- Car Insurance Ombudsman Australia Phone Number

- It Was A Disaster’: The Problem With Electric Car Insurance Claims

- Car Insurance Rip Off!?

- 6 Cheapest Car Insurance Companies Of November 2024

- Person Suing Me Cos I Guess They Didn’t Accept The Offer My Insurance Offered Them?

- Import Car Insurance: Comprehensive Guide For 2024

- Contact Us For Insurance Cover

- Insurance For Tradies

Car Insurance Ombudsman Australia Phone Number – The Australian Financial Services Authority (FAO) will usually try to resolve the problem through informal channels and to reach an agreement between you and the financial institution through negotiation or agreement.

However, if we make a legal decision, there are a number of remedies – “remedies” – that we can provide under our Act.

Car Insurance Ombudsman Australia Phone Number

Part D of our rules and regulations provides more information about medicines and when we can use them.

If You Run Quotes, Don’t Use Anything That Can Connect To Your Person. No Names, Address (even Next Door) Or Licence Plate Unless You’re Ready To Click “buy”. They Will F’ You

We may decide that the financial institution or the complainant should initiate a process to resolve the matter. We will make a claim if we find that you have suffered loss or damage as a result of the financial institution’s conduct.

Some of the options we can offer are worth the money, some are not, and the examples on this page are not exhaustive. We can choose another convenient solution. We are not responsible for damage, sample or accident.

If we decide that a creditor’s duty to provide financial assistance has been breached, we will consider whether the claimant has suffered financial or non-financial loss. If the creditor had met its obligations, it could have avoided potential financial losses in terms of foreclosure or repossession. Non-monetary losses can cause unnecessary stress or inconvenience.

We may decide that the financial institution must compensate you for your financial loss. When calculating the cost of this type of remedy, we include remedies where monetary damages and value can be easily calculated, such as debt relief.

It Was A Disaster’: The Problem With Electric Car Insurance Claims

In addition, or instead, we may decide that the financial institution must pay the financial loss directly. This is $5,400 for claims made between January 1, 2021 and December 31, 2023. For claims filed on or after January 1, 2024, the reimbursement is $6,300.

We may also decide that the financial institution must provide compensation for non-monetary losses. Non-monetary loss compensation is $5,400 per claim between January 1, 2021 and December 31, 2023. Compensation is $6,300 per claim filed on or after January 1, 2024.

We may also decide whether to pursue your claim or pay any fees associated with the benefits. Our rules and regulations provide more information.

The table below shows the maximum amount we can offer for unpaid claims. It also shows the financial limits of our power.

Car Insurance Rip Off!?

Our jurisdiction to determine pension claims is set out in section 1055 of the Companies Act and regulations D.1.1 and D.1.2.

If we are satisfied that the decision or procedure is unfair or unreasonable, or both, we may do one of the following:

If the decision involves the payment of death benefits, we must decide whether the decision is unfair or unreasonable in terms of its impact on the plaintiff and other parties involved in the lawsuit.

What is appropriate and reasonable depends on the situation. There may be different decisions that are considered fair and reasonable. If a reliable decision exists in that context, it must be affirmed.

How To Get Complaints Resolved When Insurance Companies Don’t Act

When determining pension claims, decision makers consider all available information to determine whether the applicant (and the parties, in the event of a death decision) has any material impact or influence on the decision.

In the absence of a maximum pension limit, the provision of remedies may be used to accommodate the claimant as far as possible, which is no longer unfair or unreasonable.

The damages provided for in rule D.3 and the monetary damages in rule D.4 do not apply to excessive claims, but we may consider it unfair or unreasonable for the trustee not to resolve the issue or to deal with the claim. another way. . We may seek a remedy to compensate the claimant for damages.

Please be advised that we cannot provide you with financial or legal advice. However, we can refer you to law firms or financial advisory services if you need help.

6 Cheapest Car Insurance Companies Of November 2024

Our live chat is powered by Genesys Cloud on your behalf. Both organizations will treat personal information obtained in this discussion in accordance with their respective privacy policies, available at /privacy and www.genesys.com/company/legal/privacy-policy

An application error occurred. Check your network and try again. If the problem persists, call 1800 931 678 (free) or 1300 56 55 62 (members). Proper management can also strengthen customer relationships and the reputation of the insurer.

Olivia Hua, attorney at Sophie Grace Compliance and Legal: “Settlement is an important step in the dispute resolution process.” “It’s critical to business success.”

It was developed by consumer experts and the University of Newcastle, who found that every dollar invested in solving a problem can return up to $10 to the organization – a 1,000,000 percent return on investment.

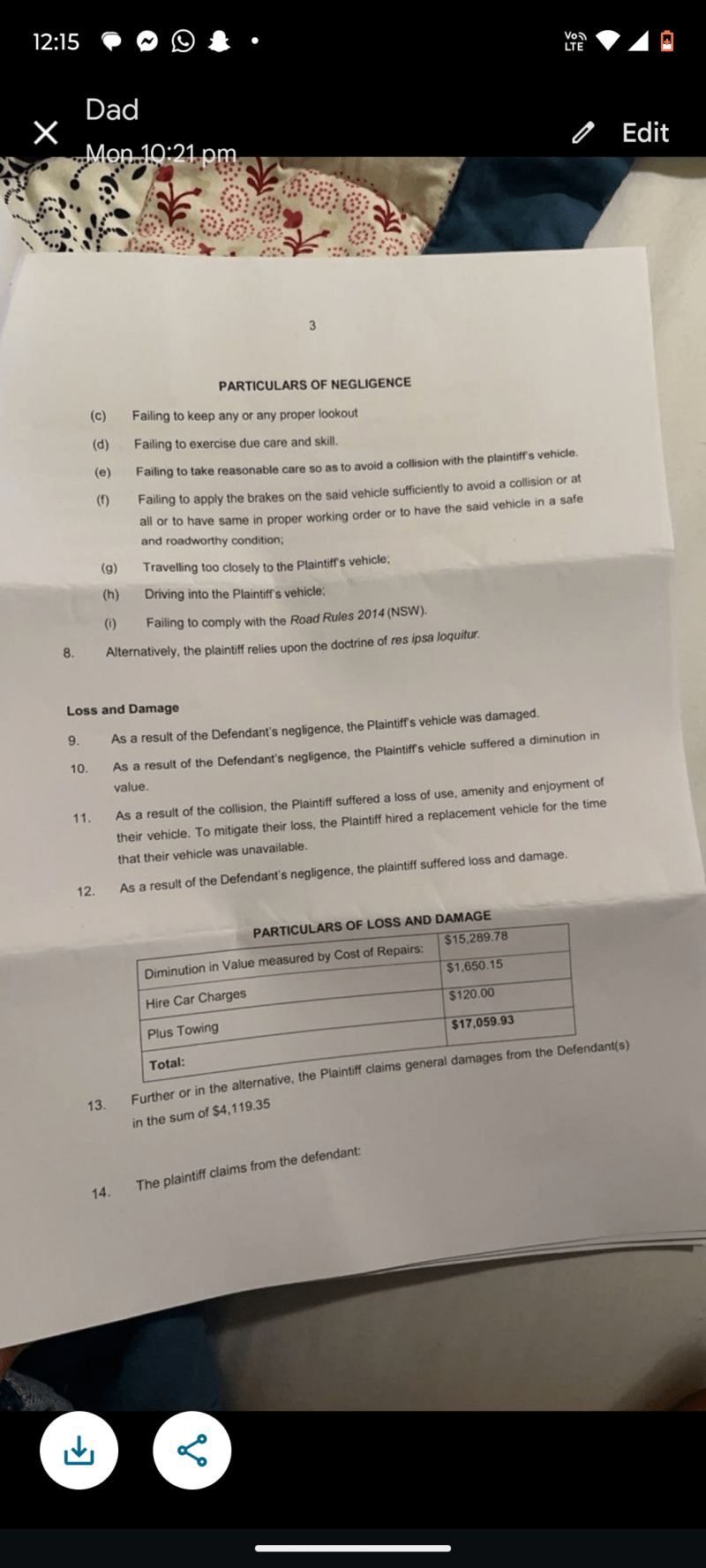

Person Suing Me Cos I Guess They Didn’t Accept The Offer My Insurance Offered Them?

Between 1 January 2020 and 31 December 2020, the Australian Financial Claims Agency (AFCA) received a total of 19,562 insurance claims. very often they do not understand what the insurance policy covers or their rights under the policy.

‘Research by the Australian Securities and Investments Commission [ASIC] and the Insurance Council of Australia confirms that many consumers do not read product disclosures at all, much less know how to read the full text.’

‘They often don’t understand the level of cover or products available until it’s time to make a claim.’

There can be confusion between an accident policy and an insurance policy, and even though the policy may mention additional benefits such as temporary accommodation or garbage disposal, these may not be included in the sum insured.

Import Car Insurance: Comprehensive Guide For 2024

When it comes to health insurance, it can be difficult for people to understand what it means, especially when income disability or health products are sold without the need for medical information. ‘

Anyone handling or resolving an insurance dispute must hold an Australian Financial Services License (AFSL) until January 2022. They must also be members of AFCA and have an internal dispute resolution process that meets the requirements of ASIC’s new regulations (RG). 271, which takes effect in October of this year.

Hua says: ‘The updated standards and requirements of RG 271 are designed to provide customers with timely and accurate problem resolution.’

And, more than ever, insurers need to ensure they communicate and listen to their customers in a timely manner.

Contact Us For Insurance Cover

Pricing includes a variety of upgrades that work together to support an efficient and customer-centric model. “They also sit well with the gender equality project we are developing in partnership with the University of Melbourne,” she said.

The goal of AFCA’s Fairness Project is to create clarity and uncertainty in what the organization considers to be “fair” for stakeholders.

“We have created a framework that incorporates key aspects of the AFCA that will address financial disputes within our jurisdiction,” says Price.

It provides clarity about how we use our judgment and establishes a framework for how we use them in our decision-making process. It will also help with consistency in decision making. ‘

Comprehensive Review Released Into Insurers’ Response To 2022 Flood

AFCA has recently consulted on the communications agreement and is looking forward to how people behave when dealing with it. These include financial service providers, small businesses and individuals, as well as AFCA itself.

“We want parties to be conducted in a manner that respects our employees and everyone,” Price said. “We will award the contract in the coming months.”

AFCA has completed a 2020 special meeting on expansion and capital projects, but continues to engage with partners to improve service delivery.

The project officially closed on June 30, but AFCA will focus on “delivering satisfactory results in a timely and efficient manner,” Price said.

Insurance For Tradies

“Partners participated in the Treasury Department’s independent review of AFCA and we look forward to the results.”

Insurers will have to make significant changes to meet the new obligations, but the prices they will be confident about.

“I heard that many companies are preparing for the new season,” he says. “After discussions with people in the industry, I am confident that insurers are fully aware of what is required and that preparations are underway.”

The Australian Financial Conduct Authority (AFCA) has changed its rules to clarify its powers to deal with complaints to consumers and financial institutions.