High Risk Car Insurance Australia – Imported car insurance is a type of insurance. It is for exotic cars. This cover is suitable for cars not intended for the domestic market. The Insurance Council of Australia is the representative body for the general insurance industry in Australia. Work with consumer group members and governments at all levels to support consumers and communities. We can not provide advice or service directly to clients, but we try to help as much as possible. Read more about ICA on our website.

1. Imported car insurance covers the same items as the standard principle but can provide special protections such as original insurance, inflation adjustment and value added consideration of the vehicle.

High Risk Car Insurance Australia

2. Unlike conventional insurance, imported car insurance operates on a “negotiable price” basis, which insurers pay a predetermined amount if the vehicle is total.

Will Your Car Insurance Cover Mechanical Issues?

3. This insurance is usually for vehicles that are not used as daily drivers, so they have lower mileage limits.

Imported vehicle insurance is similar to regular car insurance, but there are some important differences. This is to take into account the fact that unlike conventional cars, prices of imported cars always increase over time. . In addition to the standard terms, the participating vehicle insurance includes additional insurance for replacement or repair of original equipment manufacturer (OEM) parts.

This article identifies imported vehicles as the primary non-intended vehicles for the Australian market. These vehicles are imported to Australia through dealers or professional buyers rather than through official brand channels.

Imported vehicles are vehicles that are legally imported from another country and not through the official distribution network of the manufacturer. Brands such as Honda, Toyota and Mazda are made overseas, but cars from these brands that are officially sold in Australia are not considered imported.

Non-owner Car Insurance: Who Needs It?

Gray market cars also fall into this category. For example, Honda models for the Japanese market imported into Australia fall into this category. Although gray market vehicles are allowed to be imported, they may be modified to meet local regulations.

Gray imports are usually made by market-oriented dealers or by individuals who import vehicles. Whether assembled or vintage, these vehicles cater to specific enthusiasts and unique insurance needs.

For those looking for imported car insurance, leading insurance companies such as NRMA Insurance, Allianz Australia and AAMI offer plans in partnership with specialized insurance providers. These plans offer a combination of reliability and customer service of reputable insurance companies with the expertise of insurance agents.

To help you find the best insurance, we have evaluated the best insurance companies that offer insurance for imported vehicles at the right rate. As far as we can tell, these are the main import car insurance providers.

My Partner Has To Pay More Car Insurance

When choosing the right imported vehicle insurance, it is important to compare quotes from different providers. Imported car insurance professionals should consider the following.

NRMA offers specialized insurance for classic and imported vehicles, including OEM parts and unlimited comprehensive insurance. Known for its reliable claim service, EHMUT has a high financial rating and a reliable claim process in a timely manner. Members enjoy assistance and street care, including access to hard-to-find sections.

Shannons is Australia’s leading insurance provider specializing in driving insurance. Their policy is for owners of imported or modified vehicles. Shannons offers a wide range of insurance options, including negotiation rates, road assistance and flexibility in choosing your preferred vehicle. In addition, they provide a “cover” for the vehicle being repaired, providing protection even when the vehicle is off the road.

MB Insurance is a leading specialized car insurance company specializing in luxury and import vehicles. They offer a wide range of coverage, including negotiable prices, road assistance and special attention to high-end vehicles. MB Insurance is known for its customer-oriented services, offering customized packages to meet specific needs such as modifications and OEM parts. Their policy also provides distance flexibility, providing peace of mind to drivers who regularly use their imported vehicles. Customers commend MB Insurance for its response and claim process.

New Driver Car Insurance Quote From £4000

Allianz is one of Australia’s most trusted insurers for exotic imported cars. Allianz guarantees customer satisfaction and financial stability with an insurance plan that includes unlimited distances and a wide range of accessories. Customers can also opt for a higher deduction to reduce the monthly premium.

AAMI offers classic car insurance for imported vehicles that includes negotiable price protection that increases the car price by 6% in the event of a total loss. AAMI provides 30 days of automatic protection for newly added vehicles to ensure continuous protection. Eligibility criteria include vehicles for entertainment or garage, driver’s license and drivers with at least five years of driving experience.

GIO offers a wide selection of imported and covered vehicle covers. Their policy covers classic cars between the ages of 10 and 24 and used cars over the age of 25. Insurance includes liability, medical bills, comprehensive and collision insurance, and insurance for uninsured drivers. GIO plans include street assistance, insurance, negotiable prices and up to $ 1,200 in spare parts.

Budget Direct offers competitive import car insurance options with competitive price protection and single liability insurance for multiple vehicles. Budgeted direct costs also include up to $ 2,000 in road assistance for spare parts. Known for its exceptional customer service, direct budget is a reliable option in the insurance market.

Why Insurance Premiums Are Squeezing Australians And Fuelling Inflation

Imported vehicles are designed for safety and road regulations, unlike cars manufactured for the Australian market. According to the Australian Department of Transport Infrastructure, Regional Development and Communications, imported vehicles require modifications to comply with local road laws. These necessary changes can increase the value of insurance premiums. Most changes will not prevent you from getting insurance (as long as you tell your insurance provider), but depending on the scope of the change, the insurer may charge an additional premium.

If your imported car is considered a “sports car”, you may face high insurance costs. Cars designed for speed, such as Ferraris or Lamborghinis, which are classified as “prestigious cars” are often considered high risk by insurance companies because they are prone to accidents. As a result, the insurance company: refuses to insure at all, guarantees a much higher premium, or specializes in old or prestigious car insurance, where a higher premium is the standard practice.

Well-known brands such as Toyota and Mazda are Australia’s best-selling car listings and are known for their low maintenance costs, but not the same for imported cars. Imported models, especially those not sold locally, need expensive parts and services. Even among high-end vehicles, some cars are more expensive for service and maintenance than others.

Fewer people are willing or able to guarantee a car imported to Australia, so your options will be limited and more expensive. Less competition in this market often leads to higher prices. In addition, good principles may include additional functions or benefits that increase premium value.

Young Driver Car Insurance

Imported vehicles are vehicles that are legally imported from another country but do not go through the official distribution system of the manufacturer. These can include a single car purchased by a specialist dealer or an individual in a smaller and more modern market and then imported to Australia.

Foreign cars are not always more expensive to insure, but the cost of insurance can be higher depending on factors such as vehicle type, price and usage. In many cases, imported car insurance can be cheaper than regular car insurance.

When choosing an imported vehicle insurance policy, consider the cost of the vehicle, the use of local regulations, and the need for additional insurance.

Mileage limits can affect the amount you pay for your car insurance. Imported car insurance may seem expensive, but it depends on the number of drivers. Car insurance companies want more exotic or imported car drivers than your daily driver. In this case, your insurance plan will have an annual term limit. If you are below the threshold, imported car insurance is often cheaper than regular car insurance.

They Quoted £7,000-£8,000′: Young Drivers Face Huge Car Insurance Rises

The main benefit of importing a car is falling in love with the model. In addition, imported cars offer benefits such as better fuel economy, higher reliability ratings and a more comprehensive warranty.

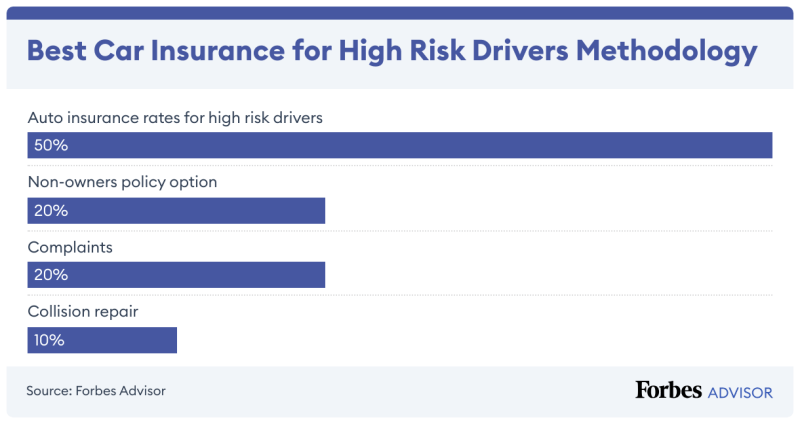

Do a thorough research to provide a detailed and objective review of the best car insurance companies. We evaluate several key factors that are important in determining the top insurance companies for consumers.

Reliability: We prioritize insurers with AM Best’s strong financial ratings that reflect their ability to meet their obligations. Companies with a clear record of reliable service also receive high rankings.

Availability: We consider the geographical distribution and entitlement of the insurer. Providers with access to a wider range and offering fewer restrictions are more likely to meet different customer needs.

Understanding The Risks Of Owning An Electric Vehicle

Insurance: Our assessment considers insurance options such as limits and deductions. We also consider additional benefits, such as roadside assistance to assess the overall quality of the cover.

Price: Price comparison is complicated because it is different.