- Car Insurance Discount Malaysia

- Cheap Bmw M3 Car Insurance In 2024 (check Out The Top 10 Companies)

- Receive 10% Discount With Takaful Malaysia!

- Allianz Car Insurance: Top 2 Plans To Consider For Your Vehicle

- No-claim Discount (ncd): A Comprehensive Guide

- What Is Voluntary Deductible In Car Insurance?

- Airasia Money Now Offers Digital Car Insurance — Airasia Newsroom

Car Insurance Discount Malaysia – When dealing with your car insurance, you will see something called NCD in the cover note of your policy. But… what exactly is NCD?

NCD is short for No-Claim Discount, also known as No-Claim Bonus. NCD is like a special reward from your insurance company if you can avoid claims for some time. Simply put, if you haven’t made a claim in the past year, you’ll get a discount on your next car insurance renewal.

Car Insurance Discount Malaysia

Consider NCD as a thank you gift for being a careful driver. It starts when it’s time to renew your insurance, reducing the cost of your motor insurance and giving you extra savings.

Cheap Bmw M3 Car Insurance In 2024 (check Out The Top 10 Companies)

The longer you drive without a claim, the higher the discount. Over time, you can accumulate and stack discounts up to 55%.

So, when you see an NCD on your insurance, consider it your bonus for safe driving (and the key to paying less for car insurance).

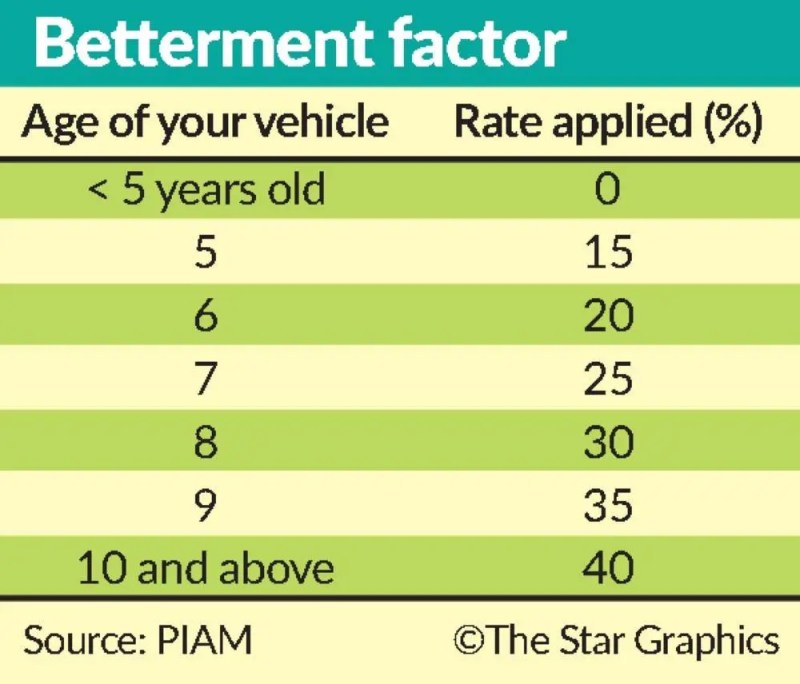

In Malaysia, NCD rates are regulated by Persatuan Am Asuransi Malaysia (PIAM), and the rates are as follows:

You have two options to check your NCD now: You can check the central NCD database, or you can check your NCD with us for free!

Receive 10% Discount With Takaful Malaysia!

Your NCD may not disappear, but it can be reduced. If you do not renew your car insurance, your NCD rates will gradually decrease based on the number of years you do not renew.

For example, if your NCD is 55% but you decide not to renew next year, then in the second year, your NCD will be 45%.

If you continue to not renew your car insurance in subsequent years, your NCD entitlement will continue to decrease until it reaches 0%.

The key to protecting your NCDs is simple: Avoid claims whenever possible. However, there are situations where this may not be practical.

Car Insurance In Malaysia: All You Need To Know

If you find yourself in a position where you need to claim without affecting your NCD, consider the following options:

If the losses are manageable and you can cover your costs, this may be a wise move. Because the claim can affect your NCD.

So, before deciding to admit, consider the pros and cons of protecting your NCD. It’s worth saving a valuable bonus that rewards your safe driving habits.

First, your NCD will not automatically recover in the event of an accident. The impact on your NCD depends on who is at fault and how the accident is resolved. Here are some examples to help you understand:

How To Get Comprehensive Car Insurance In Malaysia

Great news! If you want to switch to another insurance company, you can keep the NCD you have earned over the years with your existing insurance. Because your NCD is linked to your IC number.

Switching insurers is easy. Simply select your new insurance and purchase your policy. When you request a quote, your NCD will automatically appear, making the transfer smooth and easy.

In conclusion, understanding the ins and outs of the no-claims discount (NCD) is essential to effectively navigating the world of car insurance. As a driver, NCD is a valuable reward for your safe and responsible behavior on the road.

Whether you’re changing your policy, changing your insurance or considering the impact of a claim, your NCD plays a big role in shaping your insurance experience.

Allianz Car Insurance: Top 2 Plans To Consider For Your Vehicle

By understanding the importance and making informed decisions, you not only save money but also contribute to a safer driving community.

Received the Financial Inclusion Award Accredited by the Monetary Authority of Singapore at the Singapore FinTech Festival… There are no exempt or foreign claims for car owners commonly known as NCD. NCD is a type of discount that insurers offer if you do not make a claim during the entire coverage period. If you do not make a claim on your insurance policy, your NCD rates will increase, thereby reducing your car insurance premium.

In this post, we look at NCD rates for different vehicles, the conditions under which you can keep your NCD even after making an insurance claim and some important things you need to know about NCD.

NCD rates are different for private cars, private motorcycles and commercial vehicles. For your reference, NCD rates for vehicles are given below:

No-claim Discount (ncd): A Comprehensive Guide

For your information, you will automatically receive NCD when renewing your insurance policy. However, note that your NCD rate may return to 0% if an insurance claim is made on your policy. However, you can continue to enjoy NCD after admitting the following:

If you are involved in a car accident caused by a third party, you may be able to claim for no-fault damages. In order for you to make this claim, the authorities must confirm that the accident was not your fault.

If you claim for no-fault damage, your NCD will not be affected, so you can keep it. Also, your insurance company will help you claim from the third party insurance company that caused the accident.

Have you purchased glass cover in addition to your car insurance? If you do, you’re in luck because you can keep your NCD even after making an insurance claim for your windshield replacement or repair.

Can You Cancel Your Car Insurance Policy?

However, if you don’t purchase this additional cover, your insurance claim for your windshield will definitely affect your NCD.

At this point, you are probably familiar with what NCD is and how it works. But you may not be aware of other aspects related to NCDs. So, we share below some facts about NCDs that you should know:

Your NCD is yours, not your car – this means you can transfer your NCD to another vehicle of the same type (cars; motorbikes). However, you cannot transfer your NCD to another person as it is exclusive to you.

Your NCD applies to all insurance companies – if you want to switch to another insurance company, for example, from AIA to Allianz, your NCD will still apply.

Cheap Car Insurance: 3 Steps To Choose Your Car Insurance

Keep your NCD – Avoid making insurance claims especially if the price is low because it will affect your NCD.

You enjoy your NCD at the time of insurance renewal – As shown above, first year car users cannot enjoy NCD. However, they can start enjoying NCD at the time of their insurance renewal if they do not claim insurance.

To check your NCD, go to MyCarInfo and click NCD Online Search. Next, check your vehicle’s license plate number and identification number. Once done, click the ‘Get my NCD record’ button. If your vehicle is registered to a company, enter the check in the business registration number.

After entering the required information, you will be able to see the NCD and other information like this.

What Is Voluntary Deductible In Car Insurance?

Simple, right? This free service can be used to check NCDs for all vehicles including motorcycles and rental vehicles.

As shown in our article, your NCD will help you enjoy affordable insurance premiums. So, make sure you drive safely and avoid accidents so you can protect your NCD.

For more savings, we recommend you renew your car insurance online. Just go and choose from 15 car insurance companies that offer various benefits at attractive rates. Get your free auto insurance quote today. What is the difference between Myvi and Mercedes? Answer: Both vehicles need the right car insurance to drive on the road.

New or second hand, local or imported, if you own a car you need valid car insurance to be able to drive on the road; It’s as simple as that.

How Is Car Insurance Premium Calculated?

Anyone who tells you that is either ignorant or simply doesn’t care about their own well-being – as well as those around them.

Also, if you don’t have the right car insurance and road tax (the two go together, you can’t buy or renew one without the other) you might have to spend extra money to pay for a traffic call if you have to be cited. by the police. or road block.

According to the Road Transport Act 1987, all car owners in Malaysia are required to have valid car insurance and road tax, both of which must be renewed annually.

But, apart from the legal requirements, it is also important to have adequate car insurance coverage for your vehicle, so that if something bad happens (whether collision, natural disaster, or even theft), you can rely on your insurance policy to repair the cover. Costs – or alternatives.

Airasia Money Now Offers Digital Car Insurance — Airasia Newsroom

Based on research conducted by the Malaysian Institute of Road Safety Research, more than 400,000 road accidents were recorded in 2020 alone, with nearly 5,000 deaths.

That’s why it’s important to buy the right – and enough – insurance policy to cover you and your car when you’re on the road.

There are three types of motorcycles