Car Insurance Australia Cheapest – Our goal is to help you make smart financial decisions, and our award-winning comparison tools and services are free. As a marketplace business, we earn money by advertising and displaying products on this page with referral links and/or other paid links where the provider pays us if you visit their site or buy a product from them. . You don’t pay extra to use our service.

We pride ourselves on the tools and data we provide, and unlike other comparison sites, we include the ability to search for all products in our database, whether or not we have a business relationship with the suppliers of those products.

Car Insurance Australia Cheapest

“Sponsored,” “Hot Deal,” and “Popular Product” labels indicate products for which a supplier has paid for prominent advertising.

How Car Insurance Premiums Are Calculated

“Sort order” refers to the original sort order and does not imply that any products are better than others. You can easily change the sort order of the products displayed on the page.

Terms, conditions, exclusions, limitations and sub-limitations may apply to all insurance products listed on the Website. These terms, conditions, exclusions, limitations and sub-limitations may affect the benefits and level of coverage available for all insurance products listed on the Website. Before making any decision about an insurance product, please refer to the relevant product disclosure statement and target market definition on the provider’s website for more information. We all know it’s important, but finding the cheapest car insurance in Australia can be a real pain. With so many insurance companies and policies, you are overwhelmed.

Good thing you’re in the right place! Come in and find out what makes cheap car insurance and why you need it, and later we’ll reveal the cheapest car insurance in Australia! Are you excited? And tie it!

Car insurance is compulsory in Australia. It is a legal requirement to have at least compulsory third party insurance (CTP) before you can register and drive your car on public roads.

Pd.com.au Pet & Car Insurance

There are four main types of car insurance in Australia, but they are divided into two – compulsory and optional.

It is important to note that while CTP insurance is mandatory, the choice of the other three types depends on your personal needs and budget.

Australia car insurance companies are all over the place, but which one is the cheapest? Through our extensive research, we’ve found four of the cheapest car insurance providers in Australia, each offering the best value for your money while keeping you safe.

Youi stands out as the cheapest car insurance in Australia, but also prides itself on quality customer service. They are just a phone call away and will be happy to help you with your car insurance questions. About 93% of their customers are satisfied with their customer service.

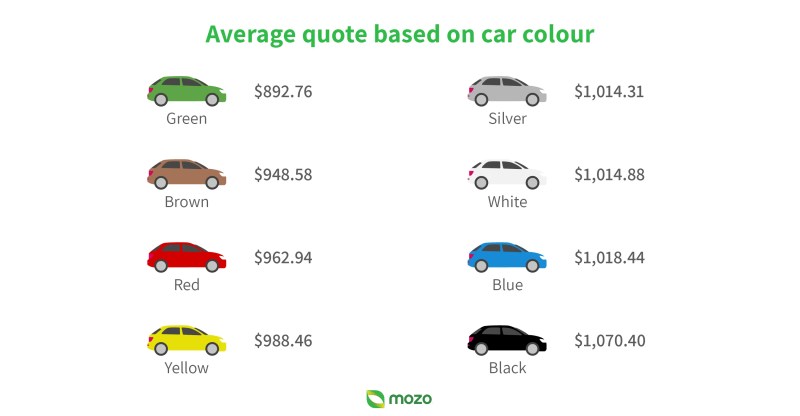

Mozo Car Insurance Report 2024

The Youi car insurance plan starts at $1,359, with up to $750 in value and up to $1,000 in coverage if you lose your car keys or leave them in your car. If needed, they also offer car repairs or trade-ins for a new car.

Another advantage of Youi is that its car insurance plans come with automatic roadside assistance, which most insurance companies do not. This makes your insurance plan even better because they are ready to help when the going gets tough.

If you are looking for the best value car insurance provider, look no further than Budget Direct who offer the cheapest car insurance in Australia.

They offer comprehensive but budget-friendly premiums that work like any other insurance company, with prices starting at $992. For example, after a fire, theft or damage, their comprehensive plans depend on protecting your car and other assets. Your policy type.

Finding The Cheapest Car Insurance In Australia

Your plan covers up to $500 of personal items and an additional $1,000 for replacement locks and keys. They also offer compulsory CTP and third party car insurance plans.

Like Youi, Budget Direct also offers car repairs through partners across the country, ensuring you’re back on the road in no time. And if you’re a new customer, you can get up to 15% off your application.

All of this is reason enough to award Money Australia the Budget Direct Insurer of the Year award, proving its quality as Australia’s cheapest car insurance for eight years in a row.

If you are a young driver and don’t want to commit to a car insurance plan for a long time, then ROLLiN’ Car Insurance digital platform is the right place for you. One of the cheapest car insurers in Australia, its benefits depend on its appeal to young drivers and those who want to cancel their insurance plans at any time.

Choosing The Right Car Insurance

Unlike other providers, ROLLiN’ will not charge you extra based on your age. The base fee for each driver starts at $800. FYI, other providers charge extra if you are under 25.

They also offer agreed value cover, which gives you more control over your payment if your car is written off. And, if you want to cancel, you won’t pay any exit fees. Other providers may charge up to $40 to cancel a plan.

While it will keep the lock and key replacement up to $1,000, it doesn’t offer coverage for your belongings, which can be important.

The crown for the cheapest car insurance in Australia belongs to Bingle. The average car insurance policy in Australia costs around $1,400, with Bingle’s offer starting at $862.

Put The Brakes On Expensive Car Insurance

The cheapest price because it covers only the essential parts of an auto insurance plan, such as coverage for accidents, property damage, and potential injuries to you or those around you. Plus, you can pay in monthly installments, unlike the annual lump sum offered by other providers.

But even the low price has its caveats. As it only covers basic driving needs, Bingle does not have roadside assistance or personal items cover. But it retains the options of changing the lock and key and exchanging for a new car.

Have you chosen the cheapest car insurance in Australia? By checking out their offers, you can save money without sacrificing coverage. Remember, it’s all about balancing cost and protection when finding the cheapest car insurance in Australia. Cheapest car insurance in Australia

And while you’re at it, why not check out Motor Matcher for your next car? We host trusted dealers that sell quality vehicles to meet your driving needs, from budget options to luxury vehicles. With Motor Matcher you can find your perfect car and save on your car costs.

Lead Generation For Brokers

Welcome to Motor Matcher! The fast and easy way to compare, buy and sell new and used cars online. Our goal is to help you make smart financial decisions, and our award-winning comparison tools and services are free. As a marketplace business, we earn money by advertising and displaying products on this page with referral links and/or other paid links where the provider pays us if you visit their site or buy a product from them. . You do not pay extra to use our service.

We pride ourselves on the tools and data we provide, and unlike other comparison sites, we include the ability to search for all products in our database, whether or not we have a business relationship with the suppliers of those products.

“Sponsored,” “Hot Deal,” and “Popular Product” labels indicate products for which a supplier has paid for prominent advertising.

“Sort order” refers to the original sort order and does not imply that any products are better than others. You can easily change the sort order of the products displayed on the page.

Bupa Car Insurance

Terms, conditions, exclusions, limitations and sub-limitations may apply to all insurance products listed on the Website. These terms, conditions, exclusions, limitations and sub-limitations may affect the benefits and level of coverage available for all insurance products listed on the Website. Before making any decision about an insurance product, please refer to the relevant product disclosure statement and target market definition on the provider’s website for more information. .

The online car insurer has won the Low Cost category in the Finder’s 2024 Auto Insurance Awards for its average comprehensive cover of just $862.

RELATED: Aussies are switching car insurance companies – these are the companies they choose. RELATED: Ignoring a Rain Warning Could Get Your Insurance Claim Denied?

Bingle’s premiums were “substantially cheaper” than other car insurance providers, according to the Finder study, which included more than 1,900 quotes from 37 car insurance companies using 60 different user profiles.

Australia’s Biggest Car Insurance Companies In 2023

Runners-up in the “Low Cost” category were Rollin’.