Top Fintech Companies In Usa – The US has 105 fintech unicorns, making it the world leader in the future. The US has managed to rise to the top of the number of fintech unicorns, without losing to its main rival China – a great success in the fintech space. The growing number of North American fintech unicorns is driven by the large amount of investment seen in the region. The number of VCs in 2021 continued to rise in Q2 2021 compared to the number of sales that fell in Asia and Europe.

Looking at the sector on a smaller scale, we see that the fintech unicorns that have a US ecosystem mainly come from sub-sectors such as financial technology, payments and challenge banking, since this sector is seeing an increase in digital financial services Yes, and around. 9 out of 10 Americans now use some form of fintech software to manage their financial lives, according to Fortune.

Top Fintech Companies In Usa

The US fintech ecosystem has made major checks in H1’21. In the first six months of 2021, economic activity has already managed to grow by 117% compared to H1’20. The increase in funding was led by $3.4 billion raised by Robinhood, $600 million raised by Stripe and $500 million raised by Better, service titan and Delipay.

Ranked: The Top 10 Most Valuable Unicorn Companies

However, this does not mean that 2020 itself was not a year of big money. According to the 2021 report of KPMG – $ 78.9 billion was invested in 2020. Looking back, the industry has come a long way since fintech started in 2009, when the total investment was only $ 1.1 billion. This is an increase of about 80 times in 11 years.

This investor excitement in the US is largely driven by the realization that Big Finance is on the cusp of a technological revolution – a realization that continues to attract venture capital into emerging areas such as payments, richtech and crypto.

FinTech is a big business in the US. This sector has matured faster than other countries. In November 2021, there were 10,755 fintech startups in the US, making it the region with the most startups in the world, according to Statista’s 2021 survey.

Of these, only 1% of the 10,755 fintech unicorns are valued at $1 billion or more. While this may seem like a drop in the ocean, America’s 105 unicorns make up nearly 45% of the world’s fintech unicorns. China follows the US with 13 fintech unicorns, a tenth of what the US boasts.

Figure & Bolt Named To Fintech 250 — Your Site Title

What about encouraging innovation and startup growth? The main part is the rules! US federal and state regulators have become ‘pro-fintech innovation’ with regulatory sandboxes and pilot programs that have become central to financial services.

The US market is also seeing an increasing number of consumers jumping on the fintech bandwagon – leading the country in mass adoption. According to Fortune, the percentage of US consumers using fintech rose to 88% in 2021, compared to only 58% in Plaid’s 2020 survey. This growing demand is a great business environment for US fintechs to thrive, and you can bet they are.

WealthTech and Payments or PayTech companies are the most popular sector in the club of fintech billionaires, where 38% of unicorns live in this sector. Challenger Bank is next on the division list, which is also the best business in the United States.

Richtech companies have seen incredible growth driven largely by the continued post-pandemic economic boom. Increased demand directly affected VC investment. The sector received $4.7 billion in sales in Q1’21, a jump of 562% from Q4’20, according to CBIsights.

Fintech Website Design

The growth of the desire for digital payments has also been brought down by the epidemic. To put this in concrete terms, consider the 186% jump in PayPal’s share price over the past 12 months. Also, the way Square’s shares rose is a big part of 5. This part has been driven by various factors, including the e-commerce boom and the move away from cash as the primary way of selling.

Undoubtedly, although the growth in both sectors has been epidemic, changes in consumer behavior and demand for these new financial products will continue to grow in the coming years. But only time will tell how the business will fare, and we’ll be watching closely.

Introduction As asset management companies continue to embrace artificial intelligence, the focus is shifting to better data management.

Introduction The wealth management market is undergoing major changes driven by changing trends and market trends. seam

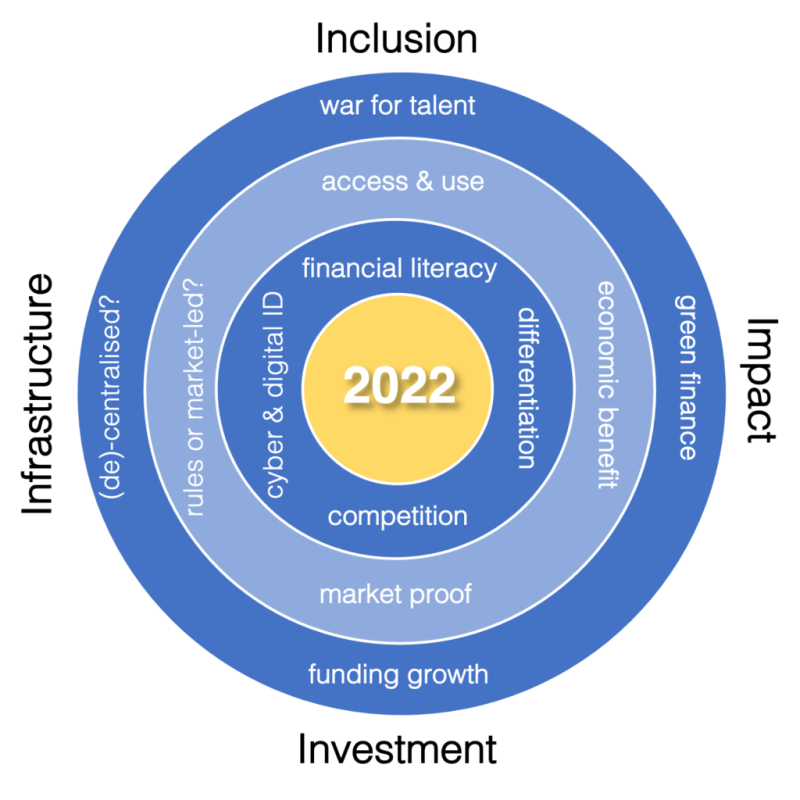

Fintech In 2022. The I’s Have It

Introduction The future of Artificial Intelligence (AI) is very exciting as it continues to transform industries by increasing efficiency,

The Center for Finance, Technology and Entrepreneurship (CFTE) is a global learning platform that aims to equip financial professionals and organizations with the skills they need to remain competitive in a rapidly changing industry. Our innovative programs, developed by global industry experts, help develop skills to join the digital financial revolution. CFTE courses are recognized internationally by ACT, IBF, CPD, Future Skills and ABS.

At CFTE, our work aligns with each student’s goals to advance their career, succeed in their next career, or even start their own financial and business breakthrough. To help you do this, CFTE provides you with the tools you need to develop the right skills for the digital economy. We bring unique insights from leaders driving economic change, from global CEOs to disruptive businesses. With CFTE, you don’t just learn what’s in the books, you gain experience in understanding what’s happening in the world.

If you’re looking for more information on how the financial technology sector is changing from the inside, we can help you learn about the latest trends that could disrupt your career. CFTE offers leading online programs in digital finance covering topics such as – payments, AI, open banking, platforms, fintech, entrepreneurship and much more that will help you tackle financial technology. With the expertise you have, you will be well on your way to advancing your career.

Top 10 Core Banking Software Development Companies Usa

You will learn from a panel of industry leaders, experts and entrepreneurs from Fortune 500 companies and Tech Unicorns, among others. Everyone will contribute their knowledge and experience in the digital economy. Whether you are starting a new journey or adding to your field, these speakers and expert guests will give you the ideas of established institutions such as – Starling Bank, Wells Fargo, Google, IBM, successful startups such as – will advise in Cabbage or plaid , among many others! Advances in data analytics, artificial intelligence, blockchain and mobile technologies have given top fintech companies powerful tools to innovate and disrupt traditional financial systems. These companies don’t just change for the sake of change; He drives fast.

At a time when technological advancements seem limitless, the financial sector is undergoing massive change, and 200 fintech companies are leading the change and reshaping our relationship with money.

CNBC, in collaboration with Statista, presents a definitive list of the top 200 fintech companies in the world in 2023. The 200 carefully selected companies represent examples of financial innovation and are reshaping the way people, companies and organizations deal with financial services.

, the only Spanish company selected among the 25 solutions companies, facilitates communication between technology startups, investors and companies through its digital platform and a global network of more than 130 countries.

10 Biggest Us Fintech Companies Worth $88.1bn

Join our global team and discover the ideal digital AI platform to find the best partners, investors or B2B customers. You will be able to get funding, apply for contract calls or connect with the best fintechs, investors and companies with one click.

The final list includes not only industry leaders such as Ant Group, Tencent, PayPal, Stripe, Klarna and Revolt, but also many new and upcoming startups that are committed to shaping the future of financial services.

These categories include NeoBanking, Electronic Payments, Electronic Assets, Electronic Financial Planning, Electronic Wealth Management, Alternative Finance, Alternative Lending, Electronic Banking Solutions, Electronic Business Solutions.

The fintech sector is growing rapidly and has become an area of interest especially among investors, as B2B companies offer more services than ever before through platforms such as fintech, banks, insurance companies, investors, organizations and Start communication between other startups. All around the world.

10 African Startups Dominate 75% Of Fintech Equity Africa Funding In 2023

In a partnership between Statista and CNBC, I am proud to announce that it has been included in the world’s top 200 fintechs list.

The international recognition highlights the leading position established in the fintech industry, not only in Spain but also worldwide. Statista, the leading platform for statistics and market data, in collaboration with CNBC, the financial services group, conducted an in-depth study to identify and recognize the most interesting and promising companies in fintech.