Fintech Startups Usa – The United States has 105 fintech unicorns, making it the global leader in the field. The United States managed to top the list, not losing to China and competing with the number of fintech unicorns – an important achievement in the field of financial technology. North America’s continued growth in the number of fintech unicorns is fueled by the significant investment seen in the region. Compared to the number of deals in Asia and Europe, the number of VC deals in Q2 of 2021 continues to increase.

In terms of small portions, we will see the largest fintech unicorns in the US ecosystem especially from sub-sectors such as wealth banks, payments and challengers as the region’s desire for digital financial services a ‘ growth among nearly 9 out of 10 Americans who currently manage their. financial life according to Fortune.

Fintech Startups Usa

The US fintech ecosystem saw a big fat money search in H1’21. In the first 6 months of 2021, the value of investment contracts increased by 117% compared to H1’20. The funding increase was led by $3.4 billion raised by Robinhood, $600 million by Stripe and $500 million by Better, services titan and DailyPay.

Fintech Startup Ideas To Succeed In The Finance Industry

However, this does not mean that 2020 itself will not be an important investment year. According to the KPMG report, 2021 – 2020 saw an investment of $78.9 billion. In retrospect, the industry was far from over when the financial technology boom began in 2009, with investments totaling nearly $1.1 billion. That’s almost an 80-fold increase in 11 years.

These US-based investors are particularly motivated by the realization that big financial technology is ripe for an overhaul – something that will continue to attract venture capital into sectors that ‘ continues to grow as currencies, wealth and crypto.

Fintech is obviously big business in the US. This sector has grown faster than other countries. As of November 2021, there were 10,755 fintech startups in America, making it the region with the largest number of startups in the world, according to Statista’s 2021 survey.

Of those, only 1% of the 10,755 fintechs are unicorns valued at $1 billion or more. While this may seem like a drop in the ocean, the 105 unicorns in the United States account for nearly 45% of the world’s fintech unicorns. China follows the US with 13 fintech unicorns, just a tenth of the US brute.

Fintech Companies: A Bibliometric Analysis

So what drives more innovation and growth in startups? Management is a big part! US federal and state governments have been ‘pro-fintech innovation’ with regulatory sandboxes and pilot programs acting as central centers for financial services development.

The US market is also seeing more consumers jumping on the fintech bandwagon – leading the country to mass adoption. The percentage of American consumers using fintech rose to 88% in 2021, compared to just 58% in the 2020 edition of the Plaid survey, according to Fortune. U.S. The growing demand for fintech is a perfect business environment, and you better believe they are.

The wealth industry and payments or payment technology is the most popular sector of the multi-billion dollar fintech club, with 38% of unicorns based in the sector. Next is the challenging banking sector, which is also a promising industry in the US.

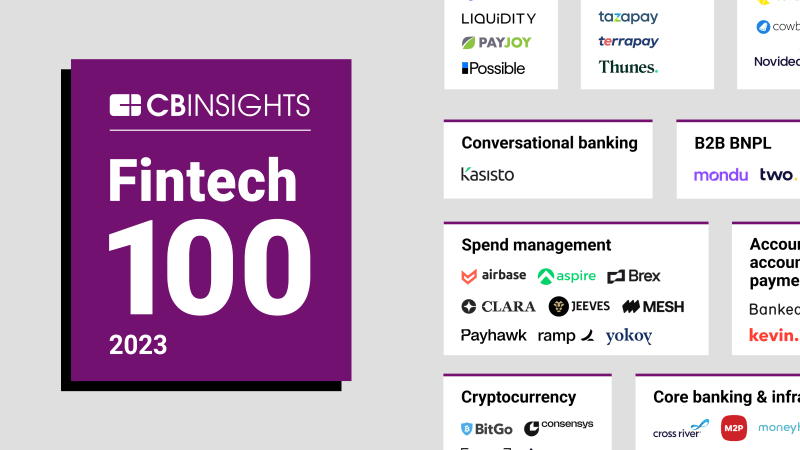

The wealthtech industry has seen unprecedented growth driven primarily by post-crisis growth in retail investment. Rising demand has had a direct impact on VC investment. The sector received investments of $4.7 billion in Q1’21, a jump of 562% from Q4’20, according to CBINsights.

How Startups Can Benefit From Uae’s Booming Fintech Industry

Growing interest in digital currencies has also been dampened by the crash. To illustrate this clearly with hard facts, consider the 186% jump in PayPal stock over the past 12 months. Additionally, Square’s stock is up more than 5 percent of the scale.

It can be said that although the growth of these two sectors has been stimulated by the crisis, the change in consumer behavior and the demand for these new age financial services products will continue in the coming years. But only time will tell how the business will fare, and we’ll be watching closely.

Introduction As the asset management industry continues to embrace generational AI, the focus continues to shift to managing data more effectively.

Introduction The wealth management industry is undergoing significant changes due to generational change and evolving market conditions. like

Fintech: Financial Technology

Introduction The future of artificial intelligence (AI) is extremely promising as it continues to transform businesses by increasing operational efficiency,

The Center for Finance, Technology and Trade (CFTE) is a global learning center focused on providing financial professionals and organizations with the skills they need to remain competitive in a rapidly changing industry. Key training programs developed by international industry experts help build professional skills to join the digital revolution in the financial sector. CFTE courses are internationally recognized with accreditation from ACT, IBF, CPD, SkillsFuture and ABS.

At CFTE, our mission aligns with each student’s goals to rapidly advance their careers, move on to their next project, or lead to financial disruption in their careers. To help you do this, CFTE provides you with the tools you need to learn the right skills in digital finance. We bring unique insights from leaders driving the evolution of finance, from global CEOs to disruptive entrepreneurs. In CFTE you don’t just learn what’s in the books, you live the experience by understanding real world applications.

If you’re looking for rich insights into how the financial technology space is changing from the inside, we can help you find the latest knowledge that will accelerate your career. CFTE offers a leading online program in digital finance, covering a wide range of topics such as payments, AI, open banking, platforms, fintech, entrepreneurship and more, to help you succeed in financial technology landscape. With this knowledge in hand, you will be well on your way to fulfilling your career.

13 Fintech Startup App Ideas To Consider In 2024

You’ll learn from a curated lineup of business leaders, experts and entrepreneurs from Fortune 500 companies and tech unicorns. Each will reveal their knowledge and experience in the field of digital finance. Whether you’re starting a new journey or consolidating your career, these guest speakers and experts will bring you the perspective of established organizations such as – Starling Bank, Wells Fargo, Tech – Google, IBM, startups successful – Cabbage or Plaid, and many more! Fintech or financial technology has been one of the most promising sectors in the world in the last decade. FinTech has changed the way money is managed with mobile banking, investments and blockchain applications. According to World of Modern Knowledge, the United States is at the center of technological change with 1,491 startups and $58.5 billion invested in the sector.

But banks are not the only financial institutions that have changed technology. Digital financial access is connected to all markets, including digital credit and mobile sharing systems, e-commerce payment networks and digital currency exchanges.

In this article, we will discuss some of the top fintech startups in the United States. So, let’s begin.

This is where founders, entrepreneurs, startups and businesses meet and get inspired. If you can afford it, we have a way! Inviting founders and startups who build sustainable solutions from the ground up! The novice who runs the show, tells the world!

How To Start A Fintech Company: Complete Guide For Owners

Fintech stands for Finance + Technology which refers to the combination of the two software aimed at improving and automating the provision and use of financial services. Fintech describes any business that provides financial services through software or other technology, from smartphones to cryptocurrency payment applications.

Fintech companies have transformed almost every part of the financial sector in recent years. Ten years ago, individuals had to visit a branch or bank to make a deposit, apply for a loan or indeed transfer money from one bank to another. Currently, Fintech has made it possible to spend, borrow, save and transfer money through online and mobile services, without ever going to a bank. However, traditional organizations are constantly embracing fintech technology.

Fintech has been around longer than most people think. Although the current version of fintech helps you pay for a cup of coffee with a smartphone app, the history of the financial infrastructure goes back to the first credit cards that were accepted by the public late in the 1950s.

Financial technology has developed and subsequently implemented many important advances in the credit card market, such as ATMs, electronic stocks, mainframe bank computers, and Internet stock investing. Much of today’s technology has improved the financial system that most people used to have, but rarely think about.