How Does Car Insurance Work In Malaysia – Car insurance is an important aspect of car ownership and provides financial protection in the event of an accident, theft or damage to your vehicle.

Understanding the ins and outs of car insurance is important in Malaysia to ensure responsible and safe driving. This comprehensive guide will walk you through the essentials of auto insurance, from coverage types to factors that affect premiums.

How Does Car Insurance Work In Malaysia

Car insurance in Malaysia usually offers several types of coverage, each suitable for a specific purpose. Choose between traditional insurance plans or Sharia-compliant Takaful plans.

A Guide To No-claim Discount Rate (ncd)

Understanding these types of coverage will help you make an informed decision when choosing the insurance that best suits your needs.

This is the minimum requirement for car insurance in Malaysia. This covers personal injury or death or property damage to third parties.

This provides broad protection, covering liability and damage to your vehicle due to an accident, theft or natural disaster.

Depending on your specific needs, you can enhance your coverage with add-ons like windshield coverage, flood coverage, and special perils coverage.

Understanding Cart In Car Insurance Policy

Several factors affect the cost of car insurance in Malaysia. Knowing these factors can help you manage your insurance costs more effectively.

NCD is a compensation system provided by insurance companies to policyholders who do not file claims during the insurance period.

Discounts accumulate over several years, resulting in significant premium savings. NCD rates increase each year without a claim and can be as high as 55% after five years without a claim.

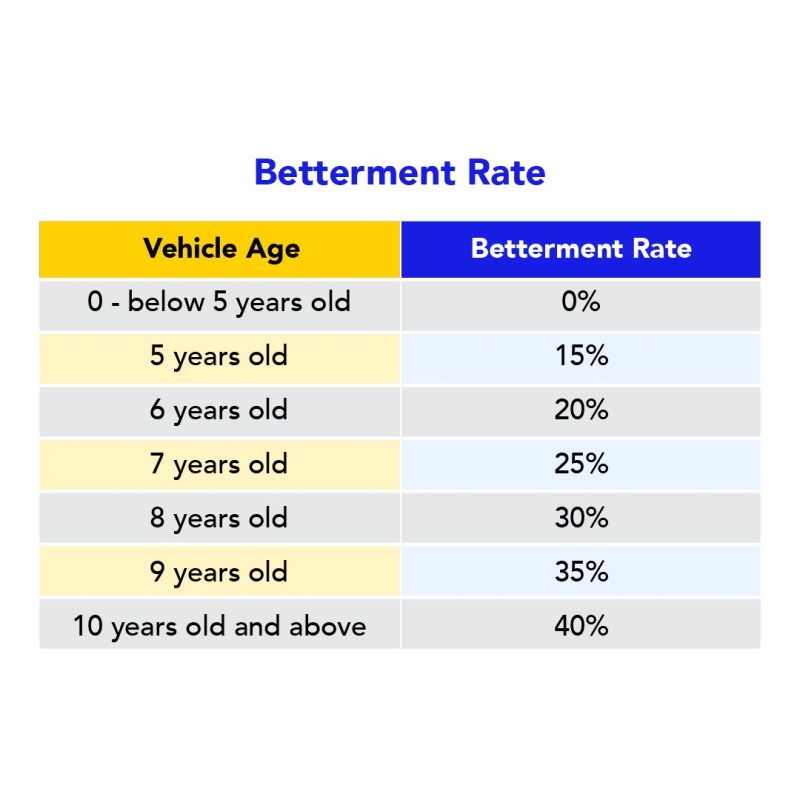

Tip: If you are involved in a car accident caused by you, continue to file a claim and your NCD will reset to 0% for the following year. Therefore, you should always consider whether it is worth paying out of pocket for the damage to your and/or the victim’s vehicle, or filing a claim and facing more expensive renovations in the years to come. Do the calculations according to the table above and find out!

Which Is 2024 Most Fuel Efficient Car In Malaysia?

Understanding the auto insurance claims process is essential for a smooth experience during these difficult times. The general steps are:

Renewing your car insurance is a simple process, but it’s important to make sure your policy doesn’t lapse. The steps are as follows:

Buying car insurance can be overwhelming because there are so many options. Here are some tips to help you find the best coverage.

Car insurance is more than just a legal requirement. It is a safety net that protects you and your vehicle. Understanding the intricacies of car insurance in Malaysia can help you make informed decisions and ensure you have the right coverage at the best possible price.

Psv License Process With Grab

Regularly reviewing your policies, being a responsible driver, and staying up to date on regulatory changes will help you have a safe and worry-free driving experience.

Are you considering switching to a new insurer or looking for the best option for your financial situation? Look no further and check out these car insurance products. In this article, we will inform you about the latest important tax-related notifications. There are a total of 17 tax components that companies should be aware of. Scroll down for more details!

If the company incurs road tax, car insurance, repairs and maintenance costs on non-business vehicles, including the car owned by the seller, these will not be deductible for tax purposes unless the company declares a gain in kind. / Required for the EA of the respective owner. Record the owner’s name in the ledger.

:max_bytes(150000):strip_icc()/certificate_of_insurance.asp-final-1ea2d171486e4511af547e5d8c2b843a.png?strip=all)

Wiring costs, like installing a new car, are not tax deductible. Wiring costs for repair purposes are tax deductible. Clearly record the nature of wiring costs in your general ledger.

Malaysia Has Made Refinements In Vep Application Process, But Room For Improvement Remains, Say Analysts

*For non-SMEs, SVA is limited to a total of RM20,000 per assessment year.

Typically, repair and renovation costs are billed as a deduction from the individual’s gross income from his or her business or rental income sources. Section 33(1)(c) of the ITA allows deductions for costs incurred in full:

Expenses for repairs and renewals of assets generally of a capital and income nature include:

Repair or replace/change the original condition of the property as an improvement or upgrade to the property;

Modifications That Make A Car Uninsurable

Replacement and renovation of appliances, fixtures or items with an expected useful life of two years or less.

BIK is a benefit that has monetary value but cannot be converted into cash. Non-collectible language means that when a benefit is provided to an employee, the benefit cannot be sold, transferred, or exchanged for money, either due to the employment contract or the nature of the benefit itself.

The company must calculate the corresponding benefits in kind from the employee’s EA, such as the company car used by the director. When calculating your monthly tax deduction (PCB), you must also take into account the corresponding BIK and divide the BIK value by 12 months.

Non-company vehicle gas costs are allowed and no prerequisites are required if claimed as miles through the claim form or as fuel costs paid per trip. Only the total price of fuel paid according to the benefit will be taxed.

Malaysia Travel Advice & Safety

1. To claim travel expenses based on mileage, you will need to submit a claim form and indicate whether the expense was incurred based on the client and purpose.

2. If you charge for petrol, only up to RM500 per employee per month (RM6,000 per year) will be exempted; Any excess amount will be declared mandatory on the EA form or the remaining amount will be added back by IRBM. Amount incurred.

Ang Pow paid to employees with the pure intention of celebrating the festival must be justified by providing a list of employees and the same amount will be paid to each employee. Otherwise, a replacement of the voucher may be considered. Included on the employee’s EA form.

Wages paid to part-time or contract workers must be supported by appropriate supporting documentation, such as pay stubs, pay stubs (bank transfer recommended), time sheets, and daily time sheets/logs (if available). ).

Road Accidents In Malaysia: Top 10 Causes & Prevention

In addition to this, recent changes to Form E guidelines state that all types of employment at a company (including permanent, internal, part-time and contract salaries) must be reported. The recent audit of employer files by the IRB requested reconciliation between data presented on Form E and wages reported on the income statement.

Compensation paid to disabled employees is subject to double deduction. In this regard, please provide the documents and information below for your tax deduction claim.

· Salaries, wages, overtime, commissions, bonuses, allowances, bonuses or incentives, commissions, benefits, Employee Share Option Scheme (ESOS) and taxes payable by the employer.

Remuneration paid to senior citizens/insured persons/former medical personnel who are purely employees is subject to double deduction. In this regard, please provide the documents and information below for your tax deduction claim.

5 Banks That Offer The Best Car Loan In Malaysia [2024 ]

Companies are considered small and medium-sized enterprises (SMEs) for tax year 2020 and can enjoy preferential tax rates if they meet the requirements below.

1. Total revenue from all business sources for the year is less than RM50,000,000;

2. The paid-up capital of the company’s ordinary shares of less than RM2.5 million at the beginning of the base period;

3. None of the relevant companies has paid-up capital per ordinary shares exceeding RM2.5 million;

Malaysia Simplifies Vep Renewals And Car Deregistration With New Online System, Says Anthony Loke

To support flexible working arrangements, the government has allowed a special deduction for employers who incur the cost of smartphones, tablets or personal computers provided to employees starting in tax year 2020.

In this sense, it may be a good idea to create a special account book and segregate it by employee for easy tracking, or rename each transaction by employee.

Note: The above conditions apply only to eligible residents/entities within Malaysia. Costs incurred are paid to workers and are therefore not considered fixed assets of the employer.

Landlords who offer rent discounts of at least 30% to small business tenants are eligible for special discounts on rent discounts.

Allianz Motor Protect

The government has introduced incentives from March 1 to December 31, 2021 under the economic stimulus package to combat the impact of COVID-19. The total cost of renovations eligible for special deductions carried out during this period is RM300,000.

These rules do not apply if the taxpayer has claimed separate deductions for allowable expenses or capital allowances to avoid double-claiming issues.

There are several benefits that are eligible for tax deductions for the company and at the same time pass into the hands of the employees. However, the exemption does not apply to controlling/controlling directors.

The usual annual capital allocation rate is 10% or 14% (depending on the type of asset), but the government has published new rules for what is considered an “accelerated annual rate” of 40%.

Enterprise Car Rental Insurance Guide: What You Need To Know

Under the Rules, you incurred Qualified Factory Expenses (“QPE”) on machinery and equipment (including information and communications technology equipment (“ICT Equipment”)) for business purposes between March 1, 2020 and December 31, 2021. person who is going to pass. The Accelerated Capital Allocations (“ACA”) are: