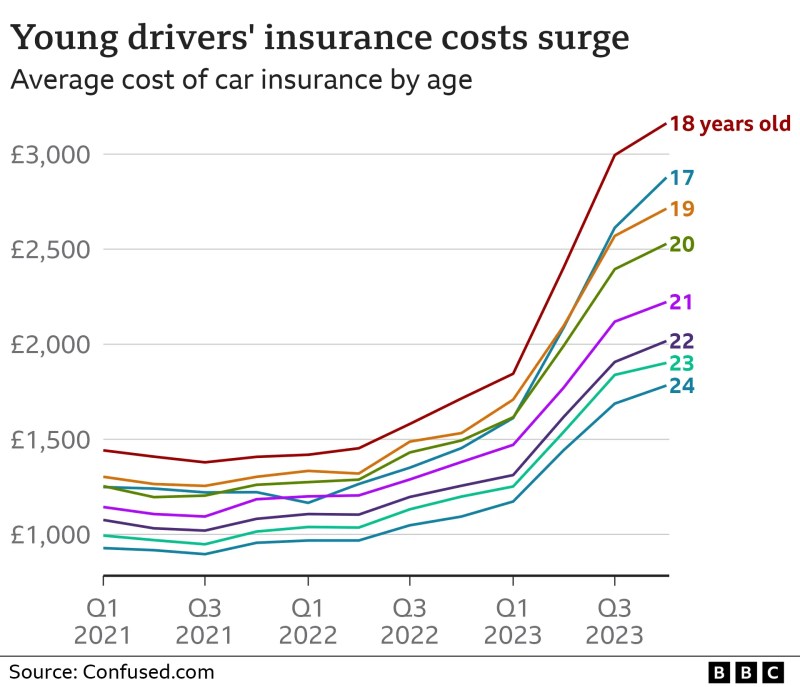

Car Insurance For Indian Licence In Uk – According to the data, young drivers are the ones who are most affected by insurance premiums. The most expensive car ever, some face an administration fee of almost £3,000.

Confused.com, a price comparison company, said the average 17-20 year old has seen their insurance rise by more than £1,000 since the same time last year.

Car Insurance For Indian Licence In Uk

Steve Dukes, managing director of Confused.com, told Radio 4’s Today programme: “The frequency of claims has increased in the last two years since the pandemic, and so have the costs.

The World’s Strongest Driving Licences

“Used car prices are higher than ever, parts costs, repair labor costs – and it’s all passed on to the consumer.”

The price of used cars – the first vehicle commonly used by newly qualified young drivers – has fluctuated for months amid the Covid pandemic. Demand for used cars is increasing as production of new vehicles declines due to global shortages of computer chips and other materials needed for production.

By March 2022, the price increase in the used car market will increase to 31%, according to the Central Bureau of Statistics. Since then, the number has decreased significantly.

But young riders face the highest jump. For 17-year-old drivers, premiums rose from an average of £1,423 to £2,877. For an 18-year-old driver, the average policy price stands at £3,162.

Young Drivers Face £3,000 Cost For Car Insurance

The data is calculated as an average of the five best offers found on Confused.com, not the price paid for the policy.

Dukes said there are ways to reduce premiums. “When they can legally share the ride with an older, more experienced driver and add that person as a named driver, this can have a huge impact and reduce the cost by hundreds of pounds, it’s definitely worth considering,” he said. . .

Dukes also advises young drivers to explore the use of telematics, or “pay as you drive”, insurance, where their behavior on the road is shared with their basic insurance provider or occasional motorist insurer.

But he said with prices rising for the 17-20 age group, many young drivers had to consider whether they were capable of driving.

Cheap Car Insurance For 18-year-olds

“The industry needs to be careful not to encourage young drivers to switch to other modes of transport and this is a real risk when transport costs are so high,” he said.

The Association of British Insurers (ABI) says that although car insurance is expensive, there are ways to reduce costs.

He added that it was important for motorists to never drive without cover and urged anyone struggling to afford it to speak to their insurer.

However, the ABI said that insurance is still risk-based and its data shows that the average cost and frequency of claims are higher for younger drivers, which may affect premiums.

How To Get A Pco Licence In 2024

According to ABI’s analysis of 28 million policies, the cost of motorist insurance has increased between July to September average of £561, up 29% compared to the same time last year 2022.

The association said the figure was based on the price customers paid for their cover, not the price they were quoted.

Please enter the contact number if you want to talk to the reporter. You can also contact us through the following methods:

If you are reading this page and cannot see the form, you will need to visit the mobile version of the website to submit your question or comment or you can email us at [email protected]. Please include your name, age and location with any submission.

Get Your Idp Online For India In 8 Minutes

21 hours ago firefighters urged drivers to stop to watch Essex Fire Service issue an appeal after a van was parked at the entrance to a fire station. 21 hours ago Essex

2 days ago the driver with 229 points still has a valid driver’s license, there is a call to review the ban exemption as the data shows that hundreds of people can drive with penalty points. 2 days ago Wales

3 days ago Motorists who buy cars through financing could get a share of billions The auto finance industry is putting up billions to pay possible claims after court cases. 3 days ago Wales

6 November 2024 “Dartford Charge Ended With Officers On My Doorstep” The Dart Charge has raised almost £112 million since 2019, it has been revealed. November 6, 2024 UK

Health Insurance For Nris: Compare & Buy The Best Plan

November 6, 2024 Do bright headlights really dazzle drivers? Specialist cars will be fitted with a headlight level measuring instrument.6 November 2024 UK When a driver’s license expires, we usually approach an agent. However, you can apply for renewal of your expired driver’s license and pay online. You can register online and send a copy to the RTO office.

Step 1 All information such as driving license and registration details are available on the website. Department of Motor Vehicles website (www.parivahan.gov.in). Go to the Parivahan website. On the website, ‘Vahan’ handles vehicle-related procedures and ‘Sarathi’ handles licensing issues. Click Sarathi, select the driving service and then the state where you got your driver’s license. All SIM-related services appear on the screen.

Step 2 Select ‘DL Service’ (SIM Service). Enter the license number and date of birth and details about the license holder will appear. If the details are correct, click on the ‘Yes’ option. Then select “Renew SIM”. The option to update your phone number will be shown to you. If you have not updated your mobile number, do so and you will immediately receive a reminder. Number of applications in the form of SMS.

When you apply for driver’s license renewal, you will be given the option to download the Self-Declaration Form, Form 1, Form 1A, and Form 2. These are the Health Fitness Form, Eye Certificate, and Fitness Form. Download and print. The form includes your photo and digital signature. Visit the medical officer and eye doctor, check yourself and get their signature on the form.

International Auto Insurance: Everything You Need To Know

Step 4 Open the application window after providing the application number and date Your birth year, scan and upload all files. When scanning, make sure the stamp and registration number of the ophthalmologist officer is clear. Then pay the fee online and then submit the application. Once the online process is completed, submit the photocopies of all the documents to the RTO along with the original driving license. Also, give an envelope with your complete address with PIN code and phone number, as well as a stamp of Rs 42. The license will arrive at your home. Due to the situation, the period of all driving licenses has been extended until December 31. Applications can be submitted through Akshaya Kendras or E-Seva Kendras.

How to Change Address If you want to change the address on your driver’s license, you can apply through the “Change Address” option on the Parivahan website. Address can also be updated during SIM renewal. This service will cost 260 Rs. You need to upload all the documents required to change the address.

RTO Appointment You need to make an appointment with the RTO when you change your address, when you apply for a duplicate driver’s license, or if you want to change your driver’s license. On the day of the appointment, you must appear at the RTO with self-declaration.

Grace period If you apply for the renewal of your driver’s license within one year after the expiration of the valid period, you can do so without paying any fine. If after one year, you must follow the necessary steps to apply for a new driver’s license. Up to five years, you only need to take the second part of the road test. If it is more than five years old, you should do the first soil test (H test). Now, you can renew your license in the last year of its life.

Car Insurance In Italy For Expats

Black List If you are involved in criminal activity, your driver’s license will be black listed. You can get your name off the blacklist only after paying a fine, after completing requirements such as license suspension, or after attending court in person. Foreign license, you may want to use the car of a friend or relative when visiting them, or traveling to the UK. Taking out a temporary insurance policy for non-UK residents is the perfect solution. This is a separate insurance policy that only covers unlicensed drivers in the UK when they use a loaner car. The coverage period starts from one day, however you can choose the coverage period you want, two days, three days, one week, one month, up to three months under the foreign permit if you are visiting the UK for a longer period. Most short term insurance providers do not offer cover to non-UK residents, and those who do not hold a UK driving licence. That’s why we’ve created temporary car insurance for foreign drivers in the UK.

We’re here to provide you with temporary car insurance even if you don’t normally live in the UK. Maybe you are visiting friends or family or even on a business trip and you need insurance