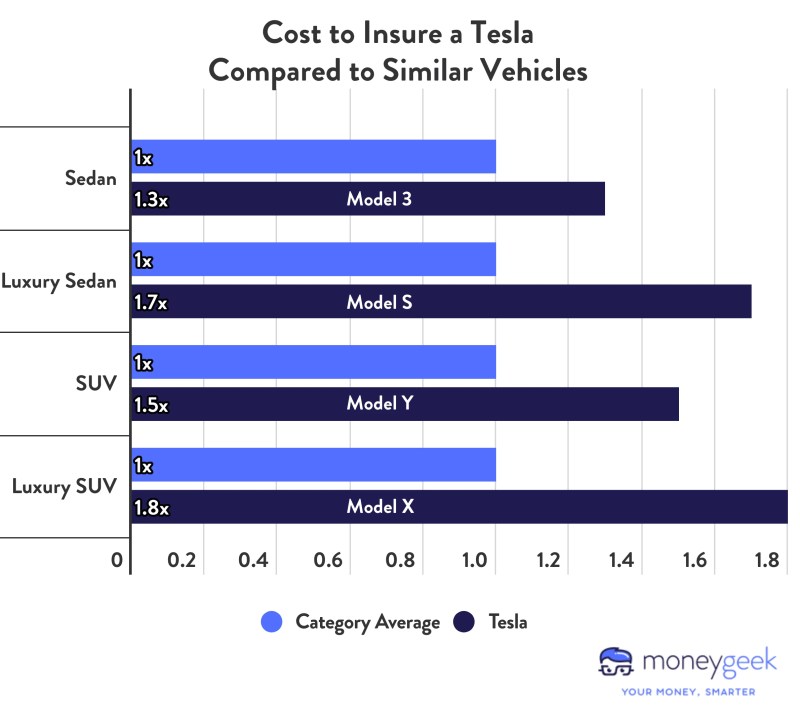

How Much Does It Cost To Insure An Electric Car?

When we looked at some of the responses from different age groups, we found that higher car insurance rates disproportionately impact Gen Z drivers compared to other age groups.

Interestingly, over a third (33%) of 18 to 24-year-olds saw their car insurance increase by between £101 and £250 at renewal, but for all other age groups the majority chose an amount between £1 and £250 pounds. 1. 100. Nearly half of Gen Zers (43%) believe there is no reason to increase prices.

Looking at how Gen Z pays for car insurance, it seems that they, too, are choosing the more expensive option. Half (50%) of 18-24 year olds, the most of any age group, said they paid for their car insurance in monthly installments set by the insurer.

Gen Z is also considering radical changes to save money: 17% say they are considering getting rid of their car altogether because car insurance costs are too high, 26% are considering downsizing, and 25% say they use public transportation. vehicle to reduce the number of kilometers traveled.

19 September: Martin’s Car & Home Insurance Alert

With costs for drivers rising, we wanted to use a survey to find out whether they felt they were getting good value for money with their current car insurer due to rising prices.

Almost two fifths (37%) said the level of protection they received was good value for money. Although many people are concerned about high prices, 34 percent are dissatisfied and believe that there is no reason for annual price increases.

Interestingly, a fifth (17%) said that while they felt they were getting good value for money, further price increases would challenge this situation.

We wanted to find out what changes drivers are making to save money and help raise their car insurance premiums. With rising costs for homeowners everywhere, it’s no wonder drivers are looking for ways to save money.

The Rising Cost Of Uk Car Insurance

More than a third (35%) of respondents said rising costs meant switching from upfront payments to monthly payments to make car insurance payments easier to manage, even though this would be a more expensive solution in the long run.

Non-essential expenses will also suffer, with almost a quarter (23%) saying they would cut spending to increase their car insurance premiums.

Interestingly, 20% are considering downsizing their car to cut costs, and 16% are considering using public transport and lowering their mileage to reduce insurance costs. Another 14% are considering increasing their insurance coverage to lower the overall cost of insurance premiums.

Surprisingly, only a quarter (25%) of UK drivers say they can afford their car insurance as is.

Why Are Low Mileage Drivers Charged More?

The survey asked how British drivers look for the best deals when their premiums run out, what methods people use to save money and whether they need more advice on the best way to get the best deal. they are. This is especially important when costs are rising everywhere.

Our findings show that the majority of respondents (78%) use a price comparison website to compare offers and find the best one for themselves.

At this time